ORC trade ideas

ORCL looking at a new returned upsideRising momentum is seen for ORCL L after mid-term stochastic oscillator performs an oversold crossover and rising momentum. Furthermore, the 23-period RSI has rose steadily above the zero line.

Meanwhile, price action saw continued upside coming after forming a pair of higher high and low. Ichimoku's conversion and base line has performed a crossover, indicating an early signs of uptrend returning. Will buy spot or wait for a small retracement until 1433.00. or 128.00 to enter a buy. 1st target at 180.00

ORCL - Weekly - The PlayClick Here🖱️ and scroll down👇 for the technicals, and more behind this analysis!!!

________________________________________________________

________________________________________________________

..........✋NFA👍..........

📈Technical/Fundamental/Target Standpoint⬅️

1.) The most recent two earnings reports came in slightly below expectations, but not enough to warrant a significant sell-off reaction.

2.) Annually, the company has shown consistent revenue growth since 2019 and net income growth since 2020.

3.) Its financial health has been in good standing and has remained so since 2019.

4.) Market manipulation has been apparent since March 24, 2025, which leads me to believe that Oracle's true value is closer to $148.

5.) My analysis suggests that the earnings report on June 17, 2025, will be a positive surprise, potentially resulting in a short squeeze if there isn't a significant run-up in price before the announcement.

==============================

...🎉🎉🎉Before You Go🎉🎉🎉…

==============================

Leave a like👍 and/or comment💬.

We appreciate and value everyone's feedback!

- RoninAITrader

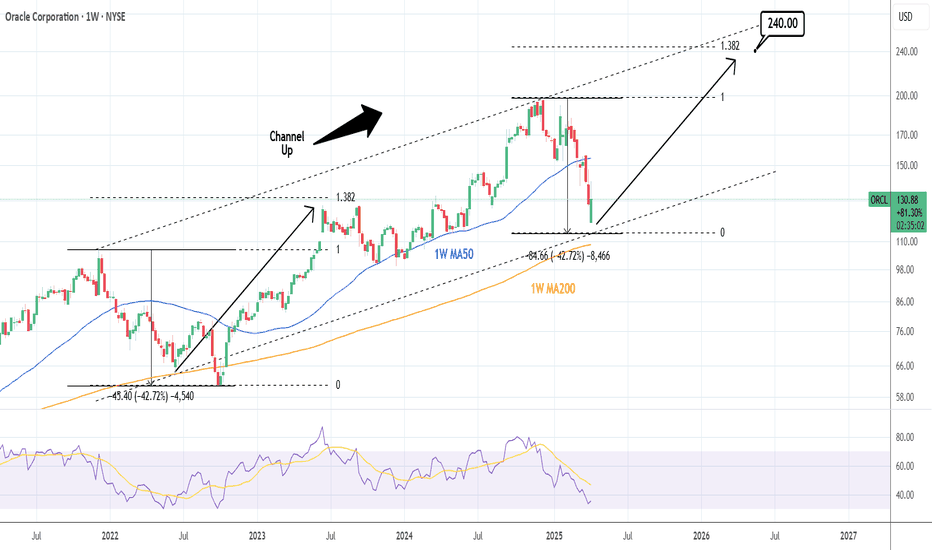

ORACLE: On a 3 year bottom. Buy opportunity for 240 long termOracle is bearish on its 1W technical outlook (RSI = 35.862, MACD = -4.360, ADX = 42.565) as this week it reached almost the same levels of correction as the 2022 Bear Market (-42.72%). This is also nearly a HL bottom for the 3 year Channel Up and as the 1W MA200 is right below, a great long term buy opportunity. The bullish wave after the 2022 bottom almost reached the 1.382 Fibonacci, so we have a technical level to target this time also (TP = 240).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

ORCL for BuyOracle Corporation (ORCL) has recently reported its fiscal third-quarter earnings, with adjusted earnings of $1.47 per share on sales of $14.1 billion, slightly below Wall Street forecasts of $1.49 per share on $14.4 billion in sales. Despite this, the company provided a strong sales forecast for the upcoming fiscal year, driven by high demand in artificial intelligence (AI), expecting a 15% increase in overall revenue.

