Why Coinbase (COIN) Shares Are RisingWhy Coinbase (COIN) Shares Are Rising

As the Coinbase (COIN) stock chart shows, trading closed yesterday above the $200 mark — for the first time since March.

Since the beginning of April, COIN's share price has risen by nearly 20%, while the S&P 500 index (US SPX 500 mini on FXOpen) has declined

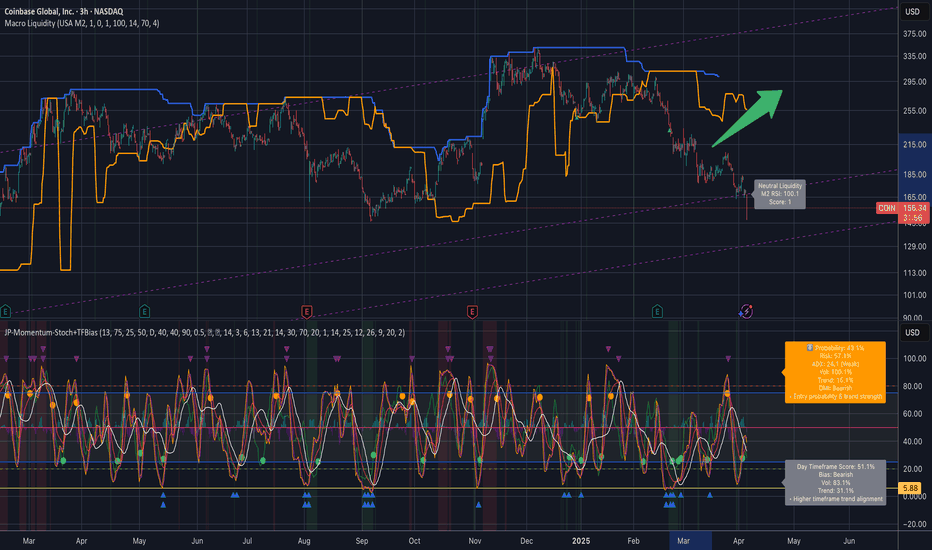

$COIN $83-100 before $500+NASDAQ:COIN is still in the process of correcting down to it's target at $100 (with a possibility of a wick down to $83) and after we get there, I think we'll start our next leg up which will take us past $500.

Why do I still think we have another leg down? Well if you look at the chart, you'll se

Long Coinbase as a proxy bet on Crypto until end of yearUntil proven otherwise I must be under the assumption that the worst is behind us for the time being. That being said, more debasement is infinitely more likely than less, so long risk assets.

-looking for a lovely retest of the broken downtrend, coinciding with a nice support level within the next

COINBASE (COIN) | 3W Outlook

Price just closed above $209.64 — reclaiming the 0.236 Fib level with a +19.77% candle! We're now watching to see if this breakout has the momentum to continue toward the 0.382 ($221.54) and eventually retest the 0.5 zone ($245.99).

🟣 Previous High at $349.75 remains a major target — but notice ho

Coinbase Global, Inc. Goes Bullish —The Correction Is Over!COIN's bearish volume peaked November 2024. Ever since this date, peak bearish volume continued to drop. As we approached today, the lowest price since February 2024, COIN ended up closing with a green bar rather than a red one; the bears are gone.

I am giving you technical analysis in a very simpl

i missed the target before -30% i'd like to offer you The Bottomt's awkward when 'all models are wrong, some are merely useful' when i called 'the fear is in the streets' with a buy action forward. boy was i wrong (and so paid the price for that call)

but with -30% additional downside i've been stalking this patiently.. and +/- 5% diff i think This is it a good

Opening (IRA): COIN March 21st 220 Covered Call... for a 215.96 debit.

Comments: High IV + weakness. Selling the -85 delta call against shares to emulate the delta metrics of a 16 delta short put, but with the built-in defense of the short call. Going lower net delta due to the shorter duration (35 DTE).

Metrics:

Buying Power Effect/Break

COINBASE GLOBAL - Technical Analysis Key Observations:

Elliott Wave Structure: COIN has been trading within a clear Elliott Wave pattern across the timeline shown. The chart displays a complete 5-wave impulse followed by a corrective phase. Currently, we are observing the development of another impulse wave which could be signaling the

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where COIN is featured.

Interest-earning crypto wallets: Put your digital money to work

12 No. of Symbols

Software stocks: US companies at our finger tips

49 No. of Symbols

See all sparks