CADGBP trade ideas

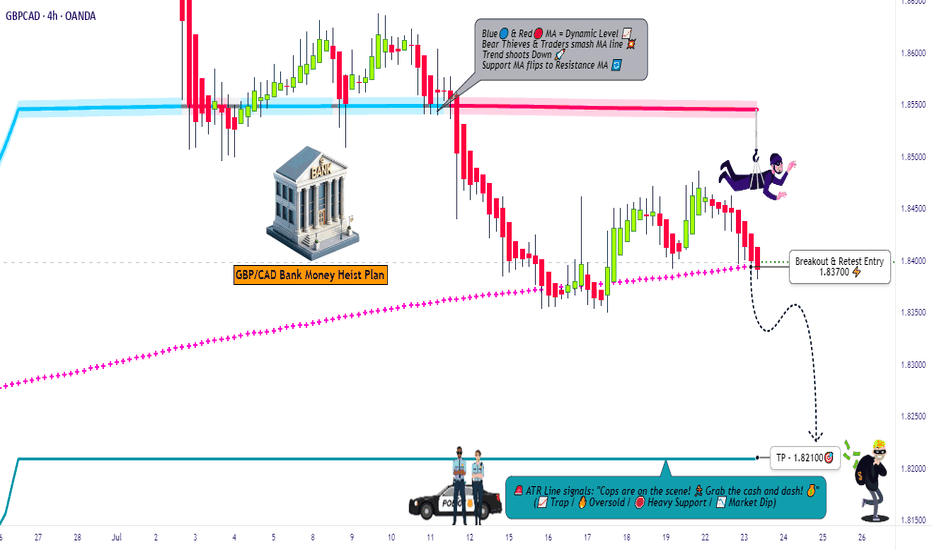

GBP/CAD Downtrend Setup – Clean Heist Entry Strategy🔥💷💣 THE GBP/CAD FOREX HEIST PLAN 💣💷🔥

Thief Trader Style – "Rob the Market, Not Each Other"

🧠 Smart Strategy | 🔍 Deep Analysis | 🎯 High Probability Plays | ⚔️ Risk-Controlled Attack

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba!

Dear Money Makers & Market Robbers, 🤑💰✈️

Welcome to another legendary forex robbery mission – this time, we’re planning the ultimate Pound vs. Loonie Heist (GBP/CAD). Powered by Thief Trading’s precision analysis (both technical & fundamental), this setup is designed for disciplined, stealthy traders who know how to attack at the right moment. Let’s take what’s ours from the market – the Thief way.

🔫 THE SETUP: GBP/CAD MARKET RAID

We’re eyeing a Short Entry near 1.83700 after the Moving Average Breakout Confirmation.

This ain’t just any pullback – this is a trap zone, a Police Barricade ATR Blue Zone, where liquidity fakes out the greedy bulls and invites a high-probability short for those with a thief’s vision.

Chart structure screams: overbought, slowing momentum, divergence + confluence = Bear Attack.

📍 Entry Plan:

💥 “The Heist is ON! Wait for the MA break… Then make your move at 1.83700!”

☑️ Sell Stop Orders – Just above the Moving Average or after key Support Break

☑️ Sell Limit Orders – For pullbacks at 15m or 30m TF near SWING H/L

☑️ Layered Entries / DCA Style – Multiple small entries for maximum control

☑️ Set Alerts! – Chart alarms keep your eyes sharp, your entries sharper.

🚨 Stop Loss Protocol (SL):

🛑 “No SL before breakout. You place early – you get burned.”

🗡️ After Breakout ONLY: SL near 1.84500, 4H Swing High

🛡️ Adapt based on your risk %, lot size, and number of open orders

🤫 Pro Tip: Smart SLs protect you, not limit you. Be like a ghost in the market.

🎯 Target Zone (TP):

📉 Initial Target: 1.82100

💨 “Get in, grab the bag, get out.”

You’re a thief – no greed, just precision. Exit before the alarms ring if the market flips!

🔎 Macro Factors Fueling the Bear Trend:

📉 Hawkish BOC tones down, GDP data contraction vibes

📈 GBP sentiment mixed; technical overbought signals dominate

🎭 Consolidation breakdown = High-Reward Entry Window

📰 News Awareness = Smart Survival:

⚠️ Avoid New Trades During Major News

📍 Use Trailing SLs to Protect Open Profits

🧨 Don’t get caught in the volatility trap – let the chaos work for you, not against you.

💥 BOOST THIS HEIST PLAN – ROBBERS UNITE 💥

Smash the “Boost” Button to power up our Thief Gang's momentum. Your support sharpens the edge for all fellow robbers in this daily market hustle.

🧠 Precision Plan

🧭 Risk-Aligned Entry

📈 Profitable Exit

That’s how Thief Traders operate.

🤑 Stay ready for the next drop. Another Forex bank is about to get robbed clean.

💣💰Let’s rob the charts – not each other.

