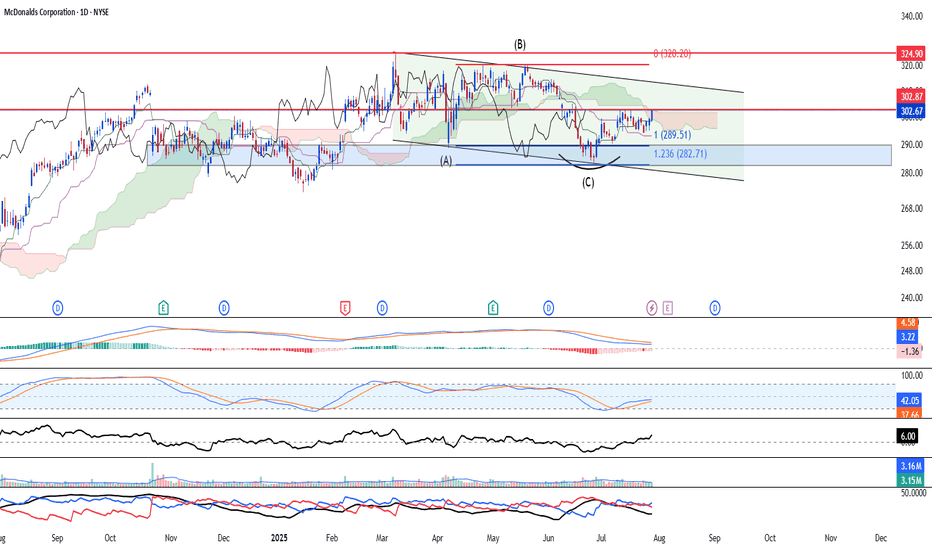

MCD - Expanded flat likely completed Mcdonald's NYSE:MCD is looking at a resumption of the uptrend after price action indicates a strong bullish rebound at 123.6% extension of wave A-B (US$282.71). We believe further upside is likely to continue as Stochastic has shown clear oversold confirmation signal. Volume is also in a healthy p

Key facts today

McDonald's is set to announce its second-quarter results on August 6, 2025, prior to the market opening.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

10.082 CHF

7.47 B CHF

23.54 B CHF

714.44 M

About McDonald's Corporation

Sector

Industry

CEO

Christopher J. Kempczinski

Website

Headquarters

Chicago

Founded

1955

FIGI

BBG006M6YLS4

McDonald's Corp. engages in the operation and franchising of restaurants. It operates through the following segments: U.S., International Operated Markets, and International Developmental Licensed Markets and Corporate. The U.S. segment focuses its operations on the United States. The International Operated Markets segment consists of operations and the franchising of restaurants in Australia, Canada, France, Germany, Italy, the Netherlands, Russia, Spain, and the U.K. The International Developmental Licensed Markets and Corporate segment consists of developmental licensee and affiliate markets in the McDonald’s system. The firm's products include Big Mac, Quarter Pounder with Cheese, Filet-O-Fish, several chicken sandwiches, Chicken McNuggets, wraps, McDonald's Fries, salads, oatmeal, shakes, McFlurry desserts, sundaes, soft serve cones, pies, soft drinks, coffee, McCafe beverages, and other beverages. The company was founded by Raymond Albert Kroc on April 15, 1955, and is headquartered in Oak Brook, IL.

Related stocks

McDonald's Signals Long Trade Opportunity: Bullish Momentum MounCurrent Price: $297.07

Direction: LONG

Targets:

- T1 = $305.50

- T2 = $312.00

Stop Levels:

- S1 = $294.00

- S2 = $290.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intel

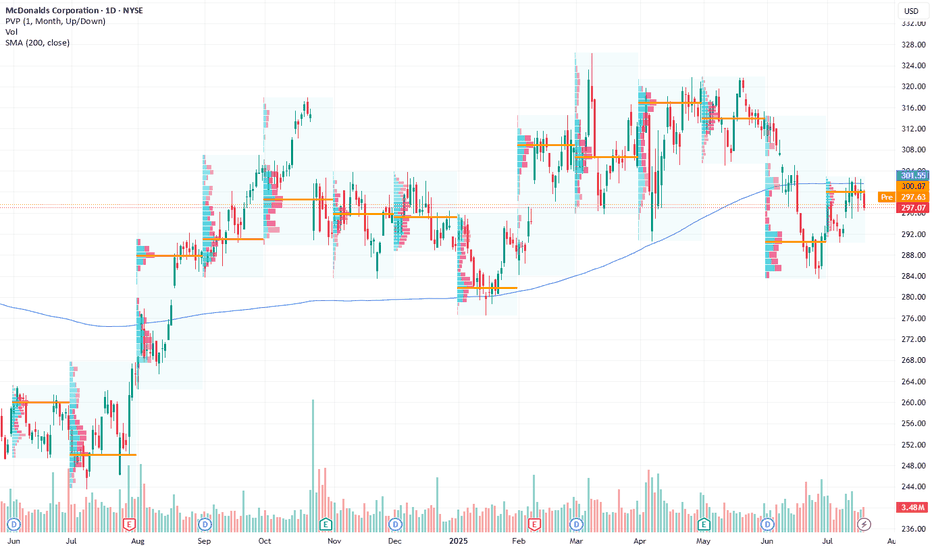

The key is whether it can be supported and rise near 300.17

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(MCD 1D chart)

Before following the basic trading strategy, the first thing to check is whether the current price is above or below the M-Signal indicator on

McDonald 1H Long PositionMy self-built strategy has sent me a signal for a long position. I bought a tranche of NYSE:MCD long and will be targeting the upper gaps as my profit targets. The first station will be around $306, and the second target lies between $318 and $319. Currently, the 1H chart is forming a nice diver

McDonald (MCD): Near Critical Trendline Support Overview: McDonald's (MCD) on the daily chart has been consolidating within a broad range after a significant uptrend. The stock is currently trading at a pivotal point, testing a long-standing ascending trendline that has supported its bullish movement. Bearish pressure is evident from repeated rej

Is the Golden Arches Losing Its Shine?McDonald's, a global fast-food icon, recently reported its most significant decline in U.S. same-store sales since the peak of the COVID-19 pandemic. The company experienced a 3.6 percent drop in the quarter ending in March, a downturn largely attributed to the economic uncertainty and diminished co

The 3 Step System Used To Buy This Stock Trying To forgive someone is very hard for me because I am emotional.Once a person disappoints me it's hard to trust that person again.

