IBRK short term trendTrade #1 of this month

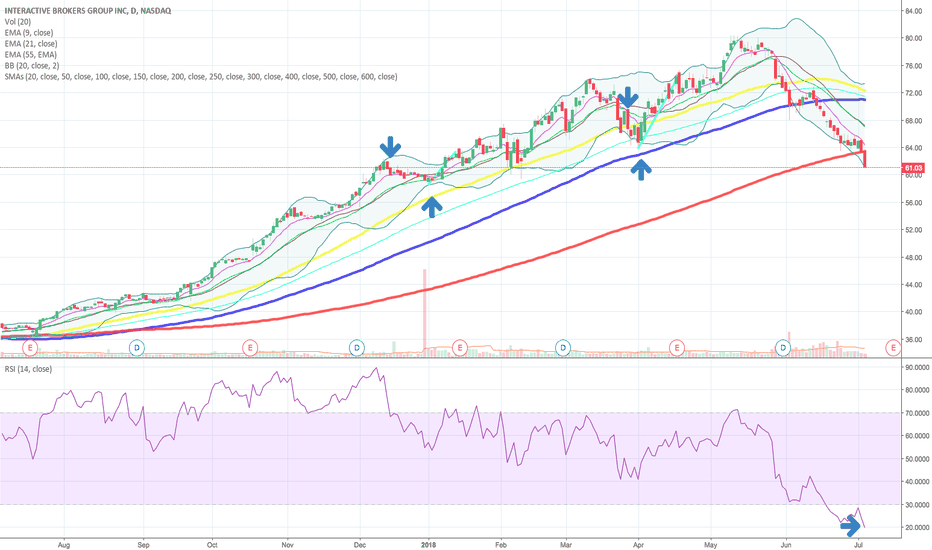

Yes MA200 EMA50 MA21 are all going downtrend but I think this is a near-term bottom. Entry around this level with a small position with first target at $44 and second target at $49.5 for the next two weeks timeframe and reduce position at $36.5/$32

Risk-return ratio at 1.2 - It's not a lucrative ratio if you are an aggressive type trader but it shall be a relatively safe starting position since anything logical or illogical could happen in a split second during this high volatile time.

IBKR trade ideas

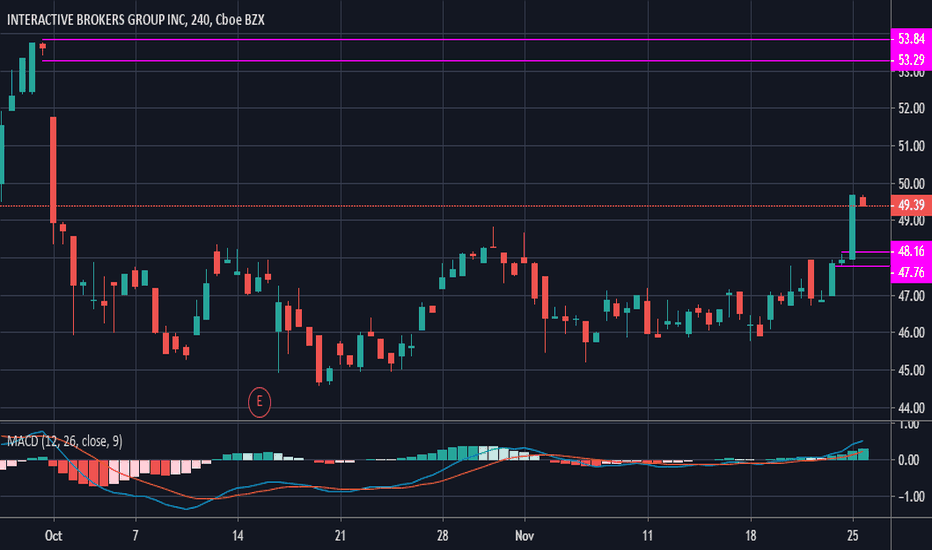

bullish IBKR20EMA crosses 50EMA, meeting resistance but on an uptrend. Upcoming earnings call, figures to be good. IBKR is sensitive to slashed interest rates but is earning a large portion of revenue from commission and fees.

