Demystifying Corn Demand, Supply, and SeasonalityCorn is a versatile crop. It is used in a variety of ways. Corn is a major source of food for humans and animals. It is also an input in industrial products, such as ethanol and plastics.

According to the FAO, in the past year, over 1.1 billion tons of corn was produced worldwide. Gross production value stood at $192 billion, second only to sugarcane (1.8B tons) by volumes and to rice production ($332B) by value.

Previously , we highlighted that a bumper US harvest is expected to send corn prices tumbling. This paper is a primer on Corn. It describes demand and supply dynamics and delves into the usage of the crop, its price behaviour and seasonality, among others.

Corn is an integral part of human diet. It is consumed both as staple food and in processed products. It is also an important animal feed source.

Corn is used in the production of ethanol fuel, plastics, adhesives, and pharmaceutical products. It is also a primary ingredient in alcoholic beverages.

SEASONALITY IN CORN PRICES

The world’s largest corn producer is the US, representing 32% of production, followed by China with 23%. In October, harvest season in the US overlaps that in China, pushing corn prices to their lowest during the year.

Based on data observed over the last 17-years, the seasonal impact of harvest in the US and Chinese on corn prices is clear.

Corn price pop through the first half of the year and then plunge through Q3 until start of Q4 when the crops in the US, China, and Brazil commence harvesting.

Based on front-month corn futures, the average prices of corn have ranged between 200 USc/bushel to 800 USc/bushel.

Over the last 17-years, with the exceptions of six years (2008, 2010, 2012, 2013, 2021 and 2022), Corn prices tend to be stable through the year underpinned by stable demand and robust steady supply.

However, external shocks such as the global financial crisis, pandemic, and the adverse weather conditions cause outsized impact leading to large price volatility.

Based on CME front month corn futures prices, the heat map below shows an upward trend in corn prices from December until May which is the period immediately after US and China harvesting seasons. This phase also represents the corn planting season.

As harvesting begins, corn prices tend to plunge from June until September before starting to recover. On average, based on the analysis into corn prices during the last 17 years, February, October, December, and April are months when corn prices turn bullish. While corn prices are most bearish during the months of June, July, and March.

As corn is a hard crop which can grow in various climatic conditions, most countries have ample domestic production to match their needs with few relying on imports. Consequently, marginal demand from importers can have an outsized impact on prices.

China is the largest importer despite huge domestic production. Other major importers include Brazil, Mexico, North Africa, European Union, Japan, South Korea, and Vietnam.

WHAT DRIVES CORN DEMAND?

Demand for corn is chiefly from animal feed followed by food and industrial use. Corn’s high protein and carbohydrate content makes it suitable animal feed for cattle, pigs, and chickens.

Unsurprisingly, the US, representing 26% of global consumption, and China, representing 25% of global consumption, are also the largest consumers of corn due to their large livestock populations. The quantity of corn used for feed has remained largely unchanged ~5 billion bushels, since the late 2000’s.

Another major demand driver is Ethanol production. Ethanol has many industrial uses, the foremost of which is gasoline blending. Ethanol complements gasoline as they are mixed to create a cleaner burning and higher performing transportation fuel. The demand for corn-ethanol mirrors gasoline demand.

This year, the IEA expects 2% higher demand for Crude Oil and its by-products. Consequently, the USDA expects ethanol production to rise by the same margin.

Corn supply used for Ethanol production rose sharply in the late 2000’s but has since plateaued around 40%. At the same time, share of corn consumption for feed declined from 60% to 40%. This was accommodated through higher corn production.

Although not as significant as feed and ethanol, demand for human consumption of corn is another major contributor. Humans consume corn directly as cereal and in its processed forms. Corn can be processed into multiple by-products including Corn Flour, Corn Starch, Corn Syrup, Corn Oil, and Dextrose. Corn is present in most foods consumed by humans in one form or another.

