US30 trade ideas

US30 bullish LongWall Street goes full bull with tariffs and payrolls looming

I buy the correction

Price closed at low on Friday,for me:Time to buy the correction

Also non farm payrolls looming coming this Friday.

I dont use price action,because it is worthless to use past gone data,on future movements.

Instead I use my favourite commercial analysis

Big commercials buying US30, hedgefunds taking profit and selling it.It means its time to BUY!!!

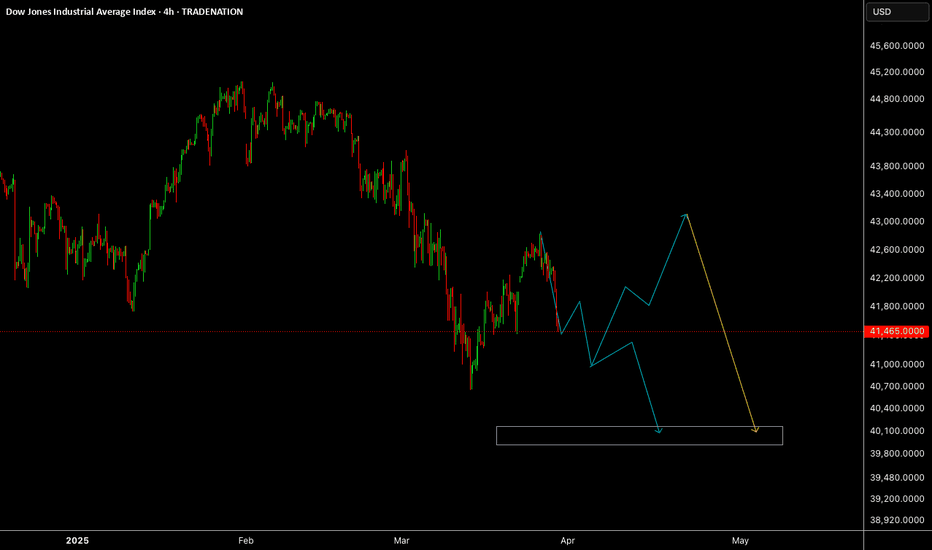

US30The US30 (Dow Jones Industrial Average) this week is showing a bearish direction, driven by several factors:

1. **Tariff Concerns**: The announcement of new tariffs, particularly a 25% tariff on auto imports, has caused market uncertainty. Investors are wary of potential inflation and the impact on corporate earnings.

2. **Inflation and Interest Rate Fears**: Ongoing concerns about inflation and the Federal Reserve's policies on interest rates are also contributing to market volatility.

3. **Upcoming Earnings Reports**: Key earnings reports, including Tesla's Q1 delivery numbers, are creating uncertainty. Depending on these results, market sentiment could either stabilize or worsen.

Given these factors, the market is leaning bearish this week, and more volatility can be expected depending on upcoming economic data and corporate earnings releases.

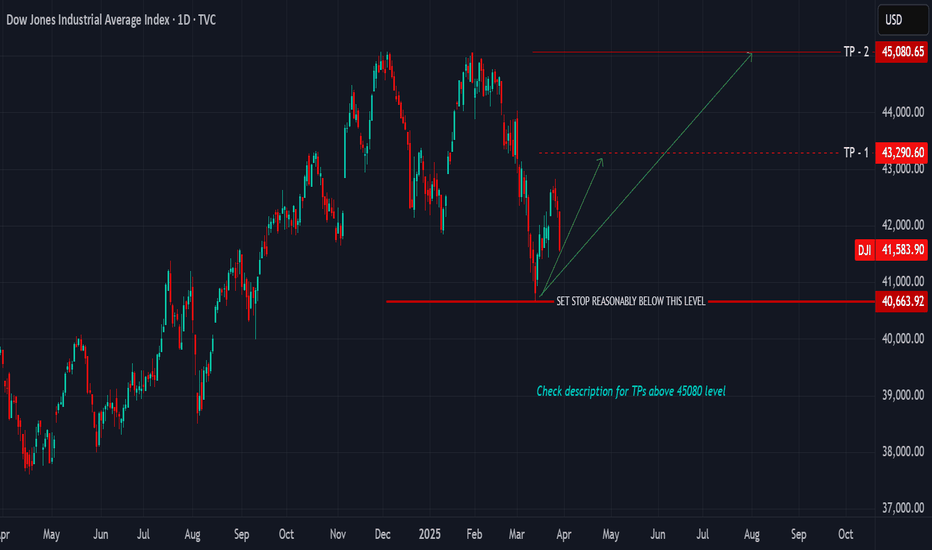

BUY EVERY DIP, HOLD FOR THE NEXT 7-MONTH CYCLE UNTIL OCTOBERThere are the current turmoil by tariffs and perceived recession, yet, the cycles strongly support a further advance from the March lows until October 2025. The bottom in March 2020 formed the base for the 5 year bull cycle nested within the larger 13 year cycle.

