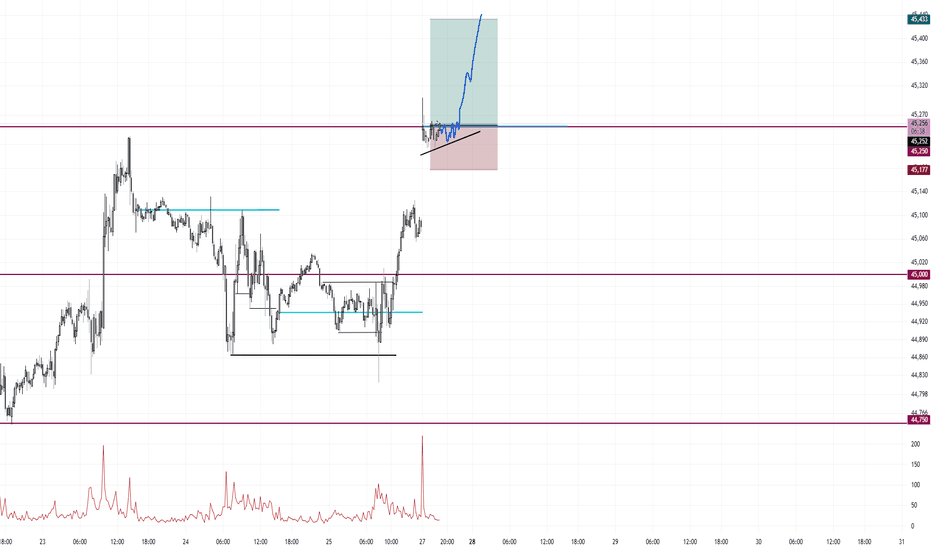

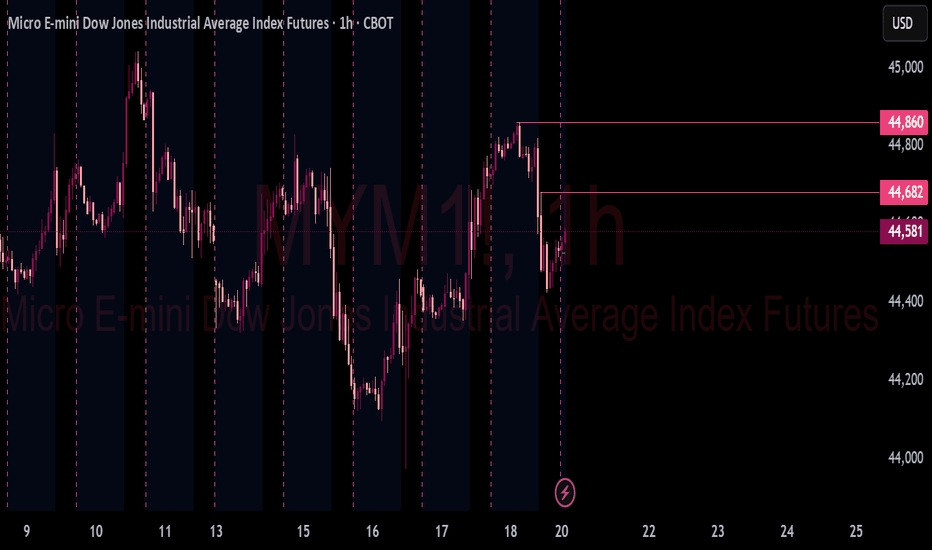

Dow Jones Monday Gap and Rally Long Trade EntryI am going for a gap up and rally idea. Extremely bullish bias. I am already triggered in Long at 45,252

stop is 75 ticks

target is 180 ticks

This is my one trade for the day.

Same idea as Sunday May 11th where it too gapped up at the open over 1% and right into 250 for the rally all day

