CADCHF SHORT LIVE TRADE AND BREAKDOWN EXPLANATION 9K PROFITThe CHF/CAD pair tells the trader how many Canadian Dollar (the quote currency) are needed to purchase one Franc Swiss (the base currency). These two economies are quite intensely linked because Canada is an important producer of gold while Switzerland is a great importer of that same commodity - a quart part of the overall commodities imported by Switzerland is gold and there is a solid tradition of gold refineries/gold mining companies in the country. Switzerland can be considered as a stable and safe country. The same accounts for its currency, the Swiss Franc (CHF). The currency is often referred to as the “safe-haven” currency, as it is a backup for investors during times of geopolitical tensions or uncertainty: it is expected to increase its value against other currencies in times of volatility.

CADCHF trade ideas

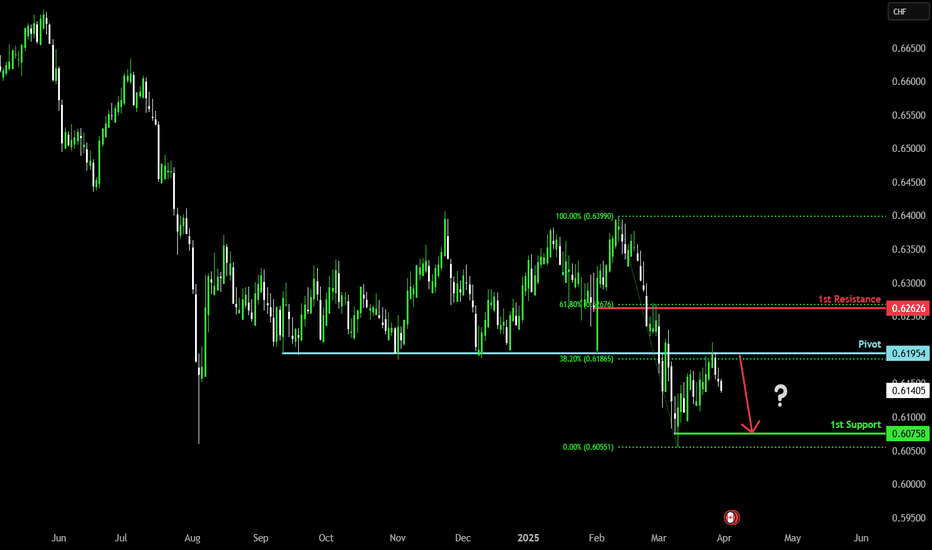

Bearish drop off pullback resistnce?CAD/CHF has rejected off the pivot and could drop to the 1st support.

