U.S. Dollar (DXY) bearish?Will dollar continue its bearish momentum or will it reverse?

Technical Summary

DXY remains in a firm bearish trend, having dropped around 11% this year. The setup is formed by a chain of lower highs and lower lows, confirming an unrelenting downtrend.

Support Level: ~97.70

Resistance Zone: 98.55–98.80

Long-Term Outlook: Bearish, unless a clear break and close over the resistance zone on the daily or weekly timeframe.

Technically, the momentum indicators remain weak, and the failure to sustain rallies above the 99.00 level also contributes to downward pressure further. The market is now consolidating within a narrow range after steep selling, which suggests probable continuation if macro catalysts are favourable.

Fundamental and Sentiment Drivers

Several macroeconomic and geopolitical drivers are underpinning the weakening of the U.S. dollar:

Federal Reserve Uncertainty:

Speculation over the ultimate fate of Federal Reserve Chairman Jerome Powell under political pressure from the executive branch has severely undermined investor confidence in the central bank’s independence. This has been manifested in increased volatility and bearish pressure on the dollar.

Trade Policy and Tariff Risks:

Ongoing trade tensions, including the possibility of sweeping tariffs (15–20%) on Chinese and European Union goods, have created a risk premium on valuations of the U.S. dollar. Market players still fear retaliation and its effects on trade stability in the world.

Fiscal Position and Credit Ratings:

The US fiscal deficit, which is approaching 7% of GDP, and recent credit rating downgrades to its outlook, have set alarms ringing regarding the structure. These fiscal developments have eroded the popularity of the US dollar as a safe-haven asset, particularly with foreign investors.

Global Monetary Landscape:

With European Central Bank and Bank of Japan maintaining policy guidance tight, and Federal Reserve already indicating that direction for a rate cut in Q4 2025 is being eyed, the falling rate differentials still maintain pressure on the dollar.

Market Outlook: Week of July 21–25, 2025

Major Geopolitical and Economic Events:

DATE : Ongoing

EVENT : U.S.- EU & U.S. — China Trade Negotiations.

MARKET RELEVANCE : High

Resolution or escalation will directly impact USD demand.

DATE : Mid-week

EVENT : Federal Reserve Speeches (including Powell)

MARKET RELEVANCE : High

Monetary policy guidance and institutional stability.

DATE : July 24–25

EVENT : Jobless Claims, Flash PMIs, New Home Sales, Durable Goods Orders

MARKET RELEVANCE : Medium–High

Labour market data, housing data, and production activity have the potential to shift rate expectations and dollar sentiment ahead of the FOMC and PCE releases.

Strategic Implications

Outlook: DXY remains structurally bearish in the short to medium term. Additional weakness below 98.80 and sustained closes below 97.70 would reassert downward momentum, risking a further retracement to the 96.00-95.50 region.

Possible Bullish Reversal Triggers:

A conclusive resolution to U.S. trade negotiations.

Unexpectedly solid economic data (particularly core inflation or employment).

Hawkish Fed commentary supporting policy tightening expectations.

Last thoughts

The U.S. Dollar Index is currently at structurally weak technical and fundamental foundations. Absent a sudden reversal of the monetary policy message or geopolitical resolution, the path of least resistance appears to remain to the lower side. Market participants need to pay special attention to upcoming economic data releases, central bank rhetoric, and trading news because any one of them could be a pivotal driver of near-term dollar behavior.

