US30 trade ideas

Falling towards pullback support?Dow Jones (US30) is fallling towards the pivot and could boucne to the 1st resistance.

Pivot: 41,777.16

1st Support: 40,202.56

1st Resistance: 43,339.19

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

US30USD - Short AnalysisThere has been a lot of consolidation in the market. I can see the bulls making a run on liquidity sweeping the previous internal highs before reaching the swing high, and the bears building momentum to the downside.

I could see a retest of the 1h Low marked on the chart before sweeping liquidity above the current Range (Consolidation). Once price has swept the sell side liquidity, the Bears will enter the market at my Potential Sell Entry to continue with downside momentum.

US30 (Dow Jones) 4H & 1H Analysis US30 is currently trading in a well-defined downward channel, making lower highs and lower lows. The next critical support sits near the 31,880 “Major Low,” where any decisive break could lead to further downside. On the upside, watch for a potential bullish bounce targeting the fair value gap and Fib confluence around 32,400–32,500. A breakout above the channel top may signal a trend shift, while a rejection there would likely keep the bearish momentum intact. Always monitor price action and manage risk around these key levels.

US30 BUY?The market is currently testing the current Weekly area.

Based on Daily, the market seems to be forming a possible reversal pattern which could lead to a possible reversal.

We could see BUYERS coming in strong should the current level hold.

Disclaimer:

Please be advised that the information presented on TradingView is solely intended for educational and informational purposes only.The analysis provided is based on my own view of the market. Please be reminded that you are solely responsible for the trading decisions on your account.

High-Risk Warning

Trading in foreign exchange on margin entails high risk and is not suitable for all investors. Past performance does not guarantee future results. In this case, the high degree of leverage can act both against you and in your favor

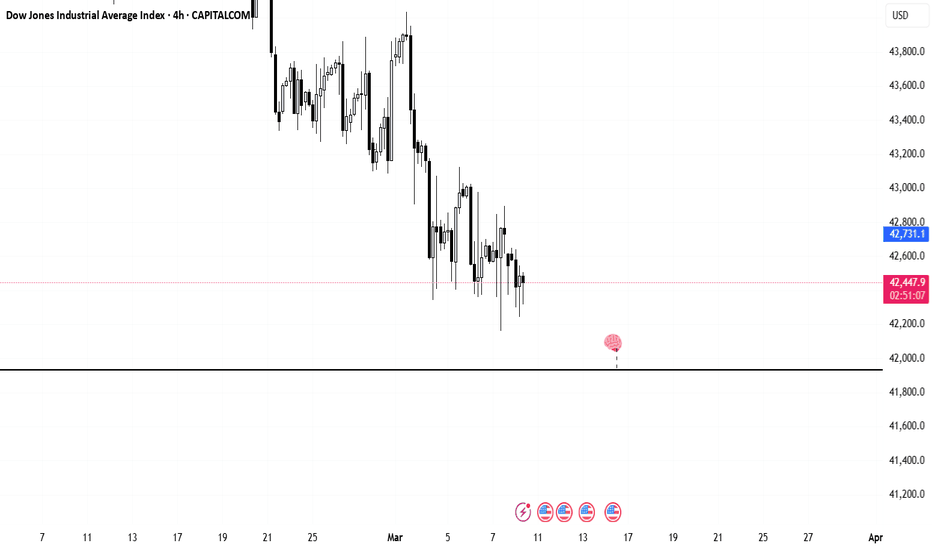

US30 LongsThis is my weekly analysis for US30. After the introduction of tariffs we saw a decline of the Dow,price nearly retraced 100% from itsintial bullish move from the 41,750 Daily Key Level.I think this was a perfectly time correction that was inevitable after an almost parabolic amount of bullish momentum the past few months. I do believe that the down trend is becoming exhausted judging by the wicks we are seeing around the Monthly 42,450 level. I am also seeing a 4H head and shoulders pattern which is distinguishable on some higher time frames as well. There is a possibility to see some consolidation between the Daily 42,150 area and the Monthly key Level @ 42,450. I could also see potential for a liquidity grab below 42,150 before a strong bullish move up. This prediction is being made based on past price action around these same key levels. With the bullish engulfing forming on the 4H time frame and the doji closing above the 42,750 4H key level there is a possibility to see price go straight through that 42,900 Daily Level without anymore liquidity, time will tell.

