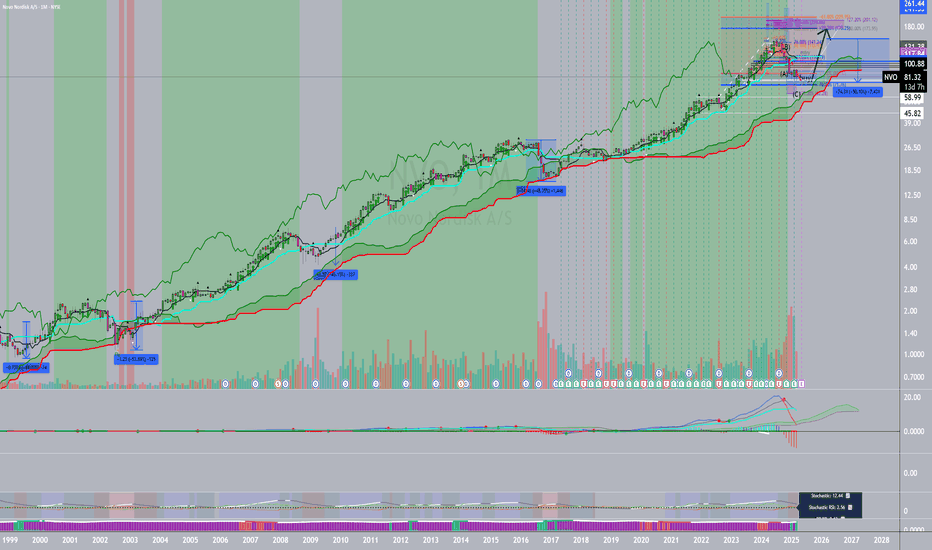

Novo Nordisk (NVO) – Oversold Reversal + Earnings CatalystNovo Nordisk (NVO) has declined 61.13% from its all-time high of $148 (June 2024), finding support at $57.55. Over the past two weeks, the stock has rebounded over 15%, currently trading around $66.30, with strong reversal signals just ahead of earnings.

This setup presents a compelling opportunity, both technically and fundamentally, for a tactical trade or a longer-term position.

Simply Wall St

🔍 Technical Highlights:

✅ Rebound from long-term ascending trendline (~$57–58 zone)

✅ RSI rising from oversold levels (28 → 32 and climbing)

✅ MACD approaching a bullish crossover, indicating momentum shift

✅ Two consecutive green weekly Heikin Ashi candles post-bottom

✅ Defined risk with invalidation below $57 support

📈 Trade Setup:

🟢 Entry Zone: $66–68 (current price range)

🔴 Stop Loss: Below $57.00 (break of structure and breakout base)

MarketWatch

+6

StockAnalysis

+6

Simply Wall St

+6

✅ TP1: $78 – previous support zone

✅ TP2: $90 – February 2025 high before the selloff

✅ TP3: $110 – around December 2024’s local top

🗓️ Earnings – May 7, 2025

🔹 Analysts project ~19.7% YoY revenue growth

🔹 Continued strong demand for Ozempic and Wegovy

🔹 Forward P/E ratio at 16.33, below industry average

🔹 Robust margins and high institutional ownership

🔹 Significant free cash flow and a promising innovation pipeline

StockAnalysis

📌 This appears to be a high-quality oversold bounce with a well-defined risk/reward structure ahead of a significant earnings catalyst. Whether you're considering a swing trade or building a core position, this setup aligns both technical and fundamental factors.

Let’s monitor how this unfolds. 📊🔬

Disclaimer: This is not financial advice – just sharing my perspective. Please conduct your own research before making investment decisions.

NOV trade ideas

NVO - looking for move upMy MVP system

M: rsi bottoming, rounded w a higher low

V: solid increase in vol

P: steep downward channel; could have nice pop to the upside; I would like the price better if it were forming a base instead of a steep down path, though price did hit a prior support/resistance zone

*Im wondering if NVO pops on earnings & then moves into a sideways range to form a new base

*If NVO drops on earnings, I’m even more interested for a lower entry as an investment

Bias: I don’t get into the weeds of fundamentals. However, I have a significant bias towards the GLP1 (and other peptides) industry. My background is in medicine.

Thank you.

