NZDCAD What Next? SELL!

My dear subscribers,

This is my opinion on the NZDCAD next move:

The instrument tests an important psychological level 0.7949

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 0.7903

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

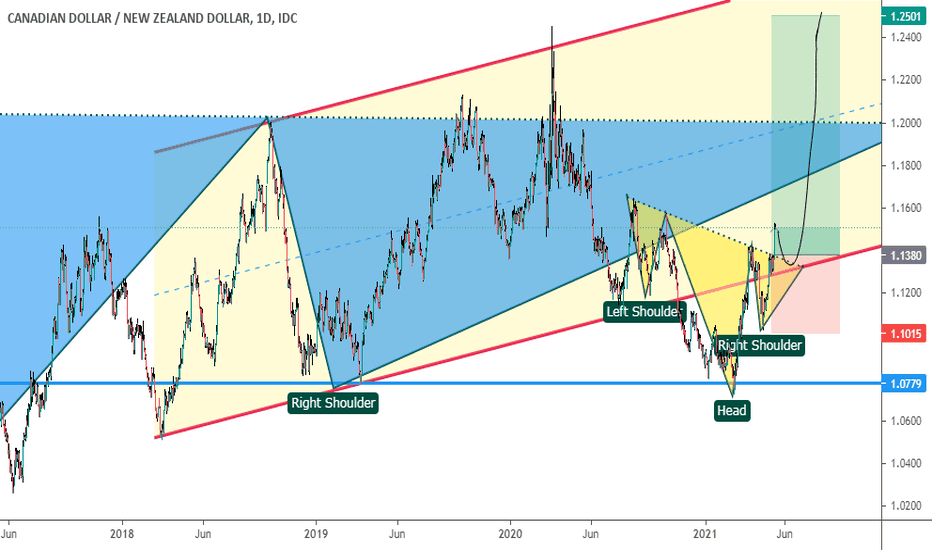

CADNZD trade ideas

Bullish bounce?NZD/CAD has bounced off the pivot and could rise to the 1st resistance.

Pivot: 0.81458

1st Support: 0.81095

1st Resistance: 0.82317

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

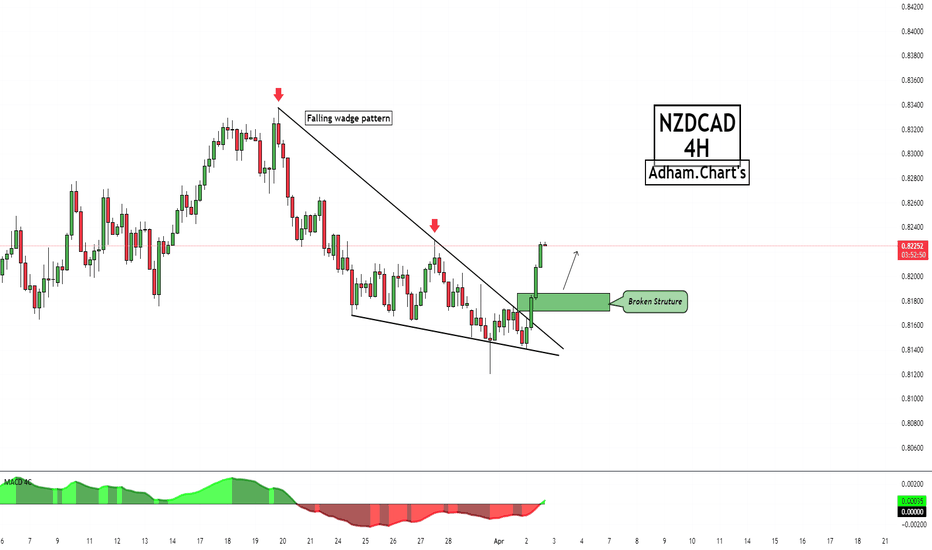

NZDCAD💡Chart analysis of the NZD/CAD currency pair (4-hour timeframe). A falling wedge pattern appears, a reversal pattern that indicates a potential price rally after a breakout. The MACD indicator supports the bullish scenario, showing improved buying momentum after the breakout.

⛔️Not investment advice. For educational purposes only.

Bullish bounce?NZD/CAD has bounced off the pivot which acts as a pullback support and could rise to the 1st resistance which is a pullback resistance.

Pivot: 0.81458

1st Support: 0.81069

1st Resistance: 0.82317

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

NZD/CAD Daily AnalysisPrice is moving within an ascending channel with price now testing support.

Look for potential buy setups after a change of sentiment on the smaller time frames if this meets your strategy rules.

This is an idea of what may happen. You should always trade with a well tested and profitable trading strategy using good risk management.

NZDCAD ShortsMarket structure bearish on HTFs 3

Entry at both DW

Weekly Rejection at AOi

Daily Rejection at AOi

Previous Structure point Daily

Around Psychological Level 0.82000

H4 EMA retest

H4 Candlestick rejection

Levels 4.3

Entry 105%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

NZDCAD Will Fall! Sell!

Please, check our technical outlook for NZDCAD.

Time Frame: 2h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 0.816.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 0.813 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

How To Trade Forex-Part1In this chart i show you my frustration as i am trying to find a better way to scan for Forex trades but at the end of the chart we can see the light at the end of the tunnel.

Because i am now able to scan for Forex trading using:

1-Candle stick patterns

2-Directional Movement indicator

3-Moving Averages.

Study this chart in order

to see how i have really broken it down to

a simple science

I will try to make a video to demonstrate this

system.

Rocket boost this content to learn more.

Disclaimer:Trading is risky please

learn risk management and profit taking

strategies.Also feel free to use a simulation trading

account before you trade with real money.

NZD-CAD Free Signal! Sell!

Hello,Traders!

NZD-CAD made a bearish

Breakout of the key horizontal

Level around 0.8182 so we are

Bearish biased so lets let the

Pair make a pullback and

Retest the lower bound of

The new resistance level

And from there we can go

Short with the Take Profit

Of 0.8136 and the Stop

Loss of 0.8196

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDCAD Potential Bullish ReversalNZDCAD price seems to exhibit signs of a potential Bullish Reversal on the shorter timeframes if the price action forms a credible Higher High with multiple confluences from key Fibonacci and Support levels.

Trade Plan :

Entry @ 0.822500

Stop Loss @ 0.81600

TP 0.9 - 1 @ 0.82830 - 0.82890

Bearish drop?NZD/CAD has reacted of the pivot and could drop to the 1st support.

Pivot: 0.8201

1st Support: 0.8078

1st Resistance: 0.8309

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

NZDCAD is Bearish, strategy this weekNZDCAD was bullish in March, but selling pressure was seen last few days. It forms evening tarts in weekly view and already has a broken triangle pattern.

It is already playing Long time old Divergence in Daily View, and currently forming LH - LL.

In Hourly view, it has already tested Support multiple times, forming a triangle.

from last 5 hours itis forming spinners.

my strategy is to take short position after confirmation (break of support).

NZDCAD is in the Selling Direction after Breaking SupportHello Traders

In This Chart nzdcad HOURLY Forex Forecast By FOREX PLANET

today NZDCAD analysis 👆

🟢This Chart includes_ (NZDCAD market update)

🟢What is The Next Opportunity on NZDCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts