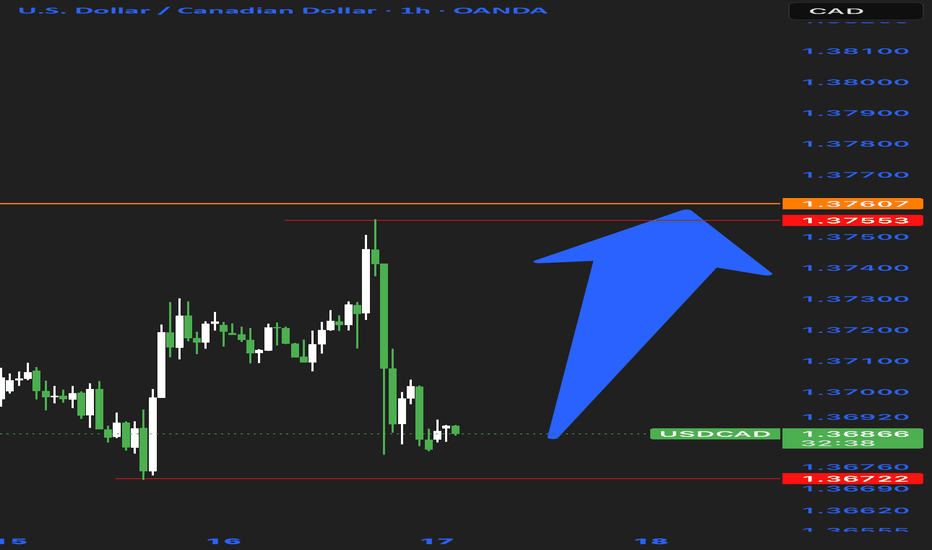

USDCAD SELLUSD/CAD retakes 1.3700, eyes multi-week top amid a broadly firmer USD

The USD/CAD pair attracts some dip-buying during the Asian session on Thursday and climbs further beyond the 1.3700 mark amid a broadly firmer US Dollar. Spot prices have now reversed the previous day's retracement slide from a three-week high and seem poised to appreciate further

The year will be politically marked by Trump’s return to the White House. A Republican government is seen as positive for financial markets, but Trump’s pledge to cut taxes and impose tariffs on foreign goods and services may introduce uncertainty to both the political and economic landscape.

Canada’s political crisis peaked in late 2024 with a no-confidence vote against Prime Minister Justin Trudeau, leading to snap elections and a weakened Liberal minority government. Policy uncertainty and economic challenges dominate 2025’s outlook, raising concerns over market stability and investor confidence.

The BoC is set to continue easing interest rates through 2025, at least at a faster pace than the Fed is expected to, which could apply pressure on CAD’s already-rising rate differentia

