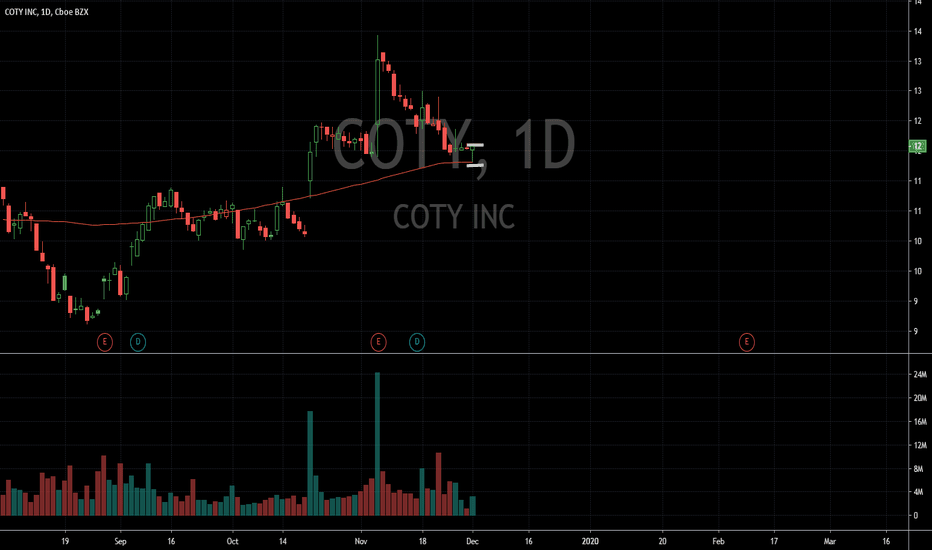

COTY - Exiting Oversold ConditionThe stock gapped up on October 21st & created a bull flag pattern. It broke out of this flag pattern on November 6th on an earnings announcement. The former resistance line of the flag pattern looks to have become support as the stock price is trying to move back up from this level.

Price target levels are noted on the chart.

COTY trade ideas

COTY trade update longCOTY together with its subsidiaries, manufactures, markets, distributes, and sells beauty products worldwide. The company operates in three segments: Luxury, Consumer Beauty, and Professional Beauty and has $9.49B market cap.

Recently they bought 51% stake in Kylie Cosmetics, Kylie Jenner’s beauty company. Stock expected to continue rising.

Downtrend line tested 3rd time on the news release of the purchase and confirmed. Going into wave 3, buy the break of resistance and trend line.

Early entry possible is we make a low again before the spike with best risk-reward.

Good Luck!

Coty on verge of breaking resistance Target price $15.25 but a lot of resistance to get to that region.

Entry level above immediate monthly resistance $13.40.

The stock has quite a high interest of 11.78% .

Coty, Inc. engages in the manufacture, market, sale, and distribution of branded beauty products. It operates through the following segments: Consumer Beauty, Luxury, and Professional Beauty. The Consumer Beauty segment offers color cosmetics, retail hair coloring and styling products, body care, and mass fragrances. The Luxury segment comprises of prestige fragrances, premium skincare, and premium cosmetics. The Professional Beauty segment consists hair and nail care products for salon professionals. The company was founded by Francois Coty in 1904 and is headquartered in New York, NY.

$COTY Coty's Amazon sales Jump 40%The stock is very bullish but maybe needs a little break to gather up a head of stream to break through very heavy resistance above.

Blowout earnings sent the stock surging today, Amazon got all the plaudits from COTY as its brand grew 40% on their platform.

Analysts will be forced to regrade the stock as it is now well above the average analysts target of $11.48 | Hold

Company profile

Coty, Inc. engages in the manufacture, market, sale, and distribution of branded beauty products. It operates through the following segments: Consumer Beauty, Luxury, and Professional Beauty. The Consumer Beauty segment offers color cosmetics, retail hair coloring and styling products, body care, and mass fragrances. The Luxury segment comprises of prestige fragrances, premium skincare, and premium cosmetics. The Professional Beauty segment consists hair and nail care products for salon professionals. The company was founded by Francois Coty in 1904 and is headquartered in New York, NY.

Coty has taken a ugly turn, Wait for break of $11 for nice shortIt was all going so well for Coty investors as a big winner for the first half of 2019, yesterdays restructuring announcement opened the selling floodgates and the chart has now taken a ugly appearance. The $11 level held yesterday but we expect it to be tested once again as downgrades and negative analysis could trigger a new batch of selling. Below $11 and support is feeble with large gaps to the $8 range. So set alerts for below $11 as we cant see this recovering anytime soon.

If the 34MA would happen to cross the 50MA, it is major confirmation to short, it has lead to major drops in the past.

$COTY Short Straddle OpportunityWhile implied volatility percentile (IVP) is modest at around 41 for $COTY, implied volatility itself is around 35%, meaning that option premiums are still attractive for selling. Yellow lines represent breakeven points for the AUG19 13 short straddle, which are beyond the current 30 day expected range.

$COTY massive open interest on strike 15 may 17th. will it move?For the straddle to be in the money the price needs to go out of blue lines 15.12 - 6.70

over 1M of contracts on calls and puts is ridiculous.. it's odd.

May 17, 2019 0.05 0.05 0.06 28630 1027574 COTY 15 May 17, 2019 4.05 -0.19 4.00 4.15 28483 1027768

$COTY COTY has massive call buying activity. 35% upside.Coty has been in a tight price range for 2 months now, after a initial pop on earnings and investor interest. This is somewhat of a battle ground stock within the analyst community. Despite the downgrades and upgrades we are long due to the heavy accumulation in stock and the extremely heavy call buying with a $15 strike.

JAB seeks to buy controlling stake in CoverGirl maker CotyCoty shares surged as much as 18 percent Tuesday, and have catapulted more than 50 percent in the past three trading days after posting quarterly sales gains last week that were lifted by a licensing deal with Burberry Group Plc.

Coty is rebounding under new Chief Executive Officer Pierre Laubies after a difficult few years.

Last fall, it spooked Wall Street with a slew of supply chain disruptions, including a hurricane that forced the shutdown of a manufacturing plant and warehouse in North Carolina.

Coty’s quarterly results saw luxury outpace mass-market names, and were particularly strong on its deal with Burberry. Coty licenses perfumes and cosmetics with more than a dozen European brands.

JAB said Coty’s recent management changes are “an important first step in addressing the company’s recent performance.” Jefferies’ Wissink said the new management seems “more realistic than prior execs on the time required to turn around the business.”

finance.yahoo.com

finance.yahoo.com

The trading system Equity Trend to go short in COTY stockThe equity trading system Equity Trend will open a short position in beauty company Coty, Inc. (ticker: COTY) today at the market open - December 3

Stock:

- Short - Coty, Inc. - Ticker: COTY

Each day, the system scans around 10,000 stocks to find just 1 or 2 which are ready to move immediately.

The system combines elements of breakout trading, trend following and risk management from Turtle trading.

System: bit.ly