Kleppiere Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

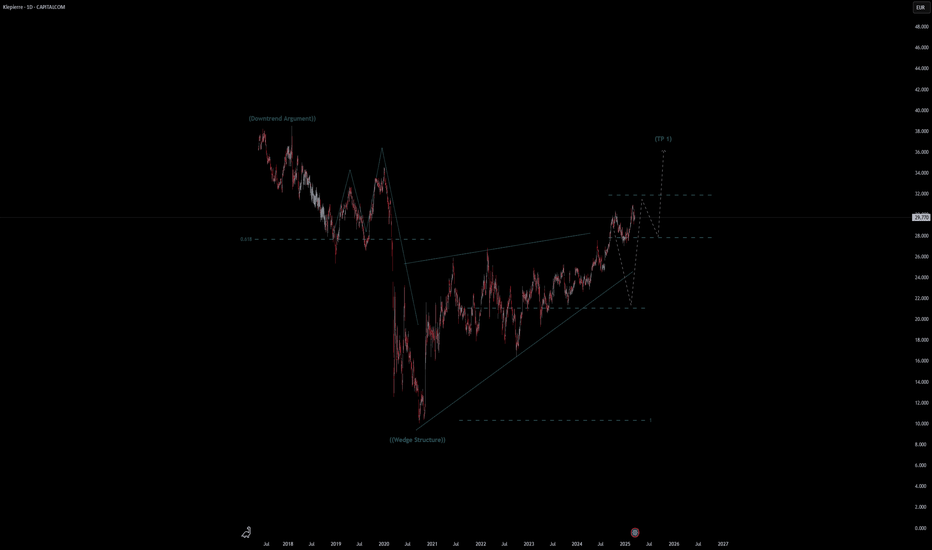

# Kleppiere Stock Quote

- Double Formation

* (Downtrend Argument)) | Completed Survey

* 0.618 Retracement Area | Short Bias Entry | Subdivision 1

- Triple Formation

* ((Wedge Structure)) & Uptrend Area | Subdivision 2

* (TP1) At Resistance Area(Previous Levels) | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Indexed To 100

- Position On A 1.5RR

* Stop Loss At 74.00 EUR

* Entry At 82.00 EUR

* Take Profit At 94.00 EUR

* (Uptrend Argument)) & Pattern Confirmation

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

LI trade ideas

A clear buy if it stays more than 2 weeks above EUR 25 ps.Fundamentals for European shopping mall REITs have improved dramatically and they are coming out of a 9 year old long bear market, now appearing to break out out a consolidation pattern formed in the past 3 years.

What initially started as revenue cannibalization and retail death due to e-commerce was followed by COVID, and then a perfect storm of higher interest rates, lower consumer disposable income due to increased electricity prices, and portfolio mark-downs.

Though revenue cannibalization from e-commerce still persists, operators have re-shifted their portfolios more towards services, capitalizing on good locations, good infrastructure and parking opportunities. With interest rates having stabilized (for now at least) and consumer spending recovering due to wage increases and lower electricity prices, and the most leveraged REITs having successfully conluded deleverating operations, the massively marked down valuations of European REITs are set for a rebound.

This rebound has already started in some of Klepierre's peers, such as Mercialys, Olav Thon Gruppen, Unibail Rodamco Westfield, and NEPI Rockastle, which for the last two weeks have consistently held prices above breakout levels.

Priced at just 9.4x current year earnings with large potential for earnings upgrades, this is definely one to watch.

Bullish outlook Horizontal volume levels seems to be broken trough by bulls. The moving average of 200 has been retested once, though might be retested once more. When "retouching" the MA 200 (in case of), there will be a confluence of large volumes and the MA, giving a strong trampoline effect. If this support will break trough, then we should look onto downward move with the retest of the same level. As said overall the scenario is rather bullish - a local bullish triangle can be formed just above the MA adding odds to upward move.