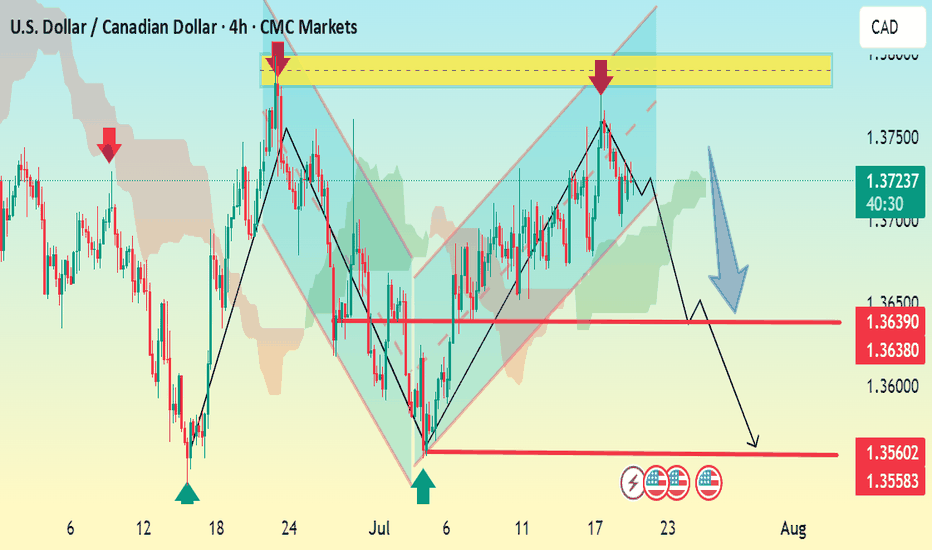

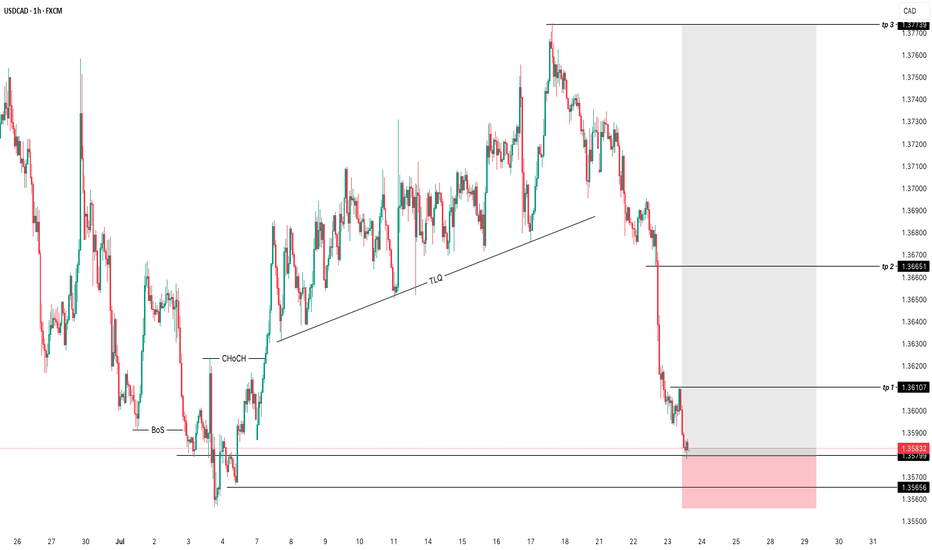

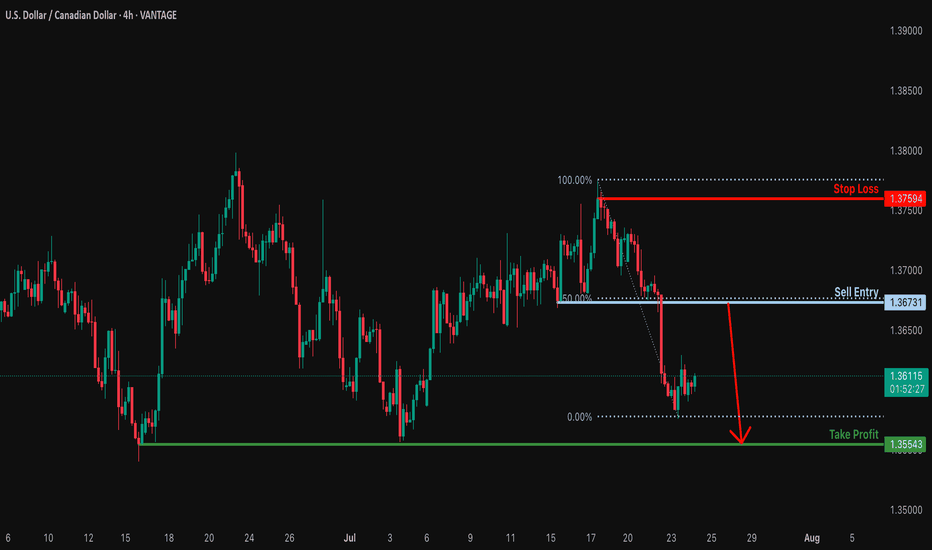

USDCAD 4H Bearish SetupThe USDCAD chart shows a clear bearish breakdown from the ascending channel. Price has broken below support near 1.3720, confirming a shift in structure.

Key Analysis:

Bearish Momentum: Break below the channel and current market structure signals downside pressure.

Immediate Resistance: 1.3725–1.

About Canadian Dollar / U.S. Dollar

The Canadian dollar is the official currency of Canada. The Canadian dollar is symbolized by $, or C$, CA$ or CAD$. The Canadian