INVESTORS.COM

Analysts have a positive outlook on Oracle's stock. The consensus price target is approximately $194, suggesting a potential upside of about 30% from current levels.

INVESTOPEDIA.COM

Additionally, the company's involvement in the $100 billion AI infrastructure initiative, Stargate, which could expand to $500 billion, is viewed as a significant growth opportunity.

INVESTORS.COM

Oracle's advancements in AI and cloud-based software have also been notable. In 2024, Oracle shares surged by nearly 60%, influenced by its progress in these areas.

INVESTORS.COM

The company's cloud infrastructure sales increased by 49% in the recent quarter, and it has secured significant cloud agreements with companies like OpenAI, Meta Platforms, Nvidia, and AMD.

INVESTORS.COM

However, it's important to note that Oracle's stock has experienced a 12% decline year-to-date, reflecting current market challenges and uncertainties.

INVESTORS.COM

Investors should also consider the competitive landscape and broader market conditions when making investment decisions.

In summary, Oracle's strong sales forecast, involvement in significant AI initiatives, and positive analyst outlooks present compelling reasons to consider investing in ORCL now. However, potential investors should weigh these factors against recent stock performance and market dynamics.

Check Out Oracle’s Chart Heading Into Next Week’s EarningsOracle NYSE:ORCL is set to report fiscal third-quarter results next Monday (March 10) after the closing bell rings in New York. What is technical and fundamental analysis saying about the software/cloud/AI giant’s stock heading into the results?

Oracle’s Fundamental Analysis

As I write this, the Street is looking for ORCL to report $1.49 of adjusted earnings per share and about $1.07 of GAAP EPS on $14.4 billion of revenue.

Such an adjusted-earnings print would represent 5.7% growth from the $1.41 Oracle reported in the year-ago period, while revenues would gain some 8.4% from the $13.3 billion the company saw in Q3 2024.

That kind of growth would be more or less in line with what Oracle has seen in its past two quarters, which saw y/y sales growth of 7% and 9%, respectively.

Oddly enough, while all 27 analysts that I found who cover the stock have reduced their earnings estimates for Oracle’s fiscal third quarter since it began, sell-side analysts expect to see better things over the longer term.

They forecast Oracle's y/y sales growth will accelerate over the balance of calendar-year 2025, ending the 12-month period about 12% higher.

Of course, readers might recall that for its fiscal second quarter ended Nov. 30, Oracle fell short of analysts’ consensus estimates on both revenues and adjusted earnings per share.

In fact, Oracle has missed the mark on analysts’ sales expectations in six of the past seven quarters. In other words, don’t take anything for granted.

Some believe Oracle has missed estimates because the firm is somewhat dependent on Nvidia NASDAQ:NVDA for chips, but that rising demand for NVDA’s high-end, AI-capable chips has crimped Nvidia's ability to deliver in quantity,

There’s also speculation that DeepSeek’s success in creating AI systems with fewer high-tech chips means demand for Nvidia’s older GPUs could rise, creating scarcity for firms like Oracle that rely on older chips.

Oracle’s Technical Analysis

Now let’s check out ORCL’s chart going back some 18 months:

Readers will see that the stock has been in a persistent uptrend since late 2023.

However, ORCL failed in December 2024 to break out of that trend to the upside and instead sold off. The stock also tried to rally in early 2025, but failed again.

Still, Oracle has consistently found support close to $152 (marked with a purple line at the right of the above chart) since 2025 began.

What this has done is to create what looks like a so-called “descending triangle” pattern, marked with the two purple lines at right in the chart above.

What's the difference between a “descending triangle” and a “falling wedge”? A whole lot.