— Thief Trader, Robbin’ with Logic & Style

🏴☠️📉📲

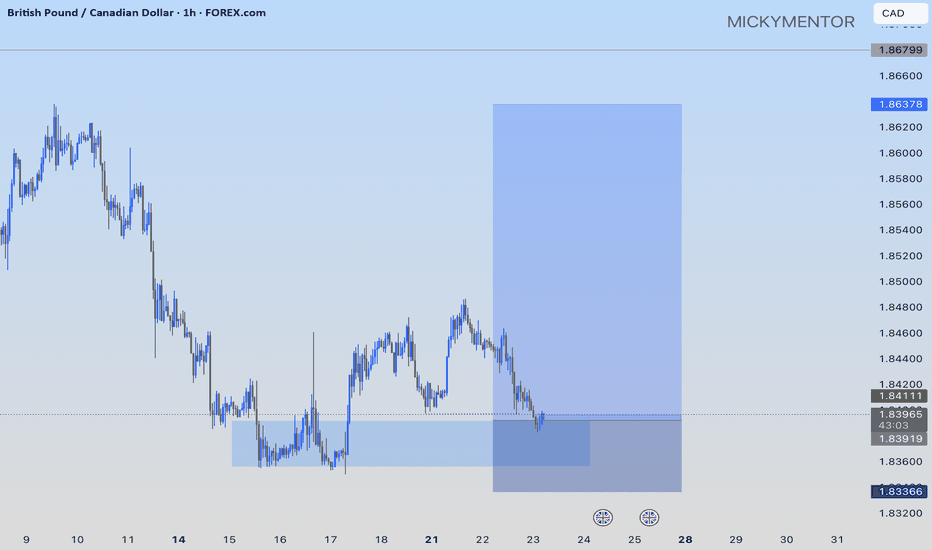

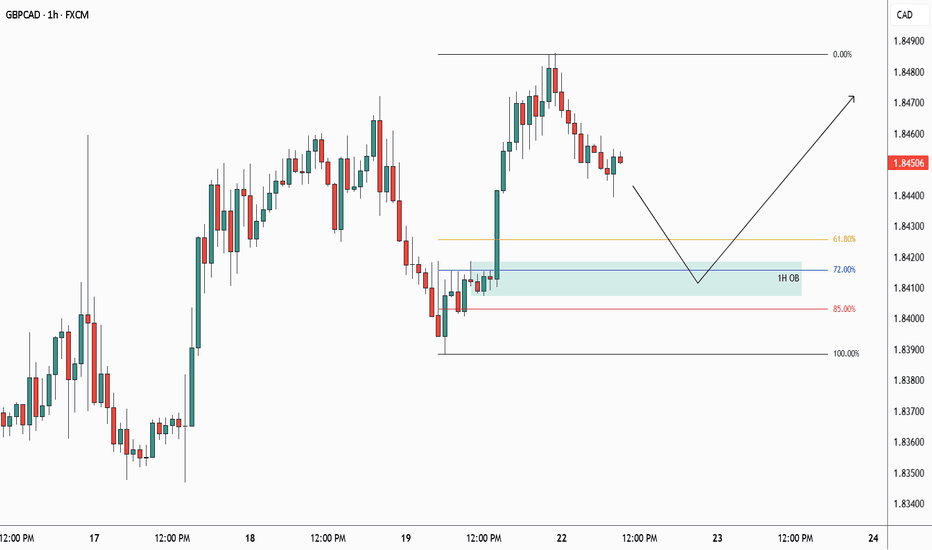

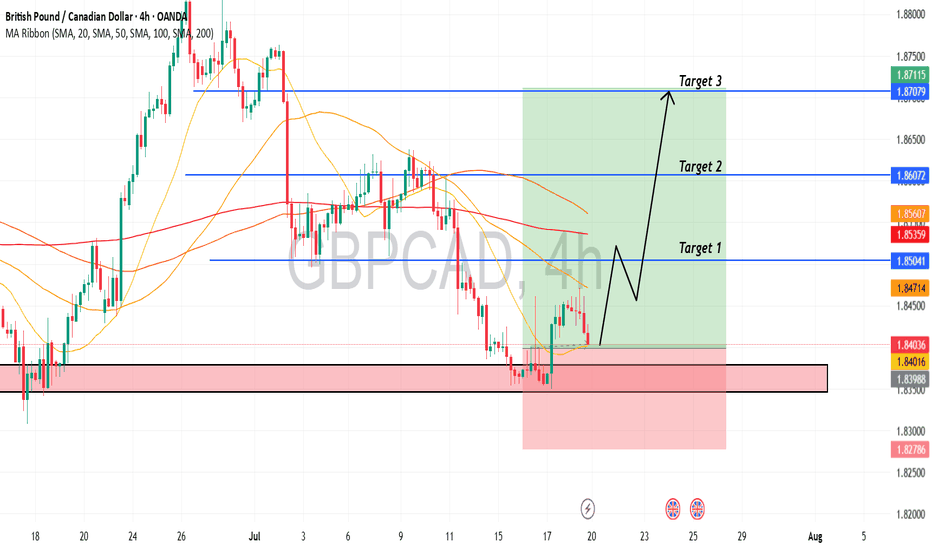

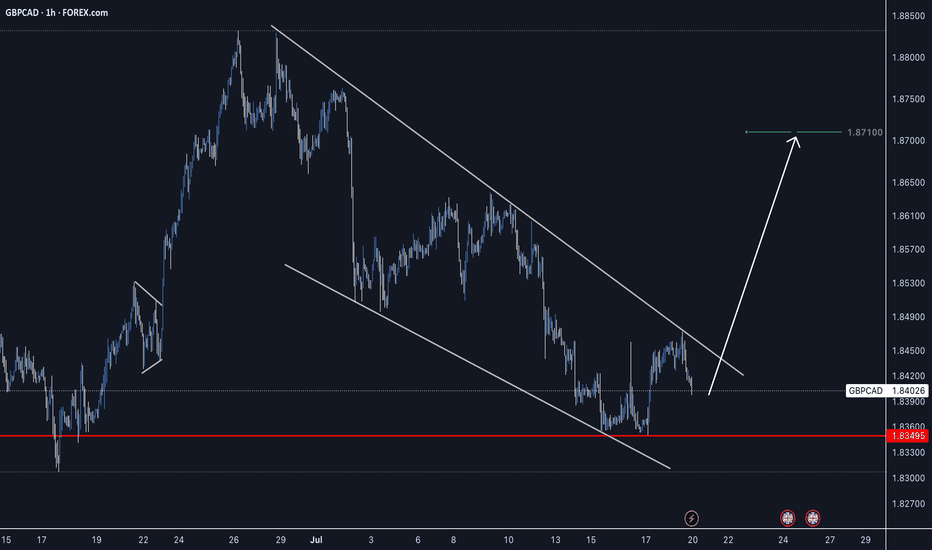

GBPCAD Bullish Set-upAfter an impulsive bullish move, price is currently in a corrective phase. It is approaching the Optimal Trade Entry (OTE) zone, which aligns with the 1-hour demand zone (bullish order block). This confluence of the Fibonacci 61.8%–85% retracement levels and the demand area suggests a potential bullish bounce and continuation toward the recent high.

