ZQ1! trade ideas

SP500 Dividend Yield greater than 10 Year US Bond Yield ... When SP500 dividend yield greater than 10 Year US bond yield, stocks, in general, look cheap on a relative basis ... So as the chart suggests, in this current cycle only, when this happed lead to a long period of a recycle bull market for stocks...

LIBOR OIS SpreadSpread b/w variable and fixed rates. As the spread widens, it expresses the propensity for banks to hold excess reserves over lending. During an expansion, the spread generally hovers between +/- 6 bps. During the credit crisis of 2008, the spread expanded wider than 360 bps. Moving into the back half of 2019, it will be critical to keep a close eye on this metric.

Short August Fed Fund FuturesAugust Fed Fund Futures are currently pricing a 27% chance that the Fed will cut by 50 basis points or 0.5% at the end of July. ( The July 31st meeting to be exact). Historically the Fed has only cut interest rates by 0.5% twice before in its entire history. Once in 1999 (we know what was happening then) and once in 2007 (we know what was happening then). Today, we don't see the same froth and insanity we did in those two bubbles in credit or otherwise. If the Fed did cut by 0.5% in July then I would also sell equities like crazy because it would mean the Fed sees something really bad compared to what markets see. There is NOT a Fed meeting in August.

The strategy is to sell the August Fed fund futures down to 97.78 which is where the market is simply pricing in ONE cut of 0.25% for July, with a stop at 98 for the aggressive traders, but lower for the less aggressive. Fed futures provide huge margin, so you can make almost 3x your required overnight margin maintenance even if the fed just cuts once. IF THE FED DOESN'T CUT, then you can make even more.

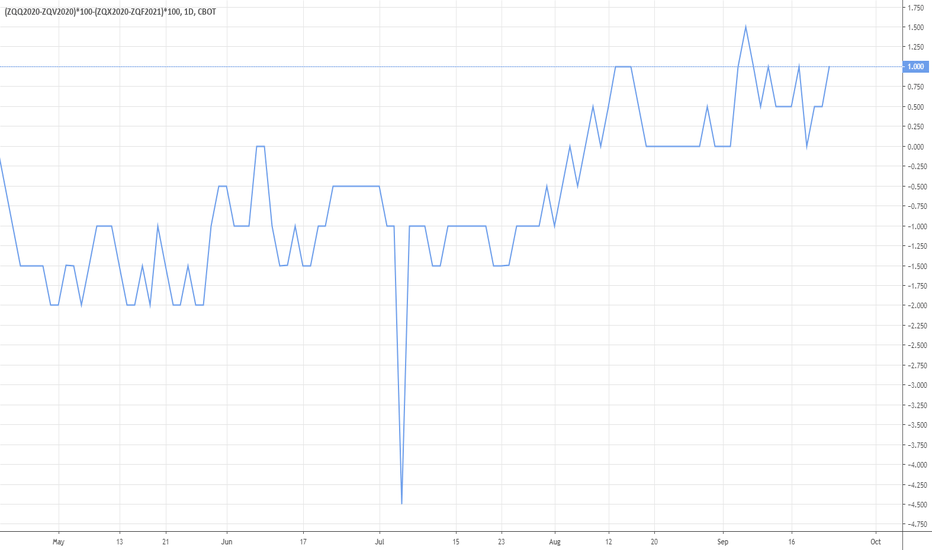

FED FUNDS CONDOR AUG19-OCT19 vs NOV19-JAN19FED FUNDS CONDOR AUG19-OCT19 vs NOV19-JAN19

(FFQ2019-FFV2019)*100-(FFX2019-FFF2020)*100

LIBOR-OIS Curve Trade Mar19 - Dec19LIBOR-OIS Spread between March19 - December19

((FFN2019-QEDM2019)-(FFF2020-QEDZ2019))*100

USD FX/ RATES RETRACE EARLIER GAINS: FED KAPLAN SPEECH HIGHLIGHTFed funds flopped back under 20% implied probability for a september hike following Fed Kaplans comments.

In reality the spike higher in early US trading was largely uncalled for with Rosengrens comments not much of a real impetus for long term stability.