Corn flour like wheat flour is used for cooking and baking. Corn Starch is used as a thickening agent and binder for food and pharmaceutical production. Corn Syrup (also high-fructose corn syrup) is a cheap and effective sweetener created from corn starch used in the production of processed food as well as beverages such as Coca Cola. Dextrose is a sugar substitute used as an artificial sweetener and preservative.

CORN INVENTORIES ENSURE SUPPLY YEAR ROUND

Although corn supply is cyclical based on harvest levels, demand remains strong year-round. Corn inventories play a huge role in ensuring availability even months after the harvest.

Excess corn that is not consumed in the year is carried over to the next to ensure that a baseline supply is always available. These carryover stocks are managed carefully by the USDA using regular demand and supply estimates that it publishes in a monthly WASDE report. Changes in carryover stock mirror supply-demand trends.

The USDA generally maintains carryover stocks between 1-2 billion bushels. Last year, the US ended the year with 1.2 billion bushels of corn, sharply lower from the 1.9 billion bushels in 2020-21.

However, a bumper harvest this year signals that carryover stocks from the current harvest season and marketing year are expected to surge 56% to 2.2 billion bushels.

CORN SUPPLY, PRODUCTION, DEMAND AND PRICES IN 2023

Corn prices in 2023 have broken their seasonal trend with bumper harvest expected.

In their general seasonal trend, as seen over the past 15 years, corn prices rise during the first half of the year as supplies from the previous year’s harvest start to get depleted. Prices fall sharply following the start of harvest season.

However, corn’s price since the start of 2023 shows a divergence from this seasonal trend. Prices are sharply (-12%) lower YTD. This is due to strong planting in the US as well as weak import demand.

USDA expects a record US corn harvest of 15.3 billion bushels this year. This is expected to lead to the highest levels of carryover stock since 2016-17. China’s imports and domestic production is expected to rebound sharply but is largely expected to be compensated for by huge carryover stocks in Brazil.

Brazil is expected to be the largest corn exporter followed by the US. As such, harvests in both countries should be closely watched to identify shifts in projections. In case harvest in either country is lower than expected, it would not be able to match import demand from China which would lead to higher prices.

Overall, USDA expects 27% lower average price for corn in 2023 at USc 480/bushel. This will lead to far higher global trade and consequently higher trading volumes in Corn futures.

USDA’s WASDE REPORT IS AN IMPORANT RESOURCE FOR CORN TRADERS

As stated, the USDA’s WASDE report is a critically important resource for investors. Specifically, the May WASDE report is vital for Corn as this is the start of the planting season and estimates in this report form the basis for the next marketing year’s outlook for major crops such as Wheat, Corn, and Soybeans.

WASDE includes an outlook summary for each crop as well as statistics measuring the estimated demand, supply, exports, and carryover stocks for major countries as well as different regions within the US .

The 2023 May WASDE report showed expectations of record global corn production as well as consumption. However, consumption is expected to lag production leading to larger ending stocks compared to last year. With higher ending stocks, supply of corn is expected to remain stable year-round. This is bearish for corn prices.

Understanding the supply-demand characteristics in the WASDE report can equip investors with a long-term price outlook. Still, it is equally important to keep track of the market on an ongoing basis due to the myriad of factors affecting price as highlighted above. A summary of these is also given below.

SIX KEY TAKEAWAYS

In conclusion, the following key takeaways summarise this primer:

1. Corn is a versatile crop. It is a major source of food for humans and animals.

2. Gross production value of corn stood at $192 billion, second only to sugarcane (1.8B tons) by volumes and to rice production ($332B) by value.

3. US and China are the world's largest corn producers and consumers, representing over half of global corn production & consumption.

4. Corn prices are heavily influenced by the harvest season in US and China which overlaps between September and October.

5. Major demand sources for corn are animal feed, industrial use (especially ethanol production), and human consumption .

6. May WASDE report showed expectations of record production and consumption of corn and higher ending stocks, leading to lower prices.

