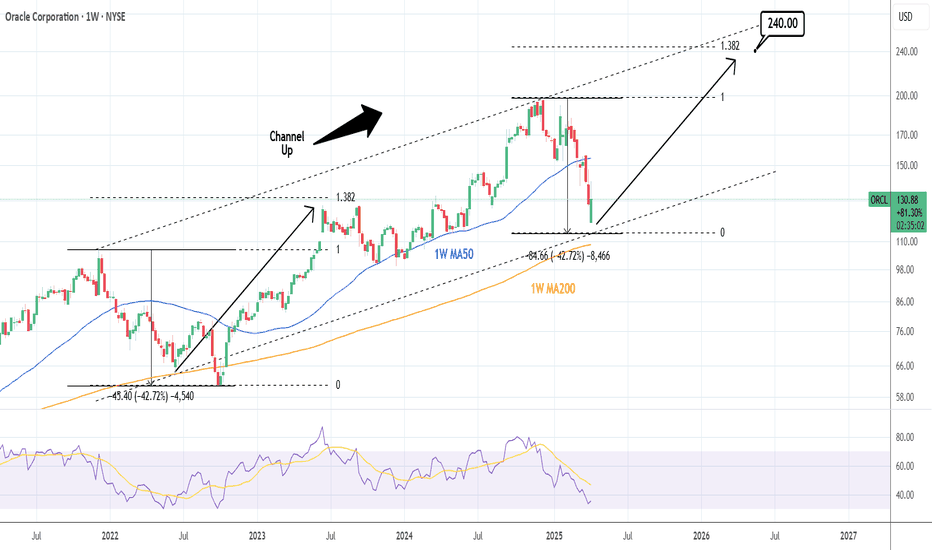

ORACLE: On a 3 year bottom. Buy opportunity for 240 long termOracle is bearish on its 1W technical outlook (RSI = 35.862, MACD = -4.360, ADX = 42.565) as this week it reached almost the same levels of correction as the 2022 Bear Market (-42.72%). This is also nearly a HL bottom for the 3 year Channel Up and as the 1W MA200 is right below, a great long term bu

Key facts today

BNP Paribas Exane has adjusted its price target for Oracle (ORCL) to $165 from $210 while maintaining an outperform rating.

ORCL for BuyOracle Corporation (ORCL) has recently reported its fiscal third-quarter earnings, with adjusted earnings of $1.47 per share on sales of $14.1 billion, slightly below Wall Street forecasts of $1.49 per share on $14.4 billion in sales. Despite this, the company provided a strong sales forecast for th

Check Out Oracle’s Chart Heading Into Next Week’s EarningsOracle NYSE:ORCL is set to report fiscal third-quarter results next Monday (March 10) after the closing bell rings in New York. What is technical and fundamental analysis saying about the software/cloud/AI giant’s stock heading into the results?

Oracle’s Fundamental Analysis

As I write this, t

Projected Growth Post-CorrectionKey arguments in support of the idea.

Remaining in Focus: Announced $500 Billion Investment in AI Infrastructure.

Primary Cloud Infrastructure Development Partner for All Big Tech Companies.

Investment Thesis

Oracle Corporation (ORCL), an American technology titan, excels in crafting and

Oracle: Tilting Downward…After a sharp rebound from the $152.02 support following the steep drop from the peak of the beige wave II, Oracle is once again tilting downward as expected. The next step should see the price fall below $152.02 to reach the projected low of the beige wave III. After a countermovement of wave IV, t

SHORT ORCLOracle Corporation (ORCL) has recently experienced a decline due to underwhelming earnings and concerns over its valuation.

The stock is currently trading at $183.47. Given the elevated implied volatility in the options market, a short call strategy may be more cost-effective than purchasing puts

Stock Of The Day / 01.27.25 / ORCL01.27.2025 / NYSE:ORCL #ORCL

Fundamentals. General decline in the technology sector amid news of cheaper and less resource-demanding Chinese AI.

Technical analysis.

Daily chart: Movement within a wide range of 198 - 152.40. Strong daily level is ahead which is formed by a gap in September

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where ORCL is featured.