CADGBP trade ideas

GBPCAD SELL1day

2downtrend

3resistance level

4double top /triple top/

5rsi60/sto96/vol expection ceaeish sign at the zone

6

7fibex blue down move

8fibretra red down move

9

10

11

12

13bearish divergence

14bearish harami/tweer top/pierching bearish

15

1.4h

2downtrend

3resistance level

4double top

5rsi78/sto91/volbearish

6

7fiibex done at the perfect zone to sell

8fibretrac blue zone perfect zone to sell

9

10

11

12bearish divergence

13bearish expanding triangle

14 bearish flag pattern

1.2h

2downtrend

3resistance level

4rising wedge /bearish pannent

5rsi60/sto67/volpower loss and selling getting geround

6

7fibextern blue zone exoec

8fib retrac redzone breakout structure

9

10

11

12bearish divergence /

13bearish engulfin/three dark soldiers

14

Because of usa new tomorrow we wait to sell at the fibex blue zone above or execute below thehl of the bearish pannent (sell)

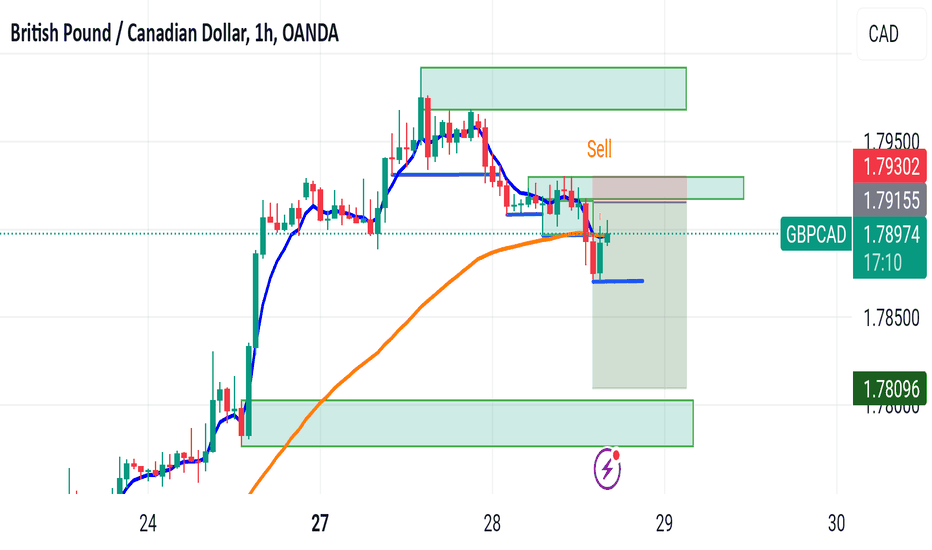

1.1h

2consolidation

3resistance

4symmentric expanding triangle

5rsi58/sto77/volbull insisting but a bearish signal s good to sell

6

7fibex

8fibretrac

9

10

11

12bearish divergence/

13doji spinning top/

GBPCAD A Fall Expected! SELL!

My dear friends,

GBPCAD looks like it will make a good move, and here are the details:

The market is trading on 1.7924 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 1.7785

Recommended Stop Loss - 1.8018

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

———————————

WISH YOU ALL LUCK

GBP/CAD SELL SETUPthis is gbp/cad analysis,as we can see price is at supply zone to fill some imbalance that was left when price move to the downside at the moment there is change in market structure has already happen indicating that the pullback is almost over before bears come in the market.in 4 hour time frame there is a clear hammer candle showing sellers momentum.

GBP/CAD Daily AnalysisSince forming a double bottom (reversal) at 1.7500, buyers have been in total control of the GBP/CAD market.

Now we may see a correction/retracement play out before the next move up.

An area of interest is 1.7750 which has previously acted as support.

There is a Bank of Canada rate statement on Wednesday.

GBPCAD (288m): DT TECHNICAL ANALYSISTREND OVERVIEW

The current structure indicates a downtrend after reaching a recent pivot high. Price is reacting to key resistance zones, with multiple sell orders placed at strategic levels. The GBPCAD 288m chart highlights a well-defined trade structure with clear resistance and support zones. A short position remains favorable unless price breaks and holds above 1.8001. Watch for reactions at mid-pivot and TP zones to gauge momentum. Stay patient and trade with discipline.