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

ZC1! trade ideas

Corn Prices Fizzle on Bumper HarvestCorn prices have fallen 14% since the start of 2023. The latest USDA report points to further downside. Corn prices are expected to fizzle with expectations of a bumper harvest combined with tepid demand.

The USDA expects a record harvest of 15.27 billion bushels. The 2023/24 forecasts signal rising corn supply boosting ending stocks to their highest level since 2016/17.

To hedge against falling corn price, this case study proposes a short position using CME Corn Futures (ZCN2023) expiring in July with an entry of 586.25 and a target of 433.25, which is hedged by a stop loss at 654.25, is likely to yield a reward-to-risk ratio of 2.25x.

RECORD CORN HARVEST IS ANTICIPATED RESULTING IN SOARING ENDING STOCKS

WASDE, short for World Agricultural Supply and Demand Estimates, is a monthly report released by the US Department of Agriculture (“USDA”) that tracks the supply and demand for various agricultural commodities.

In the latest WASDE report, released on May 12th, USDA expects a record 15.3 billion bushels of corn to be harvested in the US this year.

The US is the largest producer of corn, representing 32% of total global production. Global corn production is expected to rise 6% YoY in 2023-24.

While production is robust, demand and consumption are not expected to grow as fast. Global demand is expected to rise 3.7% with US consumption expected to climb 3.4%. This will result in an oversupply of corn with soaring inventory levels (i.e., Ending stocks).

Ending stocks represent the supply of corn that is carried over to the next year. They are expected to rise 56% YoY to 2.2 billion bushels, the highest level since 2016-17. This leaves plenty of supply to accommodate any demand expansion.

A bumper harvest in October is expected to cause an oversupply pushing corn prices lower.

Despite the recent decline in corn prices, they remain significantly higher than pre-pandemic levels. With ending stocks now expected to reach pre-pandemic levels, prices will likely follow.

WEATHER MAY UPSET BUMPER HARVEST EXPECTATIONS

The WASDE estimate assumes stable weather conditions as well as demand assumptions regarding China.

Weather conditions play a huge role in final harvested yield. In the current year, drought conditions & intense heat in Argentina led to lower crop yields. With extreme weather events rising globally, it is possible that unfavorable weather may reduce the final US corn output.

China is the largest consumer of corn. With hopes of strong economic recovery still simmering, demand in China may spike higher than USDA expectations.

If supply fails or demand spikes, Corn prices may remain steady or even rise.

Asset Managers and Options Markets are positioning for Corn price to plunge

CFTC’s Commitment of Traders Report shows that asset managers have more than doubled their net short positioning in Corn futures over the last twelve (12) weeks.

Other reportable traders have reduced their net long positioning by almost 50% in the same period. Both indicate rising bearishness about corn prices.

Similar sentiment is reflected in the options market. Although June and July contracts have Put/Call ratio of ~0.85 (more calls than puts), this is before the bumper harvest is expected (August-October). The September and December contracts which expire after the harvest have a Put/Call ratio of ~1.2.

The futures forward curve, which is in backwardation, also shows expectations for prices to drop following the harvest.

TRADE SETUP

Each lot of CME Corn Futures provides exposure to 5,000 bushels of corn. A short position in CME Corn Futures expiring in July (ZCN2023) with an entry of 586.25 and a target of 433.25, which is hedged by a stop loss at 654.25, is likely to yield a reward-to-risk ratio of 2.25x.

