NZDCAD Will Go Up! Long!

Please, check our technical outlook for NZDCAD.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The price is testing a key support 0.825.

Current market trend & oversold RSI makes me think that buyers will push the price. I will anticipate a bullish movement at least to 0.847 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

CADNZD trade ideas

NZDCAD: Short Trading Opportunity

NZDCAD

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short NZDCAD

Entry Point - 0.8240

Stop Loss - 0.8326

Take Profit - 0.8088

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Bearish Forecast on NZDCAD NZDCAD New Forecast👨💻👨💻

This is my personal trade and not in anyway a mandatory setup.

Note:

Follow proper risk management rules. Never risk more then 2% of your total capital. Money management is the key of success in this business...... Set your own SL & TP.

Please support this idea with a Like and COMMENT if you find it useful click "follow" on our profile if you will like these type of trading ideas delivered straight to your email in the future.

Thanks for your continued support!! lemme know your thoughts in the comment sec..

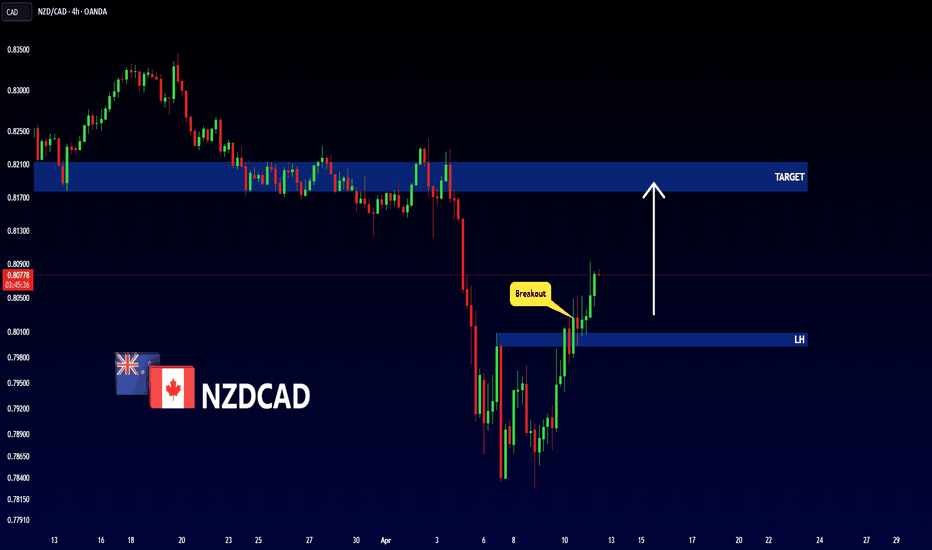

NZD/CAD Fundamental updateNZD/CAD – Potential Short Setup (M30 Timeframe)

The NZD/CAD pair on the M30 timeframe is showing signs of a potential selling opportunity following the recent formation of a breakout pattern, indicating a possible shift in momentum to the downside over the next few hours.

Possible Short Trade:

Entry: Watch for a short entry near the trendline of the breakout pattern.

Target Levels:

1st Support: 0.8138

2nd Support: 0.8077

This setup aligns with a breakout-retest scenario. Wait for confirmation before entering.

---

Please hit the like button and leave a comment to support my post!

Your likes and feedback are incredibly motivating and inspire me to share more quality analysis with you.

Best Regards,

JAMES_GOLD_MASTER_MQL5

Thank you!

NZDCAD Discretionary Analysis: Bank Manipulation?The price just crashed into the distribution block, straight into that sellside liquidity order block like it knew exactly where it was going. Bank manipulation? It's all over this one. The institutional orderflow is running the show, and with a sharp liquidity spike followed by orders stacking up like a ticking time bomb, it's getting real... they are manipulating the price. The fair value gap is wide, and that uptrust into the distribution channel? That's the red flag that’s flashing "this is it." Everything is lined up for a big move, and I'm here for going on the lower timeframe and entering on that liquidity sweep from a NY Open manipulated candlestick.

Just kidding, I just think it's gonna go up.

