MELI at Risk from Momentum Shift and High ValuationMELI has gained over 35% since the April dip, but momentum has been fading since September. The slowdown has become increasingly visible, and last week's high may remain the top for some time unless Wednesday’s earnings report surprises the market on the upside.

The consensus estimate for MELI’s re

Key facts today

Goldman Sachs is bullish on MercadoLibre (MELI), citing its strong Latin American e-commerce position and potential gains from trade tariffs affecting competitors like Alibaba and Amazon.

Technical Analysis of $MELI (MercadoLibre) - For Long TermAfter a thorough analysis of MercadoLibre ( NASDAQ:MELI ) charts on 1M, 1W, and 1D timeframes, here’s a summary covering market context, key levels, trading opportunities, and price phases. Perfect for traders or investors looking for actionable insights.

Market Context

1M/1W: Strong bullish trend

MERCADOLIBRE ($MELI) SOARS IN Q4—E-COMMERCE & FINTECH SHINE MERCADOLIBRE ( NASDAQ:MELI ) SOARS IN Q4—E-COMMERCE & FINTECH SHINE

(1/9)

Good evening, Tradingview! MercadoLibre ( NASDAQ:MELI ) is sizzling—Q4 revenue up 37%, a $ 6.1B haul 📈🔥. Fintech and e-commerce fuel a 33% surge—let’s unpack this Latin dynamo! 🚀

(2/9) – REVENUE RUSH

• Q4 Take: $ 6.1B—37

Will MELI repeat its historic pattern ?The price action pattern in MELI since 2022 shows that whenever the stock has touched its green trendline and pushed to cross above the EMA line, the price action has typically led to approximately a 40% increase. In some instances, there was first a 20% increase followed by a correction, before con

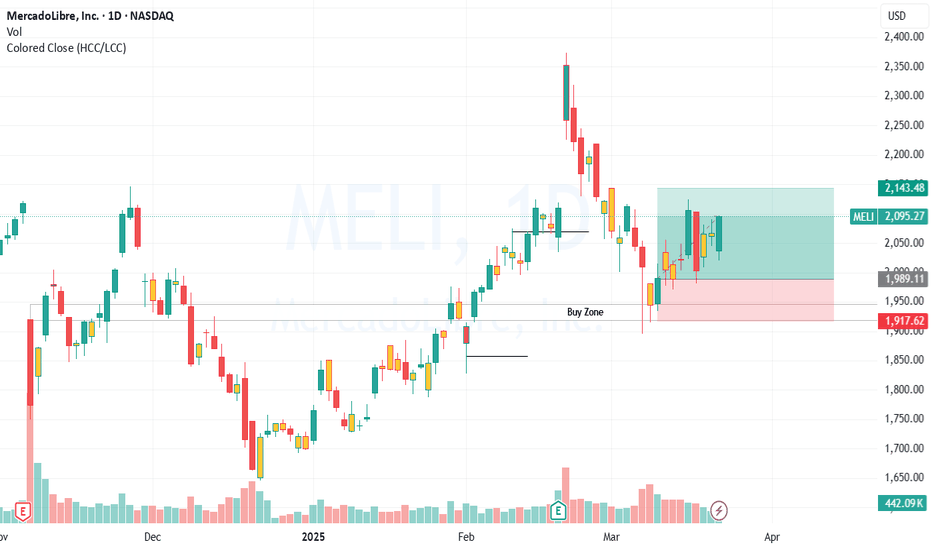

MercadoLibre setting up for good buy opportunityHello,

MercadoLibre, Inc. engages in the development of an online commerce platform with a focus on e-commerce and related services. It operates through the following geographical segments: Brazil, Argentina, Mexico, and Other Countries.

TECHNICAL ANALYSIS- Checklist

1. Structure drawing (Trend

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.