CADJPY trade ideas

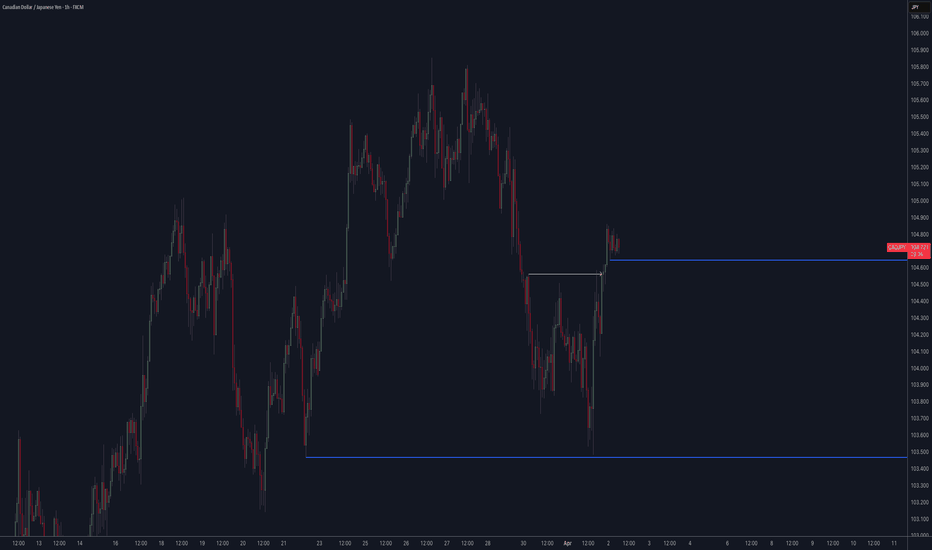

Falling towards pullback support?CAD/JPY is falling towards the pivot and could bounce to the 1st resistance which is a pullback resistance.

Pivot: 104.27

1st Support: 103.54

1st Resistance: 105.58

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

CAD/JPY hits resistance ahead of tariffs dayThe CADJPY rebounded alongside risk assets, but its now testing key resistance at 104.50, where the recovery might falter.

This level was prior support and resistance, and where the 21-day exponential moving average comes into play.

Given an overall bearish structure, I wouldn't be surprised if the selling resumes here.

By Fawad Razaqzada, market analyst with FOREX.com

BUY CADJPY for bearish trend reversal STOP LOSS : 103.53 BUY CADJPY for bearish trend reversal

STOP LOSS : 103.53

Regular Bullish Divergence

In case of Regular Bullish Divergence:

* The Indicator shows Higher Lows

* Actual Market Price shows Lower Lows

We can see a strong divergence on the MACD already and There is a strong trend reversal on the daily time frame chart.....

The daily time frame is showing strength of trend reversal from this strong level of Support so we are looking for the trend reversal and correction push from here .....

TAKE PROFIT : take profit will be when the trend comes to an end, feel from to send me a direct DM if you have any question about take profit or anything

Remember to risk only what you are comfortable with…….trading with the trend, patient and good risk management is the key to success here

Pullback resistanceahead?CAD/JPY is rising towards the pivot which acts as a pullback resistance and could reverse to the 1st support which is a pullback support.

Pivot: 104.77

1st Support: 103.15

1st Resistance: 105.39

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

CADJPY Multi-Timeframe Price Analysis: Trade SetupIn this video, we analyse the CADJPY across multiple timeframes (4H, 1H, and 15M) to identify a high-probability long trade setup based on structural price action, momentum shifts, and Fibonacci retracement levels.

🔍 4H Analysis (Momentum High Formed)

The CADJPY has shown a strong bullish recovery on the 4-hour chart, forming a Momentum High — a key signal that often precedes price movement. According to the principle "Momentum Precedes Price," we anticipate a corrective pullback to form a Higher Low (HL). This HL is expected to become a decision point for buyers looking to join the uptrend.

