Palantir Is Up 600%+ Since August. What Do Its Charts Say?National-security software firm Palantir Technologies NASDAQ:PLTR hit a new all-time high this week and has gained more than 600% since hitting a 52-week low last August. What does technical and fundamental analysis say could happen next?

Let's look:

Palantir's Fundamental Analysis

PLTR has been on a tear of late, hitting a $153.91 intraday record high on Thursday. (Full disclosure: I own the stock.)

Shares have been rising in part because NATO member nations recently agreed to increase defense and defense-related infrastructure spending to 5% of each country's gross domestic product -- news that could play right into the company's hands.

Only Spain opted out from among the 32 Western nations that belong to the military alliance, although Canada went along only somewhat reluctantly.

The move surprised many NATO observers. Just some eight years ago, President Trump couldn't get a majority of these nations during his first term to pay what he called their "fair share" -- which was then mandated at only 2% of GDP.

But having a hostile Russian Army in Ukraine knocking at NATO's front door has changed global perceptions of what's fiscally necessary and what's not. Spain and Canada are far away from the Russia-Ukraine war, but some NATO members physically closer to the fighting have far more enthusiastically embraced the new 5% spending target.

What becomes of these promises to boost military spending?

There will, no doubt, still be costly purchases of expensive military hardware like tanks, artillery, aircraft and naval vessels. But intelligence provided by the kind of data-based, AI-assisted analysis that Palantir sells seems likely to only grow in significance.

Purchasing such intelligence (or the high-tech, modern systems to gather it) looks to be far more cost-effective than simply throwing money at things like submarines and fighter aircraft.

That's what nations need these days for national security, as well as what many large businesses need just to compete. All of that sounds like music to Palantir's ears.

The company will report Q2 earnings after the closing bell on Aug. 4, with analysts looking for the firm to post $0.14 in adjusted earnings per share on $939.3 million of revenue.

That would represent a 55.6% increase from the $0.09 in adjusted EPS and 38.5% improvement on the $678.1 million in revenues that PLTR reported for the same period last year.

Of the 19 sell-side analysts I found that cover Palantir, 12 have revised their earnings estimates higher since the current quarter began, while three have lowered their forecasts.

Palantir's Technical Analysis

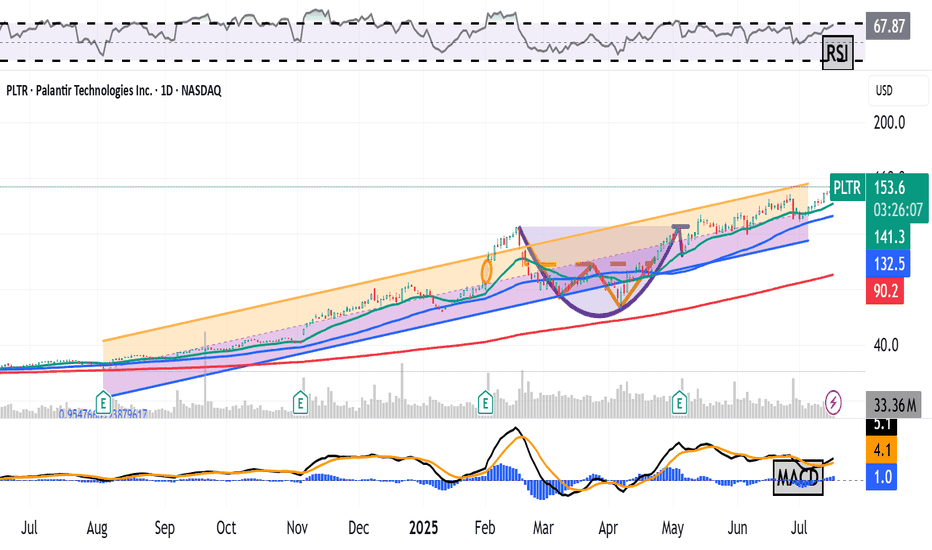

Now let's take a look at PLTR's charts, beginning with this one that runs from January through Tuesday afternoon:

Readers will first note that Palantir continues to break out from the bullish "cup-with-handle" pattern that became visible this spring (shaded purple in the chart above).

The stock's Relative Strength Index (the gray line at the chart's top) also remains quite robust, but is not yet technically overbought.

Similarly, Palantir's daily Moving Average Convergence Divergence indicator (or "MACD," marked with gold and black lines and blue bars at the chart's bottom) is postured bullishly as well.

Within that MACD, the histogram of the stock's 9-day Exponential Moving Average (or "EMA," denoted with blue bars) is above zero. That's often seen technically as short-term bullish.

Meanwhile, Palantir's 12-day EMA (the black line) is back above its 26-day EMA (the gold line), with both in positive territory. That's also a historically bullish signal.

Now let's look at PLTR's chart going back 12 months:

Taking a longer look back, we can take a Raff Regression model (the orange and purple field above) and place it over the stock's price action to better illustrate the trend that's in place.

This view shows PLTR riding its 21-day EMA (the green line above) since mid-April.

Palantir's current pivot is the upper trendline of the model -- about $156 in the chart above vs. the $153.43 that PLTR was trading at on Thursday afternoon.

