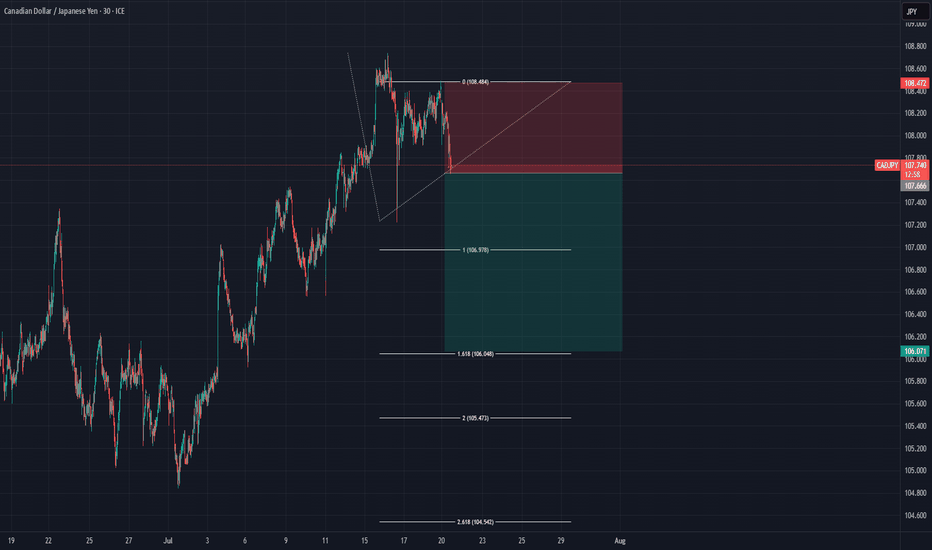

CADJPY I Weekly CLS Range I Model 1 I H4 entry ConfirmedYo Market Warriors ⚔️

Fresh outlook drop — if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The invisible hand behind $7T/day — banks, algos, central players.

📍Model 1:

HTF bias based on the daily and weekly candles closes,

Wait for CLS candle to be created and manipulated. Switch to correct LTF and spot CIOD. Enter and target 50% of the CLS candle.

For high probability include Dealing Ranges, Weekly Profiles and CLS Timing.

Analysis done on the Tradenation Charts

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trading is like a sport. If you consistently practice you can learn it.

“Adapt what is useful. Reject whats useless and add whats is specifically yours.”

David Perk aka Dave FX Hunter

💬 Don't hesitate to ask any questions or share your opinions

CADJPY trade ideas

CADJPY - Wave C Near Completion: Big Drop Coming!We’ve been tracking CADJPY for years, and price has followed Elliott Wave structure almost perfectly.

In mid‑2024, an ending diagonal signalled the top and kicked off a major bearish impulse. That drop formed wave A of the current ABC correction. Wave B completed in late 2024, and price is now in wave C -pushing toward the 50–61.8 % Fibonacci retracement, which marks our sell zone.

We’ll be watching for a trendline to form into this zone. A clean break of that trendline will be our trigger to enter shorts.

Trade Idea:

- Watch for rejection in the 50–61.8 % sell zone

- Aggressive entry: Inside sell zone with stops above rejection

- Conservative entry: On break of trendline, stops above the break candle

Targets:

TP1: 101.5 (1000pips)

TP2: 95 ( 1650pips)

Optional: Leave a runner for a long-term swing

See below for our previous CADJPY setups:

Swing 1:

Swing 2:

Swing 3:

Swing 4:

Goodluck and as always, trade safe!