US30 09/03/2025 Outlook🚨 US30 Trade Outlook 🚨

📊 Market Structure & Key Levels

The Dow Jones (US30) is bouncing off a major demand zone on the daily timeframe, showing strong rejection from recent lows. A potential bullish reversal is in play, with price aiming toward key resistance around 44,500.

🔍 Key Observations:

✅ Daily Support Held – Buyers defended the 42,300 zone, signaling strength.

✅ Bullish Momentum Building – Short-term moving averages curling up.

✅ Break & Retest Setup – 43,000 level is crucial for further upside.

🎯 Trade Idea:

If price clears 43,000, we could see a rally toward 43,700+ and potentially the previous highs around 44,500. Watching for confirmation and volume before entering longs.

💡 Stay disciplined. Trade smart. Manage risk. FX:US30

Technical Analysis of Dow Jones Industrial Average Index - 1H 1. Trend Identification

The price action is currently within a range-bound consolidation phase (highlighted by the blue box), oscillating between 42,600 - 42,800.

A volume profile analysis reveals a strong point of control (POC) at 42,639.47, indicating a key level where most volume has been traded.

There are two potential future scenarios illustrated by the bullish (blue) and bearish (red) channels.

2. Key Support & Resistance Levels

Support Levels:

42,600 (POC & previous demand zone)

42,200 (lower bound of projected bearish channel)

Resistance Levels:

42,800 (current upper range resistance)

43,200 - 43,600 (upper bound of the bullish channel)

3. Chart Patterns & Volume Analysis

Volume Analysis:

The last 60-bar volume comparison shows a slight bullish bias (Up Vol > Down Vol by 1.97%), but the price remains indecisive.

A breakout of the 42,800 resistance or 42,600 support with a volume surge would confirm the next trend direction.

Possible Patterns:

Bearish Scenario: Breakdown below 42,600 may lead to a decline towards 42,200.

Bullish Scenario: Breakout above 42,800 can drive the price to 43,200 - 43,600.

Trade Setups & Risk Management

🔵 Bullish Trade Setup (Breakout Play)

Entry: Above 42,820, upon a confirmed breakout with volume.

Stop-Loss: 42,600 (below POC).

Take-Profit Targets: 43,200, then 43,600 (upper channel).

Risk-Reward Ratio: 1:3

🔴 Bearish Trade Setup (Breakdown Play)

Entry: Below 42,580, upon breakdown with volume.

Stop-Loss: 42,800 (above POC).

Take-Profit Targets: 42,400, then 42,200 (lower channel).

Risk-Reward Ratio: 1:2.5

DowJones The Week Ahead 10th March '25Sentiment: Neutral, Price action is consolidating in a tight trading range.

Resistance: Key Resistance is at 43145, followed by 43600 and 44000.

Support: Key support is at 43303 followed by 42000 and 41650.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

DOW JONES MA200 (1d) test on the Channel Up bottom. BULLISH.Dow Jones is trading inside a Channel Up but lately finds itself on a pull back.

This pull back is about to test the MA200 (1d) at the bottom of the pattern.

The MA200 (1d) has been holding as Support since November 3rd 2023, so overall that makes it a buy opportunity.

Trading Plan:

1. Buy on the current market price.

Targets:

1. 46400 (the 1.382 Fibonacci extension).

Tips:

1. The RSI (1d) is almost oversold and at 35.00 it has turned sideways. Every time the RSI was on this level or belowsince October 2023, it was the best buy opportunity.

Please like, follow and comment!!

Edbullish Trading Live our US30 scenario NFP DAY 07/03/2025Hello Traders!

In this video, we break down a short position on the Dow Jones (US30) using the 1-minute timeframe.

As we expected yesterday The NFP will be Negative for us Dollar you can see our scenario day before.

Don't forget to boost, and Follow for more trading tips and real-time analysis!