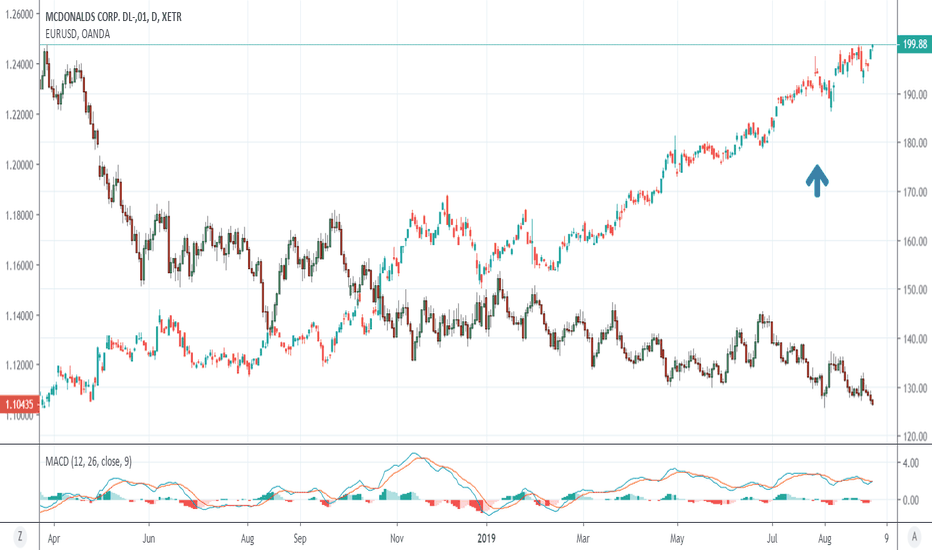

Analysis on MCDONALDS 30.08.2019The price above 200 MA, indicating a growing trend.

The MACD histogram is above the zero lines.

The oscillator Force Index is above the zero lines.

If the level of resistance is broken, you should follow the recommendations below:

• Timeframe: H4

• Recommendation: Long Position

• Entry Level: Long Position 222.00

• Take Profit Level: 225.00 (300 pips)

If the price rebound from resistance level, you should follow the recommendations below:

• Timeframe: H4

• Recommendation: Short Position

• Entry Level: Short Position 219.00

• Take Profit Level: 218.00 (100 pips)

USDJPY

A possible long position at the breakout of the level 116.70

EURUSD

A possible short position in the breakdown of the level 1.1030

USDCHF

A possible long position at the breakout of the level 0.9900

GBPUSD

A possible short position in the breakdown of the level 1.2150

MDO trade ideas

Applying Elliott Wave Theory on MC DONALDS by ThinkingAntsOkToday we will Use Elliott Wave Theory as a method to bring extra information to the chart, remember that this is a tool that must be combined with other trading analysis methods, and the final objective is to bring a clear framework for decision making. We will give a Real example on MC DONALDS chart, Elliot Wave Theory was developed by Ralph Nelson Elliott by observing the behavior of the Stock Market. This is a complex Theory, if you are interested in learning more about this, we recommend Robert Balan´s Book "Elliott Wave Principle"

Remember the Basic 3 Rules of Elliot Wave Theory:

1) Wave 2 will not retrace past the starting point of wave 1. If the impulse waves are going up, wave 2 cannot go below the origin of wave 1. If the impulse sequence is going down, wave 2 cannot exceed the peak from whence wave 1 originated.

2) Wave 3 can not be the shortest of the "impulsive waves". Wave 3 is not necessarily the longest, but it is almost always the longest

3) In an upward sequence. Wave 4 cannot overlap the peak of wave 1. In a downward sequence, Wave 4 can not rally above the bottom of Wave 1. If any of these combinations is violated the particular sequence is not impulsive in nature.

Another important concept is that Markets are Fractals by Nature, that means that the structures that you find on a 1D chart, for example, will be replicated on lower timeframes like 4HS. This Rule keeps going independently of the timeframe you are working on, the same happens on a 1H chart and a 10 minutes Chart. That's the reason you will see different symbols on the Elliott Count on this Example.