A falling-wedge pattern forms when resistance and support both fall simultaneously, but the resistance level falls more quickly than support. That’s historically an indicator of a bullish reversal that could be triggered when the two lines converge.

By contrast, a descending-triangle pattern occurs when resistance falls, but support is close to flat-lining.

This pattern also historically could trigger a response when the two lines converge, but typically sparks a bearish continuation instead of bullish reversal. That’s what the chart above appears to point to.

Looking at Oracle’s other technical indicators, the stock’s Relative Strength Index (the gray line at the above chart’s top) is weak, but not alarmingly so.

However, the stock’s daily Moving Average Convergence Divergence indicator (or “MACD,” marked with black and gold lines and blue bars) currently looks bearish.

The histogram of Oracle’s 9-day Exponential Moving Average (or “EMA,” marked with blue bars above) is below zero. So is the stock’s 12-day EMA (the black line above) and 26-day EMA (the gold line). All of that is historically bearish.

Additionally, the stock’s 12-day EMA is running below its 26-day EMA, which is also traditionally bearish.

Meanwhile, Oracle’s 200-day Simple Moving Average (or “SMA,” marked with a red line in the chart above) is close to $158 vs. the $150.94 that the stock was trading at Friday afternoon.

That $158 level currently serves as the stock’s downside pivot point -- and the line that those who are trading Oracle’s stock or related options will be focusing on.

(Moomoo Technologies Inc. Markets Commentator Stephen “Sarge” Guilfoyle had no position in ORCL at the time of writing this column.)

This article discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve. Specific security charts used are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. Moomoo and its affiliates make no representation or warranty as to the article's adequacy, completeness, accuracy or timeliness for any particular purpose of the above content. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct. Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

TradingView is an independent third party not affiliated with Moomoo Financial Inc., Moomoo Technologies Inc., or its affiliates. Moomoo Financial Inc. and its affiliates do not endorse, represent or warrant the completeness and accuracy of the data and information available on the TradingView platform and are not responsible for any services provided by the third-party platform.

Projected Growth Post-CorrectionKey arguments in support of the idea.

Remaining in Focus: Announced $500 Billion Investment in AI Infrastructure.

Primary Cloud Infrastructure Development Partner for All Big Tech Companies.

Investment Thesis

Oracle Corporation (ORCL), an American technology titan, excels in crafting and marketing software, cloud solutions, and enterprise databases. Renowned as a top producer of database management systems (DBMS), the company offers a diverse array of business products including ERP, CRM, and cloud computing solutions. Since its inception in 1977, Oracle has been at the forefront in advancing artificial intelligence, data analytics, and cybersecurity technologies. In the competitive landscape, the company stands its ground against giants like Microsoft, SAP, and Amazon Web Services, continuing to be a pivotal force in the enterprise software sector.

Remaining in Focus: Announced $500 Billion Investment in AI Infrastructure. On January 21, 2025, U.S. President Donald Trump announced a private sector investment of up to $500 billion to fund infrastructure for artificial intelligence. This initiative sees a strategic collaboration between OpenAI, Oracle Corporation, Japanese multinational conglomerate SoftBank, and the UAE-based MGX investment fund, culminating in the establishment of the Stargate joint venture. The project is designed to build both the physical and virtual infrastructures necessary to propel the next wave of AI advancements. An initial capital infusion of $100 billion will kickstart the project, with the first facility being a data center located in Texas. For Oracle, this venture presents substantial opportunities, positioning the company as a primary infrastructure provider for the AI ecosystem. The substantial capital flow and investment into AI infrastructure underscore the growing strategic importance of AI within the U.S. economy, reaffirming the nation's ambition to maintain its leadership in global tech. Positive progress or milestones within the Stargate project could serve as a significant catalyst, potentially driving Oracle's stock price upward as it capitalizes on its role in this transformative initiative.

