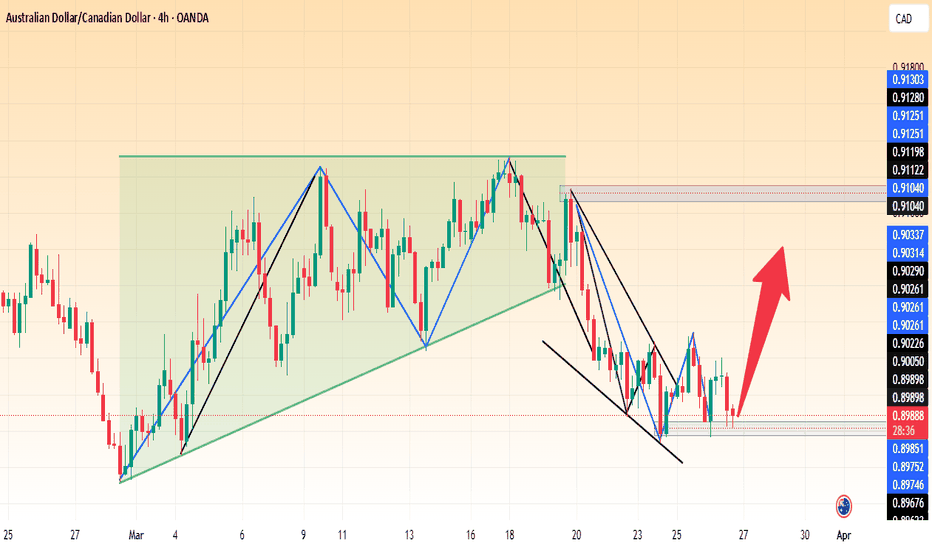

AUD-CAD Will Go Down! Sell!

Hello,Traders!

AUD-CAD shot up sharply

But then horizontal resistance

Of 0.9035 and we are already

Seeing a bearish reaction so

We will be expecting a

Further move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CADAUD trade ideas

AUDCAD SHORT Q2 W14 Y25 WED 2ND APRIL 2025AUDCAD SHORT Q2 W14 Y25 WED 2ND APRIL 2025

All the ingredients for a high probability short position. Weekly & daily 50 Exponential moving averages coming to join the short party. Higher time frame, namely the weekly time frame currently range with EMA beautifully in the middle of price action. That leaves from a deeper look into the lower time frames to see where the higher time frame EMA's line up.

I'll keep it snappy, what I require is price NOT to touch the Tokyo lows. This is added into the bag of FRGNT confluences. Price needs to trickle into the 15' just above the current Tokyo session. I need lower time frame breaks of structure to form post London open. A lower time frame order block to be created to short from. 5' Break of structure is what is I'd like to see.

Short and snappy short synopsis. I hope the photo paints the narrative better than I can explain it.

FRGNT X

AUDCAD Technical AnalysisOur analysis is based on multi-timeframe top-down analysis & fundamental analysis.

Based on our view the price will fall to the monthly level.

DISCLAIMER: This analysis can change anytime without notice and is only for assisting traders in making independent investment decisions. Please note that this is a prediction, and I have no reason to act on it, and neither should you.

Please support our analysis with a like or comment!

Let’s master the market together. Please share your thoughts and encourage us to do more by liking this idea.

Bearish reversal?AUD/CAD is rising towards pivot and could reverse to the 1st support.

Pivot: 0.90381

1st Support: 0.89522

1st Resistance: 0.90617

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

#AUDCAD: 548+ Pips Selling Opportunity! Comment Your Views? OANDA:AUDCAD

We have a good selling opportunity coming up and this can worth up to 548 pips. We estimate trade to get activated within next week or so since we have NFP next week. We recommend all of you to use proper risk management. Good luck and have great weekend.

AUDCAD KEY LEVELS TO WATCH 121 BULLISH Hello traders, I hope you’ve had a fantastic trading week!

This week we’ve been closely monitoring AUDCAD, and the market continues to offer a high-probability bullish setup, especially when we zoom out and line up our multi-timeframe structure.