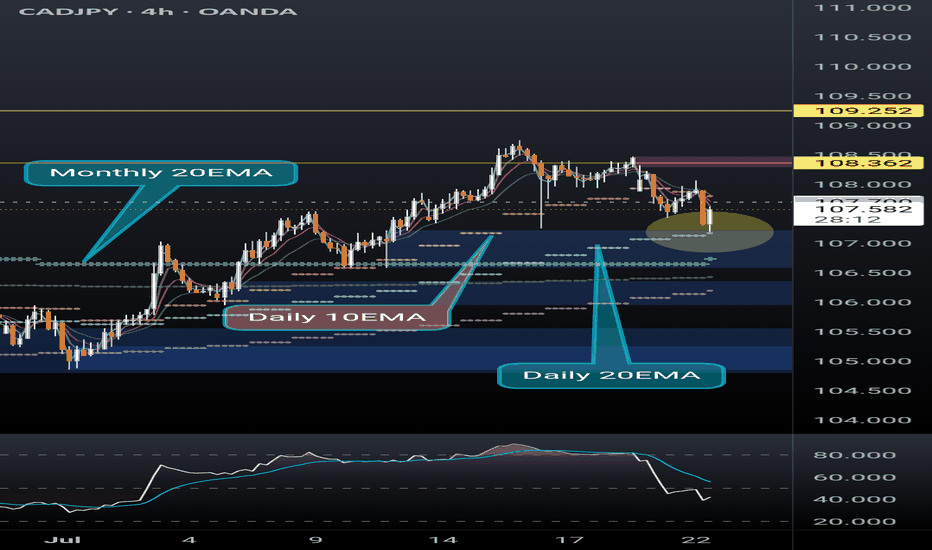

CADJPY Technical & Order Flow AnalysisOur analysis is based on a multi-timeframe top-down approach and fundamental analysis.

Based on our assessment, the price is expected to return to the monthly level.

DISCLAIMER: This analysis may change at any time without notice and is solely intended to assist traders in making independent investment decisions. Please note that this is a prediction, and I have no obligation to act on it, nor should you.

Please support our analysis with a boost or comment!

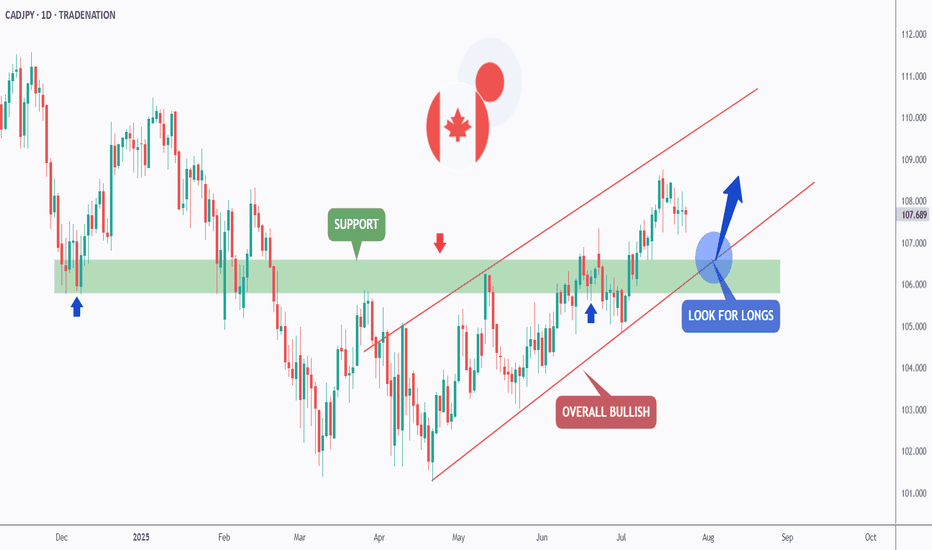

CADJPY - The Bulls Are Stronger than Ever!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈CADJPY has been overall bullish trading within the rising wedge pattern marked in red.

This week, CADJPY has been retesting the lower bound of the wedge.

Moreover, the green zone is a strong weekly support.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of the lower red trendline and green support.

📚 As per my trading style:

As #CADJPY approaches the blue circle zone, I will be looking for trend-following bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