KEY LEVELS & TRADE SETUP

Sell Zones:

Primary Sell Order: 1.7920

Secondary Sell Order: 1.7974

Pivot High Stop Loss: 1.8001

Take Profit Levels (Short Positions):

TP 1: 1.78165

TP 2 (Mid Pivot): 1.77297

TP 3: 1.76657

TP 4: 1.75668

Buy Zones (Potential Reversal Areas):

Primary Buy Order: 1.75430

Secondary Buy Order: 1.74853

Pivot Low Stop Loss: 1.74582

ANALYSIS & OUTLOOK

Price action suggests a potential shorting opportunity near the pivot high.

If price rejects resistance levels, expect downside continuation towards mid-pivot and lower TP targets.

Buyers may step in near 1.75430, but further confirmation is required before a reversal is confirmed.

Stop-loss placement at 1.80011 ensures protection against trend invalidation.

TRADING STRATEGY

Bearish Bias: Look for short entries at sell order levels with TP at 1.76657 and below.

Bullish Recovery Zone: Potential long setup near 1.75430 if bullish momentum develops.

Risk Management: Maintain discipline by adhering to stop-loss placements to mitigate risk.

GBPCAD - Idea for a buy !!Hello traders!

‼️ This is my perspective on GBPCAD.

Technical analysis: Here we are in a bullish market structure from 4H timeframe perspective, so I look for a long. My point of interest is imbalance filled + rejection from bullish OB and institutional big figure 1.78000.

Fundamental news: Tomorrow (GMT+2) we will see results Interest Rate on CAD. News with high impact on currency.

Like, comment and subscribe to be in touch with my content!

POTENTIAL SHORT TREND Price created LL and lh breaking structure at 78964, then pulled back to for a retracement to gather momentum for a short trend.

It earlier to swing into sell right now, a look at candle print out indicates upside liquidity is not yet fully taken out, which i highlighted with an arc, because of inefficiency created around 78924 up to 79172.

Price will have to take out those liquidity lying around before further downward movement.

Target would be 78964

POTENTIAL SHORTPrice was making HH and HL, broke structure to create new low around 78704. Imbalance (inefficiency) was created as result of that break out, with upside retracement on going to fill that liquidity up to 79162.

Expect massive downward movement as a result of large gap opened up by market structure and target would be 78026

GBPCAD BEARISH FOR 1000PIPSFundamental Drivers for GBPCAD Bearish Move

Weakness in the British Pound (GBP):

The British economy has faced challenges due to factors like:

Post-Brexit Trade and Economic Struggles: Ongoing economic issues related to the UK's departure from the EU (Brexit) could weaken the GBP. Supply chain disruptions, inflation, and labor shortages are some of the lingering effects.

Bank of England's Monetary Policy: If the Bank of England (BoE) remains dovish or adopts a less aggressive stance on interest rates compared to other central banks (like the Federal Reserve or European Central Bank), this could make the GBP weaker.

Political Uncertainty: Any political instability or leadership changes in the UK could further impact the pound's performance.

Strength in the Canadian Dollar (CAD):

Several factors could push the Canadian Dollar higher relative to the GBP:

Oil Prices: As Canada's economy is heavily linked to oil exports, a sustained rise in oil prices (WTI) could boost the CAD. A strong global demand for oil or supply-side disruptions could lead to CAD strength.

Monetary Policy of the Bank of Canada: If the Bank of Canada (BoC) adopts a hawkish stance or signals a tightening of monetary policy while the BoE remains dovish, the CAD would outperform the GBP.

Strong Economic Data from Canada: Better-than-expected GDP growth, employment numbers, or trade balance could support CAD strength.

Global Risk Sentiment:

If global risk sentiment shifts towards safer assets (e.g., commodities), the CAD could gain more strength. Additionally, if there's a risk-off environment with rising global tensions, the CAD might benefit due to its commodity-backed nature.

2. Technical Analysis for GBPCAD Bearish Move

Resistance Levels:

GBPCAD could be facing key resistance at a certain price level, and if it fails to break through, that could trigger a bearish reversal. For example, if the pair has repeatedly failed to sustain levels above a certain resistance zone (e.g., 1.7000 or higher), this could signal that the market is losing bullish momentum and the pair could trend lower.

Trendlines and Chart Patterns:

A clear downtrend, with lower highs and lower lows, could indicate a bearish continuation. Additionally, chart patterns like a descending triangle or head-and-shoulders formation could signal a breakdown and push GBPCAD lower.