The stock's 50-day SMA (the blue line at $131.40 in the chart above) represents PLTR's downside pivot, with the Raff Regression model's lower trendline not too far below that for potential support.

(Moomoo Technologies Inc. Markets Commentator Stephen “Sarge” Guilfoyle was long PLTR at the time of writing this column.)

This article discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve. Specific security charts used are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. Moomoo and its affiliates make no representation or warranty as to the article's adequacy, completeness, accuracy or timeliness for any particular purpose of the above content. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

TradingView is an independent third party not affiliated with Moomoo Financial Inc., Moomoo Technologies Inc., or its affiliates. Moomoo Financial Inc. and its affiliates do not endorse, represent or warrant the completeness and accuracy of the data and information available on the TradingView platform and are not responsible for any services provided by the third-party platform.

PTX trade ideas

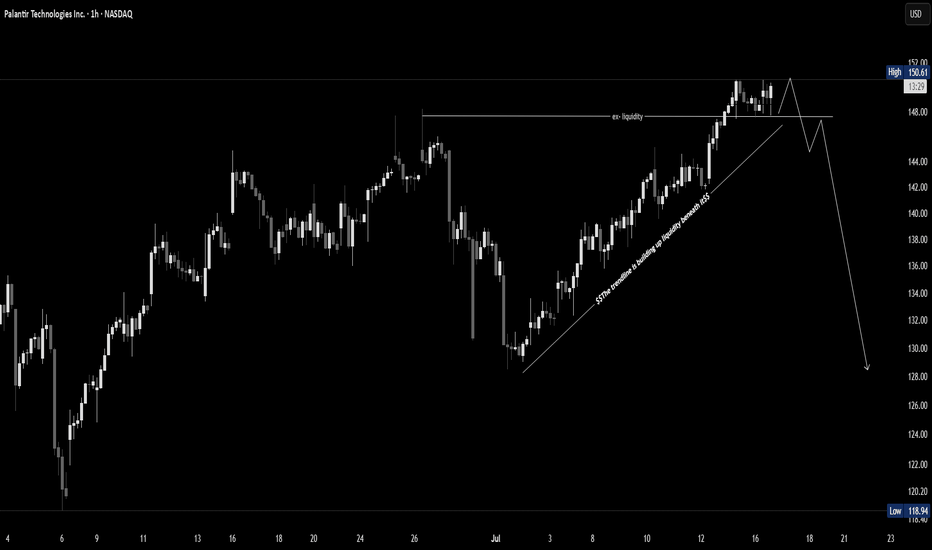

PLTR Just Broke the High - But Don't Get Trapped Palantir just broke its recent high, sparking breakout excitement. But this could be a classic liquidity grab — not a genuine breakout. If price fails to hold and shifts structure, a sharp reversal could follow.

🧠 Wait for confirmation — don’t chase green candles.

PLTR Sitting on the Edge! Will $147 Hold or Break? July 16Technical Overview:

PLTR is showing signs of a distribution top after a strong rally. The most recent 1H structure shows a Change of Character (CHoCH) just under $149 with lower highs forming and weak bullish reaction.

* CHoCH confirmed under $148.50

* Price struggling inside supply zone: $148.50–$150

* Ascending trendline now broken — possible bearish drift starting

GEX + Options Flow Analysis:

* GEX Resistance Zones:

* $150.00 (83.74% / 3rd Call Wall)

* $152.5 and $155 stacked with heavy GEX Call Resistance

* PUT Walls:

* $144 (3.07%)

* $142 (3.63%)

* Gamma Pivot: $139 = HVL + GEX10 zone

* IVR at 40, with IVx Avg 62.1 → Options relatively quiet, but favoring downside protection

* Call Bias = 55%, but weak

SMC + Price Action:

* BOS followed by CHoCH just beneath $149.15

* Price rejecting inside the OB zone from $148.50–$149.50

* Break of bullish trendline confirms bearish momentum shift

* Downward channel forming under the broken trendline

Trade Scenarios:

📉 Bearish Setup (Favored):

* Entry: $148.20–$148.50 (into supply zone)

* Target 1: $144.50

* Target 2: $139 (HVL + GEX10 support)

* Stop: $150.20

📈 Bullish Breakout (Needs Strength):

* Must break and close above $150

* Entry: Break and retest of $150.50

* Target: $152.5 → $155

* Stop: $148.20

Final Thoughts:

PLTR looks tired near the top of its rally. With GEX resistance above and CHoCH confirmed, the odds favor a pullback unless bulls can reclaim $150 with strength. Watch $147–$144 for possible bounce or breakdown.

This is not financial advice. Please trade based on your own plan and always use proper risk management.

7/15/25 - $pltr - going for kill shot again.7/15/25 :: VROCKSTAR :: NASDAQ:PLTR

going for kill shot again.