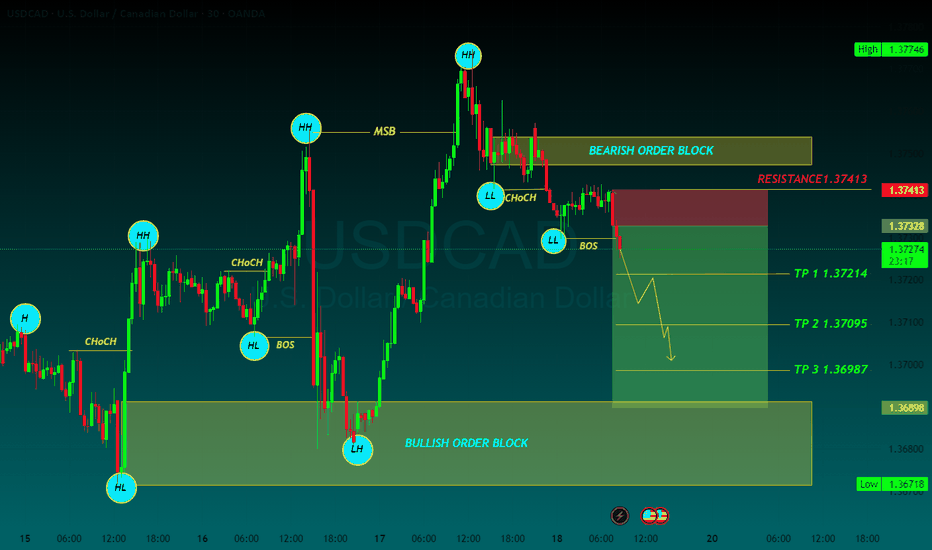

TP 1 1.37214

TP 2 1.37095

TP 3 1.36987

RESISTANCE 1.37413

CADUSD trade ideas

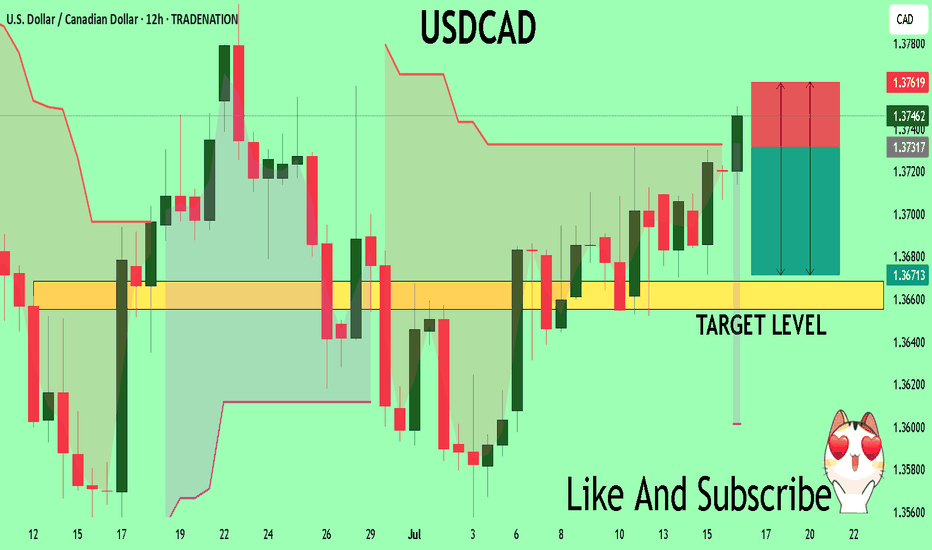

USD_CAD LOCAL SHORT|

✅USD_CAD is going up now

But a strong resistance level is ahead at 1.3800

Thus I am expecting a pullback

And a move down towards the target of 1.3720

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

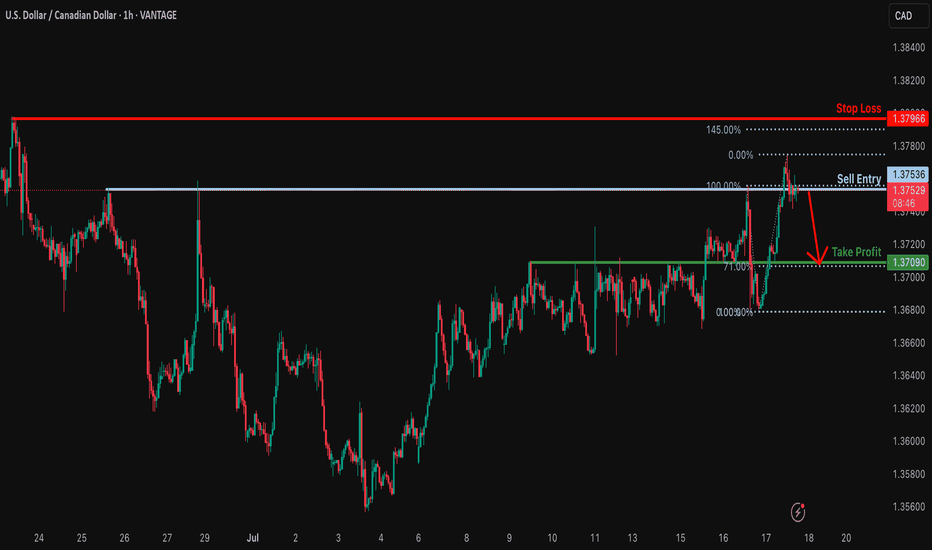

Bearish drop off pullback resistance?USD/CAD is reacting off the resistance level which is a pullback resistance and could reverse from this level to our take profit.

Entry: 1.3753

Why we like it:

There is a pullback resistance.

Stop loss: 1.3796

Why we like it:

There is a swing high resistance that is slightly above the 145% Fibonacci extension.