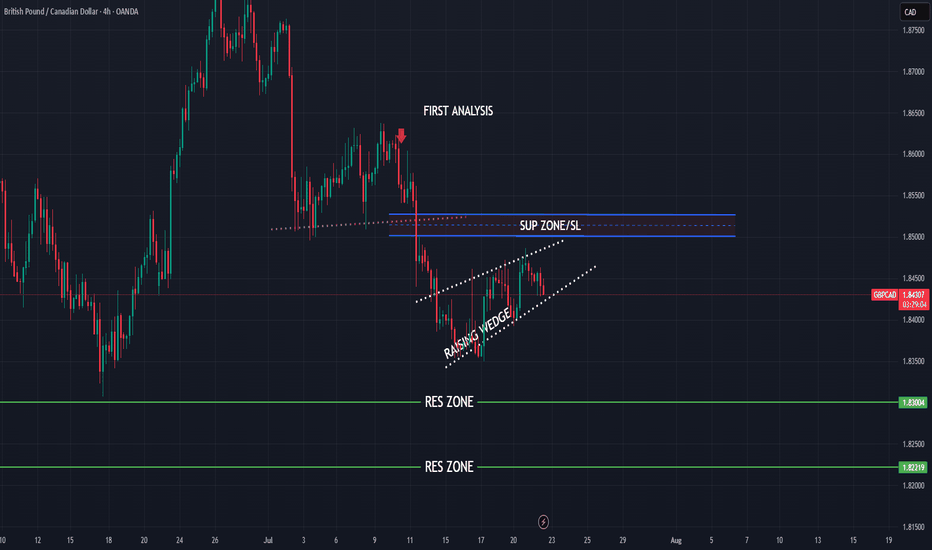

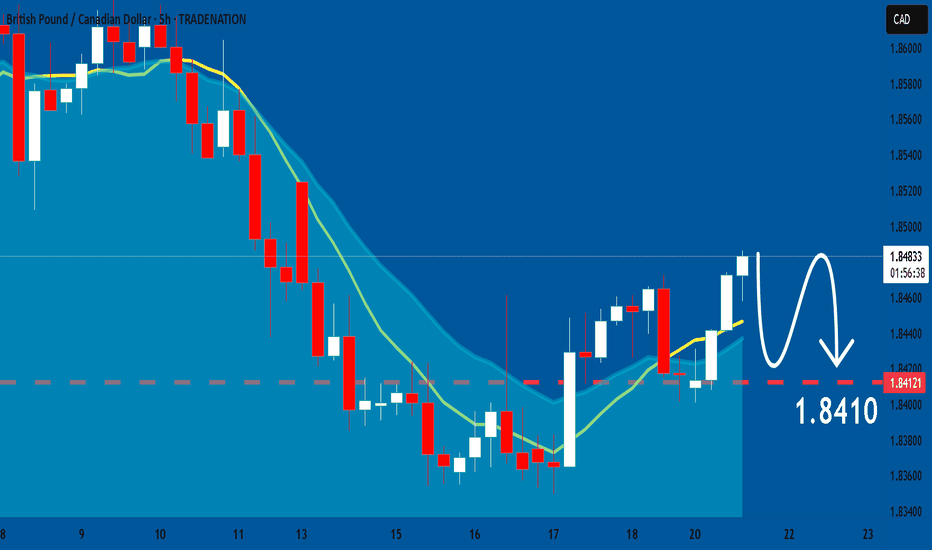

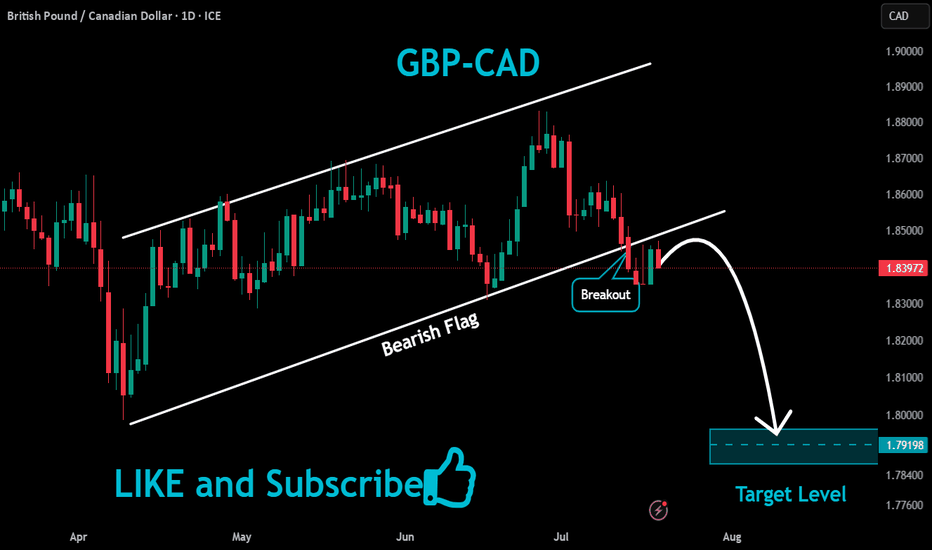

GBPCAD: Will Start Falling! Here is Why:

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the GBPCAD pair which is likely to be pushed down by the bears so we will sell!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