- using the 2x levered meme etf PTIR to buy P's

- there are no logical explanations anymore for me to justify valuation "yeah V valuation doesn't matter"... you'll see what i mean, kid

- even 2x'ing FCF over the next 2 yrs and this thing with decelerating growth and the emergence of super intelligence means more competition, more vendors... again "you'll see kid"

- so does this go down tmr idk idc. this is a great hedge on my long book and it's done in a way where i'll roll it, pull it off, whatever.. it's not a core position in any capacity

- but it's already looking weak

- good luck holding this thing up. it wants to reset lower before it can make new highs is my armchair take (and tbh, this is secondary in my process anyway vs. the guys who just draw lines and "trust me bro" energy -- gl w that)

V

Palantir Technologies (PLTR) — Bounce in Progress?NASDAQ:PLTR is testing a long-term ascending trendline near the $128.79 level, which also aligns with a horizontal support zone. A potential rebound is forming with a projected move toward $145.94 — a +13.32% gain in 12 days.

Technical Highlights:

• Support zone: $128.79 (trendline touch + horizontal level).

• Stochastic Oscillator: Deep in oversold territory — bullish crossover forming (green arrow).

• Bollinger Bands: Price pierced lower band — reversion to the mean is likely.

• Volume: Stable, with room for momentum pickup.

Targets:

• First resistance: $134.71

• Primary target: $145.94

• Stop level: below $127 (to invalidate bullish thesis)

PALANTIR REMAINS YOUR TRADING GOAL, DOUBLING IN PRICE IN 2025In the Faraway Kingdom... In the Thirtieth Realm....

Somewhere in another Galaxy.. in late December, 2024 (yet before The Second Coming of Trump), @TradingView asked at it awesome Giveaway: Happy Holidays & Merry Christmas .

1️⃣ What was your best trade this year?

2️⃣ What is your trading goal for 2025?

Here's what we answered:

1️⃣ What was your best trade this year?

- Surely Palantir NASDAQ:PLTR 💖

I followed Palantir all the year since January, 2024, from $16 per share, watch here .

Current result is 5X, to $80 per share.

Also I added more Palantir after SP500 Index inclusion in September 2024 watch here .

Current result is 2.6X, from $30 to $80 per share.

2️⃣ What is your trading goal for 2025?

- Once again, surely Palantir NASDAQ:PLTR 💖

It's gone 7 months or so... (Wow... 7 months really? 😸😸😸)

Let see what's happened next at the main graph of Palantir stock, to LEARN WHY PALANTIR REMAINS THE TRADING GOAL, DOUBLING IN PRICE IN 2025...

Palantir stock remains an attractive trading goal for several compelling reasons rooted in its strong market performance, innovative technology, and robust growth prospects, particularly in the artificial intelligence (AI) sector.

1. Exceptional Stock Performance and Momentum.

Palantir Technologies has been one of the best-performing stocks in 2025, surging over 80% in the first half of the year alone, vastly outperforming the S&P 500’s modest 5.5% gain. The stock recently hit all-time highs around $149, reflecting a nearly 400% increase year-over-year, underscoring its strong momentum and investor enthusiasm. This surge positions Palantir as a top AI stock to watch, attracting both retail and institutional investors, including conservative entities like the Czech National Bank.

2. Leadership in AI and Data Analytics.

Palantir is not just a data analytics company; it has transformed into a major AI software provider with its Artificial Intelligence Platform (AIP). This platform extends beyond government contracts into commercial sectors such as healthcare, energy, and automotive, fueling significant revenue growth. The company reported a 39% revenue increase to $883.9 million in Q1 2025, driven largely by AI adoption. Its AI platform is gaining traction globally, with many companies rapidly adopting Palantir’s software through short training bootcamps, demonstrating scalable and fast integration.

3. Strong Government and Commercial Contracts.

Palantir’s roots in government intelligence and defense continue to be a significant revenue driver. The U.S. government division alone generated $373 million in Q1 2025, with overall government revenue up 45% year-over-year. Strategic partnerships, such as with Accenture to streamline federal operations and projects like the U.S. Navy’s ‘Warp Speed for Warships,’ highlight Palantir’s expanding footprint in critical government sectors. Simultaneously, the commercial segment is booming, with revenue soaring 71% to $255 million in Q1 and projected to reach $1.178 billion in 2025.

4. Financial Health and Growth Outlook.

Palantir’s financials are strengthening, with no debt and adjusted free cash flow more than doubling to $370.4 million in the recent quarter. Analysts forecast the company’s revenue to exceed $3.5 billion in 2025, up from $2.23 billion the previous year, and project potential revenue of $7 billion by 2028. Operating margins are improving, with a recent quarter reporting a 26% margin, the highest in company history. This solid financial foundation supports further investment in AI innovation and market expansion.

5. Market Position and Competitive Edge.

While Palantir competes with tech giants like Microsoft, Amazon, and Google in the AI and data analytics space, it has carved out a unique niche with its specialized government contracts and AI-driven software solutions. Its ability to integrate complex datasets for real-world operational use distinguishes it from competitors, fostering a loyal investor base and a "cult-like" following among retail investors.

6. High Valuation Reflects Growth Expectations.

Despite a high price-to-earnings ratio (PE around 621), reflecting elevated expectations, many analysts remain optimistic about Palantir’s long-term potential due to its rapid growth and expanding AI capabilities. The company’s market capitalization has soared above $330 billion, surpassing many established corporations, signaling strong market confidence.

7. Palantir stock is a compelling trading goal because it combines robust growth, cutting-edge AI technology, strong government and commercial contracts, and solid financial health.

