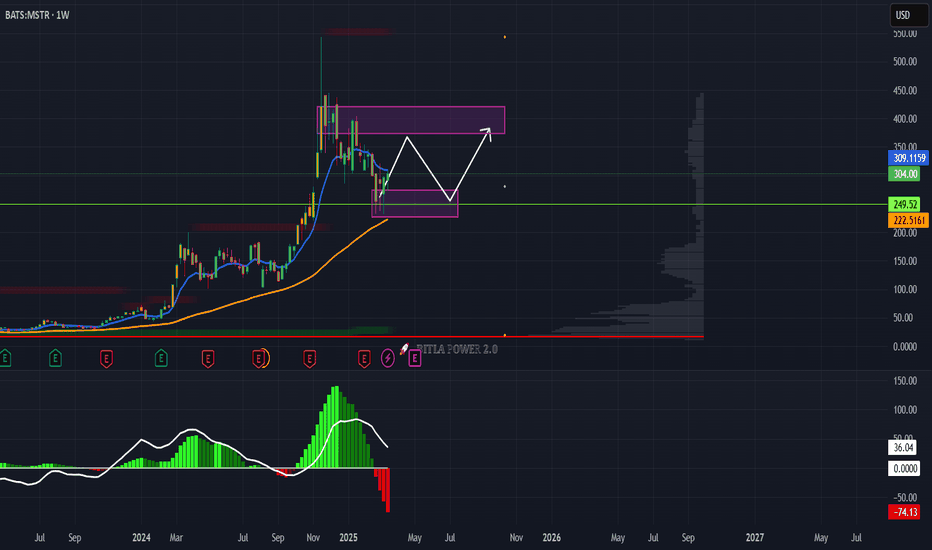

MicroStrategy To $370?Hello friends! I'm back with an analysis of MSTR. As we can see, the price had a significant drop of 57% from November 2024 to March 2025. The price is highly correlated with Bitcoin, and said cryptocurrency is in a wave 4 within an Elliott wave pattern. Therefore, Bitcoin will be returning to test $110,000. Therefore, MSTR, holding 499,096 bitcoins, will see a very significant rise in its price. In the short term, MSTR will be going to test its luck at $370 per share. However, it is highly likely that it could return to $410 per share. MSTR has many technical and fundamental indicators in its favor to be a highly profitable value asset. The best buying zones are below $300 per share.

Disclaimer: This is only an opinion; it should not be used as investment advice or recommendation.

MSTR trade ideas

MSTR...to $260Downward channel, lower lows and lower highs. What else do you need to see? Oh, a ponzi model that is based on selling high volatility digital coins to unsophisticated retail investors. High chance of MSTR dipping to mid $200s esp. with this crappy economy. Leverage MSTZ (inverse) to profit from this!!

Best of luck and always do your own due diligece!

MicroStrategy, IncStock traders may advise shareholders and help manage portfolios. Traders engage in buying and selling bonds, stocks, futures and shares in hedge funds. A stock trader also conducts extensive research and observation of how financial markets perform. This is accomplished through economic and microeconomic study; consequently, more advanced stock traders will delve into macroeconomics and industry specific technical analysis to track asset or corporate performance. Other duties of a stock trader include comparison of financial analysis to current and future regulation of his or her occupation.

MSTR: Is 300 Enough?MicroStrategy is seeing tremendous strength off the lows along with the rest of the crypto space. We are eyeing this 300 level to see if it offers a proper buy zone to coincide with Bitcoin 85,000 which has also seen tremendous outperformance relative to equities. Watch the overhead trendline drawn here as well as Bitcoin 90,000 for profit takes or continuations. We will decide which if and when we get there.

Falling Wedge?The triangle correction seems mostly invalidated, but not entirely. However, it looks like a falling wedge might be forming instead.