Take profit: 1.3709

Why we lik eit:

There is an overlap support that lines up with the 71% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

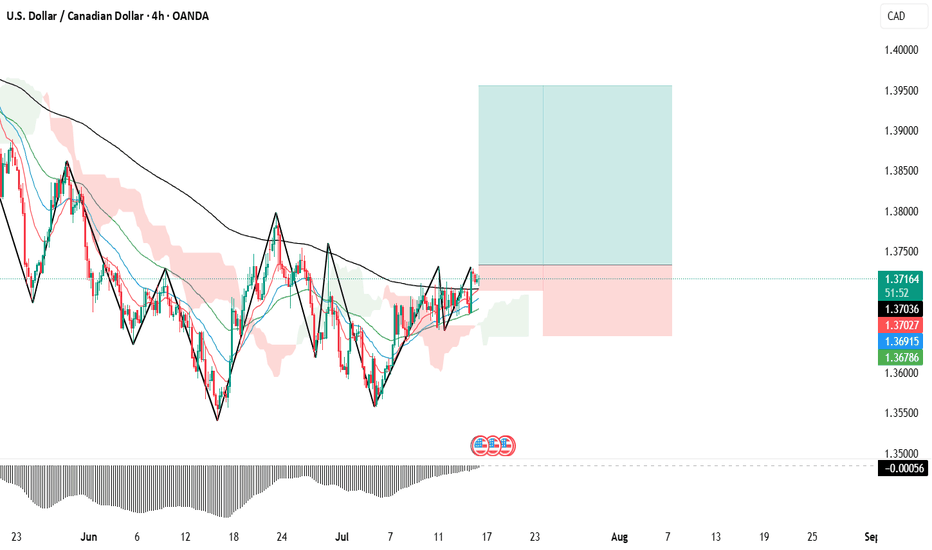

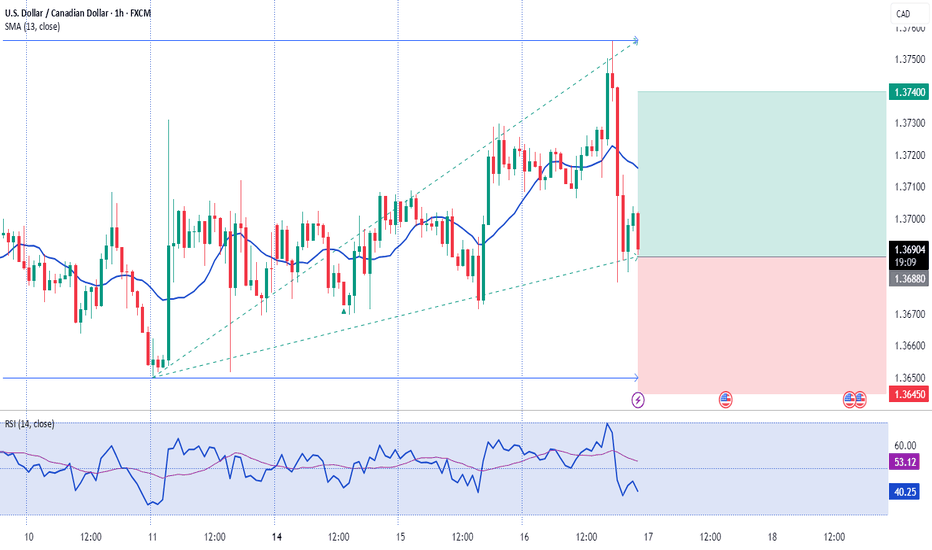

USDCAD Analysis – July 16, 2025

Following the ceasefire between Iran and Israel, oil prices have weakened, reducing support for the Canadian dollar, which is closely tied to crude. As a result, CAD could remain among the weaker currencies over the next two weeks.

Meanwhile, the US dollar may gain strength following the CPI data released on July 15, 2025, potentially setting up a favorable swing opportunity for USDCAD bulls.

🟥 High-Risk Setup – R:R 7.0

This aggressive setup targets a sharp upside move with a tight stop loss, aiming for a high reward relative to the risk. It's suitable for traders comfortable with volatility and willing to accept a lower probability for a higher payout.

🟦 Moderate-Risk Setup – R:R 2.5

A more balanced scenario with a wider stop and a closer target, offering a higher probability of success and smoother trade management. This setup aligns well with swing trading strategies seeking consistent results.

Both setups are based on the current price action structure visible on the chart.