🟩 Daily Chart – 1:1 Symmetry & Bullish Pattern

As we can see on the daily timeframe, price respected the prior harmonic rhythm and completed a perfect 1:1 AB=CD structure at 0.89665.

This symmetry lands exactly on a rising trendline from earlier this year and has already sparked a minor bullish reaction.

XA = CD symmetry confirms harmonic balance.

The entry level is 0.90085, with a stop below 0.89647.

The price is now testing the structure from above — a sign of healthy re-accumulation.

🌀 4H Chart – Cypher Completion Holding

On the 4H chart, the potential Cypher pattern has completed and so far held well. The CD leg dropped into the ideal PRZ and bounced, giving us a confluence with the 1D symmetry pattern.

We’re monitoring a potential long trigger above 0.89916.

This is a spot where bulls have to prove themselves — above the entry we may see momentum pick up again.

📊 1H Chart – Rectangle Channel Still Intact

Dropping to the 1H view, AUDCAD continues to trade within a well-defined rectangle channel.

We're yet to see a strong breakout from the 0.90292 upper level, but the tight consolidation just beneath it tells us accumulation might be in play.

✅ Conclusion

Bullish structure remains valid from the daily down to the hourly view.

We're now watching for volume and confirmation above 0.90085 and 0.90292 to open the gate for upside targets:

38%: 0.90716

62%: 0.91355

78%: 0.91835

Until then — we stay patient, protect risk, and let the structure mature.

AUDCAD Trading Opportunity! BUY!

My dear subscribers,

My technical analysis for AUDCAD is below:

The price is coiling around a solid key level - 0.9004

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 0.9043

My Stop Loss - 0.8981

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

AUD/CAD Short🔍 Technical Context:

Market Structure:

Price is in a long-term sideways range with lower highs. AUD/CAD is struggling to break above the 0.90–0.91 region, showing signs of exhaustion.

Zone of Interest (Supply):

Purple box: 0.9000 – 0.9100

A clean historical rejection zone that has acted as both support and resistance multiple times since 2022.

Entry Type:

Sell Limit @ 0.9070 placed slightly below the top of the resistance zone to increase likelihood of getting triggered on a spike.

Stop Loss:

0.9175 – above multiple wick rejections and key structure highs. Allows breathing room for volatility without compromising the structure.

Take Profit Targets:

TP1: 0.8650 (conservative target at strong support)

TP2 (optional extension): 0.8500 (major long-term range low)

Risk-Reward Ratio:

~1:3 minimum to TP1, potentially 1:4+ if extended to 0.8500.

🧠 Strategic Notes:

Trigger Conditions:

Wait for a retrace to the 0.9070 zone rather than enter at market open. This is based on the idea that a final upward effort could grab liquidity and fill your limit.

Monthly Candle Watch:

Monday is month-end. Monitor the monthly close to determine if the structure still supports the trade idea. If the close is strongly bullish and you’re triggered early, be open to closing the trade early to avoid deeper drawdown.

Why It’s High Probability:

Multi-year horizontal structure

Repeated failure to hold above 0.90

Candlestick wicks rejecting the same zone

Fundamentals slightly favor CAD over AUD (higher real yields, oil correlation)

Defined invalidation point and asymmetric reward

AUDCAD RE. CHANNEL AND KEY LEVELS Hello awesome traders i hope you have had a great trading week, let's have a look at the AUDCAD presenting a great trading opportunity.

Price is breaking above the trendline breakout at 0.90931, signaling a potential bullish continuation.

📈 Trade Setup:

✅ Breakout Level: 0.90931 (Key resistance turned support)

🎯 First Target: 0.91732 (Mid-range resistance)

🎯 Second Target: 0.92816 (Upper resistance)

❌ Stop Loss: Below mid-support at 0.90122

🧐 Key Observations:

🔹 The breakout needs sustained momentum for confirmation.

🔹 A pullback to retest 0.90931 could provide a better entry.