In the short term, we should expect to see $275 – $287 as a potential target. If the falling wedge plays out, we might get a breakout to the upside. Let’s see how the price reacts! 🚀

Go Long on MSTR: Bitcoin Correlation Presents Opportunity

-Key Insights: MicroStrategy's strategy of using leveraged positions to invest

in Bitcoin provides a unique investment angle for those seeking exposure to

cryptocurrency without direct involvement. This strategy poses risks due to

Bitcoin's inherent volatility, but it also presents opportunities for gains when

Bitcoin prices rise. Investors should keep an eye on Bitcoin's market movements

as they directly affect MSTR's stock price, creating potential entry points for

informed traders.

-Price Targets: For a long position on MSTR, consider the following: Next week

targets (T1, T2): T1 at $305, T2 at $320.49. Stop levels (S1, S2): S1 at $290,

S2 at $285. These levels take into account current market support and

resistance, suggesting a strategic plan to benefit from potential upward

momentum if MSTR aligns with Bitcoin's bullish trends.

-Recent Performance: MSTR has shown a tight link to Bitcoin, with stock

performance rising and falling in tandem with Bitcoin's price swings. This

correlation has led to mixed short-term sentiment as investors evaluate the

cryptocurrency market's stability. The current price of $297.4899902 places it

between the identified support and resistance zones, making it a critical

decision point for upcoming trades.

-Expert Analysis: Experts remain divided on MSTR due to its high leverage, with

some cautioning against indirect exposure to Bitcoin through the stock. However,

proponents of the stock argue that its strategy provides a diversified approach

to participating in the cryptocurrency market without direct investment in

Bitcoin, offering potential advantages in portfolio diversification.

-News Impact: Recent market discussions highlight MSTR's strategic Bitcoin

acquisitions and their impact on stock volatility. The company's financial

maneuvers and significant shareholder interests may further influence investor

sentiment. Future Bitcoin price trends will likely dictate MSTR's performance,

making cryptocurrency developments a vital aspect to monitor in the coming weeks

for informed trading decisions.

MSTR...tik tok and BOOOM down 10-20%It's just a matter of time IMHO, most likely tomorrow / next few days, when MSTR will drop like a brick. The fact that anyone is buying this is just bonkers; they buy high volatile BTC with debt. What could ever go wrong with this Ponzi scheme? You've been warned about this house of cards. Great if you're leveraging MSTZ!

Best of luck and be careful out there....

MSTR Trading Plan - Bounce then new lows to key year 2000 levelMSTR has a lot going on. I think we're going to see the chart build structure in this low volume top and ultimately retrace to important levels made in the year 2000. Specifically, $177.

The $177 Price level has so many points of confluence it boggles the mind:

$177 is the exact 61.8 retraca from the 2023 low of $13

$177 is the very strong resistance we saw in the first half of 2024

$177 is a key level from way back in the year 2000 (yes, MSTR was this high. In fact it hit a high of $336 way back then)

$177 is also where the current lower trendline (log chart) and the 61.8 and the lower trendlien of the current wedge intersect.

What do you think?

Saylor: The Bubble Man Saylor The Bubble Man

MicroStrategy (MSTR) – A stock that only shines in bubbles, then burns its holders.

1999 Dot-Com Hype:

MSTR skyrocketed in the late 90s, purely on dot-com speculation. But after aggressive accounting was exposed, it crashed over 90%.

Saylor paid fines, survived – investors didn't.

2021 Bitcoin Mania:

Saylor rebrands as Bitcoin maximalist. MSTR stock pumps as Bitcoin pumps. MicroStrategy stops being a software company and starts being a leveraged Bitcoin ETF in disguise.

Result? Bitcoin cools, MSTR drops over 75%.

2024 ETF Bubble:

Bitcoin ETFs approved, retail hype returns. MicroStrategy issues more debt, doubles down, and rallies hard.

Already down 50% from highs – the pattern repeats.

In between these periods? Nothing. No meaningful growth. No shareholder returns. Just silence until the next bubble.