PRICE

The 2020 crash low formed at 18213.65, the decline in 2022 formed a bottom at 28660.94. We would have a price range Low - Low of (+10447.29 pts)

(28660.94 - 18213.65) = 10447.29 units

By projection if the range between the first two bottoms is 10447.29 we would expect the third bottom connecting three expanding points to be at 1.618 of 10447.29 points from 28660.94

28660.94 + (10447.29 x 1.618) = 45564.66

This makes the current top at 45073.63 through 45564.66 level a major support whereas its also a minor resistance for some correction and we expect price to move through this level.

TIME

Time connecting the three points 23/03/2020 - 03/01/2022 - 10/10/2022 with March 2020 as starting point would give us a time count (0.0 - 651 days - 931 days).

We find that between the two bottoms the top in Jan 2022 came in at 651 days. By projection we expect the next bottom to be at least 209 weeks or 1463 days from 10/10/2022 with a top located at a Phi variation of 651.

We would project a time range 1064 - 1099 days for a top and a decline into the third bottom 1463 days from 10/10/2022 and 2394 days from 23/03/2020. Trade safe, good luck.

US30This is our View on US30, we do believe US30 will be playing around sideways before tapping close to 40K level and then will give us a buy setup for long term.

Disclosure: We are part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in our analysis.

warning dji huge correction incomingThis is whats going on,Trumps tariffs are a catalyst for whats happening.we are going back down to the 0.618 level and are in an abc correction at this time, a 3 month bearish Div on the macd,also,we only have seen dji only down 2+ percent and people are freaking out about there 401k and how the richer are going to get richer by buying this dip. i agree if you have no free cash you are stuck. if this plays out its going to be painful,but after this correction we will be shooting vertical,and is your best opportunity to buy low and get rich.

sellPlease provide a meaningful and detailed description of your analysis and prediction. Walk us through your thought process. Put yourself in the reader’s shoes and see if you would understand the context based on what you wrote. Clearly stated profit targets and stop loss areas help clarify any trade idea.

US30 Technical Analysis🔹 Trend Overview:

US30 is in a strong bearish trend after breaking key support levels. The price has dropped significantly and is currently testing the 41,500.00 support zone. If this level fails to hold, further downside is expected.

🔹 Key Levels:

📈 Resistance: 42,000.00 – 42,484.00

📉 Support: 41,500.00 – If broken, price may drop further to 40,700.00

🔹 Market Structure:

⚠️ Bearish scenario: Price could retest 41,500.00 before continuing its downtrend towards 40,700.00

🚀 Bullish scenario: If 41,500.00 holds as support, a short-term pullback toward 42,000.00 is possible.

📌 Risk Management:

-Wait for a confirmation of breakout or rejection before entering trades.

-Monitor for potential fake-outs at 41,500.00 before committing to a position.

TECHNICAL AND FUNDAMENTAL ANALYSIS FOR LONGBuying US30 from 42,300 to 42,200 with a target of 43,100 appears to be a bullish strategy. To justify this move, let's break down the fundamental analysis.

*Market Trend*

The Dow Jones Industrial Average (US30) has been on an upward trend, with a 13.7% increase over the last six months ¹. This suggests a strong bullish momentum.

*Technical Indicators*

- *MACD (Moving Average Convergence Divergence)*: Although the MACD lines remain in bullish territory, the histogram has started to tick lower, indicating a potential weakening of the bullish momentum ¹.

- *RSI (Relative Strength Index)*: The RSI is approaching overbought territory, a level often associated with trend exhaustion ¹.

*Economic Factors*

- *Strong Labor Market*: The US labor market has shown resilience, with strong payroll data and wages growing at 4% ².

- *Interest Rates*: The Federal Reserve's interest rate decisions will impact the US30. A rate cut could boost the index, while a rate hike might lead to a correction ².

*Trading Strategy*

Given the bullish trend and strong labor market, buying US30 from 42,300 to 42,200 with a target of 43,100 seems reasonable. However, keep a close eye on technical indicators and economic factors, as they can impact the index's movement.

*Risk Management*

- *Stop-Loss*: Set a stop-loss at 42,000 to limit potential losses.

- *Position Sizing*: Manage your position size to maintain a risk-reward ratio of 1:1.5.

By considering both technical and fundamental analysis, you can make an informed decision about your trading strategy.