• Entry: 586.25 ¢/bushel

• Target: 433.25 ¢/bushel

• Stop: 654.25 ¢/bushel

• Profit at Target: USD 7,650

• Loss at Stop: USD 3,400

• Reward-to-risk: 2.25x

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

Corn Fibs, gans and speedfans I made this a while ago. It’s crazy to think how well fibs are in the market. Time and price accuracy is on these fibs gans and speedfans. And they can change time frame if you zoom on and add a fib to these fib levels. One single fib can go down to the minutes. You can doubt me either. I’m here to say it’s facts with out being humble. Humble me in the comment with constructive criticism

Crop market forecastCrop dropped through the bottom after concernes about shortage switched to the low moving price down fast. If trader have big deposit he is already a buyer. If smaller he is waiting for a news and mean reversal pattern to develop to have a setup for a buy. Giving current situation in Commodities market it could take weeks for a price to respond to a buyer activity. Meanwhile hedgers and farmers are unloading their positions. Buying is justified if trader could wait and maybe buy more during said reversal and could take solid losses. Price action still looks dangerous for a buyer, sellers could trigger bigger drop in such market. Still what is happening in Crop is inretesting this is cleraly a price artefact which could be exploited for a solid profit.

Continuous CornContinuous Corn – Weekly: (Busy Chart) Currently in a sideways grinder going into an acres battle and Weather Market. Do not hesitate to Make decisions. The Red downtrending pitchfork controls the trend. Nearby resistance against the upper red line is set up with the 6.93 retracement target but volume by price resistance at 6.75-6.80. If the red line is broken for a short time look at further retracements that coincide with the lower blue line on the uptrending pitchfork. (7.24, 7.68, and 7.94) Theoretically the blue uptrend fork is still in play as long as the dashed gray uptrend line is not broken. Should we break below 6.23 then we most likely will see a test of the median line before we see 7.00 again. Median red line support in the 4.50 area targets Dec futures this Fall… **Many If/Then scenarios at Play**

Volume by price acts as a magnet. Currently the 6.75 area is pulling it up and would be resistance. The next volume spike by price is the 5.50 area and then the 4.25 area. This will act as support/risk moving forward as contract months roll forward...

CORN FUTURES Weekly Technical AnalysisZC1! Weekly - No RECOMMENDATION or ADVICE Status / EDUCATIONAL only - Support, Resistance, Trend Lines, Cluster, Confluence, Pitchfork, Modified Schiff Pitchfork - Hope it Helps, Good Luck

DISCLAIMER - This communication is not trading or investment advice, recommendation or solicitation to buy, sell or hold any investment product is provided for informational, educational and research purposes only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The author or persons involved in the conception, production and distribution of this material cannot be held responsible for transactions or any financial loss or damages resulting directly or indirectly from the use or application of any concepts or information contained in or derived from this material. Past performance is not indicative of future results. Any person who chooses to use this information as a basis for their trading assumes all the liability and risk for themselves.

Corn Futures Have Negative Weekly MA SlopesCorn has dropped below the 100, 20, and 9-week simple moving averages, all of which have rolled over to have negative slopes. The most notable is the 100sma. When it has a positive slope, it appears to act as support, but once the slope turns negative, price can go vertically down as it did in 2013. Another noteworthy item is the 45 week time span from peak to drop in 2012/2013. The current distance from the 2022 peak is 49 weeks, a time span which is comparable to 45 weeks for technical analysis purposes.

As a swing trade, a short entry should be executed as soon as possible, a stop should be placed above last week's high, and the target is near the bottom of the previous vertical drop, in the $4.50 to $5.00 range. MACD is used to colorize the bars. It’s also worth noting that the daily chart has its own bearish setup, with price having just rejected the 200, 100, 50, and 9 moving averages simultaneously. They also have negative slopes.

Daily:

Comparing May (left) and December (right) price action for 2023, it can be observed that the December contract appears to be showing more weakness which would suggest longer-term bearish expectations are starting to be priced in.

P.S. The level we're at is the same level that it dropped vertically from last time.

XC1! My Opinion! SELL!

My dear followers ,

XC1! looks like it will make a good move, and here are the details:

The asset is approaching an important pivot point 659'3

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Target - 630'3

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

———————————

WISH YOU ALL LUCK

It’s Corn!You know the “It’s Corn” song trending on TikTok? It brings a smile to our face every time we hear it. But if you look at Corn’s price chart and fundamental outlook, that’s a whole other story…

Corn’s recent breakout of a symmetrical triangle towards the downside caught our attention. With the clear break and an ensuing retest, Corn is now trading right on previous support levels. We think this might just be a small reprieve in the downward direction it is headed.