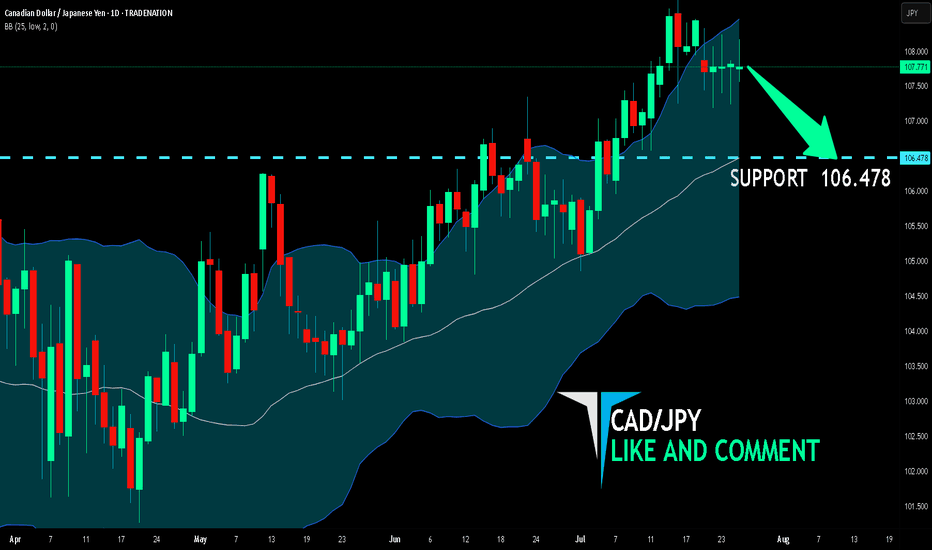

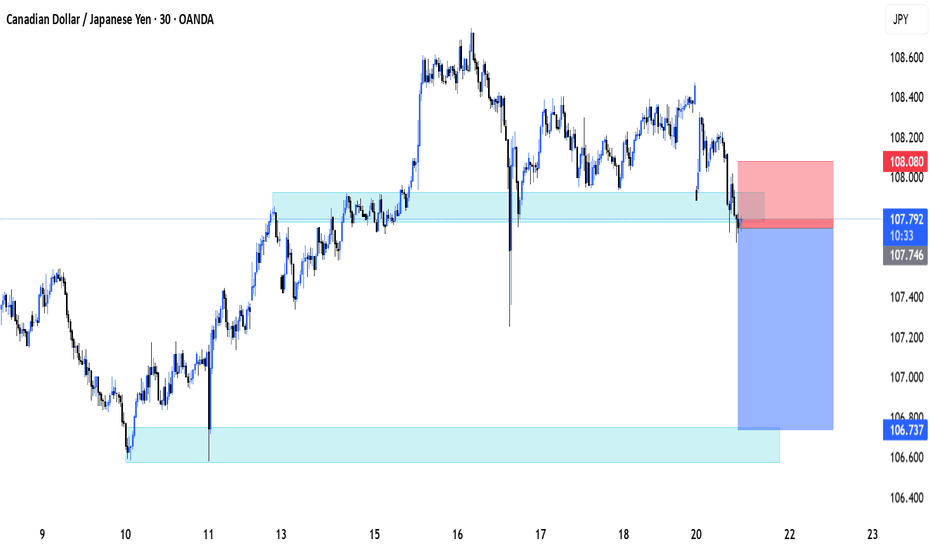

CAD/JPY BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

CAD-JPY uptrend evident from the last 1W green candle makes short trades more risky, but the current set-up targeting 106.478 area still presents a good opportunity for us to sell the pair because the resistance line is nearby and the BB upper band is close which indicates the overbought state of the CAD/JPY pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