Keep your best wishes to the Travis 👍

The possibility of the upward correction ending and the decline Considering the zone marked on the chart and considering that the price has seen a lower low, it seems that the upward correction in the price will end soon and we should wait for a new downward movement. Targets and stop loss of my position are marked on the chart.

us30This Analysis Can Change At Anytime Without Notice And It Is Only For educational Purpose to Traders To Make Independent Investments Decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView

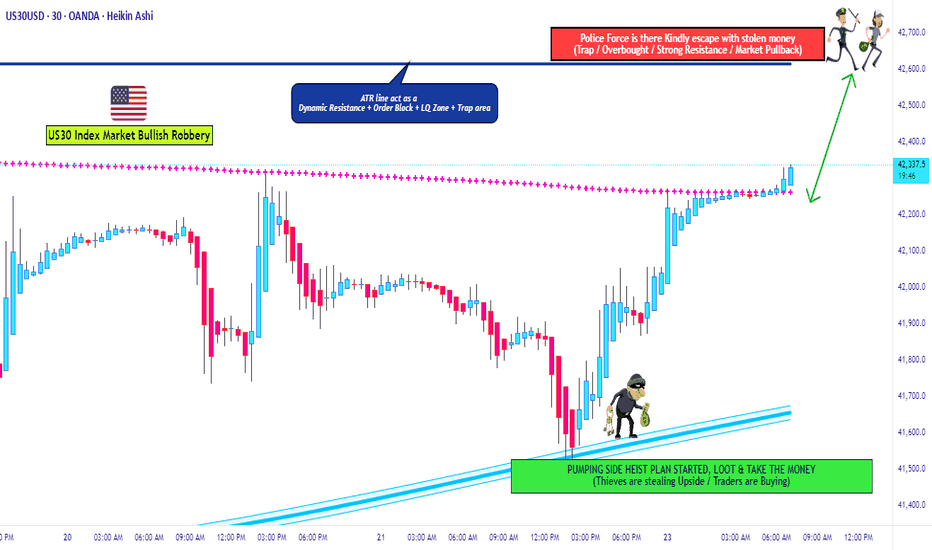

"US30/DJ30" Indices Heist Plan (Scalping / Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the US30/DJ30 Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 30m timeframe (42000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 42630 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"US30/DJ30" Index CFD Market Heist Plan (Scalping / Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

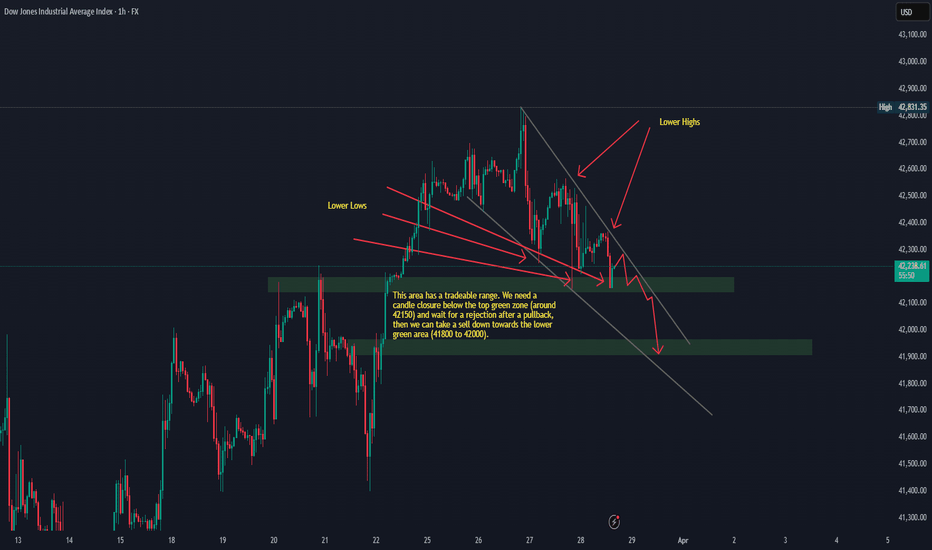

US30 Sells Idea for the New York SessionUnless we see some news come out on tariffs, we could see some downside on US30 today. It is falling inside a wedge pattern right now, and I expect the price action to fall within that wedge with a potential to go down during the New York session. I will be waiting for a break of the upper green zone (around 42150), then a pullback and rejection, to take sells down towards the 42000 (and possibly lower) areas.

I am not looking for any buys on US30 today, unless I see some really big green candles towards the upside during the 9:30 am EST.

Dow Jones Analysis for the Coming DaysEntering a buy position on the Dow Jones requires confirmation on the 15-minute timeframe after breaking out of the classic triangle, with a risk-free position around the 42,500 level. If the price breaks out of the triangle and then pulls back with strong momentum—most likely intended to shake out retail traders and trigger stop hunts—it is possible to enter with a larger-than-usual position and a very tight stop-loss.

If the support level is broken, the analysis will be considered invalid. The "strong momentum pullback" to the support level refers to the red rectangle. If the price returns to the support zone with very strong momentum, an entry can be taken with a very tight stop-loss.