Chart Pattern Analysis Of MSTU.

From K1 to K6,

It is a small scale consolidation or a bullish triangle pattern.

The supply pressure is decreasing too.

It seems that K7 or K8 will break up or fall down.

If the following candles close upon the neckline,

It is likely that another bull run will start here to test 14USD area.

On the other hand,

If the following candles close below the uptrend line,

The risk will sharply increase.

Long-8.18/Stop-7.8/Target-14

Long-8.5/Stop-7.8/Target-14

MSTU trade ideas

$MSTU – Breakout Brewing or Bull Trap? Here’s My TakeSwing Setup | Risk/Reward 3:1 | Watching MACD & Ichimoku

📊 This is a leveraged ETF that tracks NASDAQ:MSTR , and it’s setting up for a potential breakout. Here’s the breakdown:

🔍 Chart Context:

Price: $8.11 (as of June 11, 2025)

Target: $11.40 area (+40.57%)

Stop: $7.07 (–12.82%)

R:R: 3.16 – attractive setup for swing or momentum traders.

📈 Technical Breakdown:

✅ MACD Histogram just flipped positive. That’s a momentum shift after weeks of red. We’re at the zero line—any crossover here historically leads to explosive moves in leveraged ETFs like this.

✅ Ichimoku Cloud: Price is above the cloud, which is thin and transitioning to bullish. Lagging span (Chikou) is starting to clear previous price action. This is a classic bullish continuation signal—only if price confirms.

✅ Structure: Consolidation zone forming a base at ~$8.00. We've had several failed breakdowns, and bulls have absorbed the selling. If it clears $8.50 with volume, I expect short-covering and fresh entries to flood in.

⚠️ Resistance Zones:

$9.15: Local high and volume shelf

$11.40: Target based on prior impulse leg (April rally leg cloned)

💡 Strategy:

I’m long with size, aiming for a 40%+ move, using MSTR’s volatility as tailwind.

Stop is below recent higher low — invalidation is clean.

If it breaks $8.50 with strength and MSTR joins the move, I’ll consider adding.

🔄 This is a leveraged play—don’t diamond hand it. Monitor daily. It can move 10-15% in a single session.

Drop your thoughts or alternative plays. Are you using MSTU or trading NASDAQ:MSTR directly?

MSTUMy original position, which I still have, was entered around $4.50, but well before the stock split. I bought some more after the peak, but before the dip after the dip. That's always the one that gets you. So that second position is a tad underwater, but hopefully not for long. If BTC can hold $100,000, that's nice to see. BTC can decide to do a massive inverse H&S off the top of the all-time BTC linear fib channel, which would take the price to $93,000. This would be totally fine. You just don't want to see that level fail.

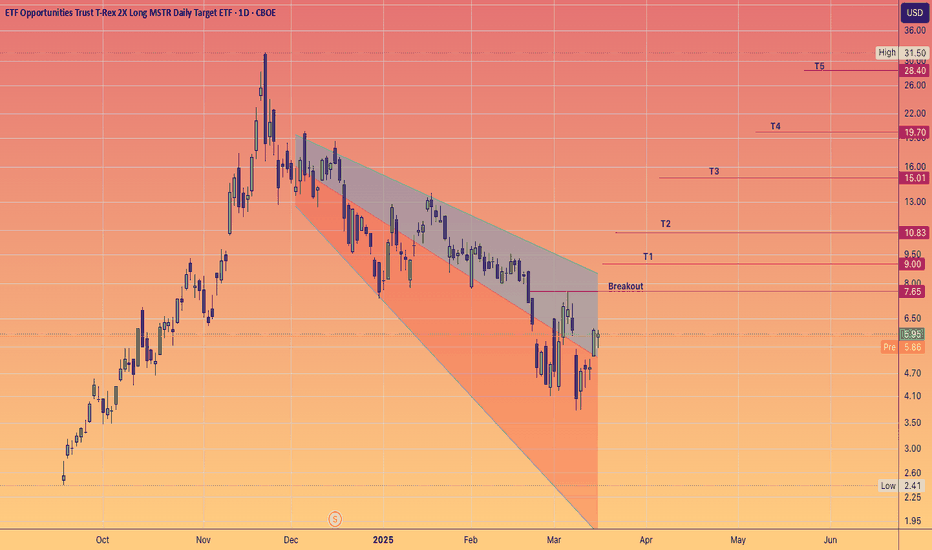

MSTU (T-REX 2× Long MSTR Daily)Chart targets

Support at the Ichimoku Kumo top (~ 7.40 – 7.50) on 1 H & daily – this is your “buy zone.”

Initial upside to 8.10–8.30 — where yesterday’s 5 min candles peaked and the daily cloud resistance sits.

Secondary target ~ 9.00 — prior swing high from last December.

CSP entries (May 16)

Sell the 7.50 puts CSP's

Only do this if MSTU holds 7.40–7.50 on an intraday pullback.

Keep a stop if price closes below 7.30 on 30 min.

Alternatively, stagger 7.25 & 7.00 strikes to pick up extra premium if you want deeper support.

MSTR (MicroStrategy) – Earnings on May 1

Date: May 1, 2025

Street consensus: +$0.06 EPS vs prior miss of –$3.03.

Social sentiment: extremely polarized – Bitcoin bulls are hopeful a beat will turbo-charge the stock, but skeptics point to ongoing cash burn and debt load.

Plan:

Stay size-light into the print.