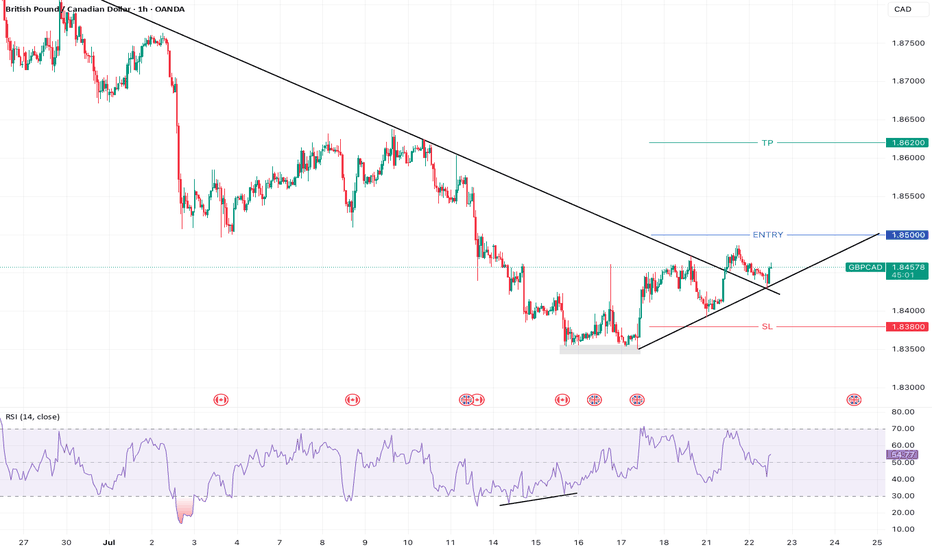

GBP/CAD POSSIBLE SETUPWatching this market closely as price approaches the key S/R zone.

If we get a pullback into that area, we’ll be looking for:

*Volume to increase in the direction of the trade (downside),

*Momentum to first push up, then hook down (the deeper the rise before the hook, the better),

*A clean engulfing candle to the downside for the trigger.

*All of this must happen near the 50EMA and in full alignment with the VMS strategy rules.

📌 Stay patient. Let the setup come to us.

Keep watching.

