Why Is the T Bond Heading Down?The downward pressure did not start with the Liberation Day tariffs on 2nd April.

Based on the 30-year long-term bond price chart, the market peaked in 2020, then broke below a major support line—established since the 1980s—in 2022.

Since that break, US bonds have been on a downward trajectory.

So, what happened in 2020 and 2022 that set the bond market on shaky ground?

Why is the recent tariff shock just a continuation of developments that began back then?

And where are bond prices heading next?

This goes beyond investors offloading its US Treasury holdings after 2nd April.

U.S. Treasury Futures & Options

Ticker: ZB

Minimum fluctuation:

1/32 of one point (0.03125) = $31.25

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

ZBZ2021 trade ideas

ZB1! - Donald Trump Took A Huge Dump In The Bonds MarketIt was only two weeks ago when market participants were cheering on the bond market for it to rally higher.... until al hell broke loose!

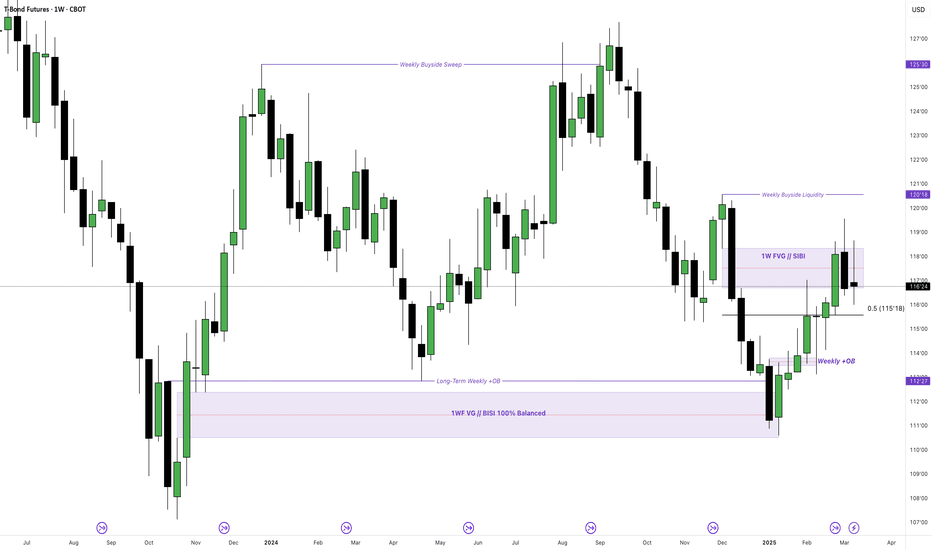

120.18 was the initial draw on liquidity before the bond market capitulated into October 2023 BISI.

What's net on the horizon?

FERRIS BULLERS DAY OFF - READ DESCRIPTIONWho knows... just posting this to watch.

"In 1930 the republican controlled house of representatives in and effort to alleviate the effects of....

anyone, anyone??

GREAT DEPRESSION....

Passed the....

anyone, anyone??

tariff bill - the Halwey-Smoot Tariff act which

Anyone??

Raised or Lowered? RAISED

Raised tariffs in an effort to collect more revenue for the federal government.

Did it Work?

Anyone, Anyone know the effects?

IT did not work and the United States Sank deeper into the great depression!

-FERRIS BULLERS DAY OFF

Bond Yields Ripping, Will Wall Street Take Notice?Rising yields can usually be associated with a period of risk on. But seeing the 30-year treasury yield rise over 20bp in Asia while Wall Street futures cling on to their cycle lows is anything but usual. In fact, it's a bad omen of things to come.

Matt Simpson, Market Analyst at City Index and Forex.com

ZB1! - Will Donald Trump Pump The Bond Market? On Wednesday, Trump mentioned the need to lower interest rates as the tariffs will have major effects with the rates being where they are at now.

In the last, whenever yields rise, bonds will fall and we have been seeing this from the beginning of September 2024, with minor signs of retracement (factoring Jan 2025 bull run)

Overall, when you look at price action over the past few weeks, it seems as though the bull run has slowed down and there could be a chance for bonds to drop to 116 going into next week.

ZB1! 18/03/25Here we go. Longs on Treasury bonds. Weekly BISI with H4 SMT and displacement. Targeting previous weeks high for this week. FOMC on Wednesday:

- If the Fed signals rate cuts are coming soon (Dovish tone) → Bullish for Bonds

Yields may drop as investors price in lower future rates.

Bond prices rise, benefiting Treasuries and fixed-income investments.

- If the Fed remains cautious and pushes cuts further out (Hawkish tone) → Bearish for Bonds

Yields could stay elevated or even rise if the Fed signals rates will stay high longer.

Bond prices fall, as higher-for-longer rates make existing bonds less attractive.

I'm believing a dovish tone for this FOMC with rates being held. If rates are not held expect a massive shock. Powell's economic projections will also provide key information on their stance.

