CRM not looking EWVwap acted as support

good price by trend

everyone are still fearful

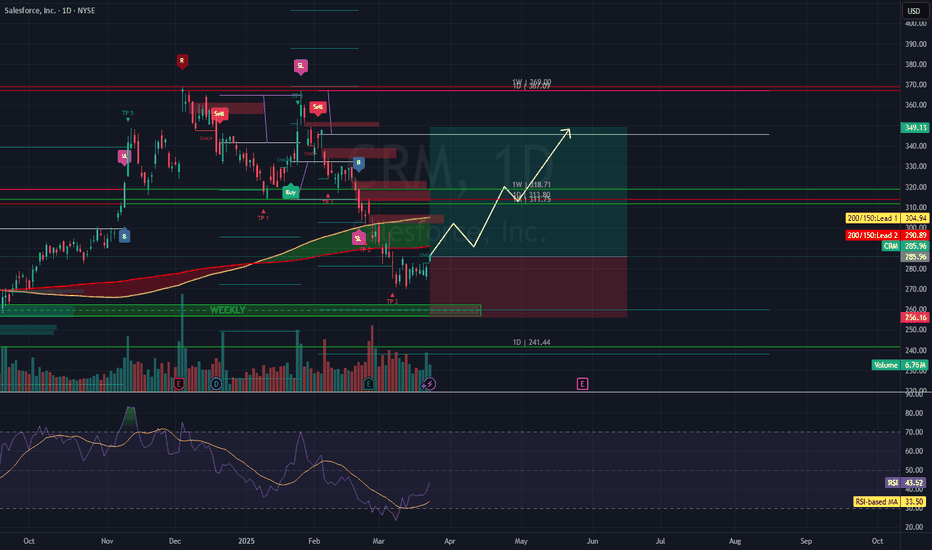

BECAUSE theres a hidden RSI bearish divergence i will only take this long IF it retraces to previous resistance trendline and it acts as support (market structure change and reversal)

if it sweeps 290 I will look for the retr

CRM watch $236.70-239.08: Resistance flip to support for bottomCRM looking weak along with the tech sector.

Watching a key support zone at $236.70-239.08

Look for Break-n-Retest or consolidation above.

.

Previous Plots below:

Topping Call after Tariff Relief pump:

Bottom Call at $212:

Profit Taking levels after bottom pump

=============================

CRM to rise on back of bad economyAs business shut down around the world, jobs will get funneled into America's agents: Employees that never need to eat, rest or ask for bonuses.

America is geared towards a service economy. While the money in goods exports and imports dries up, CRM is the grand exception.

CRM eyes on $262-265: Golden Genesis + Covid fibs for next leg CRM got a Tariff Relief bounce into resistance.

Looking for a dip or break and retest to buy.

If you missed the lower support, look here.

$ 262.54-265.36 is the exact zone of interest.

$ 254.42 below is first support for dip entry.

=========================================

Learn how to identify Fundamental levels with Technical AnalysisYes, you can see fundamental levels using your technical analysis in your charts. Dark Pool Buy Side institutions buy a stock incrementally ahead of its earnings season often weeks ahead. The fundamentals are right in your charts and are easy to see and recognize once you understand the dynamics of

CRM's Rebound Rally!Salesforce Inc. (CRM) is exhibiting potential bullish momentum, with a notable weekly gap around the $260 level. A breakout above the $313.80 level could signal further strength, positioning the stock to target the $349.13 resistance. This trade setup offers an attractive risk-to-reward ratio, with

CRM-Uptrend and Fibbo Retrace?It appears when looking at the weekly, CRM began an uptrend starting Dec '22. On the daily, the Fibbo retracement looks to have pulled back to the bottom of the golden retrace range. With both of these being touched, along with the 80 DMA on the daily, is CRM ready to run again?

If so, it looks to

Salesforce: Further ProgressDue to continued downward pressure, Salesforce has made further progress in realizing our primary scenario. During the ongoing green wave , we still expect the stock to sell off below the support at $274. However, if the price imminently climbs above the resistance at $312, we will have to reconsid

Another bullish continuation for salesforceNYSE:CRM is looking at a potential strong bullish continuation after the stock has broken out of the bullish flag with a huge bullish bar with the support of a spike in volume. Furthermore, the stock has been in an uptrend channel since Dec 2022 and it is likely to continue higher. Hence, we are ad

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where CRM is featured.