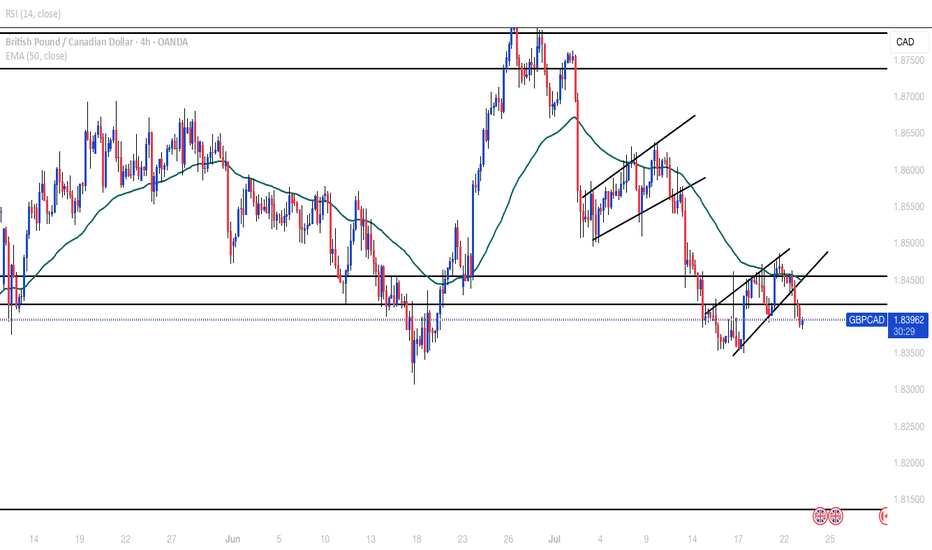

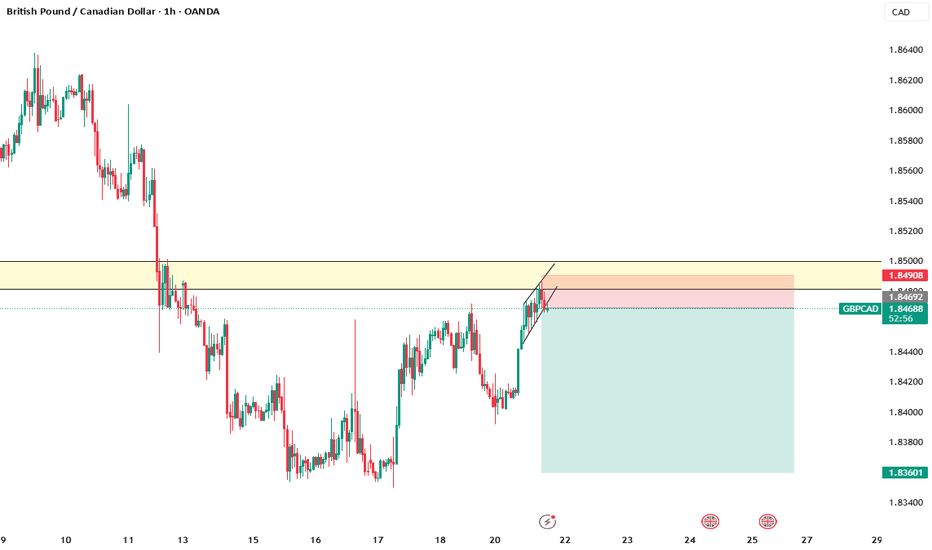

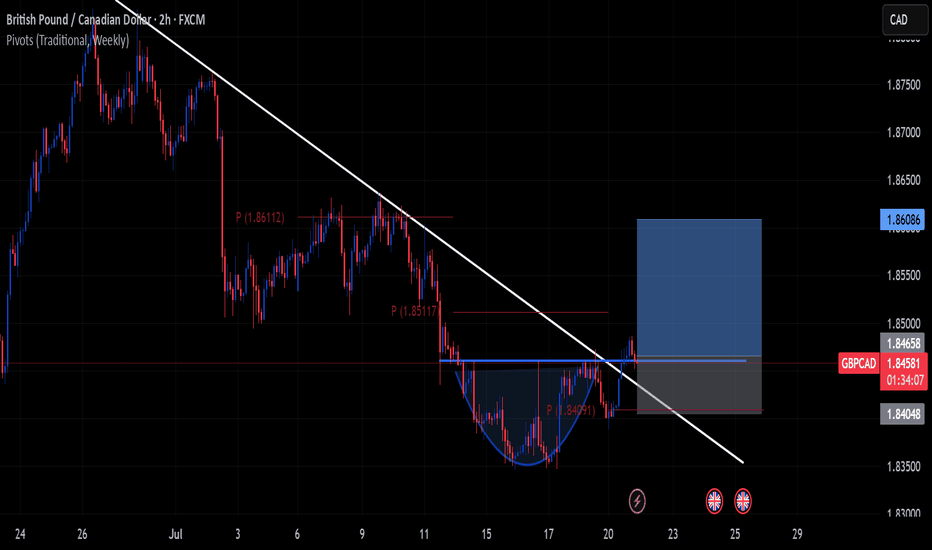

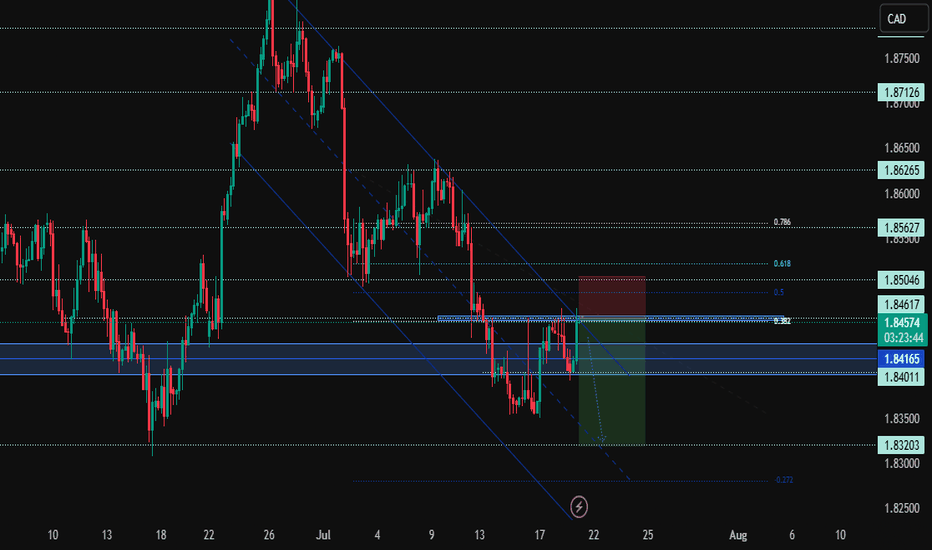

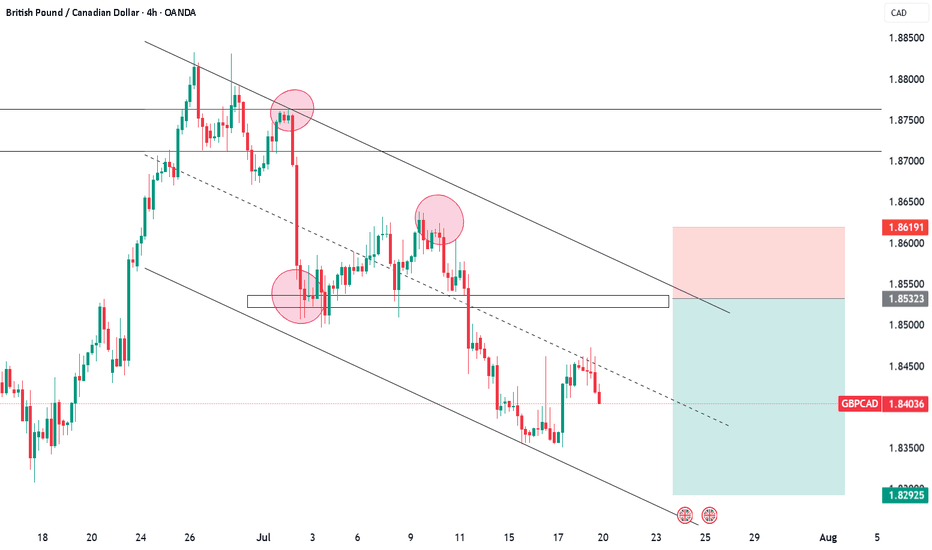

GBPCAD Rejects Key Fib Resistance – Bearish Continuation Ahead?Hey Traders,

OANDA:GBPCAD has tapped into the 1.84617–1.85046 resistance zone, aligning with the 0.382–0.5 Fibonacci retracement and channel resistance. Price is showing signs of rejection with wicks and a bearish setup brewing- suggesting a potential continuation to the downside within the descending channel.

Current Market Conditions:

Price is respecting a well-defined descending channel, consistently printing lower highs and lower lows.

Recent rejection from the 1.84617–1.85046 resistance zone (Fibonacci 0.382–0.5 zone).

Structure still bearish; price remains below channel midline.

Support region stands around 1.84165, with further room toward 1.83203.

Fundamental Analysis/Outlook:

The Canadian Dollar is underpinned by stable oil prices and cautious BoC policy tightening bias, while the British Pound remains pressured due to soft economic data and BoE’s mixed tone on rate trajectory. With risk sentiment fragile and commodity demand still steady, CAD strength could persist, adding downward pressure to GBPCAD.

Targets:

TP1: 1.84165

TP2: 1.83203

TP3: 1.83000 (channel extension / -0.272 Fib)

Risk Management:

Stop-loss: Above 1.85046 (Fibonacci 0.5 + structural high)

R:R of approximately 1:2.5 on current setup.