The Playbook:

Max leverage.

Max hype.

Assured promises about the future justifying all present risks.

Saylor promotes it not just inside his company, but publicly to anyone willing to listen.

Outcome:

Always the same.

Retail buys into the story.

The bubble bursts.

Investors hold the bag.

Saylor resets and waits for the next mania.

History is clear: Saylor doesn’t manage a business; he manages cycles of hype.

Saylor is the Bubble Man.

====

The Bubble Man: Michael Saylor and the Art of Leverage, Hype, and Hollow Returns

Saylor’s career can be accurately described as a cyclical showcase of hype-fueled rallies followed by spectacular busts.

Each surge is orchestrated through deft salesmanship, aggressive leverage, and promises of assured future riches—and each collapse leaves behind little more than shattered shareholder value and a fresh narrative to mask the wreckage. The one Saylor has always done, is promise exceptional gains in the future.

The only time people ever listen, is when the hype of the day supports it.

MicroStrategy: A Company That Rises Only on Hype

A closer inspection of MicroStrategy’s performance history reveals a striking pattern: the company’s stock only shines during the most frothy moments of speculative mania. Strip away these isolated periods, and what remains is a tech firm that has consistently underperformed, failed to deliver long-term operational gains, and leaned heavily on financial engineering and bold proclamations.

1999: The Dot-Com Mirage

MicroStrategy first burst onto the scene during the late 1990s dot-com bubble, riding high on the wave of anything remotely tech-related. Its share price exploded, reaching dizzying heights, only to collapse after revelations of aggressive accounting (culminating in a high-profile SEC settlement in 2000). Investors who bought the hype saw over 90% losses after the bubble popped, while Saylor survived by shifting the narrative and paying fines without criminal consequence.

2021: The Bitcoin Mania

Fast-forward two decades, and Saylor’s next big gamble came—not from the company’s original software business—but from pivoting MicroStrategy into a quasi-Bitcoin ETF, heavily buying Bitcoin using borrowed funds. Once again, the timing was impeccable: MicroStrategy stock surged in 2020-2021, attracting retail frenzy during the Bitcoin bull run. However, as soon as crypto markets cooled, MSTR shares plummeted over 75% from their highs, leaving investors to absorb the fallout while Saylor doubled down on his maximalist rhetoric.

2024: The ETF Echo Bubble

Today, in 2025, MicroStrategy is basking in yet another speculative surge, this time driven by Bitcoin ETF approvals and renewed crypto enthusiasm. Predictably, the company has used this window to issue more convertible debt, expanding its leveraged Bitcoin bet. However, just months into the rally, the stock has already retraced 50% from recent highs, repeating the same cycle. No meaningful growth has come from MicroStrategy's core business; all attention is once again focused on price speculation.

In response to this Saylor goes to his usual of hyping future gains and promoting people take wreck less risks. This guy has a massive following. Some of these people will obviously be naive and easily influenced and he's made statements ranging from selling your house to selling body parts to speculate in BTC.

The Playbook: Leverage + Salesmanship + Assured Future Promises

At the heart of each of these cycles is Saylor himself—a master promoter whose public persona is equal parts financial evangelist and charismatic pitchman. His message is consistent:

"Ignore short-term volatility."

"The future payoff is inevitable."

"Leverage risk is justified if you believe hard enough."

Not only does Saylor employ this approach with MicroStrategy’s own balance sheet—loading up on debt to fund speculative moves—but he publicly encourages others to follow suit, telling both individuals and institutions to embrace extreme risk under the guise of inevitable exponential returns.

This philosophy sounds eerily familiar to every bubble narrative ever told: risk doesn’t matter, because tomorrow’s gains will make it all worthwhile. Of course, for most investors, tomorrow rarely arrives as promised.

The Aftermath: What Happens When the Music Stops

History offers no ambiguity about the result:

The 1999 hype ended in collapse and accounting scandal.

