Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.352 CHF

1.37 B CHF

6.80 B CHF

692.60 M

About Monster Beverage Corporation

Sector

Industry

CEO

Hilton Hiller Schlosberg

Website

Headquarters

Corona

Founded

1990

FIGI

BBG009CQB2Y5

Monster Beverage Corp. is a holding company, which engages in the development, marketing, sale, and distribution of energy drink beverages and concentrates. It operates through the following segments: Monster Energy Drinks, Strategic Brands, and Other. The Monster Energy Drinks segment sells ready-to-drink packaged energy drinks to bottlers and full-service beverage distributors. The Strategic Brands segment sells concentrates and beverage bases to authorized bottling and canning operations. The Other segment consists of certain products sold by its subsidiary, American Fruits and Flavors LLC to independent third-party customers. The company was founded on April 25, 1990, and is headquartered in Corona, CA.

Related stocks

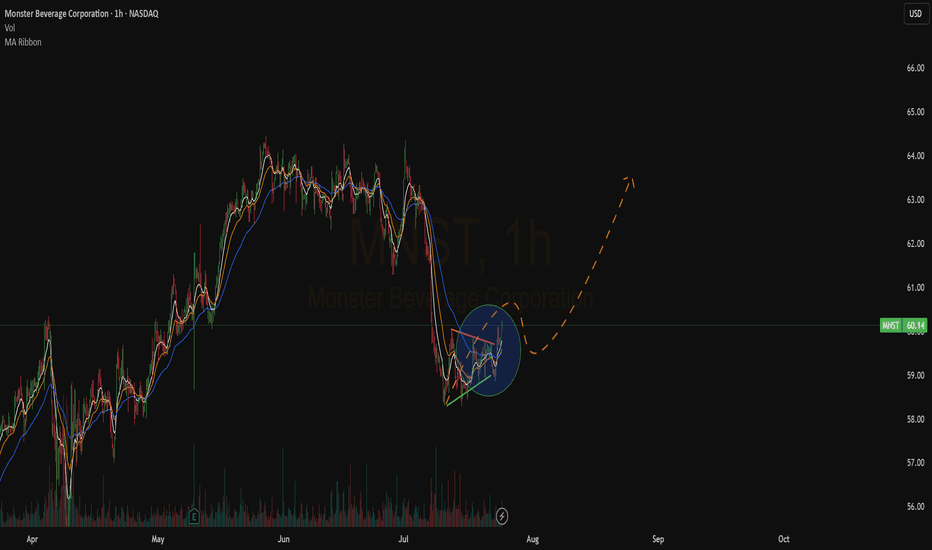

Monster Beverage: Breakout and PullbackMonster Beverage broke out to a new all-time high in May, and now it’s pulled back.

The first pattern on today’s chart is the March 2024 high of $61.23. The maker of energy drinks hesitated at that level in early May but pulled back to hold it last week. Has old resistance become new support?

Seco

Monster Beverage: A Rally Built on Solid Ground?Monster Beverage recently achieved a significant milestone, reaching a new record high after a multi-week rally. This ascent, surpassing its previous peak, indicates robust market confidence. While the proximity of an earnings report may have initially fueled anticipation, the sustained upward movem

Monster Beverage Corp (MNST) – Energizing Global GrowthCompany Snapshot:

Monster NASDAQ:MNST continues to dominate the $60B+ global energy drink market, expanding across 159 countries with a diverse portfolio and strong executive leadership.

Key Catalysts:

Global Market Expansion 🌐

Strategic brands like Predator and Fury targeting emerging markets

Correction Has BegunWe have done the correction of the rise since August.

But this shall not mean a renewal uf the rise. Instead we have to look at the weekly chart to see that we have just corrected this retracement as well.

Thus I assume that we are still within a longer downward correction that begun in December an

MONSTER Stock Chart Fibonacci Analysis 021125Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 46.3/61.80%

Chart time frame: B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: C

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

MNST to $50My trading plan is very simple.

I buy or sell when price tags the top or bottom of parallel channels.

I confirm when price hits Fibonacci levels.

So...

Here's why I'm picking this symbol to do the thing.

Price in channel zones

Stochastic Momentum Index (SMI) at oversold level

VBSM is spiked

Important Support and Resistance Area: 50.93-52.95

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(MNST 1W chart)

If it falls from the HA-High indicator and meets the HA-Low indicator, it can be interpreted that the wave ha

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where MOB is featured.

Frequently Asked Questions

The current price of MOB is 47.602 CHF — it has increased by 1.44% in the past 24 hours. Watch MONSTER BEV CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange MONSTER BEV CORP stocks are traded under the ticker MOB.

MOB stock has risen by 1.89% compared to the previous week, the month change is a −6.14% fall, over the last year MONSTER BEV CORP has showed a 6.16% increase.

We've gathered analysts' opinions on MONSTER BEV CORP future price: according to them, MOB price has a max estimate of 58.99 CHF and a min estimate of 39.06 CHF. Watch MOB chart and read a more detailed MONSTER BEV CORP stock forecast: see what analysts think of MONSTER BEV CORP and suggest that you do with its stocks.

MOB stock is 1.42% volatile and has beta coefficient of 0.25. Track MONSTER BEV CORP stock price on the chart and check out the list of the most volatile stocks — is MONSTER BEV CORP there?

Today MONSTER BEV CORP has the market capitalization of 47.16 B, it has decreased by −0.54% over the last week.

Yes, you can track MONSTER BEV CORP financials in yearly and quarterly reports right on TradingView.

MONSTER BEV CORP is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

MOB earnings for the last quarter are 0.42 CHF per share, whereas the estimation was 0.41 CHF resulting in a 2.42% surprise. The estimated earnings for the next quarter are 0.38 CHF per share. See more details about MONSTER BEV CORP earnings.

MONSTER BEV CORP revenue for the last quarter amounts to 1.64 B CHF, despite the estimated figure of 1.75 B CHF. In the next quarter, revenue is expected to reach 1.65 B CHF.

MOB net income for the last quarter is 392.16 M CHF, while the quarter before that showed 245.86 M CHF of net income which accounts for 59.50% change. Track more MONSTER BEV CORP financial stats to get the full picture.

No, MOB doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 26, 2025, the company has 6.56 K employees. See our rating of the largest employees — is MONSTER BEV CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MONSTER BEV CORP EBITDA is 1.92 B CHF, and current EBITDA margin is 28.69%. See more stats in MONSTER BEV CORP financial statements.

Like other stocks, MOB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MONSTER BEV CORP stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MONSTER BEV CORP technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MONSTER BEV CORP stock shows the sell signal. See more of MONSTER BEV CORP technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.