⏱ 1H Analysis (Confirmation of Structure)

On the 1-hour timeframe, price has formed a Higher Market Low (ML), confirming the structural HL observed on the 4H chart. Price has now entered the Fibonacci Buy Zone, providing a high-probability entry area for bullish trades.

📉 15M Analysis (Failure Setup & Entry Trigger)

The 15-minute chart shows a Failure to Make a Lower Low (LL). While a higher low is a positive sign, confirmation comes only after a break above the last Lower High (LH) that failed to produce a new low. We’re watching for a break above 104.128 to confirm this failure setup and trigger our long entry.

🎯 Trade Setup

✅ Entry: Long above 104.128

🛑 Stop Loss: Below London session low at 103.74 ± 5 pips

🎯 Targets:

T1: 106.92

T2: 108.64

💬 Wishing you a successful trading week! Don’t forget to like, comment, and follow for more technical analysis and trade ideas.

CADJPY Will Move Lower! Sell!

Here is our detailed technical review for CADJPY.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 104.000.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 102.916 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

CADJPY-NEUTRAL SELL strategy 6 hourly chart Regrssion channel The pair has moved lower and I exited @ 104.33 from my previous SELL strategy. It feels heavy and we may see move towards 103.20 area in coming sessions, but I prefer to stay out.

Strategy SELL (for those willing) @ 104.00-104.40 and take profit @ 103.27 for now.

CADJPY-SELL strategy 6 hourly chart Line Brk (2)The pair should resume downtrend as based on regression channel parameters and indicators. The feel I get is, we will test 103.40 area in coming sessions, whilst still respecting cloud support lower.

Strategy SELL @ 105.00-105.40 and take profit near 103.77 for now.

Potential bearish drop?CAD/JPY gas rejected off the pivot which is a pullback resistance and could drop to the 1st support/

Pivot: 105.18

1st Support: 101.71

1st Resistance: 107.74

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

CadJpy Trade IdeaAnother pair that ended last week bullish is gonna be CJ. We have clean structure flips on both higher and smaller time frames. This week I'll be looking for smaller time frames to shift within the range before getting into any longs. If all goes well then we could expect price to make a new weekly high. We'll see what happens.

Don't like ranges! X-(Because whether they'll return or continue It's unclear.It's fifty fifty the price to break the border or not after we individualized the range.Hello traders;Here I am watching what condition CADJPY is at.OK,after a floating ascension the price has reached a range zone ina.I would not like to trade or get signals in the range zones;So we are waiting to just break.If the price manages to break the support, we will enter the selling phase.As easy as that! >;<

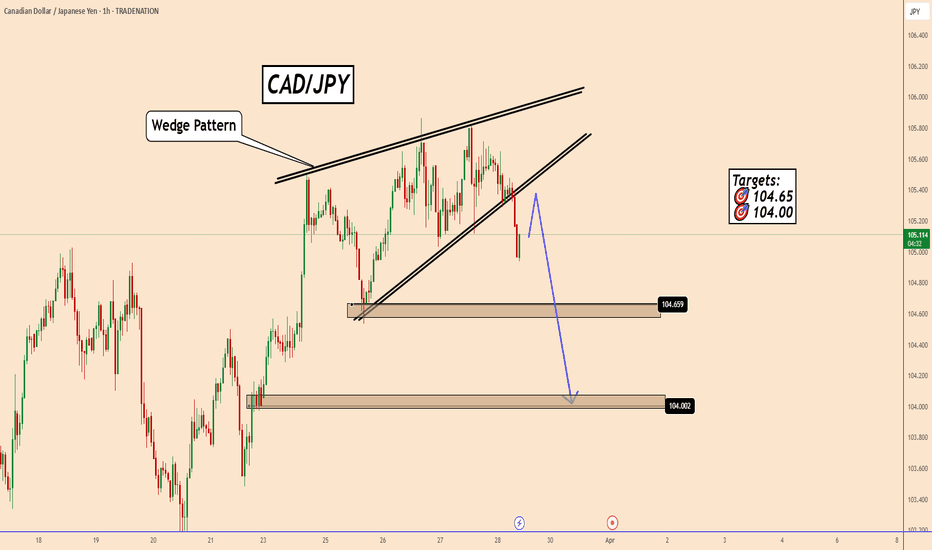

CADJPY: Bearish Wedge PatternCADJPY: Bearish Wedge Pattern

The price broke out from a bearish Wedge Pattern.