ZB1! -MASSIVE Week Ahead With Interest Rates There is a strong correlation between bonds and yields and so far, the trajectory of price action for bonds has been in my favour, trailing higher and higher into the weekly premium SIBI.

115.18 is the equilibrium of the most immediate swing high to swing low and I am expecting a draw into this area.

116 is a low hanging, first target for next week that I am aiming for and would like to see how Sundays opening reacts (if that’s the case) with 116.

ZB1! - Perfection With SIBI RejectionThis weeks delivery has efficiently delivered into a PD array mentioned previous weeks back.

Although bullish, the goal was not to predict the weeks close, just anticipate the draw on liquidity.

Aiming for low hanging fruits, I am looking at the 115.18 weekly EQ as a possible draw going into next week.

$BONDS MMSMWhen analyzing the bonds, we identified an SMT between them at a PDA located in the monthly premium region, further reinforcing the possibility of a DXY rally and a drop in EURUSD, along with bond depreciation. However, to validate this scenario, we still need confirmations on the daily chart to ensure that the bias remains aligned with the market structure.

ZB1! - End of February Analysis- Monthly bullish order block has held up well, supporting the bullish narrative of price drawing up to 120.00

- Monthly candle closed convincingly above the 3 month rejection block @ 117.08.

- Monthly volume imbalance rests a little higher than where the monthly buyside liquidity pool is @ 120.25 – 121.23. Buyside rests @ 120.18 and this is the draw that I am looking forward to going into this months price action

- October 2024’s monthly candle prints a SIBI and this is also a area to study. Many confluences in this area making it high probability for a bullish draw. Bullish delivery with bonds mean bearish delivery for US10Y.

- Successful projection of February's draw on liquidity

ZB1! - Immaculate Draw on Buystops! What’s Next?This weeks breakdown covers the similarities bonds and yields have and as mentioned in my most recent analysis with Yields, I was loooking for a draw down to discounted prices.

With that bias in mind, Bonds would be more likely to trade higher as they both highly correlated.

ZB1! - Immaculate Draw on Buystops! What’s Next?This weeks breakdown covers the similarities bonds and yields have and as mentioned in my most recent analysis with Yields, I was loooking for a draw down to discounted prices.

With that bias in mind, Bonds would be more likely to trade higher as they both highly correlated.

t-bonds x alt season.t-bonds are primed for lift-off.

we just witnessed the largest decline in the history of the treasury. since march 2020, t-bonds have looked like they’re in a correction. most are calling it five waves down, signaling a deeper bear market. but they’re seeing the surface, not the structure.

i'm building a case that says otherwise.

the five-wave drop from all-time highs? that wasn’t the start of the bear market.

it was the end of wave c in an expanded flat that began in 2016.

most think the t-bond bear market started in 2020.

i’m saying it started in 2016,,,

and if i’m right, it just ended.

---

as the market prices-in future interest rate cuts, fueled by artificial suppression of gas prices and inflation stabilisation, t-bond values will climb throughout this next year.

normally, stocks and bonds move inverse to each other.

not this time.

this time, they move together. 1:1.

why? because the us dollar is about to get wrecked.

quantitative easing is coming back.

liquidity will expand.

the global liquidity index will rise.

the way we make that happen is by crushing the dxy.

---

tldr;

- rate cuts incoming

- making t-bonds go up

- quantitative easing

- nukes the dxy

- making stocks go up

- risk-on environment returns

- risk assets go parabolic

- alt season is triggered.

🌙

US T-Bonds - End of January AnalysisNew month = more opportunities and with January closing just before a weekend, it gives me the added advantage of sitting down with price action whilst the market is not moving and gauging the next draw on liquidity on a macro scale.

This analysis goes over what to expect on a long term time frame; 6-months & 3-months retrospectively and also covers what I expect to take place in the next following weeks.

The monthly highs is 115.01

The monthly lows is 110.19

US T-Bonds - Bond Prices Will Rise SoonBond prices have been getting slaughtered for several of months and with the uncertainty around Donald Trumps potential tariffs being placed on China is causing the market to rangebound.

Although the market has been on a freefall since September, there are periods where you are able to eek out some profits if your willing to go against the grain, especially when the technical align up perfectly.

US T-Bonds - Bond Prices Falling Off A Cliff! Happy New Year Traders!

This is a perfect time to do a review on T-Bond Futures as it's the 1st month where you see the beginnings of the 6-Month candle form, which can be very powerful for gauging a bias, especially when comparing the strong inverse correlation to Gov 10y yields.

Countries like the UK are suffering as their prices for their bonds are being sold at extreme losses in order to prop up their restrictive policies.

When will it end..?

Global Bonds New LowThe UK bonds have broken below the recent decades-low in the past weeks.

What has caused this turmoil? We will drill down into the specific dates that triggered this meltdown.

10-Year Yield Futures

Ticker: 10Y

Minimum fluctuation:

0.001 Index points (1/10th basis point per annum) = $1.00

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com