And because I enjoy keeping people accountable.Its not safe for me to enter that zone when I have not forgiven them.

So before I hold an account on anyone I need

McDonald's Corporation (MCD) – Lovin’ the GrowthCompany Snapshot:

McDonald’s NYSE:MCD is the undisputed global leader in quick-service restaurants, with over 40,000 locations worldwide and a brand that resonates across generations. The company blends cultural relevance with operational excellence, continuously innovating to stay ahead of changi

Comprehensive Research - McDonald’s Stock Set to SoarQuick read:

McDonald's stock is poised for a bullish move, with Wave 3 likely starting and strong support near 290.50–295.00. Traders should long on dips within this range, for next resistance levels, 326.00 and 348.00 with a invalidation below 276.00. This setup offers a solid risk-to-reward in a

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

XS1075996907

McDonalds 4,125% 11/06/2054Yield to maturity

7.10%

Maturity date

Jun 11, 2054

US58013MFK5

MCDONALDS 19/49 MTNYield to maturity

6.64%

Maturity date

Sep 1, 2049

US58013MER1

MCDONALDS CORP. 2043 MTNYield to maturity

6.45%

Maturity date

May 1, 2043

MCD4971144

McDonald's Corporation 4.2% 01-APR-2050Yield to maturity

6.26%

Maturity date

Apr 1, 2050

MCD4666684

McDonald's Corporation 4.45% 01-SEP-2048Yield to maturity

6.24%

Maturity date

Sep 1, 2048

US58013MFC3

MCDONALDS CORP. 2047 MTNYield to maturity

6.19%

Maturity date

Mar 1, 2047

MCD3816489

McDonald's Corporation 3.7% 15-FEB-2042Yield to maturity

6.18%

Maturity date

Feb 15, 2042

US58013MEV2

MCDONALDS CORP. 2045 MTNYield to maturity

6.11%

Maturity date

May 26, 2045

XS248628502

MCDONALDS 22/38 MTNYield to maturity

6.09%

Maturity date

May 31, 2038

US58013MFA7

MCDONALDS CORP. 2045 MTNYield to maturity

6.05%

Maturity date

Dec 9, 2045

MCD5472110

McDonald's Corporation 5.15% 09-SEP-2052Yield to maturity

5.90%

Maturity date

Sep 9, 2052

See all MDO bonds

Curated watchlists where MDO is featured.

Frequently Asked Questions

The current price of MDO is 244.999 CHF — it has increased by 0.57% in the past 24 hours. Watch MCDONALD'S CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange MCDONALD'S CORP stocks are traded under the ticker MDO.

MDO stock has risen by 3.60% compared to the previous week, the month change is a 6.11% rise, over the last year MCDONALD'S CORP has showed a 4.09% increase.

We've gathered analysts' opinions on MCDONALD'S CORP future price: according to them, MDO price has a max estimate of 289.55 CHF and a min estimate of 198.32 CHF. Watch MDO chart and read a more detailed MCDONALD'S CORP stock forecast: see what analysts think of MCDONALD'S CORP and suggest that you do with its stocks.

MDO stock is 0.94% volatile and has beta coefficient of 0.30. Track MCDONALD'S CORP stock price on the chart and check out the list of the most volatile stocks — is MCDONALD'S CORP there?

Today MCDONALD'S CORP has the market capitalization of 176.55 B, it has increased by 0.51% over the last week.

Yes, you can track MCDONALD'S CORP financials in yearly and quarterly reports right on TradingView.

MCDONALD'S CORP is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

MDO earnings for the last quarter are 2.36 CHF per share, whereas the estimation was 2.36 CHF resulting in a 0.31% surprise. The estimated earnings for the next quarter are 2.49 CHF per share. See more details about MCDONALD'S CORP earnings.

MCDONALD'S CORP revenue for the last quarter amounts to 5.27 B CHF, despite the estimated figure of 5.40 B CHF. In the next quarter, revenue is expected to reach 5.31 B CHF.

MDO net income for the last quarter is 1.65 B CHF, while the quarter before that showed 1.83 B CHF of net income which accounts for −9.73% change. Track more MCDONALD'S CORP financial stats to get the full picture.

Yes, MDO dividends are paid quarterly. The last dividend per share was 1.45 CHF. As of today, Dividend Yield (TTM)% is 2.30%. Tracking MCDONALD'S CORP dividends might help you take more informed decisions.

MCDONALD'S CORP dividend yield was 2.34% in 2024, and payout ratio reached 59.52%. The year before the numbers were 2.10% and 53.87% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 3, 2025, the company has 150 K employees. See our rating of the largest employees — is MCDONALD'S CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MCDONALD'S CORP EBITDA is 12.31 B CHF, and current EBITDA margin is 53.85%. See more stats in MCDONALD'S CORP financial statements.

Like other stocks, MDO shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MCDONALD'S CORP stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MCDONALD'S CORP technincal analysis shows the buy rating today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MCDONALD'S CORP stock shows the sell signal. See more of MCDONALD'S CORP technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.