NVO Thesis earningsEarnings from LLY proved to be good on their fat drugs with concerns on tariffs for other items in their portfolio. Knowing that NVO is primary obesity with deals on the table from CVS and HIMS it is in the line of thinking that earnings will be in line with positive guidance in anticipation of market share return from these relationships. Could be wrong I am still long NVO

NVO Novo Nordisk: $195 | The Cure since forever it addresses on major conditions of humans

Diabetes Cardio Alzheimer's

from acquisition to partnering and continuous r&d

this issue is a model to new science and tech companies making it to the next 50 years

key is innovation

opportunity is wait for major crash to upsize for OG investors

or simply appreciate the Business and Leadership behind the company.

if you get stuck at fresh highs

wait for 5 years to DCA in between the range

and sit for 12 years for that life changing gains..

Novo Nordisk Stock Chart Fibonacci Analysis 050925Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 411/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

Novo Nordisk's The recent drop in Novo Nordisk's stock price is attributed to several factors. A key issue is the company’s struggle to meet the surging demand for its weight-loss drugs, such as Wegovy. Although demand remains strong, investors are concerned about Novo Nordisk's ability to scale up production and deliveries, which is creating downward pressure on the stock.

Additionally, some recent financial results failed to meet Wall Street expectations. Despite revenue growth in key product categories, overall revenues in some reports came in below forecasts. This underperformance has contributed to a negative investor sentiment.

However, analysts emphasize that Novo Nordisk's core products remain in high demand, and the company has significant long-term growth potential if it addresses its supply chain and production challenges

NVO absolutely sweet levelThis downturn is attributed to disappointing clinical trial results for some of its drugs and concerns over potential tariffs affecting Denmark. Additionally, competition from Eli Lilly's successful weight-loss drug trials has impacted investor confidence.

Despite these challenges, analysts note that Novo Nordisk maintains strong fundamentals and a positive long-term outlook, particularly in its core areas of diabetes and obesity treatments.

$NVO offers solid risk to reward for long term buyers! - I had previously called out that NYSE:NVO would have more pain to come when it was in $85-90s I have attached the link with this post for my reader's reference.

- Now, I am turning bullish on this name given these prices and compressed multiples for the growth prospects it offers.

Fundamentally,

Year | 2025 | 2026 | 2027 | 2028

EPS | 3.93 | 4.78 | 5.41 | 5.97

EPS growth% | 25.41% | 21.60% | 13.19% | 10.24%

For a quality name growing EPS > 20% deserves a fair forward multiple of 25.

| Year | Bear (fp/e = 15) | Cons. Base (f. p/e = 20) | Base (fpe = 25) | Bull Case (fpe=30)

| 2025 | $58.95 | $78 |. $98.25. |. $117.9

| 2026 | $71.7 | $95 |. $119. |. $143.4

| 2027 | $81.15 | $108 |. $135 | $162.3

| 2028 | $90 | $119 |. $149.25 | $179.1

As you can see, If you buy NYSE:NVO under $60 then you will be making money even if multiple remains compressed i.e bear case. Only thing you have to do is hold and returns would amplify once there is optimism back in the market which will lead to multiple expansion.

My fair value for NYSE:NVO for this year is $78 based on the conservative base case.

NVO: Oversold, But I’m Staying PatientYes, NVO has pulled back hard — from highs near $148 to the mid-$60s, now trading around $68.33. While this selloff may look oversold on many levels, I’m still avoiding the stock for now.

The broader market remains in a downtrend, and with macro uncertainty still front and center, I’m not eager to jump in prematurely.

That said, I’ve highlighted a longer-term buy zone on the chart, with the upper band near $59.88 and the lower edge around $46.20. It’s a wide range, but it sits within a well-defined rectangular support area that I’d be comfortable scaling into — likely in tiered buys if we get there.

No rush here. Watching and waiting.

NVO, Rhyming with historical golden buy zoneUsing the Guassian Channel indicator on the monthly timeframe. We can see that in the past, after the price has significantly correct from its ATH of 50%+, price tend to reverse at the lower channel support(2times on chart) or at the upper support line ( 1 time on the chart)

Right now we are currently at the upper supprt trendline at $70

-Median line at 60$

-Lower line at 50$

Looking at the historical trend as a whole, I think we could potentialy reach the local bottom of this current correction.