NZD/CAD Fundamental Update (17.04.2025) The NZD/CAD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 0.8138

2nd Support – 0.8077

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Bearish drop?NZD/CAD is reacting off the pivot and could drop to the 1st support.

Pivot: 0.82329

1st Support: 0.82448

1st Resistance: 0.83294

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

#NZDCAD: Great Time To Swing Sell! Comment Your View! NZDCAD is at a critical selling level, and we expect a significant drop. The chart shows potential price reversals, either continuing in our direction or rising to the red circle before reversing. A risk-managed trade could benefit from this.

Good luck and trade safely!

Much Love ❤️

Team Setupsfx_

NZDCAD Trading Opportunity! SELL!

My dear friends,

Please, find my technical outlook for NZDCAD below:

The price is coiling around a solid key level - 0.8223

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 0.8103

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NZD CAD #0010 Short Swing Trading - The trade relies on the liquidity pools around the structures.

- The Main drive for the Sell limit Order placement was the Monthly CHoCH that occurred as labeled in the diagram.

- It is supported by the nearest Break of Structure on the Monthly level, giving the impression that the Trade is on continuation, however, Correction is inevitable.

- We have decided that the Liqidity Pools exist within the Orderblock to give the highest liquidity.

- Our trade is to capture the correction price within the order blocks and ride on the continuation of the Downtrend.

- The nature of this entry is Swing Trading, where holding days are between 3 days to 10 days.

NZDCAD Buy Limit Setup

Timeframe: 15 minutes

Direction: Long (Buy)

Entry Type: Limit Order

Risk-to-Reward Ratio: 2.9

Technical Context:

The trade is based on a clean bullish structure following a strong upward impulse. The pair broke above a significant resistance zone, which has now been re-tested as potential support. This zone aligns with a prior consolidation area and serves as a key decision level.

Entry Level:

A Buy Limit order is placed at 0.82162, anticipating a retracement into the broken resistance-turned-support zone.

Stop Loss:

Placed just below the lower boundary of the structure at 0.82037, accounting for potential volatility while maintaining structural invalidation.

Take Profit:

Targeting 0.82463, aligning with the upper boundary of the previous range and offering a favorable risk-to-reward profile of 2.9.

Trade Rationale:

This setup is designed to capitalize on a pullback within a strong intraday uptrend, taking advantage of market structure shifts. By waiting for price to return to a high-probability zone, the entry maximizes precision and minimizes drawdown.

Notes:

This trade was considered only after a successful earlier setup, reinforcing the psychological discipline of not overtrading. The entry is conditional—if price does not return to the desired level, the trade will be skipped, maintaining the quality-first approach.

NZDCAD SHORT Market structure bearish on HTFs DW

Entry at Daily and Weekly AOi

Weekly Rejection at AOi

Daily Rejection at AOi

Daily EMA retest

Previous Structure point Daily

Around Psychological Level 0.81500

H4 Candlestick rejection

Levels 6.67

Entry 90%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

NZDCAD – Short-Term Bullish Setup (1H Divergence)✅ Key Observations:

Timeframe: 1 Hour

Signal: Bullish Divergence

Bias: Short-term bullish, possibly within a larger corrective structure

🔍 Technical Confluences:

Bullish Divergence on RSI or MACD:

Price made a lower low, while oscillator made a higher low – signaling weakening bearish momentum.

Possible Support Area:

Near a recent demand zone

May coincide with a minor trendline or Fibonacci level

Candle Structure:

Look for a bullish engulfing or pin bar to confirm reversal

📈 Trade Plan – LONG Position

Entry:

Buy after confirmation candle forms (bullish candle closing above previous one)

Or after a minor resistance break (micro-structure shift)

Stop Loss:

Just below the swing low where divergence formed

Take-Profit (Short-Term):

TP1: Nearest resistance level / recent high

TP2 (optional): Fib 0.618 retracement of the previous bearish move

Risk-to-Reward: Target at least 1:1.5 or 1:2

⚠️ Watch For:

A pullback before the full move starts – don't chase the first green candle blindly

If price makes a lower low with no divergence, re-evaluate the setup