8. In conclusion, Palantir remarkable stock performance and strategic positioning in the booming AI sector make it a promising investment for traders seeking exposure to transformative technology with significant upside potential.

9. ...and yet, Palantir performance since inception (It ultimately went public on the New York Stock Exchange through a direct public offering on September 30, 2020) is better, rather then Bitcoin.

--

Best wishes,

@PandorraResearch Team 😎

PLTR local top $150Palantir has has a nice run but this could be a local top. Reasons include hitting peak Trendline + hitting 2.618 fib + plus hitting #5 fib time zone. Also BTC appears to hit it's ATH Trendline today as well. So is everything hitting its local top before Trumps Liberation Day II on Aug 1? This week starts off with inflation data tomorrow, VIXEX on Wednesday, Mercury Retrograde starts Thursday, and we have OPEX on Friday. Stay tuned lets see what happens

PLTR: Trend Analysis 📈 PLTR | SMC Trend Continuation or Reversal? Watch This Key Zone

🔍 Chart Type: 15m

🧠 Strategy: Smart Money Concepts (LuxAlgo), EMA Stack (20/50/100/200)

📊 Volume Surge: 177.99K

🧭 Narrative: Institutional Accumulation + Premium Rejection

🚨 Current Price: $145.88

📍 Market Structure:

Price is currently reacting from a Premium Zone just above a recent Break of Structure (BoS).

We've seen a Chg of Character (ChgofCHoCH) and several bullish BoS confirming smart money intent.

Volume expansion at the highs suggests potential liquidity grab.

📐 Key Levels:

Premium Zone near $146

Equilibrium at ~$143

Discount Zone begins near $140

Strong Edge (deep discount) below $138

Long-term Target remains at $165.11 if bullish channel is respected.

📉 Bearish Scenario:

Break below Equilibrium and retest of Discount Zone = liquidity sweep

Watch if price retraces toward $140.10 (blue line) or lower for a higher-probability long.

📈 Bullish Scenario:

Break above current swing high confirms expansion toward $152+ and eventually $165.11

EMA stack remains bullishly aligned → trending continuation likely unless broken with momentum.

🔎 Institutional Insight:

Smart Money is likely building positions below equilibrium before major continuation. Liquidity pockets between $138–$140 are prime zones for potential long entries.

📆 Watchlist Catalyst:

Earnings cycle or Palantir federal contract news could align with breakout.

🧠 VolanX DSS Rating: BULLISH BIAS

✅ Structure: Bullish

✅ Volume: High

✅ Liquidity: Grabbed above recent highs

⛔ Confirmation: Await premium rejection or retrace to discount

—

🔁 Executed via VolanX Scanner + WaverVanir DSS

📊 Trade the future. Protect the edge. Lead with intelligence.

#WaverVanir #PLTR #SmartMoneyConcepts #VolumeProfile #MarketStructure #TechnicalAnalysis #VolanX #InstitutionalTrading #QuantFinance #TradingEdge #PropTrading

Earnings HFT gapsThe gaps that form during earnings season on or the next day after the CEO reports the revenues and income for that past quarter are always HFT driven. The concern over the past 2 previous quarters was the fact that the High Frequency Trading Firms were incorporating Artificial Intelligence into their Algos to make automated trading decisions on the millisecond scale. These small lot orders fill the ques milliseconds ahead of the market open in the US and any huge quantity of ORDERS (not lot size) causes the computers of the public exchanges and market to gap up or gap down, often a huge gap.

This can be problematic for those of you who use Pre Earnings Runs to enter a stock in anticipation of a positive to excellent earnings report for this upcoming quarter.

The HFT algos had several major flaws in the programming that did the opposite: The AI triggered sell orders rather than buy order causing the stock price to gap down hugely on good earnings news.

Be mindful that normal gaps due to a corporate event are far more reliable and consistent.

When you trade during earnings season, be aware that there is still added risk of an AI making a mistake and causing the stock to gap and run down on good news.

It is important to calculate the risk factors until it is evident by the end of this earnings season that the errors within the AI programming have been corrected and that the AI will gap appropriately to the actual facts rather than misinterpreted information.

PLTR - Premium Rejection Detected | Bearish Flow Confirms Put🧠 WaverVanir DSS | 15-min SMC x Options Flow x Liquidity

Palantir ( NASDAQ:PLTR ) has just tapped the 0.886–1.0 Fibonacci zone inside the Premium zone near $146.32, where price wicked above the weak high. This aligns with key liquidity exhaustion, suggesting a short-term distribution phase.

Meanwhile, our scanner picked up notable $144 Puts expiring July 18:

🧾 3,500 contracts traded with IV at 80.4%

🔁 Volume > OI → fresh bearish positioning

📉 $2.76 premium → traders paying up to hedge downside risk

🧩 Trade Breakdown:

Price action: Smart Money Premium rejection from $146.32 with reversal wick

Volume: Spike into imbalance zone below $143.20 = next probable draw

Options Flow: Bearish bets on $144 puts line up with chart thesis

ORB (9:30–9:45): High at $145.69, rejected cleanly at structure

🧭 Target Zone: $142.23 (discount block)

🚨 Risk Level: Above $146.50 invalidates short idea

PLTR at a Decision Point! for July 14GEX Walls and Wedge Breakdown Incoming?