Trade safe, manage your risk, and follow your plan. ✅

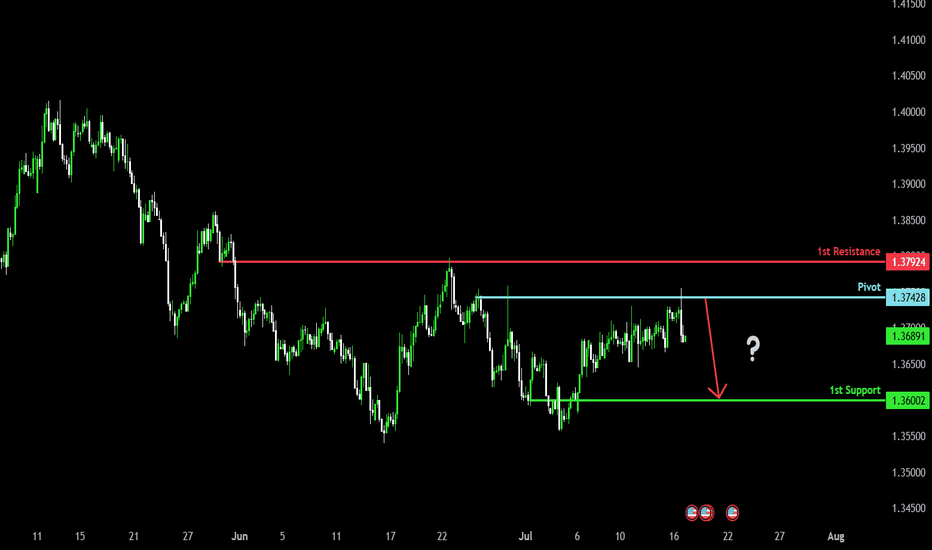

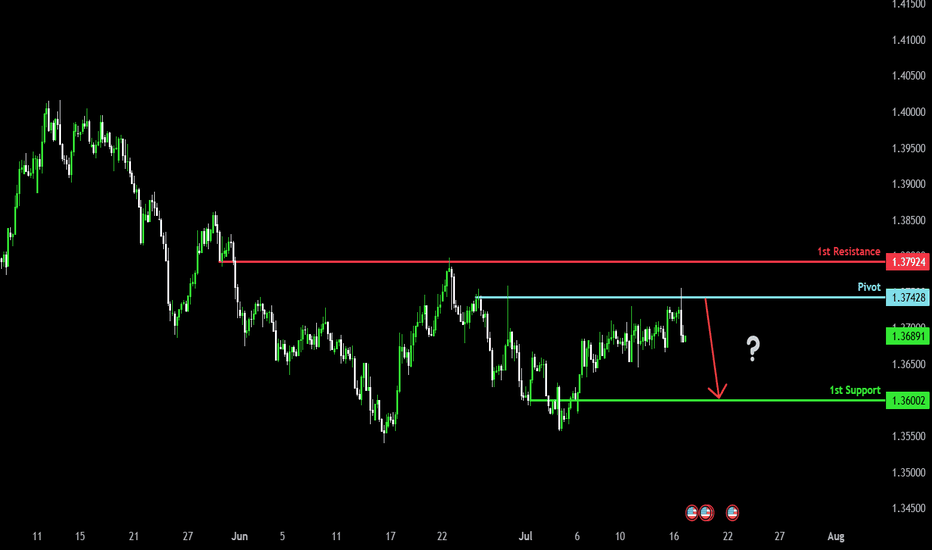

Bearish drop?The Loonie (USD/CAD) has rejected off the pivot which acts as a pullback resistance, and could drop to the 1st support.

Pivot: 1.3742

1st Support: 1.3600

1st Resistance: 1.3792

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish drop?The Loonie (USD/CAD) has rejected off the pivot which acts as a pullback resistance, and could drop to the 1st support.