Pivot: 0.61954

1st Support: 0.60758

1st Resistance: 0.62626

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

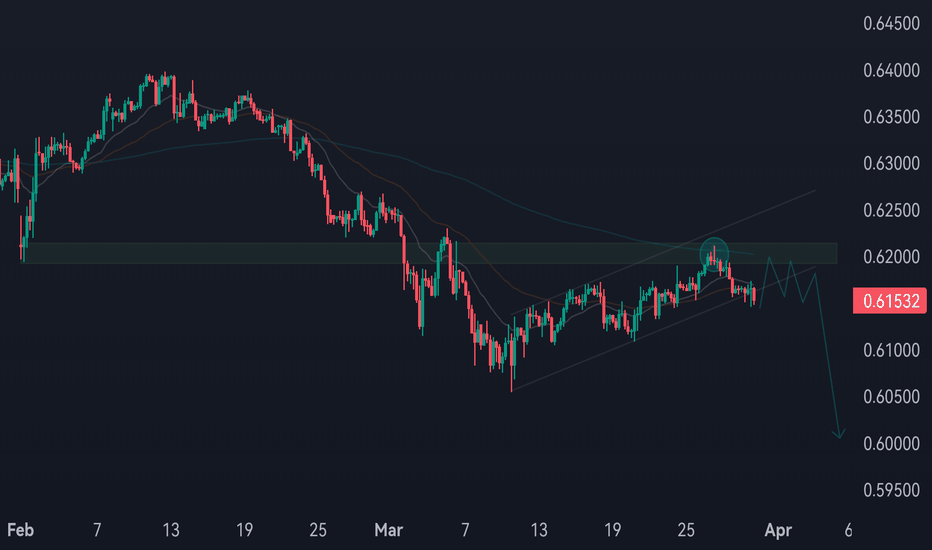

CAD/CHF Daily AnalysisPrice has closed below the CTL (counter trendline) on the final day of trading last week.

The current bearish trend started in February and has most recently been in a potential corrective pattern where it retested and rejected 0.6200

We may now see a push from the sellers back towards major support at 0.6060 unless the current break below the CTL is a false break.

Look for potential sell setups if they meet your strategy rules.

This is an idea of what may happen. You should always trade with a well tested and profitable trading strategy using good risk management.

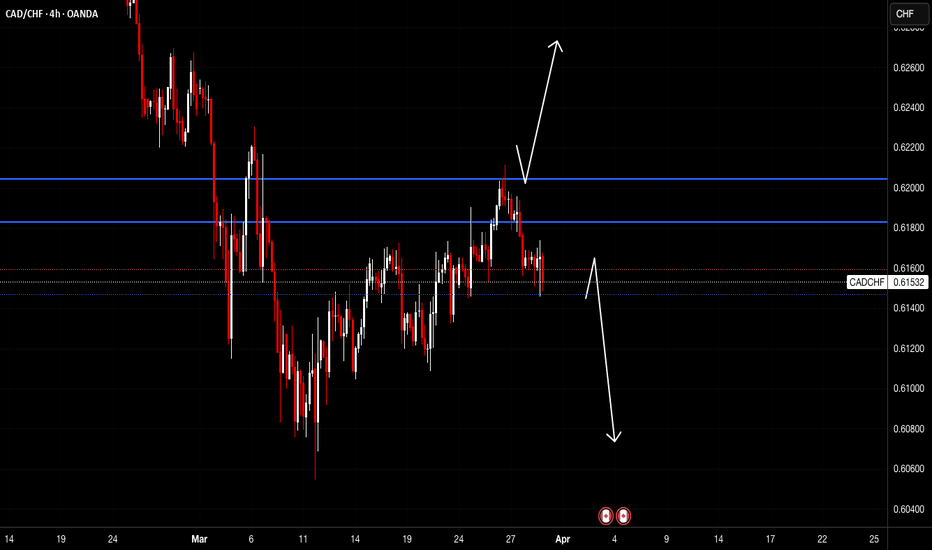

CADCHF Will Go Lower From Resistance! Sell!

Please, check our technical outlook for CADCHF.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 0.615.

Considering the today's price action, probabilities will be high to see a movement to 0.611.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

CADCHF Short Bias ! The pair attempted to break above the 0.6200 resistance zone but failed, forming a rejection. This suggests potential bearish momentum ahead.

Market Structure: Still bearish overall, despite a short-term ascending channel.

Bearish Scenario: If price respects the 0.6200 resistance and breaks below the ascending channel, it could head towards 0.6000 as the next major support.

Confirmation Factors:

Price rejection at resistance.

Moving averages acting as resistance.

Possible breakdown of the ascending channel.