dollar is the fifth most held currency in the world, at nearly US$119 billion.1) The currency code for the Canadian dollar is CAD, and the dollar itself is made up of 100 cents. The Canadian dollar is often considered a commodity currency due to the large deposits of natural resources, especially oil that is exported from Canada. The Canadian dollar is often nicknamed loonie, for the image of a loon on its one-dollar coins, and is controlled by the Central Bank of Canada.

Related currencies

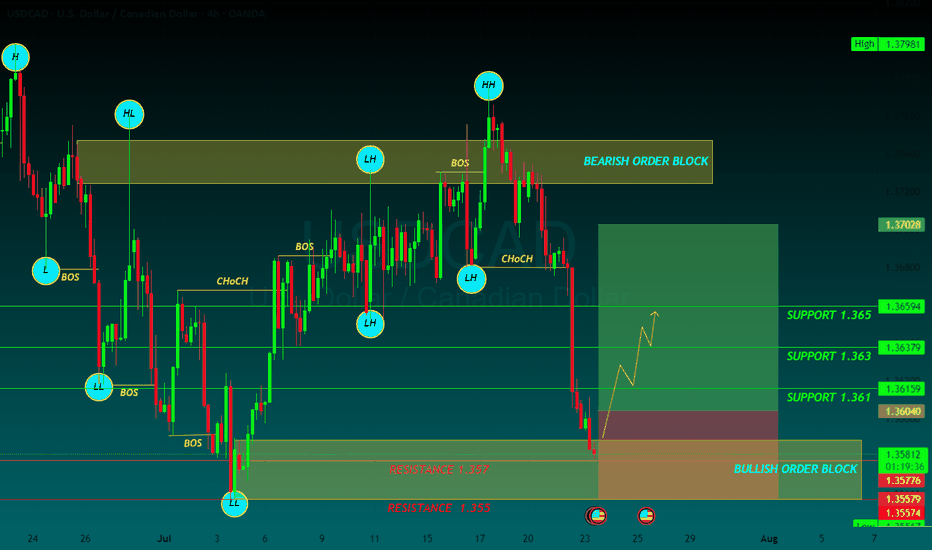

USDCAD BUYUSD/CAD returns below 1.3600, with YTD lows, at 1.3540 coming into view