What else should I be looking at in order to determine whether a breakout is coming and if it is true or not?

$IBKR Long into eps$IBKR, i have played $IBKR into the past 2 eps. It tends to sell off and then ramps up btwn 15-30 days before eps. I believe the market is giving us a good buy opportunity here into eps. With the markets being volatile that plays in favor of this stock. Traders are more active and thats how they make money. I started a position today in the July 20 65c. I bought a 1/2 a position with room to add. I see this stock around 68-70 before eps. I usually do not hold thru eps. please look at the charts to see the trends. ALSO RSI is extremely oversold. For my actual realtime trade you can follow me @breakingoptions

$IBKR Long$IBKR looks like it is consolidating after its recent decline. With all the volatility in the market we have to assume there trading volume has increased since last quarters earnings. It also has good support at 63.33. I plan to buy calls in the morning. To see my exact entry and call following me @breakingoptions

IBKRIBKR is a pretty solid stock quality wise with good earnings estimates expensively traded above 50 times of its earnings.

At the moment, we can see hidden bullish divergences fully developed on all 3 indicators (RSI, MACD and Stoch). And the fact that RSI dipped really low to 30 levels and started showing signs of picking up is bullish. Last time it did this in 04/2017, it started a freak new huge trend.

The draw back for bullish case is, price has been really stagnant in the area where there should be a strong reaction. This lack of confirmation for bullish run concerns me.

Wave count for IBKR at this point is also not very clear. Are we still in (5) of III (my main count) or III has been inplace at last high which will surely promise a much bigger drop, and the whole buildup we were talking above can very much be just a continuing flag.

So my take in this case is let us be patient and wait for a strong break out this buildup upper bounded at 71.20. If the break is strong and nice, we can take risk for some CALL.

IBKR. Long Interactive BrokersHaven´t checked a single line of company´s reports or any related news. I´m just trying to find a new broker and checking the charts one by one to see if the market will or not dump the shares.

I found IBKR may be a good buy as it bounced of the Hagopian Line and has been flat for several weeks now, underperforming the market. Notice also the price broke former, 2008, All-Time-High at 35.93 and has been consolidating above it since November 2016.

Will long on opening, targeting 56 per share. Another possible long entries are: 35 which is a weekly pivot and a strong support level or 40, on a confirmed range breakout. My SL will be set below last year minimum at 29.50

A trade for 2017...Banks -> Asset Managers -> ?? ==> BROKERS !

SECTOR THEME FOR 2017 ?

Main street banks flew first, and we are betting that asset managers will follow (LM, BX). And then what? The logical step down the sector will be the brokers: Smaller, less visible, less owned, yet sure to benefit from the pickup in trading volume of the bull market. They will be equally served (fundamentally) by any market consolidation, as volumes generally accelerate on the downside. IBKR is a leading independent online broker and is set to benefit. Set this plain-vanilla, long trade as one of the sector picks for 2017...

FUNDAMENTALLY IMPROVING ?

BAC highlighted recently that December had been one of the best months EVER for asset collection. This is bound to translate into the numbers of asset managers, and brokers. GS upgraded two of the main players of the brokerage sector today (E*TRADE and IBKR). Expect more upgrades to come. Expect good earnings and guidance, as earnings releases provide catalysts for the stocks to move higher. Technically, IBKR has been attempting to complete a very compelling Cup-with-handle (see long term chart below).

TRADING STRATEGY: PLAIN VANILLA LONG AHEAD OF EXPECTED BREAKOUT

Go long here

Target = $52

Stop = $32

R/R = 1.76x

IBKR nearing wave (iii) topI previously suggested that IBKR is slowly heading into a major top. Today it headed into the top of wave (iii). It may not be there yet, but this is one point where I start scalping against my primary position with put options. I'll scale in if we keep rising and scale out around $37