🔸 GEX (Gamma Exposure) Breakdown for PLTR:

* Current Price: $141.99

* Key Gamma Resistance Zones:

* 📍 $145.15 – Highest Net Positive GEX (Gamma Wall)

* $144.58 – 2nd CALL Wall

* $146 – Overhead resistance from 2nd wall cluster

* Key Gamma Support Zones:

* $137 – HVL & 1st Put Layer

* $135 – 2nd Put Wall

* $132 – 3rd Put Wall

* $128.51 – GEX Low & Major Put Support

GEX Sentiment:

IVR: 39.3 (moderate)

IVx avg: 66.1

Options Flow Bias: CALL$ 56.7% – Slightly bullish

📈 Options Trade Strategy Based on GEX Zones:

🔹 Scenario A – Rejection from $145.15 (Most Probable):

* Bearish PUT Spread Play:

* Buy: $142.5 PUT

* Sell: $137 PUT (exp 7/19)

* Risk/Reward: Balanced downside toward HVL

* Trigger: If price stays below $142.5 and fails to reclaim $144.58

🔹 Scenario B – Breakout Above $145.15:

* Bullish CALL Play (speculative):

* Buy: $147.5 or $150 CALL

* Target: $155 (GEX9 zone)

* Only if: Price closes strongly above $145.5 on volume

🔸 GEX Outlook Summary:

* Upside capped at $146–$150 unless breakout volume enters

* Downside path to $135 / $132 is smoother if $140 breaks

* Gamma squeeze unlikely unless > $146

🧠 1-Hour Price Action & Intraday Trading Setup

⚙️ Market Structure:

* Trendline Support: Holding from recent rally

* CHoCH formed below resistance, suggesting a potential reversal

* BOS zone near $142.5–$144.6 creating supply

* Rising wedge breakdown forming

📊 Key Zones:

* Support: $140.53 (ascending trendline), then $137 (HVL)

* Resistance: $142.5 → $144.58 → $145.15

* Bearish Bias: As long as price is below $144.6

📉 Intraday Trading Plan (1H)

🔻 Short Setup:

* Entry: If price breaks below $140.50 with momentum

* TP1: $137

* TP2: $135

* Stop Loss: Above $144.60

🔼 Reversal Long (Less Probable):

* Entry: Break and hold above $145.15

* TP: $149.5 → $155

* SL: Below $143.5

🧭 Summary Thoughts:

* PLTR is sitting below strong GEX resistance with rising wedge weakness.

* Bearish structure forming unless bulls reclaim $145+ quickly.

* Favor PUT plays targeting $137–$135 unless breakout proves otherwise.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always manage risk and do your own due diligence before trading.

PLTR - Palantir Technologies: Why PLTR is the Perfect PlayExceptional Performance Leadership

Palantir Technologies has established itself as the undisputed champion of the U.S. stock market in 2025. The stock has delivered extraordinary returns of 402.92% over the past 12 months and 87.89% year-to-date, making it the best-performing stock in both the S&P 500 and Nasdaq-100 indices. Currently trading at $142.10, the stock has surged from lows around $21, representing one of the most dramatic momentum plays in modern market history.

Powerful AI-Driven Revenue Growth

The company's financial performance has been nothing short of spectacular. Palantir's U.S. commercial AIP (Artificial Intelligence Platform) revenue has surpassed a $1 billion annual run rate with 71% year-over-year growth. The company reported Q1 2025 revenue of $883.86 million, beating consensus estimates and growing 39% year-over-year. This growth trajectory is being driven by unprecedented demand for AI solutions across both commercial and government sectors.

The company's customer base has expanded to 769 total customers, up 39% year-over-year, with 44% of revenue now coming from commercial clients. This diversification away from pure government dependency represents a significant strategic achievement that provides multiple growth vectors.

Strategic Government AI Dominance

Maven Smart System Contract Expansion

Palantir's government business has reached new heights with its Maven Smart System contract being increased by $795 million, bringing the total value to over $1.3 billion through 2029. Pentagon leaders boosted the contract citing "growing demand" for the system across all military branches, including the Army, Navy, Air Force, Space Force, and Marine Corps.

Stargate AI Initiative Leadership

The company holds a central position in the $500 billion Stargate AI infrastructure project, positioning it as a backbone for America's AI future. This initiative represents one of the largest technological undertakings in U.S. history, designed to establish domestic AI superiority and reduce reliance on foreign systems.

Strategic Partnerships

Palantir has formed landmark partnerships with Microsoft for classified AI deployment and Accenture Federal Services for comprehensive government AI implementation. These alliances significantly expand the company's reach and delivery capabilities across the federal ecosystem.