The US Dollar extends its decline for the fourth consecutive day, with the Canadian Dollar supported by a brighter market mood, as the trade deal between the US and Japan provided some certainty about the outlook of global trade

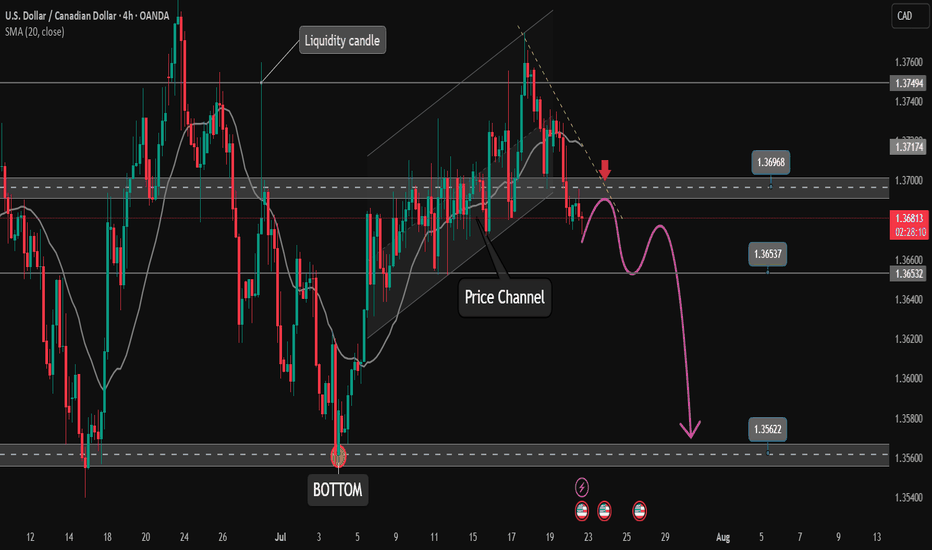

Price channel break. Will the downtrend take place?✏️USDCAD broke the price channel and started forming a bearish wave. The resistance zone of 1.370 played an important role in starting the bearish wave. 1.365 is the immediate support zone that the pair faces. If it wants to extend the decline, it needs to close the h1 candle below this price zone.

BUY USDCADUSDCAD is currently i a good and clearpoint of interest , i expect the market to push ever since it has already changed its bearish character to bullish , with a supporting trendline liquidity whivch has been swapped out with a bearish push

use proper risk management

and goodluck.. manage ur trade

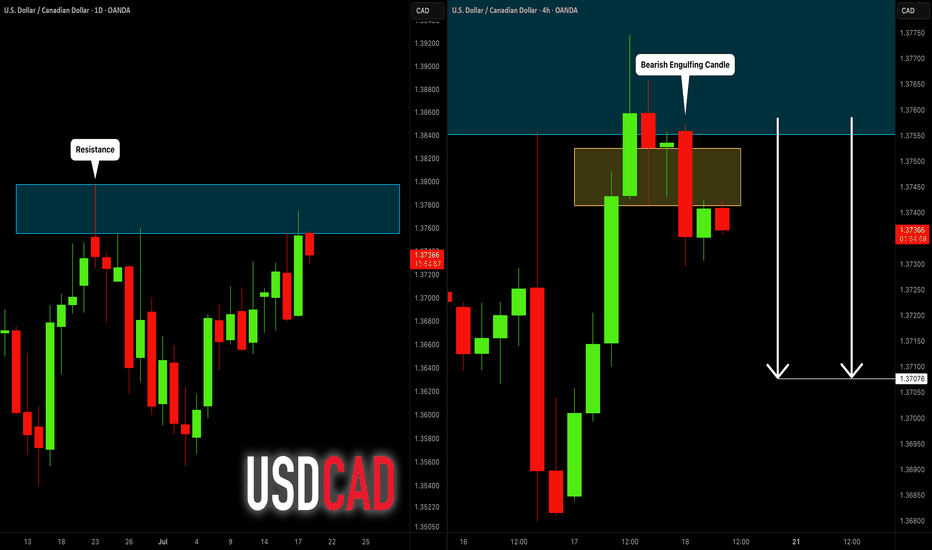

USDCAD: Bearish Move From Resistance 🇺🇸🇨🇦

USDCAD is going to retrace from a key daily resistance.