Observe how we can make a new Count on the 5th Wave we see on the Weekly Chart (is composed by a new 12345 full count). And if we go to the Daily chart, we can make a new count over the 5th wave of the 5th wave, I know this might sound complex but when you take the idea of Fractals, this process becomes really logical.

In this case, Elliott Wave Theory will tell us that all the Cycles are completed, if we combine this with price action for example (using trendlines) we can see that also the price is against a major trendline that is working as resistance, and the last Item will be the Divergence on MACD. This doesn't mean that the price will go in that direction, but if we have to put our money on something, for sure you want to do it in the strongest direction of your analysis.

Hope this Educational post is Usefull for People interested in Elliot Wave Theory.

Thinking Ants

McDonald's updateMcDonald's has been having a great run, with price rarely selling off even during economic cycles and turmoil. Now in a channel with confirmed levels. Over the past year price made it 35.57% up with all time high at $222. Creates great options to trade when the price tests the low side of the channel. Long trade with a good risk-reward or wait for the potential break to sell. Majority of banks and investment funds see this stock as 'overweight'. Watch for the next test of the channel lows. Good Luck!

$MCD McDonald's Weekly True Bearish HaramiMCD McDonald's has just completed printing a true Bearish Harami two candle pattern. True Harami's are explained in linked diagram below. The body of the second, inner candle needs to be no bigger than 25% the size of the preceding candle, in which case this one qualifies. A true large bullish candle at the top of an uptrend, followed by a 75% smaller bodied bearish candle that gaps down from the previous closing price, and is fully contained by the preceding bullish candle. That's a reversal indicator and a good spot to get short MCD if you've been looking to. I believe we could see the 202's area on a pullback. This is a stock that generally outperforms when the markets are in true turmoil, and has been on a tear lately. I wouldn't want to stay short for very long personally. I like August 30th P205, currently trading for .40 per contract for this play. Happy hunting and GLTA!! a.c-dn.net

McBubble McDiamond top updateI keep telling people this isn't worth trying to short... but here it is anyways.

The last McDiamond top coincided with a dividend date, probably gonna get the same here because it's not even overbought yet on the daily.

I expect the market to whipsaw down next week, short anything besides restaurants, lol.

The burger is dead. Long live the burgerHello Traders,

McDonald's, the world's famous fast-food seller for burgers and other stuff has may be finishing an impulsive move of high degree.

As you see oat the monthly chart, McD has an unbelievable rush from $0.14 in 1969 to a high @ $218.96 in July 2019! This high is either wave (5) of „5“ or it is wave ((iii)) of 5.

The „problem“ due to this interpretation is that the latter structure of the advance is not clear an impulse to my view. So the chart is open to different interpretations. But none the less, if one more high to come or it is in place, the next big move for McD is to the downside.

A respectable target for this move, which will morph into an a-b-c-pattern or a variation thereof, is at or around the wave 4 low at $150 at first. More bearish potential exists. There is another target for a solid decline, and for you, as Elliott fan`s it is clear to see.

If so to come, this is a „once-in-a-lifetime- trade!

I will update the chart in the coming days and weeks and let you know if enter a short trade in McD!

Have a great Sunday....

ruebennase

Feel free to ask or comment.

Trading this analyze is at your own risk!

$MCD:NYSE - McDONALDS - Resuming after minor pull backMcDonald's has had a nice steady 30% increase over the last 12 months and seems to have a tradition of dropping for a few days after earnings before recovering and we do now seem to be in that recovery mode. Could be a good stock to hold through a recession / downturn in consumer confidence. One to watch.

McDonald's Corporation (McDonald's) operates and franchises McDonald's restaurants. The Company's restaurants serve a locally relevant menu of food and drinks sold at various price points in over 100 countries. The Company's segments include U.S., International Lead Markets, High Growth Markets, and Foundational Markets and Corporate. The U.S. segment focuses on offering a platform for authentic ingredients that allows customers to customize their sandwiches. Its High Growth Markets segment includes its operations in markets, such as China, Italy, Korea, Poland, Russia, Spain, Switzerland, the Netherlands and related markets. The International Lead markets segment includes the Company's operations in various markets, such as Australia, Canada, France, Germany, the United Kingdom and related markets. The Foundational markets and Corporate segment is engaged in operating restaurants and increasing convenience to customers, including through drive-thru and delivery.