Not only that, when you zoom out to a longer timeframe, Corn has just broken its long-term trend support established since 2020.

This combined with the symmetrical triangle break proves to provide a strong bearish case from here. Classical chart pattern analysis points the take-profit range from the triangle pattern, at roughly 292 points away. From the initial point of breakout, 292 points away takes us back to the 360 level which was the average price seen from 2014 to 2020, back to pre-covid and pre-Russian/Ukraine conflict levels.

Additionally, in a or few previous analyses we emphasized how many of the commodities have started to return to ‘normality’ with prices moving back to pre-war levels. We have already seen Wheat and Soybean retracing most of the War rally as prices tumbled, therefore it’s not hard to see Corn do the same soon.

Other supporting fundamental factors include the falling Ethanol prices and in turn, lower usage of corn for Ethanol, resulting in overall supply to increase.

Fertilizer prices have also fallen from all-time highs, with continued downward momentum. Lower fertilizer cost means better margins for the farmers and potentially higher usage of fertilizers in planting, which may result in better crop yield. Both factors work to lower corn price through more competitive pricing from the farmers and increased supply.

Combined, we think the fundamental and technical chart set-up provides a convincing case for Corn to fall lower. We set our stops above the triangle apex and at the previous level of resistance, 688, and our initial take-profit levels at 565 followed by 455, giving us a risk reward of roughly 1.46 and 3.66 from the current level of 637.6. Each 0.0025 point increment in CME Corn Futures is equal to 12.5 USD.

The charts above were generated using CME’s Real-Time data available on TradingView. Inspirante Trading Solutions is subscribed to both TradingView Premium and CME Real-time Market Data which allows us to identify trading set-ups in real-time and express our market opinions. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Disclaimer:

The contents in this Idea are intended for information purpose only and do not constitute investment recommendation or advice. Nor are they used to promote any specific products or services. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios. A full version of the disclaimer is available in our profile description.

Reference:

www.cmegroup.com

www.cmegroup.com

Good Risk/Reward for May2023 Corn LongsTaking a look at K23 Corn futures, a great risk to reward setup has shown itself. Looking back to the beginning of 2023, Corn has retreated to support, and held overnight(~650). Using a tight stop (644), one can surmise that you can risk ~6 to gain ~30, as 680 is previous resistance. Happy Trading!

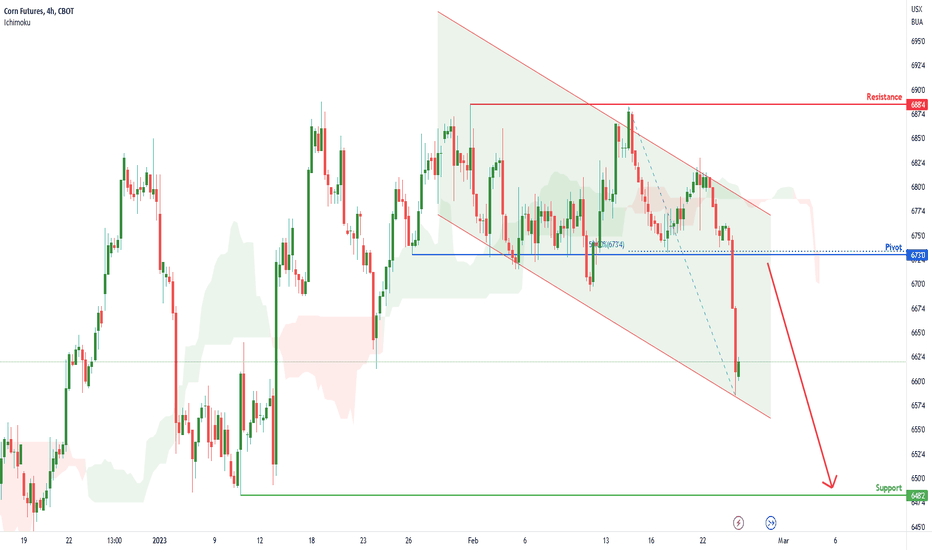

Corn Futures ( ZC1! ), H4 Potential for Bearish DropTitle: Corn Futures ( ZC1! ), H4 Potential for Bearish Drop