Primary Cloud Infrastructure Development Partner for All Big Tech Companies. Amazon, Microsoft, Google, and Meta Platforms stand in alliance with Oracle, serving both as partners and clients in the global expansion of data center infrastructure. OCI, Exadata, and the full suite of the company’s database services will be seamlessly accessible to all users of these tech giants. Partnerships with major technology firms are poised to become its pivotal growth catalysts nearing the latter half of FY2025, coinciding with the large-scale commissioning of new data centers. The recent earnings season, unfolding at the dawn of 2025, revealed that Amazon, Microsoft, Google, and Meta Platforms are set to significantly ramp up their investments in data center infrastructure, surpassing even the most optimistic projections. This trend signifies promising prospects for Oracle as their key partner, potentially enhancing the company's quarterly results and leading to upward revisions to guidance.

The target price for the shares is $210, the rating is Sell. We recommend setting a stop loss at $130.

Oracle: Tilting Downward…After a sharp rebound from the $152.02 support following the steep drop from the peak of the beige wave II, Oracle is once again tilting downward as expected. The next step should see the price fall below $152.02 to reach the projected low of the beige wave III. After a countermovement of wave IV, the broader downward movement as part of the beige five-wave decline should extend further, ultimately driving the stock to the low of the overarching blue wave (A). If Oracle instead breaks above the $198.31 resistance in the short term, the macro-level light green wave alt. will rise to a new high. However, this alternative scenario holds only a 34% probability. Primarily, we assume that wave was completed with the December peak.

SHORT ORCLOracle Corporation (ORCL) has recently experienced a decline due to underwhelming earnings and concerns over its valuation.

The stock is currently trading at $183.47. Given the elevated implied volatility in the options market, a short call strategy may be more cost-effective than purchasing puts.

Trade Plan Details

1. Short Call Strategy:

Strike Price: $190 (above current trading price)

Expiration: March 2025

Premium: Collect premium by selling call options at this strike.

2. Position Sizing:

Contracts: Determine the number of contracts based on your risk tolerance and account size.

Risk Management: Ensure the total potential loss does not exceed your predefined risk threshold.

3. Profit Target:

Objective: Profit from the premium received, anticipating that ORCL will stay below the $190 strike price by expiration.

4. Stop Loss:

Exit Strategy: If ORCL's price approaches the strike price, consider closing the position to limit potential losses.

Rationale

Earnings Performance: Oracle's recent earnings report showed revenue of $14.06 billion, slightly below expectations, leading to a stock decline.

Valuation Concerns: Analysts have downgraded Oracle due to overvaluation concerns, suggesting the stock may face further downward pressure.

Implied Volatility: Elevated implied volatility makes selling options, such as short calls, potentially more profitable due to higher premiums.

Stock Of The Day / 01.27.25 / ORCL01.27.2025 / NYSE:ORCL #ORCL

Fundamentals. General decline in the technology sector amid news of cheaper and less resource-demanding Chinese AI.

Technical analysis.

Daily chart: Movement within a wide range of 198 - 152.40. Strong daily level is ahead which is formed by a gap in September 2024 and confirmed in January 2025.

Premarket: Gap Down on increased volume. We mark the premarket low of 166.00.

Trading session: The first attempt to go below the premarket low at the beginning of the session was unsuccessful, but at the same time the price did not update the previous high and continued its gradual decline. We are considering a short trade upon a breakdown of the 166.00 level, then retest and holding of the level from the opposite side.

Trading scenario: #breakdown with retest of level 166.00

Entry: 165.39 after the breakdown and clear holding of the level.

Stop: 166.18 we hide it behind the candlewick of the retest.

Exit: Close the Part of the position around 157.20 when signs of a change from a downward trend to an upward trend appear. Since the lower high has not been updated, we can hold the remaining part of the position until the slowdown before the strong daily level of 152.40

Risk Rewards: 1/15

P.S. In order to understand the idea behind the Stock Of The Day analysis, read the following information .

iPad side side panel in chart mode please!In chart mode, can you please add the side panel so that I can scroll through stocks while the full chart and annotations show on the right panel?