The volume is growing, and after a pause, CADJPY can move down more.

Both economies are impacted by Trump's tariffs but in my opinion Canada has more problems and Trump can create more instability.

Targets:

🎯 104.65

🎯 104.00

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CADJPY analysis for a Sell!!!!Here’s a sell-side analysis for CAD/JPY on the 2H chart based on your updated screenshot:

⸻

Pair: CAD/JPY

Timeframe: 2H

Current Price: ~104.656

Market Bias: Short-term bearish shift from previous bullish trend

⸻

Sell Analysis Overview:

1. Bearish Structure Forming Below 105.300–105.600

• Price recently broke below a major support zone (~105.300–105.600), which is now turning into a resistance zone.

• This rejection aligns with the concept of structure flipping — previous support now acting as resistance.

• The marked “Sell Structure Forming Below” zone highlights this key area for short positions on pullbacks.

2. Multiple Rejections at 105.866

• There are clear lower highs forming, with repeated rejections around 105.866 (circled).

• Each attempt to push higher has failed, showing strong bearish pressure and exhaustion from buyers.

3. Breakdown of Key Moving Averages

• Price has closed below both the 50 EMA and 100 EMA, which are beginning to curl downward — a common signal of a trend reversal.

• Momentum has shifted, and sellers are currently in control.

4. Liquidity Grab + Breakdown

• After a false breakout to the upside, price grabbed liquidity around 105.866 and quickly reversed.

• This aligns with smart money behavior: sweeping highs before dropping — a classic bearish trap.

5. Short-Term Target Zone

• The current bearish move has a clear downside target in the 103.600–103.800 zone, which is marked as an “Area of Liquidity”.

• If this zone breaks cleanly, extended targets sit around 101.800–101.400, where fresh demand and buy structure are likely to form.

⸻

Sell Plan & Risk Management:

• Entry Idea: Wait for a pullback into the 105.300–105.600 zone to look for bearish confirmation (e.g., bearish engulfing, rejection wick).

• Stop Loss: Above 105.866 (invalidates structure)

• Take Profit Levels:

• TP1: 103.600 (liquidity zone)

• TP2: 101.800 (demand zone)

• TP3: 101.400 (long-term structure support)

⸻

Final Thoughts:

CAD/JPY is now showing early signs of a bearish trend reversal after a clean breakdown of structure and liquidity sweep at highs. As long as the price remains below 105.600, the bias remains bearish. A bounce from 104.500 could temporarily delay the drop, but deeper downside is likely if that level gives way.

CADJPY Bullish OutlookHere is my analysis for CADJPY for the coming weeks.

Price is approaching correctively towards the Lower time frame 0.618-0.500 area or Golden ratio, price is currently forming a Running Flat pattern and may react from that Buy zone area. Another scenario, price may be forming an Expanding Flat pattern or may go lower between 0.786-0.618 area before price reacts towards the upside.

Once the price reacts on the Buy zone, it will be expected to impulsively towards the Sell zone area or Higher time frame 0.618-0.500 or Golden ratio. From there, we might be expecting a long-term Bearish Outlook.

CADJPY Bullish Surge: Key Levels to Watch Following a strong Canadian GDP report and weaker-than-expected U.S. consumer sentiment data from the University of Michigan, CADJPY has shown significant bullish momentum. Additionally, positive discussions between former U.S. President Trump and PM of Canada Carney have contributed to market optimism.

After bouncing off a 1-hour order block, CADJPY has surged over 50% from its weak opening. If this bullish momentum persists, the pair could target the 106.000–106.500 range in the near term. Traders should watch for continued strength and potential retracements for optimal entries.