DXY trade ideas

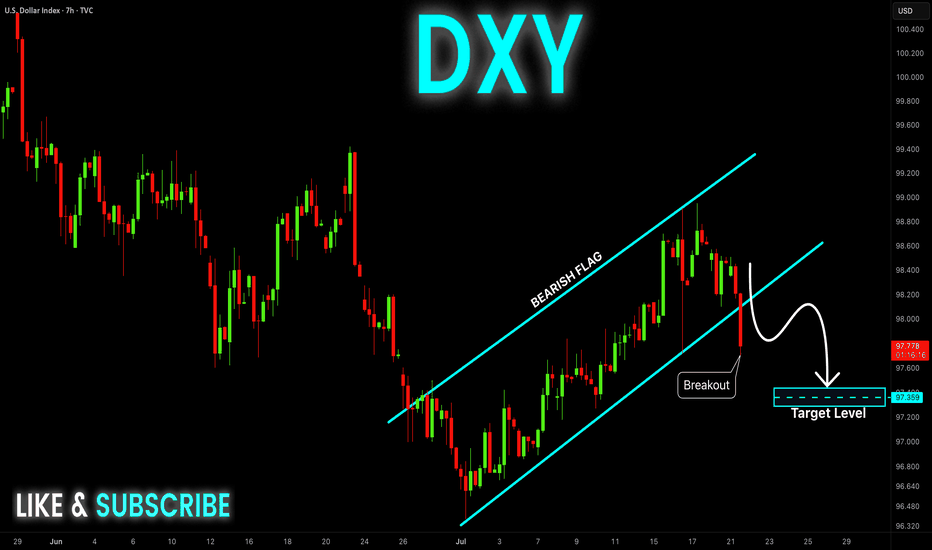

DXY Bearish Breakout! Sell!

Hello,Traders!

DXY is trading in a strong

Downtrend and the index

Made a bearish breakout

Out of the bearish flag pattern

So we are bearish biased

And we will be expecting

A further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DXY Locked & Loaded: Robber's Gameplan for Profit Pullout💸💼 "DXY Market Heist Blueprint – The Thief's Bullish Escape Plan" 💼💸

Rob the Market, Not the Rules – Trade Smart, Trade Sharp, Trade Thief Style™

🌍 Hey Money Makers, Risk Takers & Market Robbers!

Hola! Ola! Bonjour! Hallo! Marhaba! 🙌

Let’s break into the DXY vault and swipe those profits with precision. 💼💸

🧠💡This Thief Trading Style™ Master Plan is a high-stakes operation backed by technical setups, macro-fundamentals, and robbery-level insights. Follow the blueprint laid out on the chart. Our target? The High-Risk Yellow ATR Zone – where the real treasure is buried.

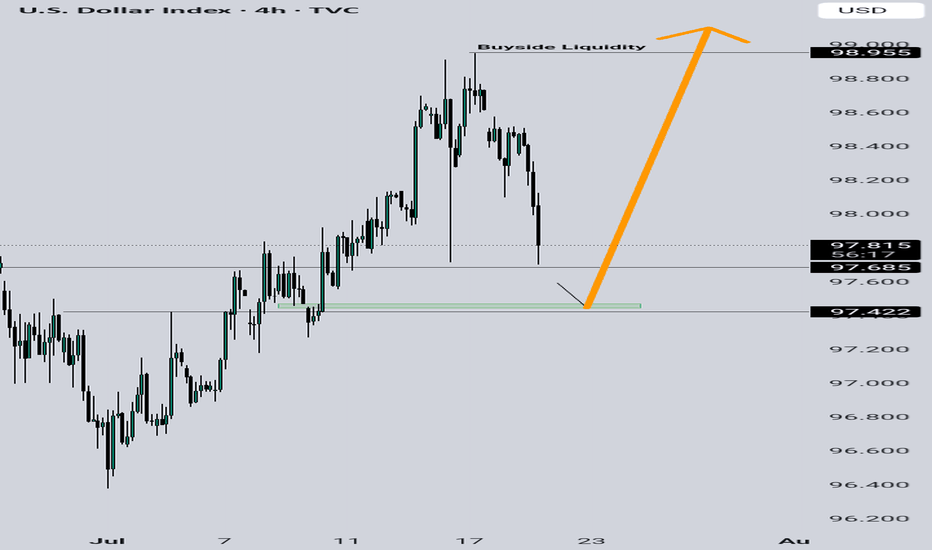

💼 ENTRY: "The Vault Is Open – Grab the Bullish Bags!"

Enter long as price approaches key pullback levels within a 15–30 min timeframe. Use the most recent candle wick’s swing low/high for sniper-style DCA entries.

🔑 Layer multiple limit orders like a thief stacking getaway bags (aka the DCA / Layering Method). Be patient and precise.

🛑 STOP LOSS: "Don’t Get Caught by the Market Police"

📍 Place SL just below the nearest 4H swing low (example: 97.300) depending on your strategy (scalping/swing).