The 2021 hype ended in massive drawdowns and underperformance.

The 2024 hype, already cracking, is shaping up no differently.

Each time, retail investors, lured in by Saylor’s conviction and bravado, bear the brunt of the losses, while MicroStrategy simply reloads, restructures debt, and awaits the next speculative wave.

Conclusion: The Bubble Man

Michael Saylor is not a visionary leader crafting sustainable shareholder value. He is, instead, the quintessential Bubble Man—a figure who thrives during periods of irrational exuberance, skillfully weaving narratives of certainty and future wealth while encouraging dangerous levels of leverage and risk. His company’s stock has consistently done nothing outside of speculative episodes, and the wreckage following each hype cycle is always left at the feet of those who bought into the story.

The question investors must now ask is not whether MicroStrategy will see another bubble—it’s how many more people will be willing to pay the price for it when it inevitably bursts again.

MSTR - Leading Indicator For Crypto and Stock IndexesLooks like it may be a leading indicator for crypto yet again.

Bitcoin is often first to breakout from corrections.

But in the previous correction MSTR broke out sooner and stronger than Bitcoin.

This is because MSTR is effectively a leveraged Bitcoin stock.

And so it is higher risk.

Higher risk assets tend to make their move first both in bullish and bearish action.

...

MSTR pumped 13% today and that has printed a very strong close to the week chart.

It now appears to have a good chance to be completing a 1:0.618 Golden Window extension.

Since the third wave is shorter, it signals weakness to the downside and thus momentum building to the upside.

Notice only the wicks have probed below the 0.786 overshoot ratio.

This is still very much fine for it to be considered a 1:0.618 GW since the market maker will push to ratio extremity and no candle bodies closed below.

...

The last 3 candles have printed an exotic Morning Star candle pattern.

It really doesn't matter what type of doji prints for candle 2...

All the matters is that it is an indecision candle and that candles 1 and 3 form a bullish engulf.

And that is what has printed; it looks to be a strong bullish engulf with candle 3 printing a lower wick.

The bullish whipsaw in candle 3 signals upside impetus.

So this is quite a bullish look here.

...

This chart signals that the storm has passed and we can resume the BBQ 😅♨️.

This is in stark contrast to stock indexes that still look dangerous.

But this is where we can get our cues from higher risk to achieve great positional entries.

- MSTR is higher risk than Bitcoin and so potentially it is a leading indicator to Bitcoin.

- Bitcoin is higher risk than the stock indexes and so potentially it is a leading indicator to stock indexes.

Until stock indexes begin to recover then this is of course dangerous...

But in a matter of hours this is now looking good here for a next wave up 👍.

I do this all day every day 🙈

Not advice.

Strategic $MSTR Accumulation: $340 Break for Macro ContinuationDecided to start buying back some $MSTR. I’ve been waiting since late December to begin accumulating, and I initially thought it would stay above $300, forcing me to jump back in.

Now that it's in an optimal buy area with enough confluence on the weekly timeframe, I’m accumulating under $250. I’ll add the last chunk once it breaks above $340.

Just keep in mind there’s a strong weekly downtrend in play, but it’s already hit the first target, so I expect a bounce. If it reclaims the POC at $340, it would invalidate the downtrend. So, I'm taking my chances on a possible invalidation and a continuation of the macro trend.

Headed down to the 1:1.618?MicroStrategy has been the leading indicator for Bitcoin for quite sometime now; as well as TOTAL.

It ran into some resistance at the 0.618 window on the 4th wave up.

In terms of Elliot Wave, typically there are 5 connective waves inside each wave of a 3 wave correction. This is not always the case but sometimes it can provide potential clues.

If I am reading the waves correctly; then MSTR may be forming the 5th wave down. And quite often the 5th wave is a doozie.

If this TA plays out and MSTR finds support at the 1:618 pocket; then this could be the completion of a 1:1.618 3 wave correction on a larger time frame.

-Not Financial Advice-