Moving Averages:

A crossover of a short-term moving average (like the 50-day MA) below a longer-term moving average (like the 200-day MA) could indicate a bearish crossover, which might signal further downside.

RSI or MACD Divergence:

If indicators like the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD) show bearish divergence (i.e., while price continues to climb, the indicator shows weakening momentum), it could signal that the trend is losing strength and a reversal is imminent.

Fibonacci Levels:

If the market has recently made a significant move upward and is now retracing, key Fibonacci levels like the 38.2% or 61.8% retracement could serve as resistance zones where a reversal to the downside could take place.

3. Geopolitical or External Events

Oil Price Dynamics:

As mentioned, the CAD is heavily influenced by oil prices. A surge in oil prices could strengthen CAD against the GBP, pushing GBPCAD lower. If global oil demand rises or there's a supply disruption, CAD could outperform GBP.

Global Economic Outlook:

A positive outlook for global growth (which often boosts commodity currencies like the CAD) could be a catalyst for a bearish move in GBPCAD, especially if it contrasts with weakening growth in the UK.

4. Potential Catalysts for a 1,000-Pip Move

Interest Rate Differentials:

If the BoC raises rates while the BoE stays put or becomes more dovish, the differential between Canadian and British rates could widen significantly, causing capital to flow into the CAD and away from the GBP.

Economic Data Surprises:

A surprising economic release from Canada (such as a strong GDP report, higher-than-expected employment data, or a trade surplus) could give the CAD a boost, while disappointing data from the UK (such as lower growth or inflation figures) could weaken the GBP, further supporting your bearish outlook.

Breakout of the Bullish momentumAs we can see, the price is currently controlled by buyers after a reversal on the Demand level. price also broke through our Previous low(Morubozu candlestick) this indicates a strong bullish momentum meaning there's also a High chance that the market will breakout above our Solid High and that would indicate that buyers are still pushing the price higher.

As a day trader, It would be advisable to enter after the break above on the Solid high to confirm buyers, and our TP's should be on the Supply level as that's where the Market might reverse

GBPCAD - Bearish Momentum Expected from Resistance ZoneOANDA:GBPCAD is currently testing a significant resistance zone. This level has previously acted as resistance, leading to a bearish reversal. The recent upward momentum into this zone suggests a potential for sellers to regain control and push prices lower.

A bearish confirmation, such as a rejection candle, bearish engulfing pattern, or signs of fading bullish momentum, would indicate an increased likelihood of a move downward. If this scenario unfolds, the price could head toward the 1.78220 level.

This setup aligns with a potential short-term correction after an impulsive move. Traders should wait for confirmation of selling pressure before considering short positions.

This is not financial advice but rather how I approach support/resistance zones. Always wait for confirmation, like a rejection candle or volume spike before jumping in. And let me know what you think of this setup in the comments!

this is a video that decribe my personal trading strategythis stATEGY IS SUPER SIMPLE AND DOES NOT REQUIRE TOP DOWN ANALYSIS, it is designed in a way that if you cannot acertain in 2 seconds where the maret is likekly to go in less than 5 seconds you dont have a trade or setup, the video is not complete yet i will make a part two if you ask for it i want to be sure anybody or sombody is interestted

GBPCAD Signals a Shift: Key Moves to Watch This Week

In the GBPCAD market, all signs are pointing to a pivotal moment early this week. Monday and Tuesday present a strong likelihood of price rejection, potentially signaling a shift in direction. On higher timeframes, the bias suggests an imminent change, as the price approaches a key supply zone. Meanwhile, on the lower 1-hour chart, the story becomes even clearer—price action has already begun to hint at this transition, painting a picture of an anticipated reversal.

With the supply zone within reach, traders can expect a significant movement in the coming days. The bias indicates not just a brief fluctuation but a probabilities trend that could sustain momentum for at least two weeks. This week holds the potential for dynamic trading opportunities, setting the stage for a compelling narrative in the GBPCAD pair. Keep an eye on the charts—this could be the moment where preparation meets opportunity.

GBP/CAD BEARS ARE GAINING STRENGTH|SHORT

Hello, Friends!

GBP/CAD is trending down which is obvious from the red colour of the previous weekly candle. However, the price has locally surged into the overbought territory. Which can be told from its proximity to the BB upper band. Which presents a classical trend following opportunity for a short trade from the resistance line above towards the demand level of 1.779.

✅LIKE AND COMMENT MY IDEAS✅