Technical Momentum Confirmation

Bullish Technical Setup

The stock exhibits exceptional technical strength with multiple confirmation signals:

Moving Average Alignment : All major moving averages (20-day, 50-day, 200-day) are positioned bullishly below the current price, indicating sustained upward momentum

RSI Positioning: At 58.42, the RSI shows healthy momentum without being overbought, providing room for continued advancement

Volume Confirmation: Recent trading volumes have consistently exceeded 50 million shares daily, indicating strong institutional participation

Golden Cross Pattern: The 50-day moving average at $131.9 remains above the 200-day moving average at $101.7, confirming the bullish trend

Breakout Pattern

The stock has successfully broken above the $140 resistance level with strong volume, targeting the $175-$220 range based on technical analysis. The pennant pattern breakout above $140 has been confirmed by institutional buying pressure and retail momentum.

Institutional Investment Surge

Record Institutional Participation

Institutional ownership has reached 45.65% of outstanding shares, with $19.19 billion in institutional inflows over the past 12 months versus only $10.43 billion in outflows. This represents a net institutional buying pressure of nearly $9 billion, demonstrating strong professional investor confidence.

Premium Analyst Coverage

Wedbush Securities has raised its price target to $160, calling Palantir the "Messi of AI" and positioning it as a top pick in their "IVES AI 30" list. The firm sees Palantir's AIP platform as foundational for the trillion-dollar AI spending wave and believes the company has a "golden path to become the next Oracle".

Competitive Advantages and Market Position

Architecture-Agnostic Platform

Palantir's AIP is architecture-agnostic, seamlessly integrating with both centralized cloud systems and decentralized frameworks. This versatility allows the company to serve diverse client needs across multiple sectors, from government defense to commercial healthcare.

Network Effects and Data Flywheel

The company benefits from powerful network effects where more customers generate more data, which improves AI models and increases retention rates. This creates a self-reinforcing competitive advantage that becomes stronger over time.

Government Moats

Palantir's deep government relationships and security clearances create substantial barriers to entry. Multi-year government contracts provide revenue stability and growth visibility that few technology companies can match.

Financial Strength and Profitability

The company has demonstrated seven consecutive quarters of GAAP profitability with expanding margins. Adjusted operating margins have improved to 36% in Q1 2025 from 29% previously, showing operational excellence alongside revenue growth. The company maintains a strong balance sheet with $4 billion in cash and equivalents.

Investment Thesis Summary

Palantir Technologies represents the perfect convergence of momentum, fundamentals, and catalysts that defines exceptional investment opportunities:

Momentum Factors:

402.92% twelve-month returns leading all major indices

Continuous institutional accumulation with $9 billion net inflows

Technical breakout above key resistance with volume confirmation

Fundamental Catalysts:

$1 billion+ AIP commercial revenue run rate with 71% growth

$1.3 billion+ government contract pipeline expansion

Central role in $500 billion Stargate AI infrastructure initiative

Strategic Positioning:

Architecture-agnostic platform creating multiple market opportunities

Government relationships providing defensive moats and growth visibility

Network effects and data flywheel creating competitive advantages

Risk-Adjusted Opportunity:

Clear support levels at $137-$140 range providing defined risk parameters

Multiple price targets ranging from $155-$220 suggesting significant upside potential

Strong balance sheet and cash generation providing downside protection

Palantir Technologies embodies the rare combination of explosive growth, defensive positioning, and strategic importance that creates generational investment opportunities. The company's leadership in AI government applications, combined with accelerating commercial adoption, positions it as a cornerstone holding for the AI revolution.

PLTR Trade Update – July 11, 2025📅

PLTR held the breakout like a champ. ✅ After a clean move through the triangle resistance yesterday, today’s price action continues to build strength above $142.50.

🔼 Bulls are in control, riding the momentum with higher lows and tight consolidation near breakout levels.

🎯 Targets remain firm at $144.05 and $146.04.

🛡️ Stop-loss still protected below $139.76 — trade remains active and technically strong.

The structure is bullish, volume supports the trend, and PLTR could be gearing up for the next leg higher. Watching closely for a push into resistance zones.

🔍 Strategy: Breakout Continuation

📊 Sentiment: Bullish & Confident

💡 Holding long — eyes on the volume and breakout follow-through.

PLTR Poised for Gamma Squeeze? Here's the Key Setup-July 10📈 GEX Options Sentiment & Trade Strategy

Palantir (PLTR) is pressing into a high-compression zone on the Gamma Exposure (GEX) chart, where multiple call walls cluster between 143 → 146, with the strongest net positive GEX wall at 146, acting as the gamma squeeze ceiling. The 3rd call wall sits at ~145, and momentum is building with IVR 40.6, IVx avg 61.3, and a strong 40.8% bullish call-dollar dominance, signaling sustained call flow.

Crucially, there’s minimal put protection above current price, with most put walls far below at 130, 127, and a weak HVL at 133. This imbalance opens room for a potential gamma push toward 145–146, especially if the 143.17 intraday high breaks with volume.

💡 Options Trade Ideas:

* Bullish Setup:

145C (0DTE or 7/12 expiry) if price confirms over 143.50, targeting the 145–146 zone.

Ideal for a short squeeze continuation with trailing stops.

* Hedge/Defensive PUT:

135P if price rejects sharply at 143.50 and loses 140.5 support—risk-managed fade toward HVL at 134.

🔍 1H Chart Technical Outlook

PLTR is moving inside a rising wedge channel, maintaining a strong bullish market structure with back-to-back CHoCH → BOS confirming bullish intent. Price is consolidating under the supply zone near 143–144, coiled for a breakout attempt. The trendline holds firm, and volume is beginning to expand with each retest.