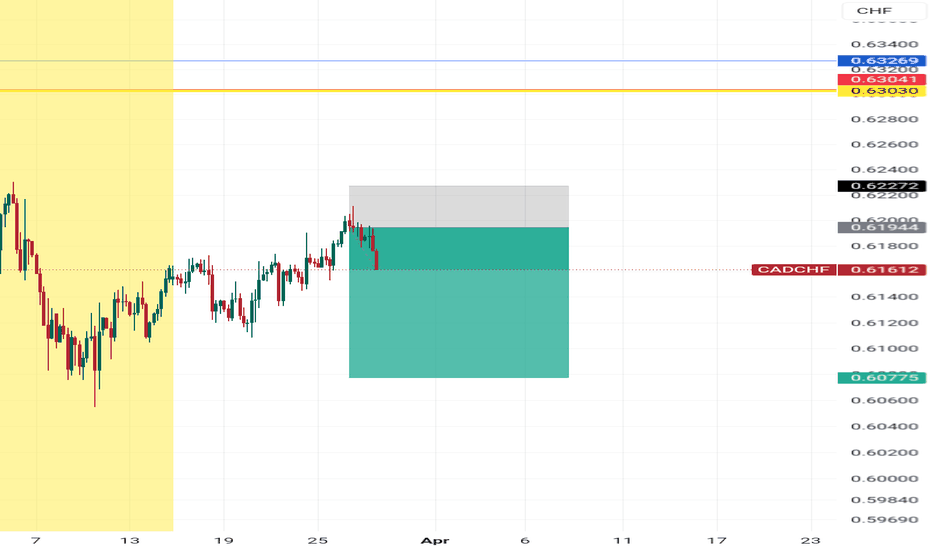

CAD-CHF Nice Bearish Setup! Sell!

Hello,Traders!

CAD-CHF made a retest

Of the horizontal resistance

Level and is already marking

A bearish pullback while trading

In a bearish wedge pattern so

If we see a breakout then

A further move done is to be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CADCHF Bullish Momentum: Will 0.63000 Be the Next Target?The Canadian dollar continues to show strength despite the 25% tariff imposed by the United States. Meanwhile, the DXY opened bearish today, and with ongoing tariff uncertainty, this weakness may persist. As investors gain clarity on policy direction, CAD could further appreciate. Given this momentum, CADCHF has the potential to reach at least 0.63000. However, multiple resistance levels could come into play, making it crucial to monitor lower time frames for partial profit-taking opportunities.

CADCHF My Opinion! SELL!

My dear followers,

I analysed this chart on CADCHF and concluded the following:

The market is trading on 0.6196 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 0.6157

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

CADCHF Bullissh or Bearish ??? Detailed analysisCAD/CHF is currently trading at approximately 0.6150, forming a bearish flag pattern—a continuation signal that typically precedes further downward movement. This pattern emerges after a sharp price decline, followed by a consolidation phase characterized by parallel trendlines. A breakout below the flag's lower boundary could potentially lead to a decline of over 100 pips, aligning with the target price of 0.6000.

Fundamental factors support this bearish outlook. The Bank of Canada (BoC) recently implemented a 25 basis point rate cut, reducing the benchmark rate to 2.75%. This move, aimed at stimulating economic growth amid trade tensions and weakened consumer confidence, has exerted downward pressure on the Canadian dollar. Conversely, the Swiss franc continues to benefit from its safe-haven status, attracting investors during periods of global uncertainty. Additionally, Switzerland's robust economic data, including a manufacturing PMI of 51.5 and a 4.0% rise in exports, further bolsters the franc's strength.

Technical analysis further reinforces the bearish sentiment. The CAD/CHF pair has been in a steady downtrend, with minor retracements occasionally. Currently, the price is preparing for another retracement aimed at retesting the immediate supply zone. The 4-hour timeframe chart shows that the supply zone falls perfectly between the 76% and 88% Fibonacci retracement levels. The presence of a Fair Value Gap (FVG) and inducement contribute to the bearish leaning of the market sentiment. Analysts have set a target of 0.6051, with an invalidation point at 0.6231.

Given these technical and fundamental factors, the CAD/CHF pair appears poised for a bearish breakout from the flag pattern. Traders should monitor key support levels and employ robust risk management strategies, such as setting appropriate stop-loss orders, to navigate potential market volatility. Staying informed about upcoming economic data releases and central bank communications will also be crucial in effectively capitalizing on this trading opportunity.