McDiamond TopMcBubble appears to be forming an expanding triangle into a possible McDiamond top again. Obviously waaaay overdue for a drop, been melting up in a narrow channel, but the wave count seems to suggest that it's going to be a wave 4, not a huge tank.

No position, not gonna play it. Last time I bought puts I made money but the return wasn't all that great. Just as easy to short the Dow with DIA puts. The Dow has basically flatlined here at the top anyways.

Daily MCD stock price trend forecast analysis. 26-Jul

Stock price trend forecast timing analysis.

See a forecast candlestick chart of 10 days in the future: www.pretiming.com

Investing position: In Rising section of high profit & low risk so far. But it would be in falling section tomorrow

Supply-Demand(S&D) strength Trend: In the midst of an adjustment trend of downward direction box pattern price flow marked by limited rises and downward fluctuations.

Today's Supply-Demand(S&D) strength Flow: Supply-Demand strength has changed from a weak selling flow to a suddenly strengthening selling flow.

Forecast D+1 Candlestick Color : RED Candlestick

%D+1 Range forecast: 0.8% (HIGH) ~ -0.5% (LOW), 0.1% (CLOSE)

%AVG in case of rising: 0.9% (HIGH) ~ -0.4% (LOW), 0.8% (CLOSE)

%AVG in case of falling: 0.5% (HIGH) ~ -0.7% (LOW), -0.3% (CLOSE)

My Kids love MCDonalds, but it is just to high to go long.Despite a earnings beat, the reaction may have been a little to positive, the fact that het income had actually dropped was somewhat papered over, as comparable-store sales growth dominated the headlines.

The stock has been on great trajectory in 2019 as the company is also rolling out Kiosk and delivery ordering.

At the current level it is just to high to look for a long as a pullback is inevitable. Any signs of weakness, the mass profits sitting in the stock right now could be a source of cash for investors taking a safe market stance.

Will get opportunity to short.

MacBubbleHoly cow, is this ever a bubble. Look at the income statements, lower revenue for 4 straight years, and lower net income for 3 quarters. Of course that means a new ATH, lol.

In all reality it should be trading at $110, but all Dow components are in a bubble, why should this one be any different?

Not shorting this yet, look for a clear reversal pattern like the last time I drew one... (diamond top).

"Joe's earning season preview" EP03 --V, BA, FB, GOOG, AMZN! It's the 3rd week and maybe start to feel a little bit improvement in my English speaking lol.

We got the following important names that I mentioned in this episode:

Mon: HAL, AMTD

Tue: BIIB, CMG, KO, V

Wed: T, BA, CAT, FB, PYPL

Thur: GOOG, AMZN (no time for MMM, INTC and SBUX )

Fri: MCD

So many want to talk about but I only got 20 minute in this video, hope everyone a great trading week yo!

Let's see how they go!

Daily MCD forecast analysis report by Supply-demand strength.03-Jul MCD

Price trend forecast timing analysis based on pretiming algorithm of Supply-Demand(S&D) strength.

Investing position: In Rising section of high profit & low risk

S&D strength Trend: In the midst of an upward trend of strong upward momentum price flow marked by the temporary falls and strong rises.

Today's S&D strength Flow: Supply-Demand(S&D) strength flow appropriate to the current trend.

read more: www.pretiming.com

D+1 Candlestick Color forecast: GREEN Candlestick

%D+1 Range forecast: 0.3% (HIGH) ~ 0.0% (LOW), 0.3% (CLOSE)

%AVG in case of rising: 1.0% (HIGH) ~ -0.3% (LOW), 0.8% (CLOSE)

%AVG in case of falling: 0.5% (HIGH) ~ -0.8% (LOW), -0.3% (CLOSE)

Shorting MCD SharesOn the daily chart of McDonalds`shares the price has formed a bearish divergent bar which is amplified by Elliott waves structure, where, with high probability, we have finished the 5th Elliott wave of a bullish period. In addition, there is an AO indicator divergence. Going short using levels that are marked on the chart.