🔹 If price fails to hold above 0.90931, a dip back to 0.90122 is possible.

📊 Market Sentiment:

📌 Monitor volume and momentum at the breakout zone.

📌 If buyers hold above 0.90931, it strengthens the bullish outlook.

🔥 Keep an eye on price action for confirmation before scaling in! 🔥

Have an amazing weekend, trade safe and may the pip be with you !!

AUD/CAD – Potential Bullish Reversal from Key Support📊 Chart Analysis

1️⃣ Accumulation Zone : The price previously traded within a rectangular consolidation range before breaking down.

2️⃣ Bullish Reversal Pattern : A falling wedge has formed, indicating a possible breakout to the upside.

3️⃣ Key Support : The price has tested the 0.8980 - 0.8970 zone multiple times and is showing signs of rejection.

4️⃣ Potential Upside : A breakout above 0.9030 - 0.9050 could confirm further bullish momentum.

🚀 Trading Plan:

📌 Entry : On a breakout above 0.9025

🎯 Targets :

First target : 0.9100

Extended target : 0.9130

🛑 Stop Loss : Below 0.8965 to minimize risk.

🔔 Confirmation Needed: Wait for strong bullish price action before entering long trades. 🚀🔥

AUD/CAD NEXT MOVESell after bearish candle stick pattern, buy after bullish candle stick pattern....

Best bullish pattern , engulfing candle or green hammer

Best bearish pattern , engulfing candle or red shooting star

NOTE: IF YOU CAN'T SEE ANY OF TOP PATTERN IN THE ZONE DO NOT ENTER

Stop lost before pattern

R/R %1/%3

Trade in 5 Min Timeframe, use signals for scalping

DCF: AUD-3 vs CAD+7Today, I’ve spotted a shorting opportunity on AUDCAD!

DCF: Capital flow favors the Canadian dollar (+7) over the Australian dollar (-3).

On the daily chart, the new downward move (Leg 1) signals the start of a fresh trend.

Currently, the price is making its third reaction from the low, aligning with lower TF supply zones and the cyclical resistance line. The fourth time unit must form a red bar; otherwise, it suggests that the downward momentum is weakening, as reactions typically last only 1–3 time units before continuing.

Ideally, identifying a Bull Trap—a bearish liquidity pattern—would serve as strong confirmation to add extra short positions.

AUDCAD - Sell Trade SetupWaiting for AUDCAD to reach the level I plotted on the chart to sell it.

Leave a comment below, let me know what you think. Share with friends. Check out my profile for more awesome trade plans and setups. DM for copy trading, use any regulated FX broker.

Trade Safe - Trade Well

~Michael Harding

AUDCAD | Reoccurring FractalsWe're looking at 3 complete fractals and the fourth one being the current one. Same phase as the last, a bit of sideways trading/consolidation then aggressive buying breaking out to the upside.

Price action has been trending upwards with HHs and HLs and we're currently at a Lower High bouncing off the lower trendline below.

Would be ideal to look for long positions only for this setup as bulls are looking stronger from this view.

~300pips going into the 3rd wave.

AUDCAD Approaching Key Support - Rebound Towards 0.90150?OANDA:AUDCAD is approaching a significant support zone, highlighted by previous price reactions and strong buying interest. This area has previously acted as a key demand zone, increasing the likelihood of a bounce if buyers step in.

The current market structure suggests that if the price confirms support within this zone, we could see a bullish reversal. A successful rebound could push the pair toward the 0.90150 level, a logical target based on previous price behavior and current market structure.

However, if the price fails to hold this support and breaks below the zone with momentum, the bullish outlook may be invalidated, potentially opening the door for further downside continuation. Monitoring price action and volume in this area will be crucial to confirm a valid setup.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

AUDCAD: Bearish Move From Resistance 🇦🇺🇨🇦

There is a high chance that AUDCAD will retrace from the intraday resistance.

A bearish movement after an extended consolidation on an hourly time frame

provides a reliable bearish signal.

I expect a down movement at least to 0.901

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.