Currently it has a tiny scroll in the bottom left left-hand corner which makes it very difficult to quickly and easily scroll to assess the differences in stock and chart patterns.

This really seems like it would be an amazing upgrade. Thank you.

Oracle Soars on USA AI Deal – Is $238 Next?Good morning, trading family!

Here’s what I’m seeing for Oracle (ORCL) right now:

If it can break above $191, we might see it push up to $199–$200. If it clears that, $230–$238 could be the next big move, especially with all the excitement around its role in the $100B U.S. AI project.

But let’s stay cautious—if it drops, $179 could be the next level to watch, and if that doesn’t hold, $166 might be in play.

If this analysis helped you, drop a comment below! A like, boost, or share would mean the world and help others join the conversation. Let’s crush it this week!

Kris/Mindbloome Exchange

Trade What You See

Oracle’s Next Big Move: $200 and Beyond – Are You Ready? 🔥 1. Strong Analyst Confidence

Evercore ISI: Raised price target to $200, maintaining an Outperform rating.

Cantor Fitzgerald: Initiated an Overweight rating, signaling high confidence in Oracle's growth.

Consensus Target: Analysts' mean price target of $197.07, with a high estimate of $220, highlights significant upside potential.

💰 2. Valuation and Earnings Strength

Current Price: Trading at $161, Oracle is well below its all-time high of $198.31.

Fair Value: Simply Wall Street values Oracle at $261.81, indicating the stock is 39% undervalued.

Earnings Growth: Oracle delivers consistent earnings growth at 16.5%, showcasing its financial resilience and expansion potential.

⚡️ 3. Growth Drivers

Cloud Leadership: Oracle continues to expand in cloud computing, challenging AWS and Microsoft Azure.

AI Integration: Oracle’s investments in AI-powered solutions position it to capitalize on the AI and data revolution.

Global Expansion: Enhanced data center infrastructure worldwide is strengthening Oracle’s market reach and competitiveness.

📈 4. Technical and Price Action

Support: The price is respecting a long-term uptrend support, with a recent bounce confirming the start of a new bullish wave.

Momentum: RSI and Stochastic Oscillator indicate a reversal from oversold conditions, signaling increasing bullish momentum.

Historical Patterns: Previous rallies from the support of 27.93% and 38.20%, suggest Oracle could replicate similar upward moves.

🔹 Price Targets:

🎯 $170 (+5.6%)

🎯 $180 (+11.8%)

🎯 $200 (+24.2%)

💡 Conclusion

Oracle is backed by strong fundamentals, growing cloud and AI capabilities, and bullish technical indicators. With a clear path to $200, the stock offers an excellent opportunity to capture gains at current levels. 🚀

What Lies Beyond Stargate's Gates?In a bold move that redefines the intersection of technology and national policy, President Donald Trump has unveiled "Stargate," a colossal project aimed at advancing the United States' capabilities in artificial intelligence. This initiative, backed by tech titans Oracle, OpenAI, and SoftBank, is not merely an investment in infrastructure but a strategic leap towards securing America's future in the global AI race. With commitments reaching up to $500 billion, Stargate is set to transform not only how AI is developed but also how it integrates into the fabric of American society and economy.

The project's immediate impact is palpable; it involves constructing state-of-the-art data centers in Texas, with plans to scale significantly across the nation. This undertaking promises to generate around 100,000 jobs, showcasing the potential of AI to be a major economic driver. Beyond the economic implications, Stargate aims at a broader horizon — fostering innovations in fields like medical research, where AI could revolutionize treatments for diseases like cancer. The involvement of key players like NVIDIA, Microsoft, and Arm underscores a unified push towards not just business efficiency but also societal benefits, challenging us to envision a future where technology and humanity advance hand in hand.