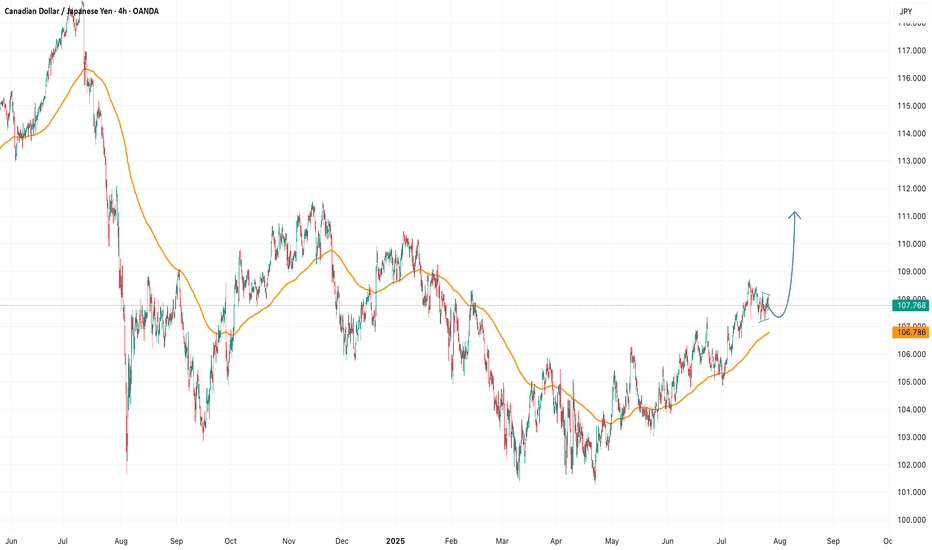

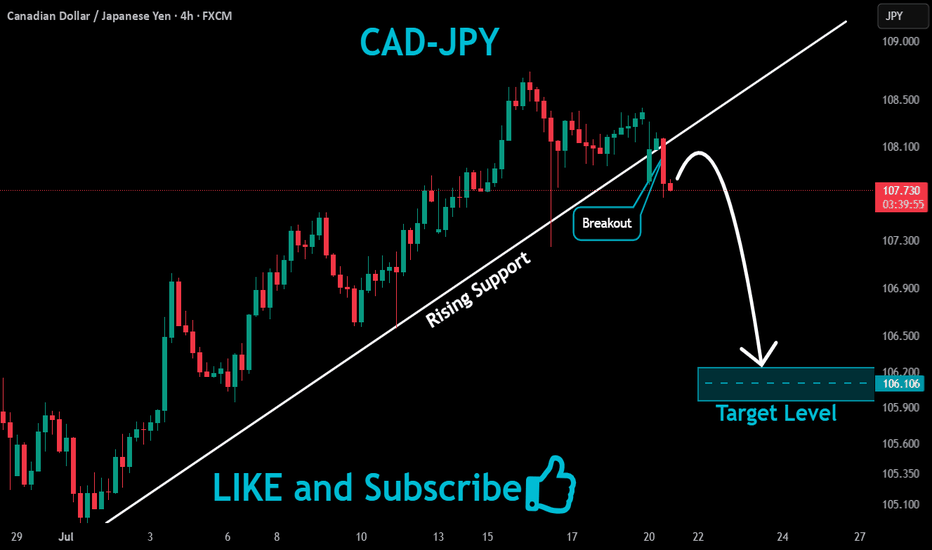

CADJPY Analysis: Uptrend Remains Intact – Look to BuyThe CADJPY pair continues to maintain its strong upward trend on the higher timeframes. Recent pullbacks appear to be temporary corrections and have not broken the overall bullish structure. Therefore, the most appropriate strategy at this stage is to wait for buying opportunities and look for confirmation before entering long positions.

Patience is key — waiting for clear price action signals or technical confirmations can greatly improve your trade success rate.

Suggested Strategy:

Monitor the H1 or H4 timeframe for bullish reversal patterns.

Look to buy when price retests key support zones and shows confirmation (e.g., pin bar, bullish engulfing, breakout).

Stick to your trading plan and follow the trend — the bulls are still in control!