Pivot: 1.3742

1st Support: 1.3600

1st Resistance: 1.3792

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

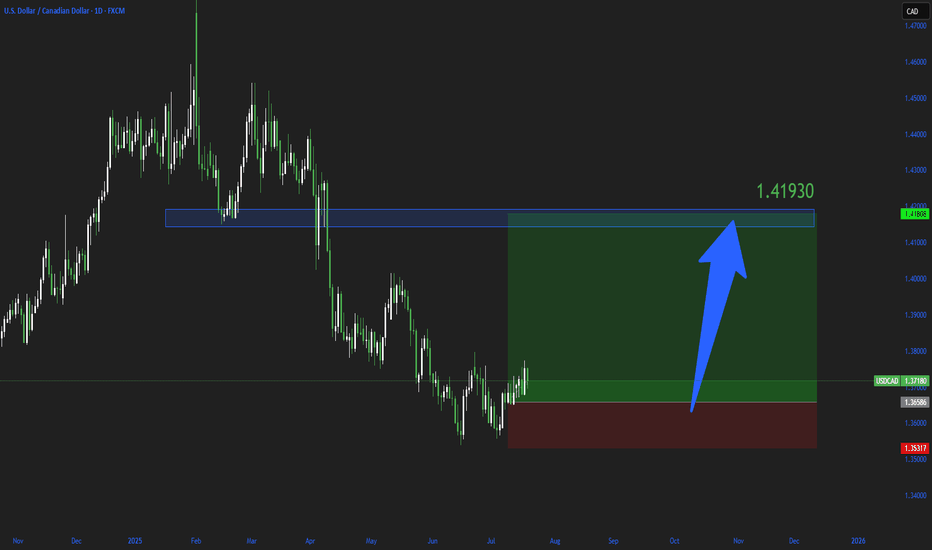

USDCAD LONG DAILY FORECAST Q3 D15 W29 Y25USDCAD LONG DAILY FORECAST Q3 D15 W29 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

Potential bullish rise?The Loonie (USD/CAD) is reacting off the pivot and could rise to the 1st resistance which is a pullback resistance that aligns with the 127.2% Fibonacci extension.

Pivot: 1.3690

1st Support: 1.3619

1st Resistance: 1.3856

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

USDCAD Analysis (4H TF)USDCAD Analysis (4H TF)

The market has been in a strong downtrend, clearly marked by multiple Break of Structure (BOS). However, we’re now seeing signs of accumulation at the lower levels, with multiple CHoCH (Change of Character) signaling a possible trend shift.

Price is currently consolidating around 1.3700, tapping into previous supply and demand zones. If the bullish structure holds, we could see a continuation upward toward the next resistance.

What I’m watching:

- A clear breakout and retest above the 1.3730 zone

- Bullish confirmation before entering

- Tight risk management, as we’re still inside a larger descending channel

Trade idea: Wait for a clean breakout or a reaction from the supply zone. Let the market confirm your bias.

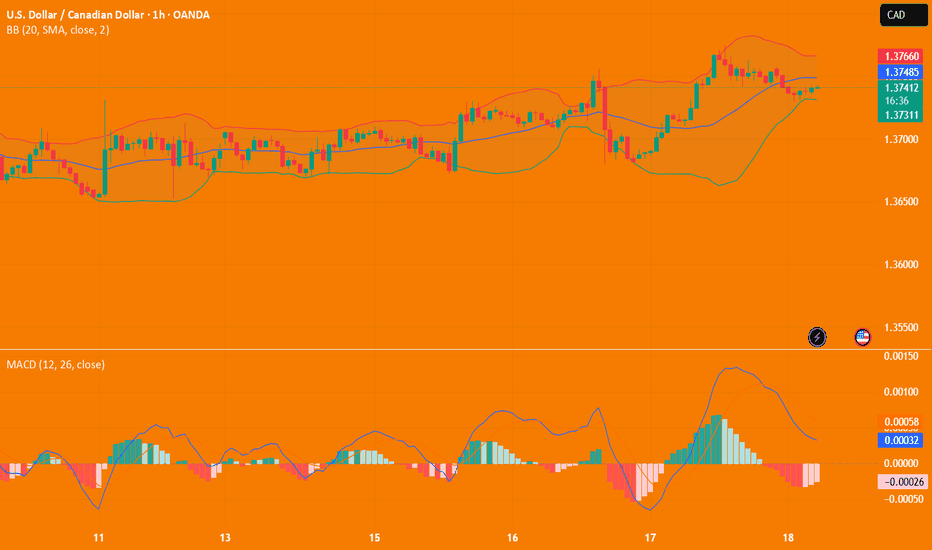

USDCAD Will Move Higher! Long!

Take a look at our analysis for USDCAD.

Time Frame: 2h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 1.368.