Watch for volatility during CAD and GBP news—tighten stops if needed.

Technical Outlook:

As long as price holds below 1.84617 and fails to break above the descending channel, the bearish outlook remains intact. Look for confirmation via bearish engulfing candle or lower time frame break of 1.84165. A decisive break below this level could accelerate a fall toward 1.8320 support.

Conclusion:

GBPCAD remains in bearish territory, rejecting a significant supply zone. With sellers defending the structure and no bullish breakout in sight, we anticipate further downside unless buyers reclaim 1.8500+. Let the chart lead—trade what you see, not what you feel.

Sign-off:

"In markets, clarity often lies just beyond the fear. Trade the levels, not the noise."

💬 I’d love to hear your thoughts- drop a comment, boost the post, and follow for more sharp setups. Stay focused and trade wisely!

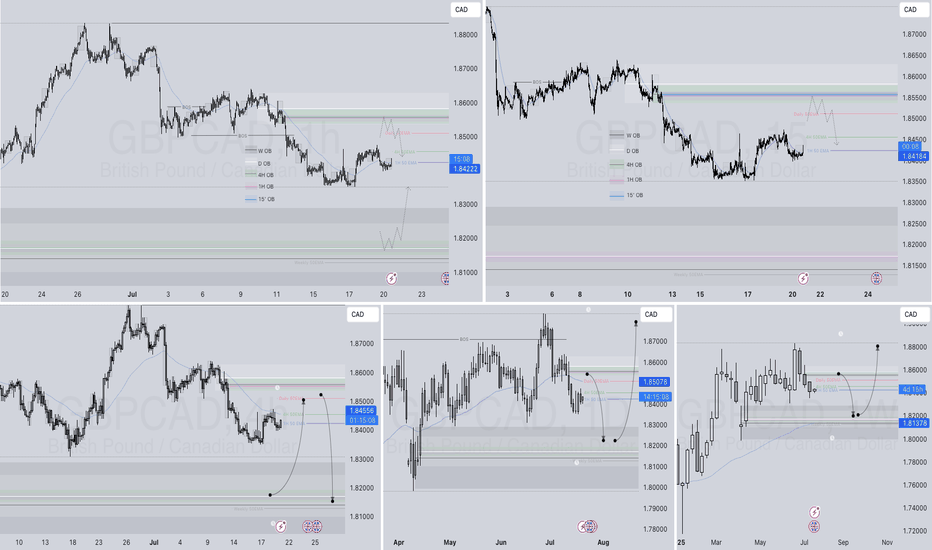

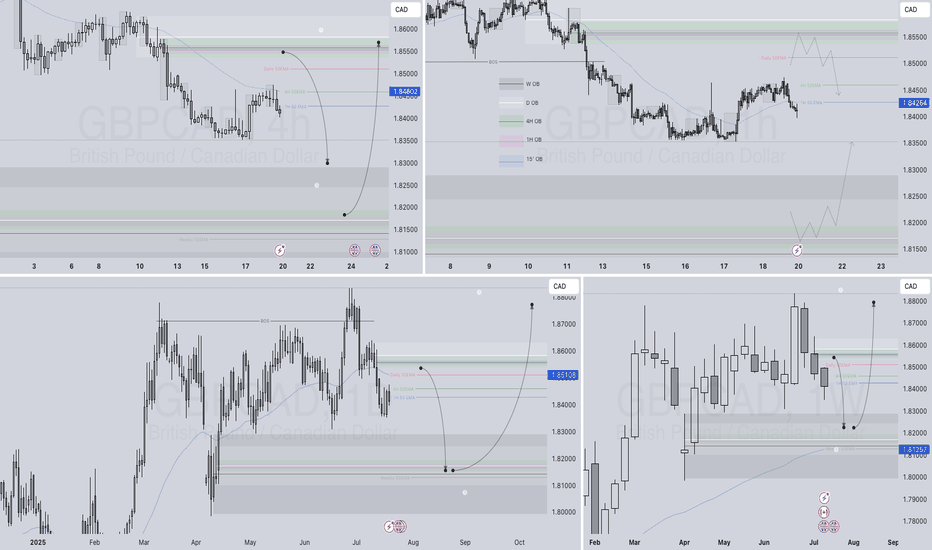

GBPCAD Q3 | D21 | W30 | Y25📊GBPCAD Q3 | D21 | W30 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT 📊