My personall action.

Start buying at 70$, and we keep buying more if we go down to test lower trend line of the channel.

All I will go all in once the reversal price is confirmed.

3/27/25 - $nvo - obvious at $70... 10% size3/27/25 :: VROCKSTAR :: NYSE:NVO

obvious at $70... 10% size

- at btc conf in miami so have been hoping for a quiet week. well. whatever. another day in trumptopia. but alas, we can't tell the market what we want. so the game today is just don't make big mistakes and try and find interesting asymmetric oppties.

- i literally flipped my NVO after last post two days in and as it proceeded to rip into $80s thought "well shoot, at least i made $, which is the goal... but i paper hands that one"

- but we're back. even lower. $70.

- wegovey vs. ozempic... these 18x PE multiples r hitting that penjamin like it's going outta style.

- when i look at LLY, which is ostensibly the mkt's "favorite" in the GLP/weight loss category it's hard to ignore the fact that financials MORE OR LESS are similar and multiples are 2x higher.

- so while idk if tariffs, the euros who trade a bit more scared, greenland stuffs, GLP "share" question marks etc. etc. are affecting the day to day.

- but at nearly 4% fcf yield, ROICs akin to the biggest tech moats, orthogonal to US/chips correlation (nevermind the geo), drugs like this being secular winners (and these guys do have pole positions)... it's pretty obvious again.

- have started to play some of the 2027 ITM expires leveraged anywhere from 2 to 3-1 so i don't need to neck out. ideally we get one more flush to the mid 60s and i can really size this up. but honestly, this is a pretty obvious LT buy zone and i'll adjust the strike accordingly based on the ST day to day.

- what chu think anon? wegovey and chill?

V

Novo Nordisk: 50% Drops Lead to Amazing GrowthFundamentals :

Take a look at NVO in 1999-2000, 2003, 2008, 2016 and June 20024-2025. Every time it dropped about 50%, that lead to a huge rally for years! NVO has secured contracts with Medicaid for their diabetes and other drugs. It is not going anywhere. It has fallen 50%. We either hold or buy more.

Technicals :

uHd + extreme indicator +u3 volume last month +horizontal support + a-b-c + key fib pb

Projection: 200 to 250 within two years, tentatively.

3/12/25 - $nvo - Hey now.. mr. mkt. i'll buy some3/12/25 :: VROCKSTAR :: NYSE:NVO

Hey now.. mr. mkt. i'll buy some

- i'm the first to tell you, i think pharma is rotton to the core

- but let's play the game here, emotions r a PnL killa

- sub 20x PE for 20-30% GROWTH?

- 4%+ cash yields

- EU's biggest co (and btw that's great orthogonal exposure to US tech)

- healthcare "defensive", and you get growth here?

- looks like i'll be ST call buying to get exposure higher on this sell off... but would also consider adding this to my 1-3% book that i'd like to rent over the coming 3-6 months while we chop sideways.

thoughts?

V

We are flipping resistance into support?Hey traders! 📈

Looking at these chart.

It seems like we broke resistance and might be consolidating above it.

Classic retest or fakeout? 🤔

What do you guys think, are we gearing up for a move toward TP1, or do we have the momentum to push straight to TP2?

RSI is cooling off, which looks more like a healthy consolidation rather than weakness—could be setting up for a solid long-term move.

Let me know your thoughts! 🔥

I am cautiously calling the bottom on NVOIt might be a bit early to call this a bottom, especially given the unpredictable market, but I’m noticing a few key signals aligning:

The 8/21 curl following a double bottom

A break above the 50-day SMA occurring on a red day like today

Momentum shifting positive and being released from a squeeze

That said, stay cautious—this setup has tricked me before.

Opening (IRA): NVO March 28th 76 Covered Call... for a 74.50 debit.

Comments: Taking what amounts to a modest directional shot with a break even below the 52-week lows, selling the -75 delta call against shares to emulate the delta metrics of a 25 delta short put, but with the built-in defense of the short call.

Metrics:

Buying Power Effect/Break Even: 74.50

Max Profit: 1.50

ROC at Max: 2.01%

50% Max: .75

ROC at 50% Max: 1.00

Will generally look to take profit at 50% max and/or roll out the short call if my take profit isn't hit by expiry.