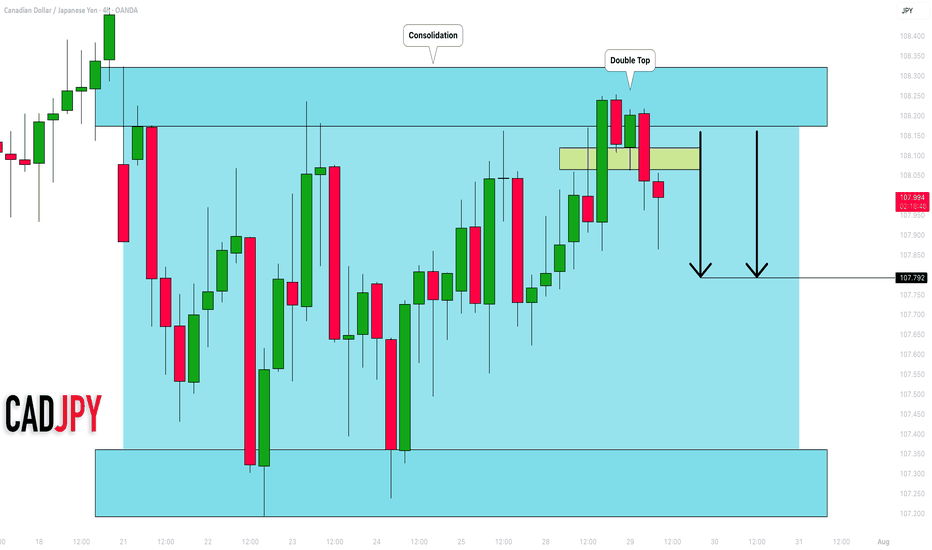

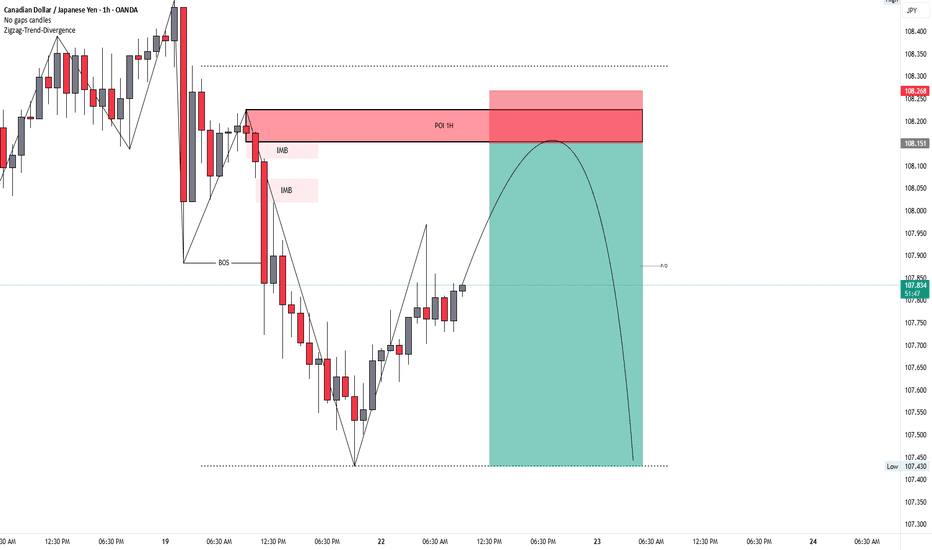

CADJPY (SMC SELL SETUP)TRADE SETUP DESCRIPTION (SMC SELL SETUP):

PAIR: CADJPY

TIMEFRAME: 1H Chart (Entry Confirmation on 15M or 5M)

SETUP LOGIC (SMC STRATEGY):

BOS (Break of Structure) confirm ho chuka hai — bearish trend active hai.

Price is retracing towards:

POI 1H (Supply Zone)

IMB (Imbalance)

Previous supply zone rejection area

Price ka expectation:

Price POI 1H zone tak jaayega.

Wahaan liquidity fill aur IMB fill ke baad bearish reaction expect karna hai.

ENTRY PLAN:

✅ After Price Enters POI 1H Supply Zone:

15 Min ya 5 Min Chart pe CHoCH (Change of Character) ka wait karo.

CHoCH milne ke baad SELL entry lena.

Stoploss POI zone ke upar lagana (above 108.268).

Target: Lower liquidity zone (marked around 107.430).

RISK-REWARD:

🎯 Risk:Reward ratio approximately 1:3 ka ban raha hai.