CAD_CHF BEARISH WEDGE PATTERN|SHORT|

✅CAD_CHF made a retest of

The horizontal resistance

Of 0.6213 which makes us

Locally bearish biased and

On top that we are seeing a

Fully formed bearish wedge

Pattern so IF we see a bearish

Breakout from the wedge

Pattern we will be expecting

A further bearish move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

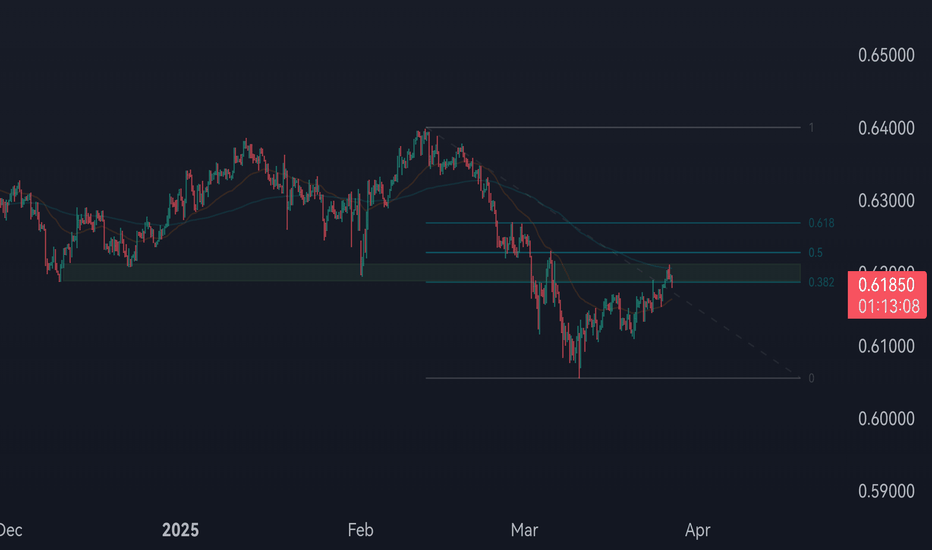

CADCHF Short BiasThe price is currently in a strong position, retesting a key resistance zone, which aligns with the 50% Fibonacci retracement level. Additionally, the 200 EMA is acting as dynamic resistance, reinforcing the bearish bias. Given these confluences, a downside move is anticipated, in line with the prevailing trend.

CAD-CHF Free Signal! Sell!

Hello,Traders!

CAD-CHF has made some

Gains from the recent lows

Just as we expected but now

The pair is entering the

Horizontal resistance area

Around 0.6212 from where

We can enter a short trade

With the Take Profit of 0.6162

And the Stop Loss of 0.6233

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CADCHF Will Go Up! Buy!

Take a look at our analysis for CADCHF.

Time Frame: 4h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 0.619.

Taking into consideration the structure & trend analysis, I believe that the market will reach 0.623 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Potential bullish rise?CAD/CHF has bounced off the pivot which is a pullback support and could bounce to the 1st resistance which acts as an overlap resistance.

Pivot: 0.61667

1st Support: 0.61189

1st Resistance: 0.62239

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

CAD/CHF Short Setup - Supply Zone RejectionI'm looking at a potential short opportunity on CAD/CHF as price approaches a key daily supply zone, which was previously a demand zone. The pair has been in a broader downtrend followed by a consolidation that went of for weeks, and with the recent break of structure, I anticipate a rejection from this area. My alert is set for when price reaches the supply zone at 0.61954, where I will be looking for confirmation to enter short positions.

Key levels to watch:

Daily Supply Zone: (0.61954)

Target Levels: (0.60550)

Invalidation: If price breaks and holds above the zone

I'll be monitoring price action closely for signs of weakness before executing the trade. Let me know your thoughts!