$MCD 7/5 Short Iron Condor: profit [201.03, 206.47], LIMIT RISKThis nearly ATM July 5th IC on McDonald's is technically driven. For the past 10 trading days, MCD's open and closes have both stayed within the parallel channel range of 203.73 and 206.16. With a great risk/reward ratio, we are entering into a short iron condor on the July 5th contracts, 8 trading days away, with a maximum profit of 147 with a mere, limited max loss of 103, per contract. This spread is constructed by taking a long position in the 207.5 calls and 200 puts, while simultaneously writing the 205 calls and 202.5 puts. Being an iron condor, we will collect the theta premium as maturity nears. This trade is done for a credit of 1.47, so there is a profit between 201.03 and 206.47.

Technical indicators buttress our neutral sentiment, as the MACD has been extremely close to zero over the past two weeks, the DI+ and DI- components of the DMI are very close to each other (within 26.5 and 27, respectively), the ADX reads an extremely low 14, the Stochastics read 50.5 and the RSI and MFI are both within the range of .

If You Invest in Dividend Stocks, Do This to Double Your ReturnsIf it seems too good to be true, it usually is. But when I say you can juice your investment returns with the click of a button, it’s the plain truth.

I’m talking about reinvesting your dividends.

It may seem like a minor thing. But if you’re not doing it, you’re leaving a lot of money on the table.

In fact, investors who reinvest their dividends can outright double their investment gains.

Let me show you how…

Reinvesting Can Make a Big Difference

Say you own 100 shares of McDonald’s Corp. (MCD).

Every quarter, McDonald’s pays a dividend of $2.00 per share. That translates to $200 in income from your 100 shares.

When this happens, you have two options:

1. Pocket $200 in cash or

2. Reinvest $200 directly into McDonald’s shares.

Hint: Choose option two.

Now, McDonald’s trades for around $200/share. So instead of pocketing $200 in cash, you get one extra share.

Then you make the same smart choice the next quarter… and the next. True, it’s only one extra share each quarter. But over time, it makes a huge difference.

That’s because reinvesting your dividends takes advantage of compound interest.

Compound interest is the interest on your initial investment, plus interest on all interest earned. This means your interest—or in this case, your reinvested dividends—earns interest, too.

In other words, those reinvested dividends make your whole investment grow much, much faster.

Reinvesting Your Dividends Can Double Your Returns

Let’s walk through an example.

Say you bought $20,000 worth of McDonald’s stock in 1998. You pocketed the dividends from half of your investment. And you reinvested the dividends from the other half.

By 2019, the first account had grown from $10,000 to $66,598. That’s a total growth of 565%, or 9.9% annually. Not too shabby.

Meanwhile, the second account—the one with the reinvested dividends—had grown from $10,000 to $120,073. That’s a total growth of 1,100%, or 13.0% annually.

Now that’s remarkable.

Your money grew almost twice as much. And the only thing you did differently was reinvest your dividends instead of taking the cash.

Reinvesting your dividends does two things:

1. You get more stock, which can grow in value over the long run.

2. For every additional share you own, you get an additional quarterly dividend.

Over time, this leads to a lot more money.

This Isn’t Limited to McDonald’s or US Stocks

Let’s look at a few other examples.

Say, 50 years ago, you invested $1,000 in the S&P 500. So did your neighbor. We’ll call him “Jim.”

Jim didn’t reinvest his dividends. But he still earned an annual return of 2.3%.

But you were smarter. You reinvested your dividends every quarter. So you earned an annual return of 5.3%. That’s more than twice as much as Jim earned.

This strategy is universally effective. You’ll make a lot more by reinvesting your dividends in any market.

On average, people who invested in one of the eight major stock markets—without reinvesting their dividends—earned 4.3% annually.

Meanwhile, those who reinvested their dividends earned 7.1% annually.

Shielding Your Portfolio from the Coming Recession

You can’t fight the math.

If you’re not reinvesting your dividends, you’d better have a solid reason why. Otherwise it’s like dropping $100 bills on the sidewalk. Just waste.

I think dividend reinvestment is a good idea for all investors—and at every point in the market cycle. That’s especially true when you own safe and stable stocks.

These stocks tend to do well no matter what’s happening in the economy or the markets. So when the next recession hits—something I expect in the not-so-distant future—and the broader market suffers, you will still own quality businesses that will make it through.

Plus, if you’re reinvesting your dividends, you’re getting more of a good thing, possibly at better prices. And you’re taking advantage of the magic of compound interest.