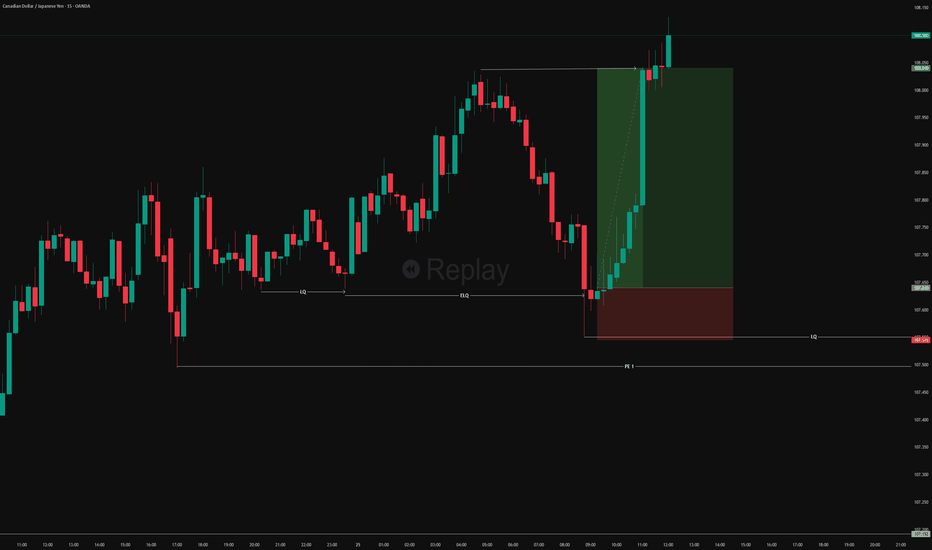

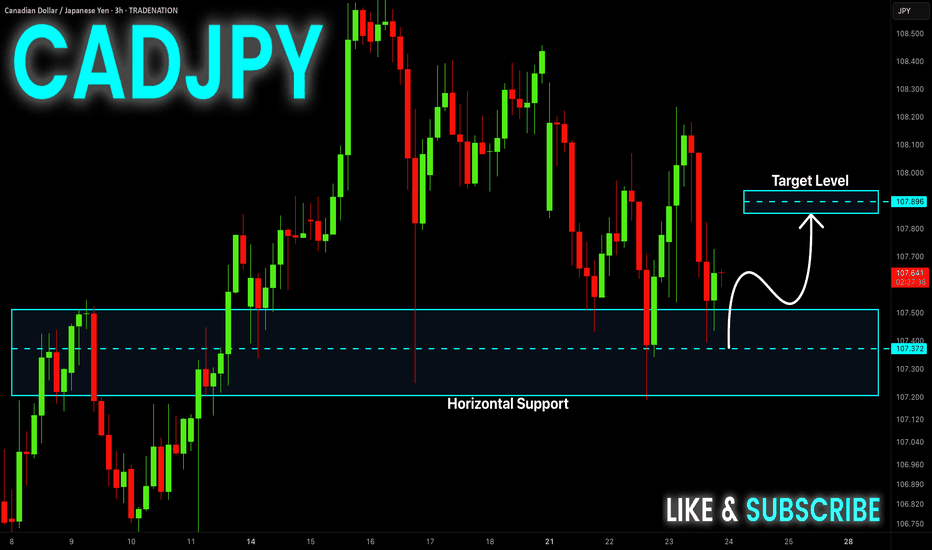

CAD-JPY Local Long! Buy!

Hello,Traders!

CAD-JPY made a retest

Of the horizontal support

Level of 107.400 and we

Are already seeing a bullish

Rebound and we will be

Expecting a further local

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

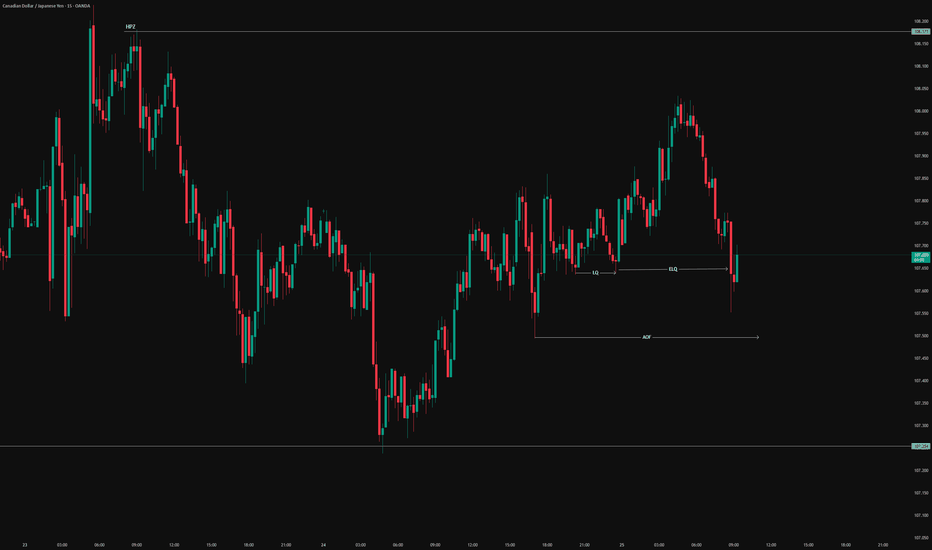

CITYSTAR | CADJPY ANALYSISCADJPY New Forecast👨💻👨💻

This is my personal trade and not in anyway a mandatory setup.

Note:

Follow proper risk management rules. Never risk more then 2% of your total capital. Money management is the key of success in this business...... Set your own SL & TP.

Please support this idea with a Like and COMMENT if you find it useful click "follow" on our profile if you will like these type of trading ideas delivered straight to your email in the future.

Thanks for your continued support!! lemme know your thoughts in the comment sec..