RYC trade ideas

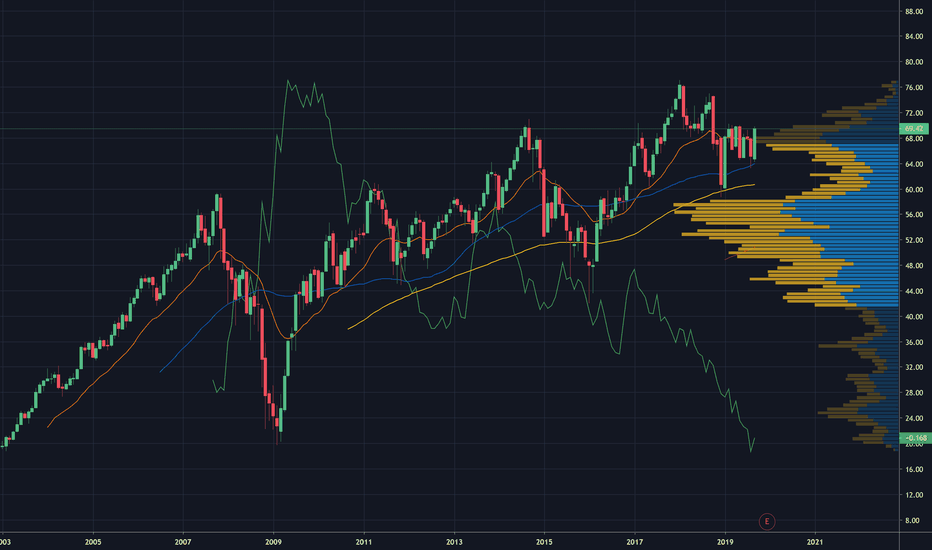

RBC $RY large head and shoulders patternRBC $RY large head and shoulders pattern forming, as the correction in September 2011 and January 2016 formed the base for the left shoulder. While the rally from 2016 to 2018-2019 formed the head of the top.

Looking for RY to retrace to the base at $44 by March 2020.

Short term retrace to lows of December 2018.

International trading problems will get us into a harsh collapseBanks are the key to understand early financial market problem, this time it is a combination between COVID19 and inflation as well as over due market correction. The magnification is very STRONG in nature and it will lead to a history record recession.

Back to the stock; if March 2020 did not see a good bull back, the orange line will be our only support. However, this chart might explain a problem in banking system and international trading obstacle. If bank are not backed up with enough gold and precious metal it would be a MASSIVE collapse. Depends on what the bank major investment is. If housing and mortgages then a massive collapse, if farming, medical, essential life goods then we will see an early pick up even during the recession.

Buy the dip playIf we take a look at the RSI and the price action at the hourly we can see several points of bullish divergence as well as on the MACD histogram in addition to its bullish uptick and potential crossover.

If we take a closer look at the 15 minute chart we can also see an RSI bullish divergence as well has the MACD bulish divergence and if you look at the MACD histogram on the positive side you can see that it is starting to make a concave shape, indicating some bull strength on the short term, but of course it was at closing ,so it can be unpredictable how that will affect it will open the next day.

If we take a look at the daily chart and compare the RSI on august we can see a hidden bullish divergence and a MACD that is about to cross over with a bullish uptick.

The gain is not that much for this play, but I think it's a pretty safe play that is worth to take in my opinion.

Undervalued RYEvery day I pick a few stocks - the most undervalued stocks in AMEX, NYSE & NASDAQ with lowest RSI and other technical analysis (200-day moving average action and volume change), to trade for the next day. Charts for RY is looking great for a 1-day long play (for tomorrow)

More Details:

youtu.be

RY - Royal Bank about to make all-time highsI predict we will hit ATH (above $87.50) by Christmas 2019, and head another 5% higher after that (PT of $92.50, then $100 by mid-march 2020). We've quite obviously been in an expanding triangle since February of 2019, and are now just breaking out of it, and will obviously fill that $83.40 gap likely this week.

Looking at the broader US financial sector, we're going to challenge the ATH (since 2007 levels) up 4% from now.

Back to Royal Bank: I charted this using the Fibonacci Resistance Fan, and you can see that we're above the 0.75 trend line. We're now breaking out of the expanding triangle, with the first target as the height of triangle. Combined with the overall sector strength, I easily see the first target of $92 being hit (which correlates with the Fib based trend extension target). As always, take 25% profit at the ATH of $87.50.

Finally, as this is a very loose Elliott wave analysis (I don't have the time or experience to map this one out), I see us in the corrective wave 4 heading into our wave 5. As per the guidelines of wave equality, I'm guessing Wave 5 will vary from 100% to 162% of wave 1 height, which puts us at a price target of $100 by spring.

RISK/REWARD: This is a buy at it's current price of $82, with a stop loss at $79.98. With the first target of 92, this is R/R of 5. Potential gain = 12%, loss = 2.54%.

Also, considering you're reading this, I'm assuming your Canadian. Yesterday, I charted out the Toronto housing market over the past 10 years, an exercise that I don't believe has been done before. I took the average sales, opening, closing, and high/low from each period to create a chart, and the results are pretty interesting. I'll be releasing it shortly!

Huge volume spike in Royal Bank Of Canada Royal Bank of Canada engages in the provision of banking and financial solutions. It operates through the following segments: Personal and Commercial Banking; Wealth Management; Insurance; Investor and Treasury Services; Capital Markets; and Corporate Support. The Personal and Commercial Banking segment deals with a broad suite of financial products and services in Canada. The Wealth Management segment offers a comprehensive suite of investment, trust, banking, credit, and other wealth management solutions to institutional and individual clients through its distribution channels and third-party distributors. The Insurance segment refers to a range of life, health, home, auto, travel, wealth, group, and reinsurance products. The Investor and Treasury Services segment comprises of asset services and a provider of cash management, transaction banking, and treasury services to institutional clients worldwide. The Capital Markets segment covers banking, finance and capital markets to corporations, institutional investors, asset managers, governments, and central banks around the world. The Corporate Support segment consists of technology and operations services. The company was founded by J. W. Merkell, Edward Kenny, T. C. Kinnear, James B. Duffus, William Cunard, John Tobin, George P. Mitchell and Jeremiah Northup in 1864 and is headquartered in Toronto, Canada.

RY (Royal Bank of Canada) | 10% Short Trade SetupConfirmation: 103.60

Invalidation: Local high

Type of Trade: Countercyclical (EMA50 above EMA200)

Target: 92.19

TF:4HR

Leverage: 2x

Pattern: 1) daily double top with 2) trendline break, 3) untested 8/1 Gann, and 4) frothy fundamentals (insufficient loan loss provisions).

RY (RBC BANK) | Watch For Rejection and New DowntrendRY has filled a gap created back at the beginning of 2018 and we also see a potential large double top formation on the daily and weekly timeframes that is being formed by rejection. This is an opportunity to position short for a new downtrend on the lower timeframes, looking for support on the 8/1 Gann and as low as the 4/1 Gann.

On the larger timeframe, don't forget Steve's trade (targets are my own though):

PS. Some Index funds might be worth shorting as well.

Steve Eisman's Canada TradeSteve Eisman (depicted as Marc Baum in The Big Short movie) has publicly revealed the institutions he is shorting in anticipation of the next wave of credit normalization. They include RBC, CIBC, Home Capital Group, and Laurentian Bank. Steve has not revealed his targets or how far exactly the trade will go, so the estimates on the chart are my own.

As you know, I have been establishing net short positions on numerous banks around the world since the end of last year.