However, the vision of Stargate also brings to mind the complexities of global tech dependencies, especially concerning AI chip manufacturing, which largely relies on foreign production. This initiative invites a deeper contemplation on how national security, economic growth, and technological advancement can be balanced in an era where AI's influence is ubiquitous. As we stand on the brink of this new chapter, Stargate challenges us to think critically about the future we are building — one where AI not only serves our immediate needs but also shapes our long-term destiny.

Oracle Stock (ORCL) Surges Amid Trump’s InitiativeOracle Stock (ORCL) Surges Amid Trump’s Initiative

Stargate – an initiative unveiled by Donald Trump on his second day as president – represents a collaborative project between OpenAI, SoftBank, and Oracle to advance artificial intelligence infrastructure in the United States. The project’s partners also include Microsoft, MGX, Arm, and NVIDIA.

The initiative involves an initial $100 billion investment to construct a data centre in Texas, with total funding potentially increasing to $500 billion over four years. Additionally, President Trump has revoked an executive order from his predecessor, Joe Biden, issued in 2023, which aimed to mitigate risks associated with AI development.

Financial markets responded with a rally in tech stocks, with Oracle’s stock (ORCL) gaining over 7% in a single day.

Technical analysis of the ORCL chart shows:

→ Price fluctuations are forming an ascending channel, and yesterday’s rally lifted the price from the lower half of the channel to its median line.

→ The price is approaching a bearish gap created on December 10 following disappointing quarterly results. This gap may act as resistance – similar to the inverse situation earlier in 2025, where the price found support at the upper boundary of a bullish gap formed after the September earnings report.

However, with support from the new administration, bulls might manage to sustain levels above $180, paving the way for a potential climb to a new all-time high around the psychological mark of $200 per ORCL share.

According to TipRanks:

→ 15 out of 27 analysts recommend buying ORCL stock.

→ The average 12-month price target for ORCL is $197.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Bullish bar break, sign of upside returning?NYSE:ORCL Trend has been well respected within the uptrend line since Oct 2022. Despite a larger than expected correction from 9 Dec 24 - 14 Jan 25, the stock managed to reverse higher after the reverse of the tik tok ban. The strong bullish bar break above the falling wedge with strong volume will support the stronger upside continuation.

Key support at 143-152 is well supported. Long-term MACD still shows bearish momentum, but stochastic Oscillator is showing signs of overbought, together with 23 period ROC. Volume and Directional movement index is healthy.

Oracle (ORCL) – Technical Sell Signal: Preparing for a PullbackNYSE:ORCL

Overview:

Oracle (ORCL) is showing a bearish setup after a period of strong upward momentum. At an opening price of $153.74, the stock appears poised for a downward correction. Based on technical signals, we’re projecting a potential target price of $145.27, representing an approximately 5.5% drop.

The combination of the Supertrend indicator and RSI readings across multiple timeframes strongly suggests that Oracle may be entering a retracement phase. These indicators align to suggest that the current trend may soon shift, offering traders an opportunity to sell short.

ORACLE Slowly turning into a long-term Buy again.Oracle (ORCL) gave us an excellent buy signal on our last call (September 18 2024, see chart below):

For the past 30 days it has been on a technical decline, which based on its +2 year pattern, is nothing but the Bearish Leg of the Channel Up. The 1W MA50 (blue trend-line) is the natural Support of this trend but the September - October 2023 Bearish Leg bottomed a little over the 0.382 Fibonacci retracement level.

As a result we expect the stock to turn into a buy by the end of the month or if the 1W RSI hits its 42.70 Support first and initiate the new Bullish Leg, which at first shouldn't be that aggressive.

Our Target is a little below the -0.236 Fib extension at $220.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Oracle: Correction Started!Although ORCL is currently still trading above the $147.50 support level, we believe the green wave has reached its peak. This implies that the overall upward trend has concluded, and we anticipate a significant correction moving forward. This correction should unfold in five parts, with the beige wave I extending well below the $147.50 level. Afterward, we foresee a corrective counter-movement back above $147.50 during wave II before the price resumes its downward trajectory.