If price breaks and holds above 143.20, bulls can target 146, and even higher toward the channel resistance near 148.21. However, caution: a false breakout here could trap late bulls, so monitor for retest confirmation before chasing.

Support to watch sits at:

* 139.70 / 139.30 – minor support zone

* 137.40 – EMA + trendline confluence

* 134.52 / 133.00 – critical HVL and invalidation zone

✅ Summary & Trade Plan

* Bias: Bullish with gamma momentum, but nearing exhaustion zone

* Breakout Trigger: Above 143.20 → ride the gamma zone to 145–146

* Key Support: 139.70 / 137.40 (hold = healthy trend)

* Invalidation: Break below 134 = game over for bulls short-term

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk accordingly.

Trade Reflection – PLTR Long Setup🧠

Lately, I’ve been focusing on breakouts from key resistance levels supported by ascending trendlines. Today’s trade on NASDAQ:PLTR was a textbook example.

📈 Ticker: PLTR

🔁 Trade Type: Long

🕒 Timeframe: 30-min

📍 Entry Zone: $139.24 (Pre-market breakout)

🎯 Target: $146.66

🛑 Stop Loss: Below $137.00

🔍 Why I Took This Trade:

Price was consolidating right below strong horizontal resistance around $139.

An ascending trendline formed over the past few sessions, creating bullish pressure.

Clean breakout with volume and confirmation on retest.

🧠 What I Learned:

Waiting for confirmation at resistance breakout is key.

Clean structure + trendline + consolidation = high-probability setup.

Reward-to-risk ratio was favorable, with room to $146.

✨ Whether this trade hits TP or not, the setup followed my plan. That’s a win.

📊 Logging and reviewing setups like this helps me stay disciplined and improve daily.

PLTR Approaching Key Gamma Resistance–Will 140 Break or Reject?🔍 Options Sentiment (GEX Analysis):

PLTR is pushing into a high gamma zone with notable resistance from options positioning:

* Call Walls are stacked at 140, 142, and 145, with the 145 line aligning with a GEX10 and 2nd Call Wall (86.54%). This suggests significant overhead resistance and a possible hedging zone.

* Gamma flip zone is near 137, where the Highest Positive NETGEX sits — this acts as a pivot or support.

* Below 133, a Put Wall at 130, along with -14.16% NetGEX, offers clear downside targets if bulls lose momentum.

Implied Volatility Data:

* IVR 38.5 / IVx avg 62.3 – Implied volatility is relatively compressed.

* Call positioning is dominant at 38.1%, with GEX showing a ⚠️ yellow signal and diamond risk signals forming — indicating risk of volatility expansion.

🧠 Options Trade Ideas:

Bullish Case (Momentum breakout):

* If PLTR clears 140 with volume, a breakout toward 144–146 is possible.

* Suggested trade:

* Buy 145C or 150C (next week) on breakout + momentum confirmation.

* Ideal for gamma squeeze into overhead walls.

* Cut below 137.

Bearish Case (Rejection & fade):

* Rejection below 140 + shift under 137 would invalidate gamma support.

* Suggested trade:

* Buy 135P or 130P, looking for unwind down to 133 → 130.

* Cut if PLTR reclaims 140 and holds.

⏱ 1-Hour Price Action Analysis (Intraday to Swing Trading):

PLTR has been climbing steadily within a rising wedge channel, forming higher lows and breaking previous CHoCH/BOS zones.

* Recent CHoCH → xBOS confirms bullish intent but we’re currently at a potential short-term supply zone.

* Price is near structural resistance at 139.30–140, while remaining above the ascending trendline support.

📌 Key Levels:

* Resistance: 140 → 142 → 145

* Support: 137 (pivot), 133 (gap/FVG), then 130

* Trendline Support: Ascending, unbroken since early July

💡 Trading Outlook & Strategy:

* This is a "make-or-break" zone — bulls must clear 140 to unlock upside toward 144–146 (in line with call walls).

* Failure to break this level likely triggers profit-taking, especially if macro headwinds align.

* A pullback to 133–137 could provide a clean dip-buy zone, but a breakdown below 133 opens room to 130 and beyond.

✅ Actionable Strategy:

* Break & Hold Above 140 = Long setup

* Target 144/146

* Stop below 137

* Failure at 140 + Break Below 137 = Short setup

* Target 133/130

* Stop above 140

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk carefully.

PLTR temporary top?Bearish case

Monthly RSI at 91

Weekly candles encountering resistance

Daily candles under the 20 day SMA

Bullish case

Monthly candle not a clear bearish candle, no monthly volume spike or no monthly RSI double top like SMCI and no bearish divergence detected yet.

Weekly no continuation down after first 2 red weekly candles

Daily volume spike suggest temp bottom

Conclusion

Let's see the next weekly candle from July 7 to 11.

PLTR just started the first phase of the Wyckoff distributionBased on the weekly and daily charts provided for Palantir (PLTR), here is a Wyckoff analysis and a corresponding diagonal option spread strategy.