A bearish imbalance candle that the price formed after its test

during the Asian session provides a strong intraday bearish confirmation.

Goal - 1.3707

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influ

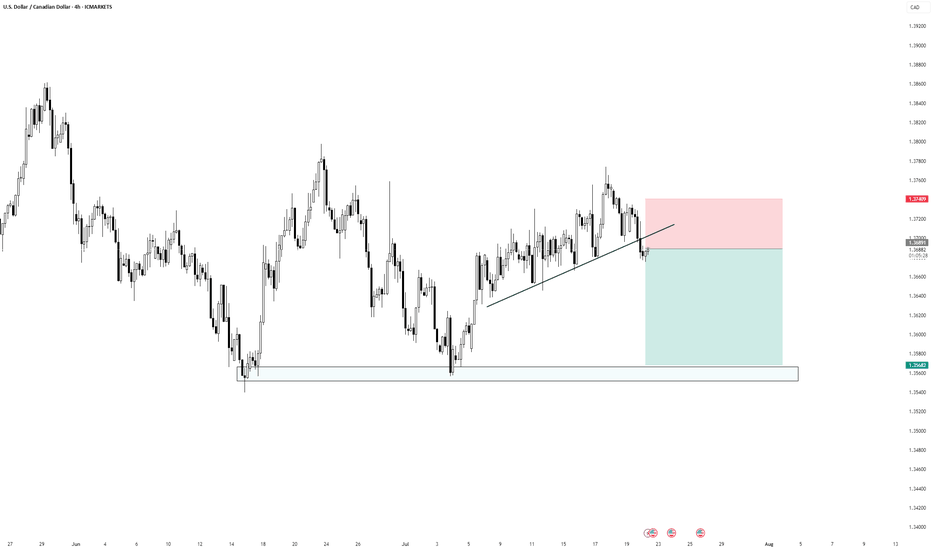

Bearish Break of Trendline + Retest | Short SetupPrice has broken below the ascending trendline, indicating a potential shift in market structure. The recent bearish momentum suggests sellers are gaining control. After the breakout, price is now retesting the underside of the trendline, providing a potential short entry opportunity.

Entry: On ret

USDCAD Bearish continuation below 1.3670The USDCAD pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a continuation breakdown within the downtrend.