Type: Bearish Drop

Resistance: 688.50

Pivot: 673.00

Support: 648.25

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bearish due to the current price crossing below the Ichimoku cloud, indicating a bearish market. To add confluence to this bias, price is also within a descending channel. If this bearish momentum continues, expect price to possibly retest the pivot at 673.00 where the overlap resistance and 50% Fibonacci line is before heading towards the support at 648.25, where the previous swing low is.

Alternative scenario: Price may head back up to retest the resistance at 688.50 where the recent high is located.

Fundamentals: There are no major news.

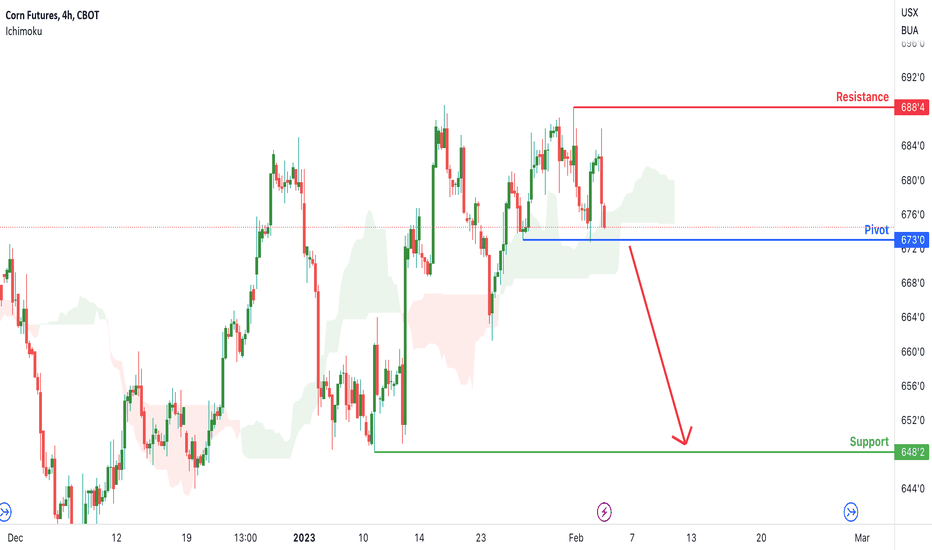

Corn Futures ( ZC1! ), H4 Potential for Bearish DropTitle: Corn Futures ( ZC1! ), H4 Potential for Bearish Drop

Type: Bearish Drop

Resistance: 688.50

Pivot: 673.00

Support: 648.25

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bearish due to the current price crossing below the Ichimoku cloud , indicating a bearish market. If this bearish momentum continues, expect price to possibly head towards the support at 648.25, where the previous swing low is.

Alternative scenario: Price may head back up to retest the resistance at 688.50 where the recent high is located.

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bearish DropTitle: Corn Futures ( ZC1! ), H4 Potential for Bearish Drop

Type: Bearish Drop

Resistance: 688.50

Pivot: 673.00

Support: 648.25

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bearish due to the current price crossing below the Ichimoku cloud, indicating a bearish market. If this bearish momentum continues, expect price to possibly head towards the support at 648.25, where the previous swing low is.

Alternative scenario: Price may head back up to retest the resistance at 688.50 where the recent high is located.

Fundamentals: There are no major news.

