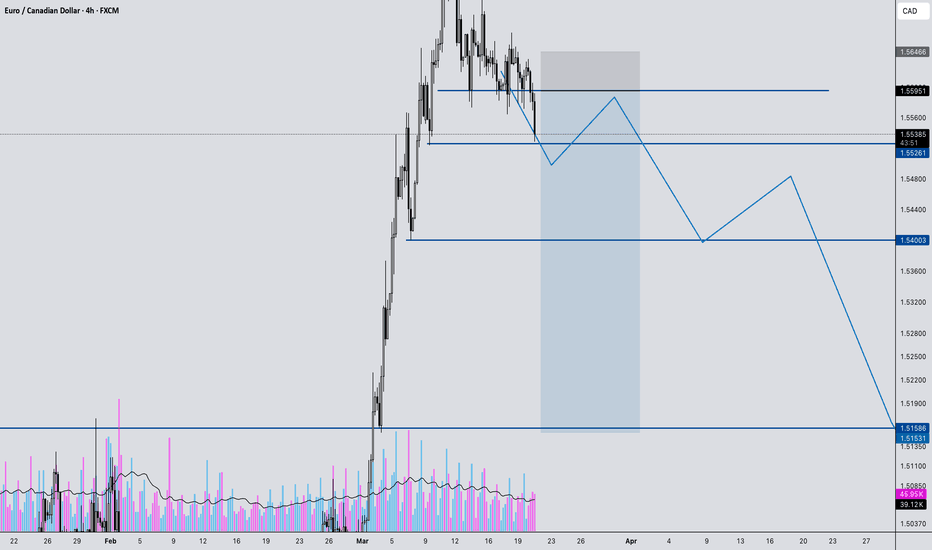

EC updateCombining COT trends (assumed sustained Euro longs and CAD shorts from March 18 data), technical analysis (corrective dip toward 1.5272–1.5449, then upside), and sentiment, EURCAD appears likely to experience short-term bearish pressure toward 1.5400 or lower (1.5272–1.51564) in the next few days, followed by a bullish resumption if support holds. The pair could target 1.5800 again or higher, assuming no significant reversal in COT positioning or economic shocks.

Key Levels to Watch:

Downside: 1.5400, 1.5272–1.51564 (support zone for buyers).

Upside: 1.5800 (recent resistance), with potential for higher if bullish momentum rebuilds.

Monitor the March 21 COT release details for confirmation of speculative positioning and watch for economic releases impacting EUR or CAD. For now, the bias leans toward a dip-then-rise scenario over the coming days, with upside favored unless 1.5272 breaks.

CADEUR trade ideas

EUR-CAD Free Signal! Sell!

Hello,Traders!

EUR-CAD made a bearish

Breakout of the key horizontal

Level of 1.5528 so we are

Bearish biased so we can

Enter a short trade with

The Take Profit of 1.5454

And the Stop Loss of 1.5576

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/CAD LONG FROM SUPPORT

Hello, Friends!

EUR/CAD pair is trading in a local uptrend which know by looking at the previous 1W candle which is green. On the 3H timeframe the pair is going down. The pair is oversold because the price is close to the lower band of the BB indicator. So we are looking to buy the pair with the lower BB line acting as support. The next target is 1.566 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Bullish bounce off 50% Fibonacci support?EUR/CAD is falling towards the pivot which acts as a pullback support and could bounce to the 1st resistance.

Pivot: 1.54200

1st Support: 1.53020

1st Resistance: 1.55988

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EURCAD Wave Analysis – 20 March 2025

- EURCAD reversed from the resistance zone

- Likely to fall to support level 1.5400

EURCAD currency pair recently reversed sharply from the resistance zone between the key resistance level 1.5800 (former major resistance from 2020) and the resistance trendline of the weekly up channel from 2022.

The downward reversal from this resistance zone will likely form the daily Japanese candlesticks reversal pattern Evening Star.

Given the strength of the resistance level 1.5800, EURCAD currency pair can be expected to fall to the next support level 1.5400.

EURCAD Breakdown: Major Reversal Incoming? Watch This Setup!In this video, we analyze a high-probability trade setup on EURCAD, breaking down key market structure shifts and potential reversal zones. 📊

🔹 Massive impulse move into key resistance – Is a pullback coming?

🔹 Breakdown of bullish structure – Signs of a trend shift?

🔹 Key entry & exit points mapped out – Waiting for confirmation at 1.5595

🔹 Targeting major liquidity zones – Potential downside to 1.5523, 1.5400, and 1.5155

If price rejects our marked resistance zone, we could see a strong move downward, stopping out euphoric buyers and creating new trading opportunities. But what if it breaks above? We discuss both scenarios and how to react accordingly.

📍 Watch until the end for a full breakdown and trade execution strategy!

💬 Drop your thoughts in the comments! Do you see something different in this setup? Let’s discuss.

🚀 Like, share, and follow for more market insights!

A possible short-term bullish set-up on EURCAD?Well, it seems that FX_IDC:EURCAD could be forming either a bullish pennant, or a falling wedge pattern in the near-term. Both patterns tend to result in a bullish breakout. However, we still require a confirmation. Without it, there is still a chance to see a move lower.

MARKETSCOM:EURCAD

Let us know what you think in the comments below.

Thank you.

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

EURCAD next move (expecting bearish move)(17-03-2025)Go through the analysis carefully, and do trade accordingly.

Anup 'BIAS for the mid term (17-03-2025)

Current price- 1.56500

"if Price stays below 1.57200, then next target is 1.55200, 1.54000 and 1.53200 and above that 1.58500"

-POSSIBILITY-1

Wait (as geopolitical situation are worsening )

-POSSIBILITY-2

Wait (as geopolitical situation are worsening)

Best of luck

Never risk more than 1% of principal to follow any position.

Support us by liking and sharing the post.

Could the price bounce from here?EUR/CAD is falling towards the support level which is an overlap support that is slightly above the 38.2% Fibonacci retracement and also slightly below the 61.8% Fibonacci projection and could bounce from this level to our take profit.

Entry: 1.5548

Why we like it:

There is an overlap support level that is slightly above the 38.2% Fibonacci retracement.

Stop loss: 1.5415

Why we like it:

There is a pullback support level that lines up with the 50% Fibonacci retracement.

Take profit: 1.5697

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

EURCAD Will Go Lower! Short!

Take a look at our analysis for EURCAD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 1.562.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 1.534 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EUR/CAD Sell ForecastEUR/CAD has been bullish for a couple of weeks now, and price is currently trading at weekly resistance which is likely to become a level of supply. There seems to be a bullish decline from the 4h timeframe but considering the strength of the bullish trend, we will need sufficient confluence to go short.

1. Wait for 4h break of support

2. Wait for liquidity grab into supply