### **Wyckoff Phase Analysis of PLTR**

From the price and volume action on the charts, **PLTR appears to be in the initial stages of a Wyckoff distribution phase (Phase A)**. This phase marks the stopping of the prior uptrend.

* **Weekly Chart:** The long and powerful uptrend is characteristic of a **Markup** phase. However, the recent price action shows a significant change. The peak near $148.22, followed by a sharp decline, can be interpreted as a **Buying Climax (BC)** and an **Automatic Reaction (AR)**. This is a classic sign that large institutions ("smart money") may be starting to sell or distribute their shares.

* **Daily Chart:** The daily chart shows a failure to make new highs, followed by a very sharp sell-off on a spike in volume. This represents a significant **Sign of Weakness (SOW)** and confirms that the character of the market has changed from bullish to potentially bearish or neutral. The uptrend has been broken.

In summary, the strong upward momentum in PLTR has halted, and the stock is showing clear signs of entering a distribution or consolidation phase at these higher prices.

### **Trading PLTR with a Bearish Diagonal Put Spread**

Given the analysis that PLTR is entering a distribution phase, a neutral to bearish outlook is appropriate. A **bearish diagonal put spread** is a suitable strategy to profit from a potential decline in price or even from the stock trading sideways, as it benefits from time decay.

This strategy involves buying a longer-dated, in-the-money (ITM) put option and selling a shorter-dated, out-of-the-money (OTM) put option.

**How to Structure the PLTR Trade (Current Price ~ $130.74):**

1. **Buy a Long-Term Put:**

* **Action:** Buy to open a put option.

* **Expiration:** Choose a later expiration, for example, **4-6 months out**, to give the distribution and potential markdown phase time to develop.

* **Strike Price:** Select an in-the-money (ITM) strike to create a bearish position. A strike price around **$140 or $145** would be appropriate.

2. **Sell a Short-Term Put:**

* **Action:** Sell to open a put option.

* **Expiration:** Select a near-term expiration, typically **30-45 days away**.

* **Strike Price:** Choose an out-of-the-money (OTM) strike below the current price. For instance, selling the **$120 strike** would provide income and define your risk.

**Example Trade (Illustrative Purposes Only):**

* **Buy 1 PLTR put with an expiration 5 months away at a $140 strike.**

* **Sell 1 PLTR put with an expiration in 35 days at a $120 strike.**

The objective is for the short put to lose value from time decay and expire worthless, allowing you to keep the premium. This premium reduces the cost of your long-term bearish put. You can then sell another short-term put for the following month to continue generating income against your long-term bearish position.

> ***Disclaimer:*** *This content is for informational purposes only and should not be construed as financial advice. Options trading involves substantial risk and is not appropriate for all investors. Please conduct your own research and consult with a qualified financial professional before making any investment decisions.*

GEX-Based Options Sentiment GEX-Based Options Sentiment (as of July 7)

* Current Price: $138.69

* Highest Gamma Resistance (Call Wall): $139 → heavy OI + positive NetGEX → magnet + possible rejection

* Next Call Walls:

* $142 (GEX7, 51%)

* $144–146 stacked (GEX8–10) — breakout potential zone if $139 clears

* Put Wall + Support Stack:

* $131 (HVL for 7/11 expiry)

* $128, $127 → deep support zones

* Net GEX Bias: Mildly bullish short-term

* IVR / IVX:

* IVR = 38.5 (low)

* IVX = 64.7 avg

* Flow Tilt: 40.4% CALLs → Balanced, but leaning risk-on

📌 Option Trade Thoughts:

If PLTR clears and holds above $139, expect potential squeeze toward $142–$144 zone. Good setup for short-dated directional calls (0DTE or 2DTE) targeting $140–$142 with tight stops.

Below $135.5–134 = breakdown back into the lower GEX zone → bearish PUT play to $131–128.

Options Suggestion:

• Bullish Scenario: 140C or 142C (0DTE/2DTE) if $139 flips support

• Bearish Scenario: 134P or 132P if price fails to reclaim $139 and breaks $135.5

Keep risk small — IV is relatively low so premiums still reasonable.

📉 1-Hour Price Action and SMC Outlook

* Structure: PLTR in a rising channel with clean higher lows

* CHoCH → BOS confirmed: Valid short-term bullish structure

* Current Zone: Consolidating under resistance ($139), forming ascending pennant inside channel

* Support Levels:

* $135.62 → prior CHoCH and EMA confluence

* $134.36 and $132.20 as deeper pullback supports

* Volume: Rising on pushes, fading on retrace → healthy structure

🎯 Trade Setup Ideas:

Bullish:

* Entry: $139 breakout with volume

* Target: $142 → $144

* Stop: Below $135.5

Bearish:

* Entry: Rejection at $139 and break back below $135.5

* Target: $132.2 → $130

* Stop: Above $139.50

📈 Watch for confirmation of breakout or rejection from this wedge. Patience is key.

🧠 My Take:

PLTR is at a decision point — either breakout and trend to mid-$140s, or fakeout and retrace to reload lower. GEX stack shows resistance is thick but not extreme. Smart Money Concepts (CHoCH + BOS + channel structure) suggest bullish bias is intact — but we need confirmation over $139.

Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always manage your risk and do your own research before trading.