Key resistance is located at 1.3670, a prior consolidation zone. This level will

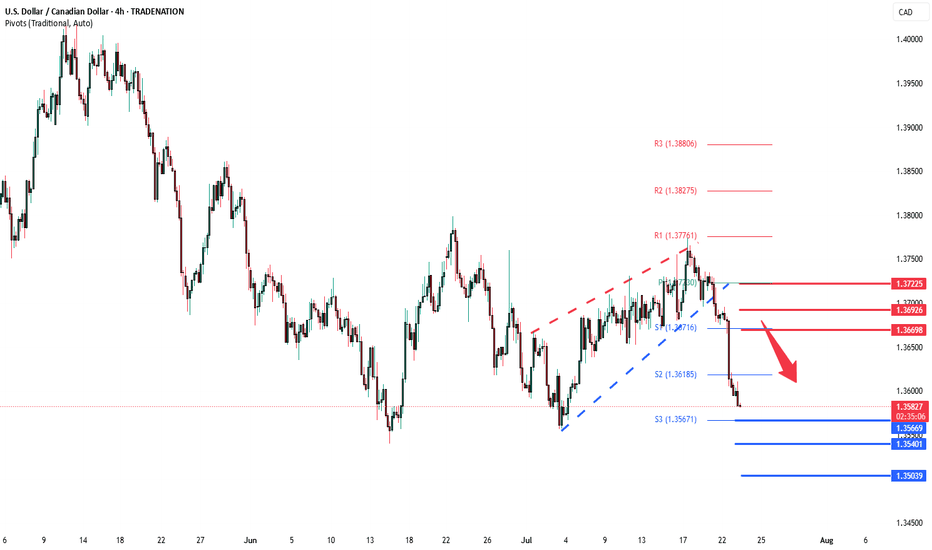

Market Analysis: USD/CAD Consolidates GainsMarket Analysis: USD/CAD Consolidates Gains

USD/CAD declined and now consolidates below the 1.3750 level.

Important Takeaways for USD/CAD Analysis Today

- USD/CAD started a fresh decline after it failed to clear the 1.3775 resistance.

- There is a key bullish trend line forming with support a

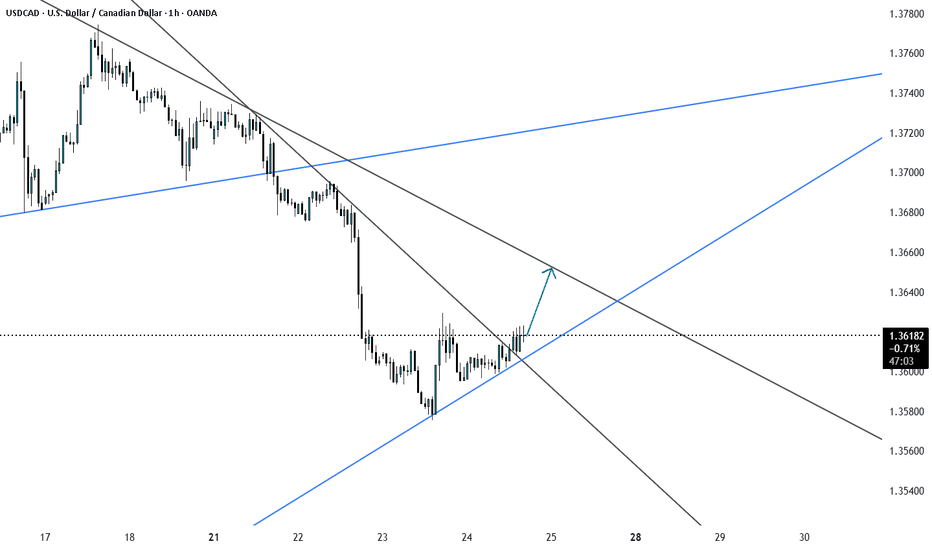

Heading into 50% Fibonacci resistance?USD/CAD is rising towards the resistance which is a pullback reistance that lines up with the 50% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 1.3673

Why we like it:

There is a pullback resistance that lines up with the 50% Fibonacci retracement.

Stop loss: 1.

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of CADUSD is 0.7293 USD — it has decreased by −0.46% in the past 24 hours. See more of CADUSD rate dynamics on the detailed chart.

The value of the CADUSD pair is quoted as 1 CAD per x USD. For example, if the pair is trading at 1.50, it means it takes 1.5 USD to buy 1 CAD.

The term volatility describes the risk related to the changes in an asset's value. CADUSD has the volatility rating of 0.62%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The CADUSD showed a 0.27% rise over the past week, the month change is a 0.08% rise, and over the last year it has increased by 0.86%. Track live rate changes on the CADUSD chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

CADUSD is a major currency pair, i.e. a popular currency paired with USD.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade CADUSD right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with CADUSD technical analysis. The technical rating for the pair is sell today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the CADUSD shows the buy signal, and 1 month rating is sell. See more of CADUSD technicals for a more comprehensive analysis.