Look for a volatility crush post-earnings to sell short-dated calls (or buy deep ITM CSP) if you’re neutral-to-bullish.

If they beat and BTC holds above 95 K, MSTR could rip back toward its January highs near $540 – but that’s a multi-day swing, not today’s game.

Risk Management:

MSTU CSP: don’t sell more than 1/2 your normal size—earnings skew implied vol across the board.

News watch: any Tweet from Michael Saylor or a surprise Bitcoin ETF update can blow these levels out in minutes.

Nice value gap....MSTUI want everyone to benefit on this! BTC has shown resilience in a horrible market and it's picking up. We can see the double bottom and nice formation on the upside. My humble opinion is that people are moving their crappy stocks and moving it to BTC in the hope that it goes back to 88k like it did a few days ago, which would mean a 20-30% upside for MSTU easily. I always watch my trades and have stop loss, but early next week looks very interesting esp if globally people start buying over the weekend (post dip).

Always do your own due diligence and safe trading! Reward favors the brave and those who take calculated risks. Trade your rice and beans for a nice steak :)

MSTU to fly soon....you need to see the signsLet's take a step back. Higher lows!!! and BTC is hitting a double bottoms during a terrible week in stock. That should be telling that while we are making a turn (with volatility), there is a very fav upside case here. I'm not emotional about any of this, just follow the signs and the data! Next week will be epic IMHO. Lock it in at a good price before it spikes and you miss out on the train.

All the best and safe trading. Always remember to have an exit strategy and follow the signs / data. It's all risk / reward. No risk -> no reward!

MSTUTalking heads like Tom Carreras put out knowingly false statements against MSTR. That’s called “scienter” and it’s a crime what he just did. Tom said that MSTU ETF may have to “sell MSTR” if times get tough. That is a false statement. Nowhere in the MSTU prospective does it say that MSTU has to buy or sell the underlying. I think they explicitly say that they do not, and that MSTU is a synthetic option vehicle. Correct me if I’m wrong. So, what he said was completely false and misleading. He wanted to threaten you against owning MSTU, but he failed to identify the primary risk in MSTU, which is a 50% drawdown in the underlying in a single day. That would completely wipe out MSTU holders, but no mention of it from Tom.

Tom fails to understand where all of the value is coming from to “buy the dip” as he says. As least he is astute enough to realize it is the dip. Degens saw their position go up by 600%, and other degens noticed it, and they want in. Where is the money coming from? Bonds.

MSTU Long term retiring ideaThe MSTU ETF offers double exposition to the ticker IG:NASDAQ MSTR, now called Strategy, and this year many call a greater bull run on Crypto assets. I have done myself a mathematical model which gave me the conclusion similar to what Michael Saylor thinks:

I think I'm going to retire on the MSTU ETF, considering it 0.35 of my Portfolio and adding into it.

For the short term, consider buying on a strong support using an ATR (Average True Range) Indicator which tells you where to buy, and considering the support on a high historical trading activity with Market Profile terminology. Not bad for doing DCA at the swing lows formed.

Not financial advice!

Double down like Michael Chad Saylor - MSTR ----> MSTU 2X"Are you convicted?"

Of Bitcoin achieving a new All time high if so Saylor will greatly rewarded and lauded.

MicroStrategy's unwavering focus on acquiring Bitcoin through unconventional financing methods, rather than building a sustainable revenue-generating business, carries significant risks, especially if a major bear market were to hit the cryptocurrency sector again. This exposure to Bitcoin offers a distinctive investment opportunity for those looking to gain leverage in the crypto space without direct participation.

While MicroStrategy's inherent volatility may deter more traditional investors, it also provides a platform for those eager to engage with market dynamics. The MSTU adds an additional layer of volatility, but unlike options, it does not have an expiration date.

Investors should closely monitor Bitcoin's market fluctuations, as these directly influence MSTR's stock price, potentially creating advantageous entry points for savvy traders.

MSTU.....nobody puts baby on the corner! Yes, I know that I've taken both sides on MSTR, but when the situation change you must adapt! Moving on, MSTU seems to be nicely positioned to jump. Look at the price action and the yellow line! What do you see? I see opportunity....

If BTC (pappa bear) behaves and does take a massive dump, you could be making a nice profit here!

Best of luck and always do your DD!

MSTUNow that we've retraced the election pump entirely, MMs that got blown out on the 2 week 356% increase have recuperated.

What if, similar to the election pump, we now price in the reduction of uncertainty surrounding Trump presidency to 0, with an inauguration pump that is even more extreme than the election pump?

Gaps in immediate vicinity as incentive for sharp move higher to $10+ locally. Wouldn't be surprised to see new highs later in January.

10X the sharesI now have 10X the shares gifted right as the price breaks above the overhead. Nice timing. Three months, and then split 10:1. I like that a lot, and I’m down for that to happen again. I was up 615% on that last pump, and we’ve come down 60% off the peak, but that’s still up 250 some odd %. Haters can hate all they want, and I’m getting the popcorn ready for this next pump

It’s a miracleIt must be a miracle to get gifted 10X the shares, right before the underlying gets included in the QQQ. It’s a one-two punch. Maybe we won’t see MSRU/MSTR parity afterall, because MSTU will keep splitting shares in order to facilitate the options, which just came online a week or so ago. This is just getting started. There’s a gap below, which we hope to not revisit on a 51% down day, lest this whole position evaporate in a Mandelbrot fractal of options implosion.

I’m staying long and looking for $10,000MSTR. Yes, I’m the first one to call for $10,000 MsTR