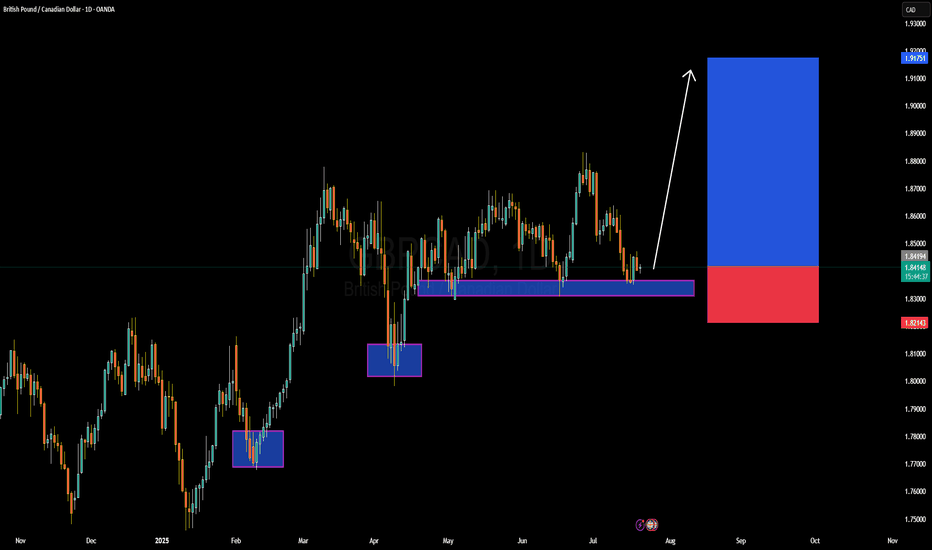

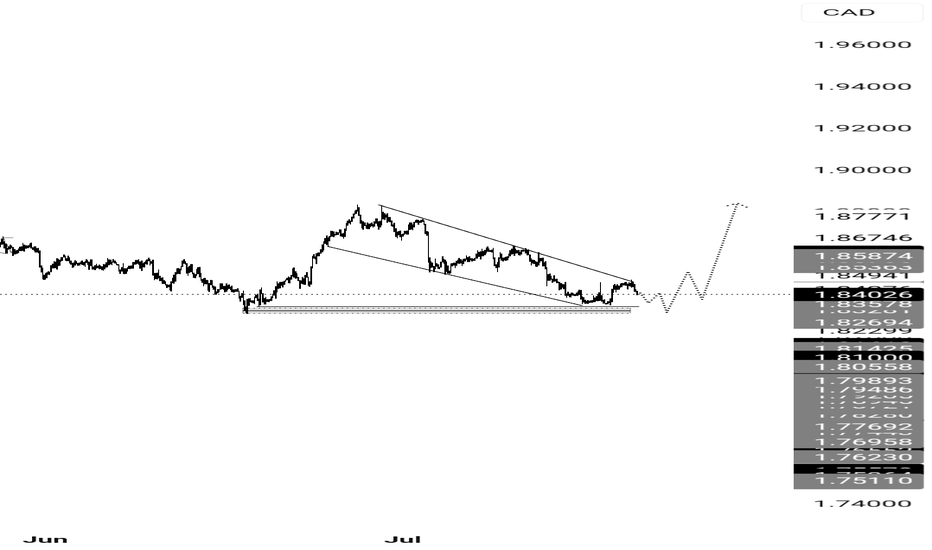

GBPCAD Forming Strong Bullish ReactionGBPCAD has once again tapped into a key daily demand zone that's held strong multiple times this year, forming a reliable support base around the 1.8200–1.8300 level. Price action has consistently respected this area, creating a clear bullish structure of higher lows following each test. The recent bounce indicates buyer interest is still strong, and I’ve entered long positions here with a high conviction that the bullish leg is about to resume. The risk-to-reward ratio on this setup is highly favorable, with upside potential targeting the 1.9150–1.9200 region.

From a macro perspective, the British pound remains supported by the Bank of England’s hawkish stance. Inflationary pressure in the UK remains sticky, keeping the door open for further rate hikes or at least prolonged tight monetary policy. On the flip side, the Canadian dollar is under slight pressure due to falling crude oil prices and the Bank of Canada's relatively more dovish outlook in recent statements, despite recent CPI upticks. This divergence in policy bias adds tailwind to the GBPCAD bullish bias.

Technically, this pair is respecting market structure with precision. Each bounce from the marked support zones has led to meaningful rallies, and current price behavior is following the same playbook. The consolidation over the past few sessions suggests accumulation, with a bullish breakout likely to follow. The marked blue target zone aligns with a clean price inefficiency and liquidity pool on the left side of the chart.

With momentum building and fundamental drivers favoring GBP strength, I expect a continuation move toward 1.9150 in the coming weeks. Patience and position management are key here, but the setup remains valid and in profit. Traders watching this zone should be alert for bullish confirmations and volume spikes to ride the next impulsive wave.

The GBPCAD is Unstoppable due to Strong Up TrendHello Traders

In This Chart GBPCAD HOURLY Forex Forecast By FOREX PLANET

today GBPCAD analysis 👆

🟢This Chart includes_ (GBPCAD market update)

🟢What is The Next Opportunity on GBPCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