Taking into consideration the structure & trend analysis, I believe that the market will reach 1.373 level soon.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

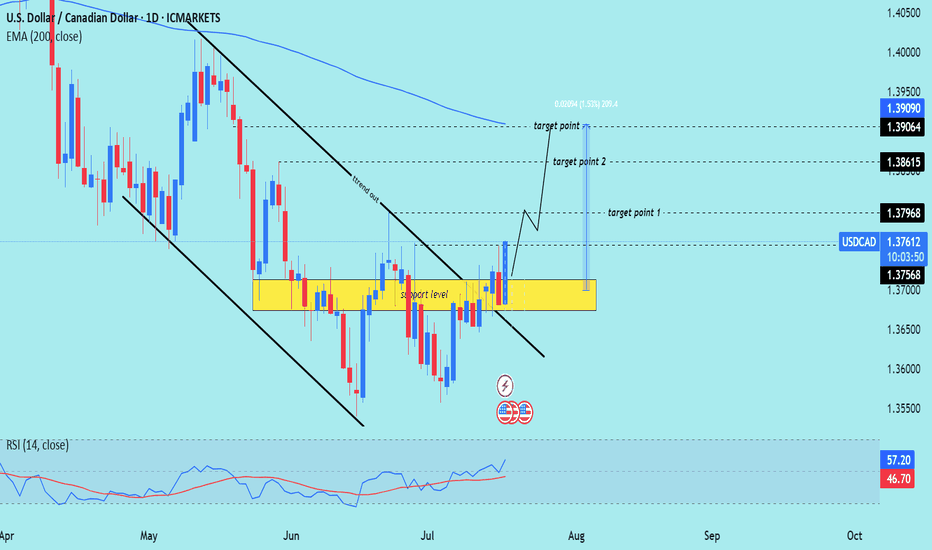

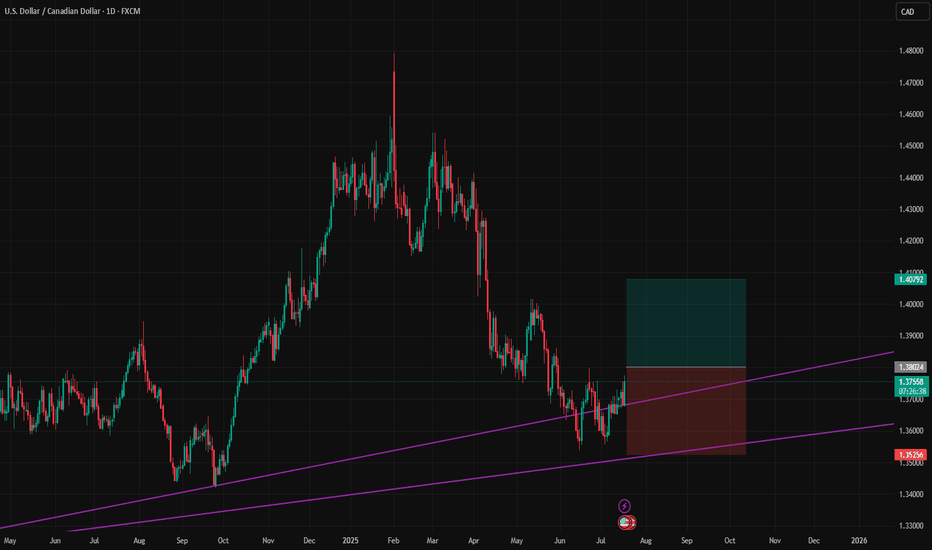

USD/CAD) strong bullish trend Read The captionSMC trading point update

Technical analysis of USD/CAD (U.S. Dollar vs Canadian Dollar) on the daily timeframe. Here's a breakdown of the trade

---

Technical Breakdown:

1. Breakout from Descending Channel:

Price has broken out above a descending trend channel (marked with black lines).

This breakout suggests a potential trend reversal or at least a bullish correction phase.

2. Key Support Zone (Yellow Box):

The yellow zone marked as “support level” was a strong consolidation area.

Price has bounced off this zone multiple times, forming a solid base for further upside.

3. Bullish Price Action:

Price has closed above the previous resistance (now support), signaling bullish intent.

Current candle structure confirms strength with bullish continuation patterns.

4. RSI Indicator:

RSI is at 56.38, indicating bullish momentum without being overbought.

