BAC trade ideas

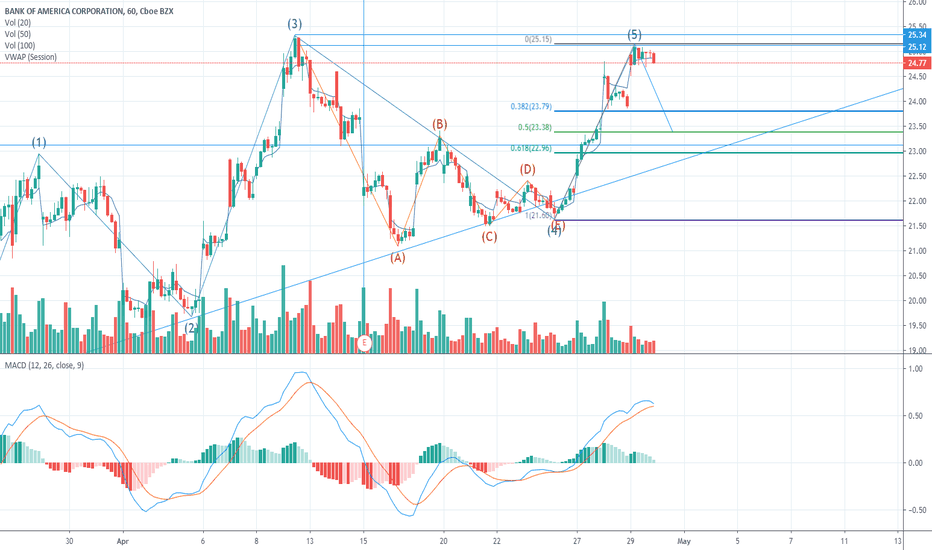

BAC novice analysis hi folx this one is my first attempt trying to master Elliott waves, i first did a full scan since the early 90s to 2020, afterwards did a 10yr and to make it short I end up with this one which is the last month performance in the stock markets, to be honest it makes sense economy is about to bounce back according to the news, which might be causing speculators to move assets in and out the stock, on top of it millions of people have been receiving the stimulus check as a direct deposit to their bank accounts spiking up the amount of money available to spend in some cases, in some others enough to cover the credit payments, small businesses must be praying and begging to get loans from banks to keep going until the pandemic is over... any recommendations or commentaries are welcome.... thank you !!! and god bless you all

Rising Wedge - Bearish outlookLooks like we're forming a rising wedge on this chart, with a possible 5th wave in the process.

There's 3 options I see to short depending on risk tolerance.

1. if 5th wave if truncated, Short on rejection

2. IF 5th waves at major resistance Short.

3. Short on completion of Wedge + break of wedge support.

BAC hasn't enjoyed the same V shaped rallies other stocks have. Bullish sentiment is expected to be relatively low given an expectancy in rising debt defaults, related obviously to the rising unemployment rates (now at 26mil+) and businesses that aren't able to generate incomes to cover their liabilities, creating something of a domino effect across the board.

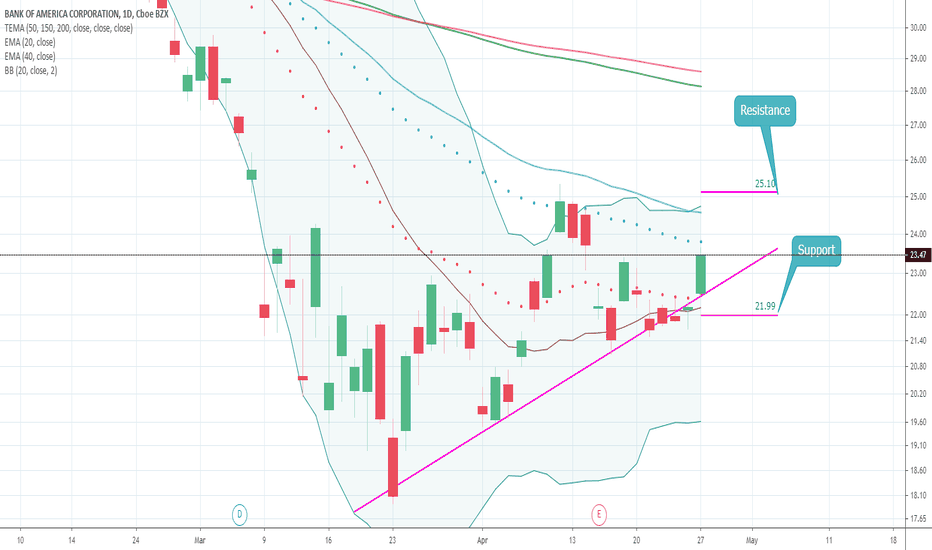

BANC OF AMERICA CORPORATION (BAC)Monthly: Principal down trend from 11/01/2006 to 09/02/2009

Weekly: Secundary up trend

Daily: Start with a down trend since 2/20/2020 (Coronavirus Crisis)

and reversed to an up trend on the 03/23

4H: Fibonacci, have arrived to the 0%level concurring with the Monthly resistance

After having reached the 0% ,the price is going back to level 61,80% again

SHORTS

BAC - Two Possible Ways to Play ItWhile others will publish just about anything to keep their click count and reputation up by first BEGGING you to LIKE their post PRIOR to even READING it, I ask you to first read my idea and THEN decide whether to contact me with questions or like my post. I'm here to help you find opportunities for trades and investments - not to beg you to raise my reputation. Now to the idea:

$BAC - "Don't buy the banks, they're not performing!" - I just trade what the chart tells me, sorry. This one is pretty simple. If the lower TL holds, we could see a revisit to recent highs where I would look to take profit. If the lower trend line breaks convincingly, we could short it back to the bottom. It's that simple.

If you found this to be insightful or helpful, please show appreciation by hitting the like button. If you want more ideas I invite you to follow as well! I try to be here for all of my followers with any questions they might have. Feel free to shoot me a DM or comment below to start a conversation!

Elliott Wave View: Bank of America (BAC) Resumes LowerElliott Wave view in Bank of America (BAC) suggests the decline from January 15, 2020 high is unfolding as a 5 waves impulse. Down from January 15 high, wave (1) ended at 32.47 and bounce in wave (2) ended at 35.45. Stock has resumed lower in wave (3) which ended at 17.95. Bounce in wave (4) is proposed complete at 25.35 as a zigzag.

Short term 45 minutes chart below shows the stock ended wave (4) bounce at 25.35. This level is now the short term invalidation level for more downside. Internal of wave (4) unfolded as a zigzag where wave A ended at 23, wave B ended at 19.51, and wave C of (4) ended at 25.35. While below 25.35, wave (5) lower is currently in progress as an impulse, but BAC still needs to break below wave (3) at 17.95 to avoid a double correction.

Down from 25.35, wave 1 ended at 21.09 and wave 2 bounce ended at 23.40. Near term, while rally fails below 25.35, expect Bank of America to extend lower within wave (5). Potential target lower is 123.6 – 161.8% external extension of wave (4) which comes at 13.3 – 16.1.