⚖️ Your SL should reflect your risk appetite, lot size, and how many limit orders you’re running. Thieves don’t risk it all on one job. 🎭

🎯 TARGET: 101.800 (or Escape Before the Sirens)

Once the target zone nears, decide whether to collect full loot or exit before resistance hits. We trade smart, not greedy. 🧠💰

📈 Why This Heist Makes Sense: Market Conditions Breakdown

Bullish momentum supported by macro drivers and intermarket forces

COT report and sentiment leaning in favor of USD

Dollar Index structure showing signs of reversal + trend confirmation

Consolidation trap zones hinting at institutional accumulation

💡 This is not just a blind entry—it's a well-researched and time-tested plan. Check the chart details and refer to:

🔗 Fundamentals | COT Reports | Sentiment Score | Quantitative Outlook

🚨 NEWS & POSITION MANAGEMENT ALERT

Before jumping in, beware of high-impact news!

🗞️ To keep your trades safe and stress-free:

Avoid opening new positions during major news releases

Use trailing SLs to protect gains

Monitor volatility triggers (economic calendar is your best friend!)

🏴☠️💥 BOOST THE ROBBERY – Hit That Like/Boost Button

The more you boost, the stronger the heist crew becomes! 💪🚀

Help fellow traders steal opportunities with the Thief Trading Style™ – calculated, bold, and sharp.

🔥 Let's continue to outsmart the markets and make each trade count. Stay tuned for the next heist update – fresh trades, deeper insights, and bigger bags. 🤑💼

🔔 Disclaimer: This plan is not financial advice. Use it for educational and entertainment purposes. Always conduct your own analysis and manage risk accordingly.

📌 Markets shift quickly. Stay adaptable, informed, and always ready to pivot.

future of the DXYHi to every one

In the DXY we are in the middle of the decisioning area which means

we should wait for the market to show its hands

First sensitive level that i am looking for is the C.E of the weekly candle(Prev.week)

IF we get resistance at that level we can wait for the price to deep into the SSL M level

Other wise i don't see any indication and obstacle for the DXY to reach the OB level above the 0.5 mid level of the range

this is my the first low hanging fruit objective which is high probability

after that my ultimate objective is the SiBi to be rebalanced

This was the technical perspective

BUT

things are happening around the world the most important one is the

USA central bank Interest Rate Cutting Decision which can leads the DXY to go lower without retracting to the 0.5 of the range

this factor also should be considered BUT overall i am bullish for DXY

DXY BEARISH TREND 30-JUL 15-JUN 2025There are some major upcoming events that could significantly impact the US dollar index (DXY), including the ADP Non-Farm Employment Change and the Federal Funds Rate decision. Because of this, I expect the DXY to continue its downward movement until it reaches around 94.5. If it breaks below that level, it’s also possible that it could drop further and reach 89.00.

Currently, the DXY is expected to start its move downward from the 99.20–99.50 range, making a decline from that level quite likely

Just a bounce off or a real trend reversal?DXY sits on a major support zone. Price often delivers a reflex bounce at strong levels before continuing the prevailing trend, so a quick pop isn’t proof of a new bull run. DXY is closely linked to US real yields (10y TIPS): if real yields roll over as the Fed eases, USD strength likely fades; if real yields stay firm, a durable reversal is more plausible.

This post is for informational/educational purposes only and is not investment advice or a solicitation to buy/sell any security. Past performance is not indicative of future results. I may hold positions related to the instruments mentioned.

DXY UPDATE FOR LONG as we forecast a long term this an update

The dollar index (DXY00) on Tuesday rose by +0.22% and posted a 5-week high. The dollar has carryover support from Monday following the EU-US trade deal that is seen as favoring the US. Also, expectations for the Fed to keep interest rates unchanged at the end of Wednesday's 2-day FOMC meeting are supportive of the dollar. The dollar extended its gains after the US Jun advance goods trade deficit unexpectedly shrank, a supportive factor for Q2 GDP, and after July consumer confidence rose more than expected.