Suggests there is room for further upside before exhaustion.

---

Target Levels:

Target Point 1: 1.37968 (near-term resistance)

Target Point 2: 1.38615 (intermediate target)

Target Point 3: 1.39064–1.39090 (longer-term resistance near the 200 EMA)

Mr SMC Trading point

---

Trade Idea Summary:

Bias: Bullish

Entry Zone: Break and retest of the yellow support area (~1.368–1.371)

Target Zone: 1.379 – 1.390

Invalidation: Break below the yellow support zone

Confluence: RSI strength + breakout of downtrend channel + structural support

plesse support boost 🚀 this analysis)

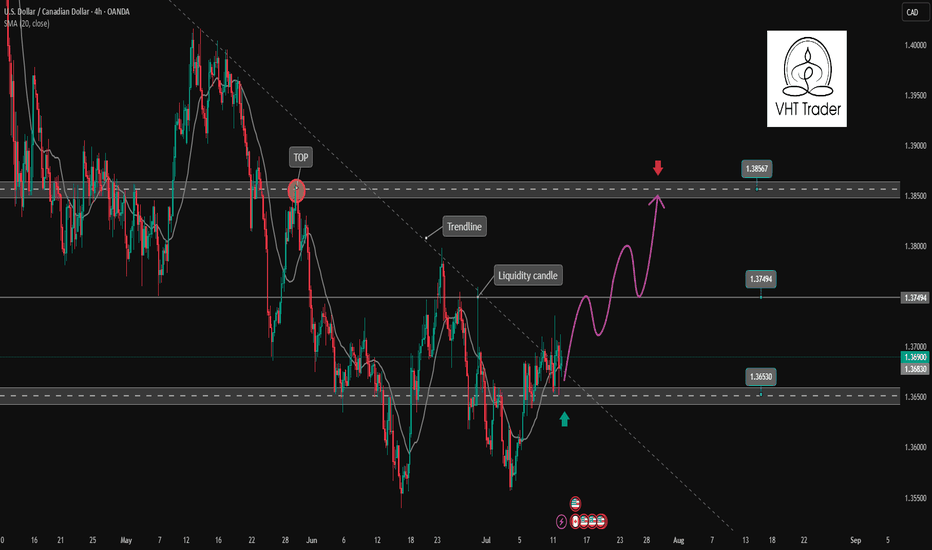

USDCAD is showing signs of bullish recovery✏️ OANDA:USDCAD has broken the Trendline structure to form a corrective uptrend. The price is still above the 20 SMA, indicating that the market's bullish momentum is still strong. The bullish wave may extend to 1.385. Pay attention to the reaction at the 1.375 liquidity candle wick zone for a positive DCA strategy.

📉 Key Levels

Support: 1.365

Resistance: 1.375-1.385

BUY Now: 1.365 (Strong support zone)

BUY Trigger: break and close above 1.375

Target: 1.385

Leave your comments on the idea. I am happy to read your views.

USD/CAD H4 | Potential bullish bounceUSD/CAD is falling towards a pullback support and could potentially bounce off this level to climb higher.

Buy entry is at 1.3724 which is a pullback support that aligns with the 23.6% Fibonacci retracement.

Stop loss is at 1.3660 which is a level that lies underneath a multi-swing-low support and the 50% Fibonacci retracement.

Take profit is at 1.3781 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

USDCAD Massive Short! SELL!

My dear subscribers,

This is my opinion on the USDCAD next move:

The instrument tests an important psychological level 1.3730

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.3668

My Stop Loss - 1.3761

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

USD/CAD(20250718)Today's AnalysisMarket news:

① Kugler: It is appropriate to keep the interest rate policy stable for "a while".

② Daly: Whether to cut interest rates in July or September is not the most critical.

③ Bostic: It may be difficult to cut interest rates in the short term.

Technical analysis:

Today's buying and selling boundaries:

1.3735

Support and resistance levels:

1.3827

1.3792

1.3770

1.3700

1.3678

1.3644

Trading strategy:

If it breaks through 1.3770, consider buying in, the first target price is 1.3792

If it breaks through 1.3735, consider selling in, the first target price is 1.3700

USDCAD Potential DownsidesHey Traders, in today's trading session we are monitoring USDCAD for a selling opportunity around 1.37200 zone, USDCAD is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 1.37200 support and resistance area.

Trade safe, Joe.