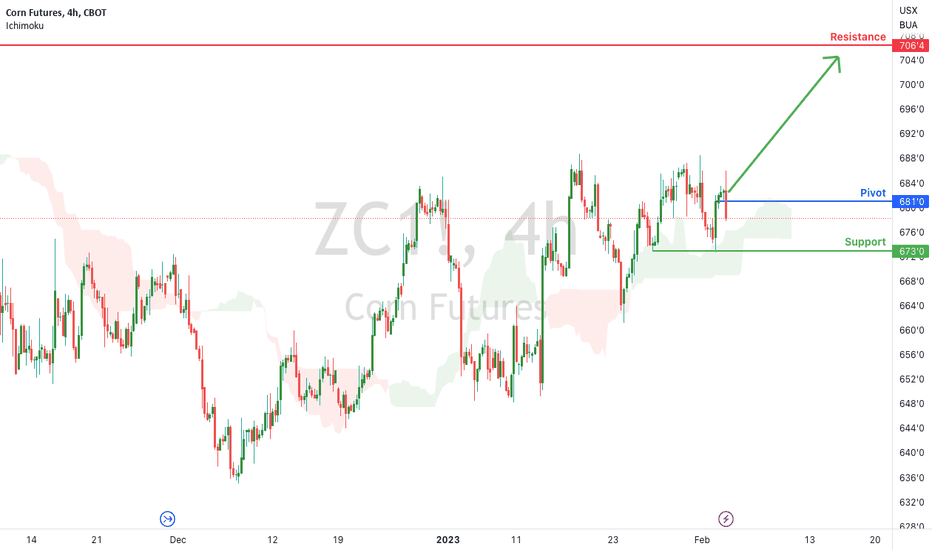

Corn Futures ( ZC1! ), H4 Potential for Bullish ContinuationTitle: Corn Futures ( ZC1! ), H4 Potential for Bullish Continuation

Type: Bullish Continuation

Resistance: 706.50

Pivot: 6681.00

Support: 673.00

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bullish due to the current price being above the Ichimoku cloud , indicating a bullish market. If this bullish momentum continues, expect price to possibly head towards the resistance at 706.50, where the previous swing high is.

Alternative scenario: Price may head back down to retest the support at 673.00 where the recent low is located.

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bullish ContinuationTitle: Corn Futures ( ZC1! ), H4 Potential for Bullish Continuation

Type: Bullish Continuation

Resistance: 706.50

Pivot: 6681.00

Support: 673.00

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market. If this bullish momentum continues, expect price to possibly head towards the resistance at 706.50, where the previous swing high is.

Alternative scenario: Price may head back down to retest the support at 673.00 where the recent low is located.

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bullish RiseTitle: Corn Futures ( ZC1! ), H4 Potential for Bullish Rise

Type: Bullish Rise

Resistance: 706.50

Pivot: 688.75

Support: 661.25

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bullish due to the current price being above the Ichimoku cloud , indicating a bullish market. If this bullish momentum continues, expect price to possibly head towards the resistance at 706.50, where the previous swing high is.

Alternative scenario: Price may head back down to retest the support at 661.25 where the 61.8% Fibonacci line and recent low are located.

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bullish RiseTitle: Corn Futures ( ZC1! ), H4 Potential for Bullish Rise

Type: Bullish Rise

Resistance: 706.50

Pivot: 688.75

Support: 661.25

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market. If this bullish momentum continues, expect price to possibly head towards the resistance at 706.50, where the previous swing high is.

Alternative scenario: Price may head back down to retest the support at 661.25 where the 61.8% Fibonacci line and recent low are located.

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bearish DropTitle: Corn Futures ( ZC1! ), H4 Potential for Bearish Drop

Type: Bearish Drop

Resistance: 671.75

Pivot: 660.00

Support: 636.00

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bearish due to the current price being below the Ichimoku cloud, indicating a bearish market. If this bearish momentum continues, expect price to possibly continue heading towards the support at 636.00, where the previous swing low is.

Alternative scenario: Price may head back up to retest the pivot at 660.00 where the 50% Fibonacci line is.

Fundamentals: There are no major news.