US Dollar Index (DXY) Chart Analysis – 1H TimeframeUS Dollar Index (DXY) Chart Analysis – 1H Timeframe

This chart shows the **US Dollar Index (DXY)** with key price zones, trendlines, and EMA indicators. Here's a detailed analysis:

**Key Observations:**

* **Price:** Currently trading near **98.41**

* **EMAs:**

* **EMA 7** = 98.373 (short-term trend)

* **EMA 21** = 98.356 (medium-term trend)

* **Trendline:** Uptrend line still intact, acting as dynamic support

* **Volume:** Steady, no strong breakout yet

* **Support Zones:** 98.20 – 98.35

* **Price Structure:** Consolidating above support and EMAs after a pullback from highs

**Bullish Scenario**

* If price **holds above EMAs and the green support zone (98.20–98.35)**

* **Breakout above 98.50** would confirm strength

* Targets:

→ **98.70**

→ **99.00+** if trendline support continues to hold

* EMAs are aligned bullishly (7 above 21) – good sign for continued upward trend

**Bearish Scenario**

* If price **breaks below 98.20 and closes under the trendline**

* Watch for rejection near 98.50 followed by strong red candle

* Downside targets:

→ **97.80**

→ **97.60**

* A breakdown below the ascending trendline = trend shift confirmation

**Conclusion**

* **Bias:** Bullish as long as DXY stays above 98.20 and trendline

* **Invalidation:** A break and close below 98.20 + trendline = bearish shift

U.S. Dollar Index (DXY) – July 30, 2025 | 15-Min Chart1. **Range-Bound Structure**

DXY is consolidating between 98.588 support and 99.134 resistance. The 98.68–98.74 zone has acted as demand, but repeated retests show weakening buyer interest.

2. **Failed Breakouts**

Multiple rejections at 99.134 indicate it's a trap zone where sellers absorb buy-side pressure.

3. **Bearish Momentum Signs**

Lower highs and wicks into resistance with weak closes suggest distribution. Momentum likely shows bearish divergence.

4. **Critical Levels**

* **Support:** 98.588 — a break below this opens downside potential.

* **Resistance:** 99.134 — bulls need a strong breakout above this for continuation to 99.41+.

Summary:

Sellers dominate below 99.134. If 98.588 breaks, expect bearish continuation. Only a confirmed breakout above 99.134 shifts bias bullish.

Interesting few days ahead... USD pairs approaching key levelsDXY is finishing a HTF consolidation and is approaching medium-term key areas. Other USD pairs are also in areas where they could aggressively turn around. EURUSD just finished a H4 3-touch continuation flag and is starting to stall on the 3rd touch, suggesting indecision in the markets.

Considering the news events in the next 3 days, starting today with USD advanced GDP data, we could see volatility kicking in on these key levels. We do need a catalyst to push price into a larger directional move, and we are prime positioned for the next leg. Technically, a breakout in both directions would make sense in these areas. Time to set alarms and be vigilant but not jump into trades too early, considering NFP on Friday as well.

*** **** ****

📈 Simplified Trading Rules:

> Follow a Valid Sequence

> Wait for Continuation

> Confirm Entry (valid candlestick pattern)

> Know When to Exit (SL placement)

Remember, technical analysis is subjective; develop your own approach. I use this format primarily to hold myself accountable and to share my personal market views.

The pairs I publish here are usually discussed in detail in my Weekly Forex Forecast (WFF) and are now showing further developments worth mentioning.

⚠ Ensure you have your own risk management in place and always stick to your trading plan.

*** **** ****

US Dollar Index: Down YTD, But at a 5-Week HighThe U.S. dollar plays a leading role in the performance of U.S. stocks versus international stocks. The greenback endured its worst first-half performance since 1973, helping ex-U.S. equities post massive absolute and relative gains through June. But could the narrative be shifting? And what might it mean for investors?

The U.S. Dollar Index (DXY) sits at a five-week high ahead of the July Federal Reserve interest rate decision and the key July jobs report to be released on August 1. Up four sessions in a row, the dollar appears poised to post its best month since last December (in fact, the DXY's first positive month of 2025). If it’s the start of a protracted recovery, then the “U.S. exceptionalism” trade could be back in vogue over the second half, resulting in the same old story of U.S. over international in the stock market.

DXY LOCAL SHORT|

✅DXY is going up now

But a strong resistance level is ahead at 98.948

Thus I am expecting a pullback

And a move down towards the target of 98.451

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.