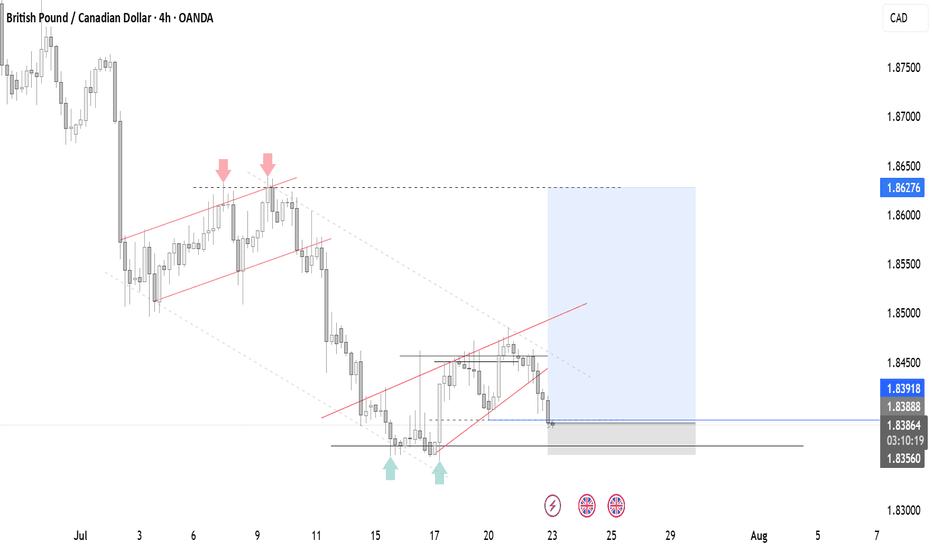

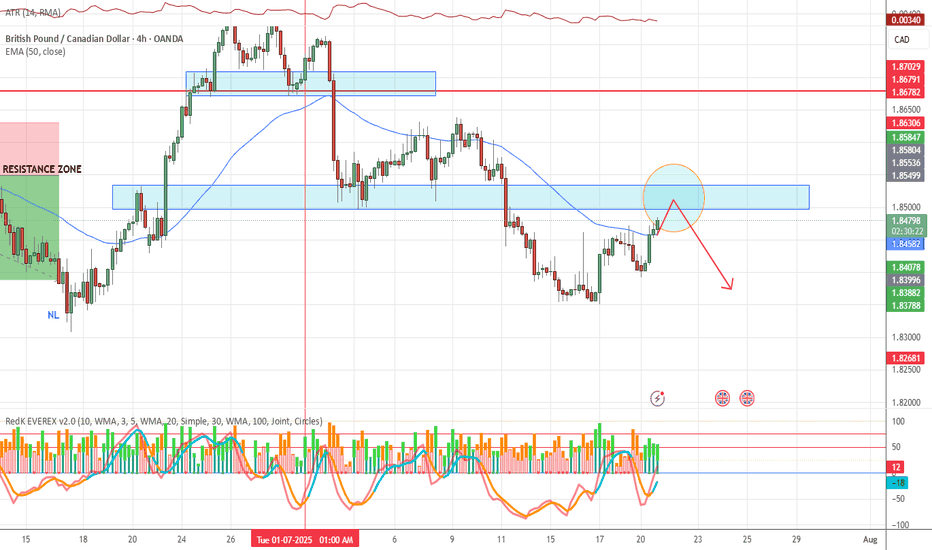

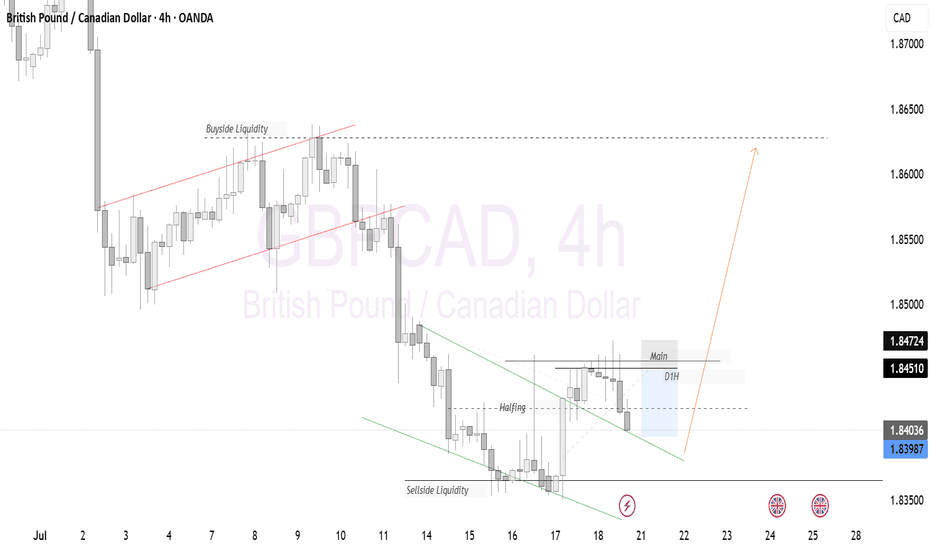

SELL GBPCAD now for a 4h time frame bearish trend continuationSELL GBPCAD now for a four hour time frame bearish trend continuation..........

STOP LOSS: 1.8480

This sell trade setup is based on hidden bearish divergence trend continuation trading pattern...

Always remember, the trend is your friend, so whenever you can get a signal that the trend will continue, then good for you to be part of it

TAKE PROFIT : take profit will be when the trend comes to an end, feel from to send me a direct DM if you have any question about take profit or anything.

Remember to risk only what you are comfortable with….....trading with the trend, patient and good risk management is the key to success here

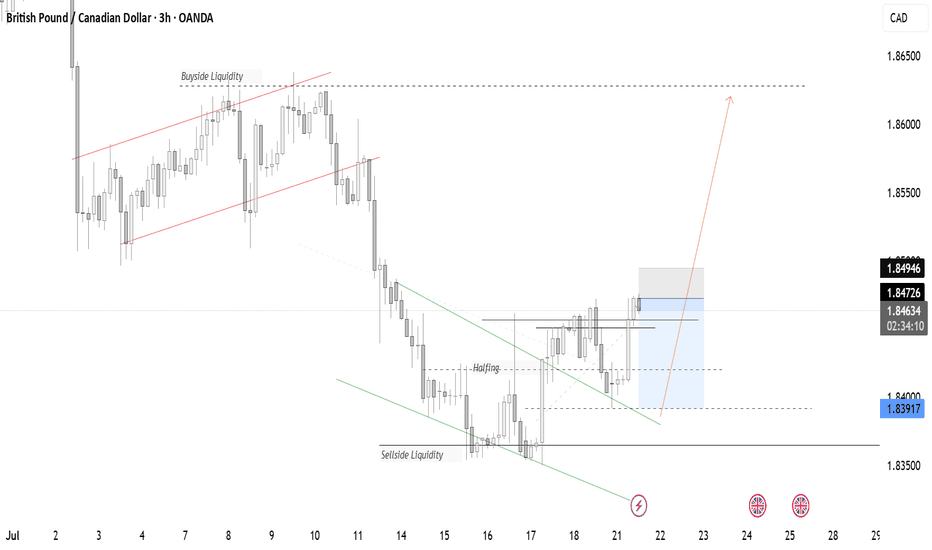

GBPCAD Plans for the New Week.Firstly, wow. You do not have to be an artist to recognize great art.

Price will soon rally towards the buy side liquidity but in order to catch an entry, a few scenarios need to happen. At market open, price should quickly recover Friday losses into the highs created on Friday but quickly reverse from there to collect orders below the low that would have been created before the hunt for the highs. Thereafter, buy GBPCAD.

GBPCAD – WEEKLY FORECAST Q3 | W30 | Y25📊 GBPCAD – WEEKLY FORECAST

Q3 | W30 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT FOREX ANALYSIS 📊