As previously mentioned USD trading is likely to remain choppy, im opting to buy yen and short SPX and keep away from USD exposure for the time being given the rocky STIR environment which is likely to continue until the 21st sept.

Fed Kaplan Speech highlights:

Fed's Kaplan: Case For Raising Rates Has Strengthened Last Few Months

Kaplan: Making Frustratingly Slow Progress On Inflation

Kaplan: Cost To Rates At This Low Level, Creates Market Distortions

Kaplan: Path Of Rates Will Be Shallow

Kaplan: Neutral Interest Rate Lower Than People Think

Kaplan: Monetary Policy More Accommodative Than People Think

Kaplan: Not Much Urgency To Raise Rates

Kaplan: Fed Can Afford To Be Deliberate In Its Actions

Kaplan: Markets Have Plenty Of Notice

Kaplan: Making Frustratingly Slow Progress On Inflation

Fed Tarullo:

Fed Governor Daniel Tarullo said Friday he isn't ruling out the possibility of raising interest rates this year, but declined to say how he believed the Fed should act at its next meeting on monetary policy later this month.

Mr. Tarullo, in an interview on CNBC, said mixed economic data will make the Fed's next meeting a "robust discussion."

He said some indicators of inflation have ticked up recently, but there isn't sustained evidence that inflation is near the Fed's target.

"We have an opportunity to continue to get employment gains in this country," he said.

USD STIR RALLY PUTS USD BACK ON BID: FED ROSENGREN SPEECHFed Funds Rallied up from 18% to 33% on the day with Fed rosengrens hawkish comments the only likely impetus.

Imo DXY here at 95 mid has an easy 50bps of topside left in it if rates can hold here at 33%, UST also seen higher across the board with the bench mark 10y yield breaking pre-brexit levels.

Long DXY, and shorting $yen on rallies is the way I intend on playing this, yen from a risk-off perspective imo is still cheap whilst USD been heavily offer for the past week.. rates need to hold up though so this is tactical positioning rather than a structural 21st Sept Fed bet. SPX likely to remain underpressure too whilst rates trade here so short positioning is paying off though i still like SPX lower to 2000s and will be holding for this.

Fed Rosengren Speech Highlights:

Fed's Rosengren: Gradual Interest Rate Increases 'Appropriate'

Rosengren: U.S. Economy Resilient Despite Drag From Overseas

Rosengren: Could Reach or Exceed Full Employment 'Over the Course of the Next Year'

Rosengren: 'Reasonable Case' for Gradual Interest Rate Increases

Rosengren: Weakness in Recent GDP Readings Reflects Inventory Adjustments

Rosengren: Expects Growth to Exceed 2% Next Two Quarters

Rosengren: 80,000 to 100,000 Jobs a Month Needed to Keep Unemployment Rate Constant

Rosengren: Stock Prices, Volatility Gauge Show U.S. Resilience

Rosengren: Commercial Real Estate Prices Have Risen Rapidly

Rosengren: Risks to Forecast 'Increasingly Two-Sided'

Rosengren: Waiting Too Long to Raise Rates Could Lead to 'More Pronounced' Slowdown in Growth

Market Doesn't Fully Expect a Fed Hike Until March 2016The Fed's statement was simply 'in-line', but that is in-line with a distinctive hawkish view (calling for 2 rate hikes in 2015) from its previous meeting. For most intents and purposes, that is hawkish and thereby Dollar bullish (risk/SPX bearish). Yet, the market remains purposefully aloof. Fed Funds futures are showing liftoff is not 100% expected until the March 2016 meeting. This has the feel of complacency rather than a genuinely critical view of the Fed, and that could mean an inevitable adjustment - further Dollar rally, equity tumble - just when the music forces them to stop.

Fed and Market Still at Odds Over HikeDespite Yellen's remarks Friday reinforcing the views that were offered up at the policy meeting in June - that notably maintained a forecast for 50 bps worth of hikes before the year is out - the market is still very doubtful. Here we have Fed Fund futures which project rate expectations. Subtract the contract value from 100 to come to the rate forecast. Remember, the Fed is operating in a target 'range', so the median for the current rate is 0.125% and the first full hike would thereby bring us to 0.375% (an average). We don't hit that threshold - fully pricing in the first hike - until around the time of the March 16, 2016 FOMC meeting.