Long Term Prospects for WHEATUSDThe WHEATUSD, symbol ZW, is in a rally within a Bear Market with price trading above the 50 week ema and the 200 ema, but below the 800 week ema. The the long term emas are mostly flat, signaling accumulation / distribution. The price action appears to be finishing up the e-wave of a b-wave which should resolve in a c-wave down into late Spring. There is a definite Seasonal aspect to this market with strong rallies that occur around June time frame.

The Market is in a Bull Market on the daily, with price above the 50 ema, which is above the 200 and 800 emas. The 50 ema is in a strong uptrend along with the long term emas.. Price is topping out in the c-wave of a a-b-c rally and looks like it is putting in a M-Top. Price can be considered to be in an uptrend as long as it is above 549’2.

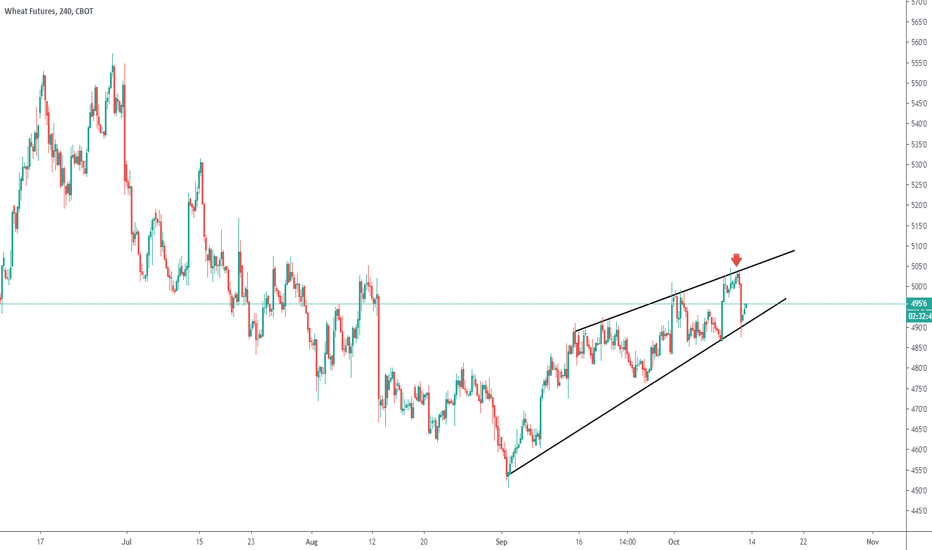

The Market is in a Bull Market on the 4 hour, with price trading back above the 50 ema, which is above the 200 ema, and above the 800 ema. Price is now technically correcting, having pulled back to the 30 ema, which is a warning. This market is out of E-waves. Probably trade up in the back end of the coming week to finish out an M-Top formation, before starting a greater down-trend.

This is my WHEATUSD look ahead for my own trading purposes. FUTURES trading involves risk. Feel free to comment, but trade off of this post at your own peril.

XW1! trade ideas

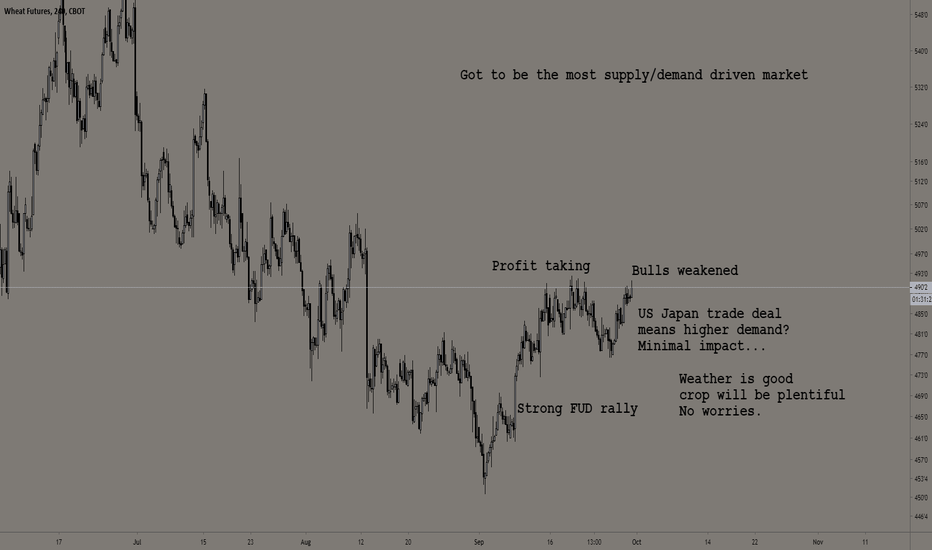

Bearish on grains & wheatBeen a while since I posted about agri.

Price is around its average now, I see no reason for it to skyrocket.

I don't think this little rally is a new trend, I see it as a correction.

And the short term uptrend is probably just noise that kindly comes fill my shorts.

Technically the price around 490-495 is a sweet spot to short this which makes it interesting.

We let the amateurs trade everything to make sure they don't miss out.

Market can stay irrational longer than you stay solvent so use a stop loss.

And also, it's not 100% sure the price is supposed to go down, might be wrong.

So in any case, stop loss (or something else) is good.

ZWZ2019-ZSX2019 - Commodity Spread TradingZWZ2019-ZSX2019

Wheat December 2019 - Soya November 2019

Interesting spread between the December futures contract of Wheat and the November contract of Soya.

As it is statistically deduced from our software, in this case the Moore Research, we have a percentage equal to 87% in which this difference is reduced, and therefore, a normal convergence of the two values of the contracts that bring their distance closer to 0 rather than move it away.

The very nice thing about this type of operation is the reduction of the volatility that can cause sometimes big problems. For example if on the soya there should be some important news its value could vary suddenly and the grain, being a correlated of it, would follow it consequently and it is for this reason that through the Spread Trading these potential unexpected problems are avoided.

www.mrci.com

ZW1! - What to expect on 4HR - WHEAT FUTURESPossible trend reversal coming up, needs a few closes below the line marked w/ text. Simple trade guys. If it closes below let it fall, get short on the pull back OR vice versa. No trade yet, just waiting for a directional signal. Gut says short it though. NOT FINANCIAL ADVICE, TRADE SAFE!