Toda

Related futures

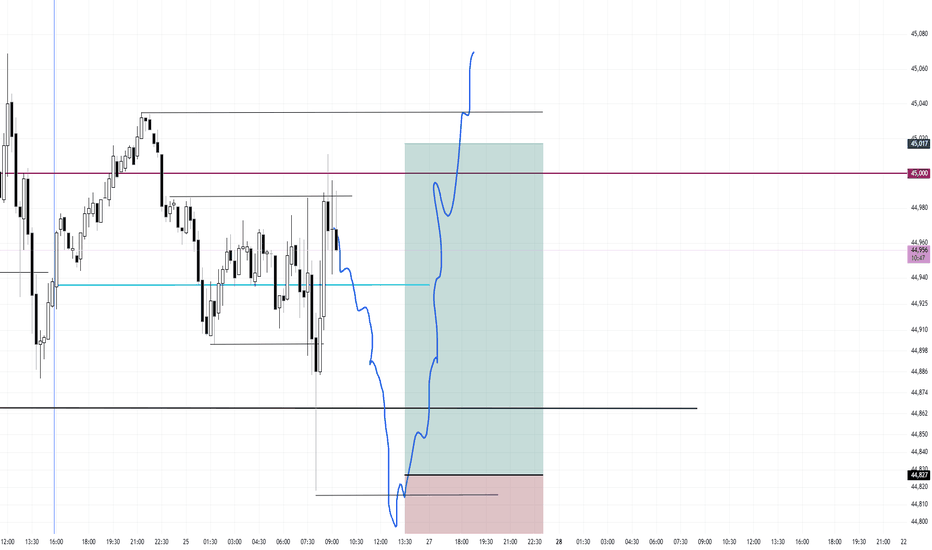

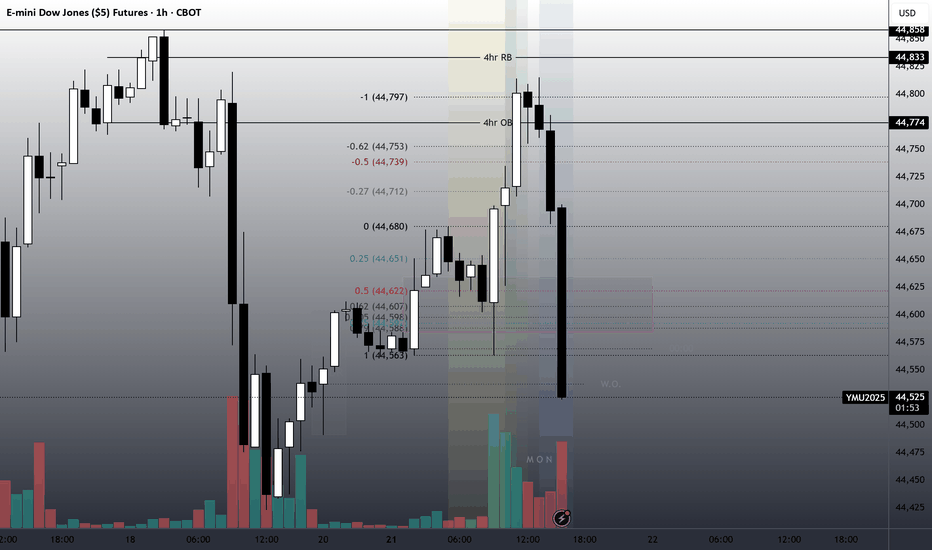

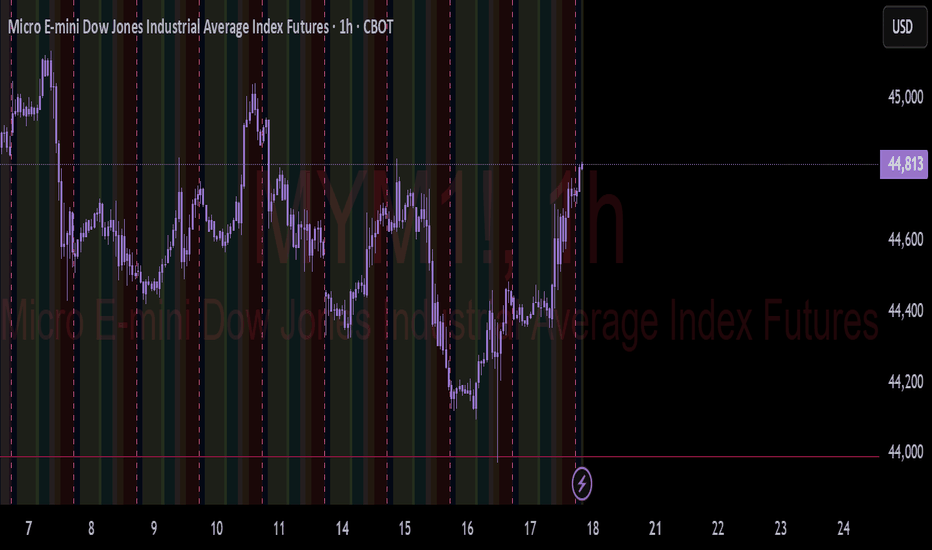

Range Bound Low of Day Buy (If Presented)Price is mean reverting around 45,000 and also mean reverting around today's open. I will be waiting for a mean reversion play under the low of day targeting the high of day.

I will be waiting for a small entry candle, a small doji. I did not take this first run up because the entry vs stop would

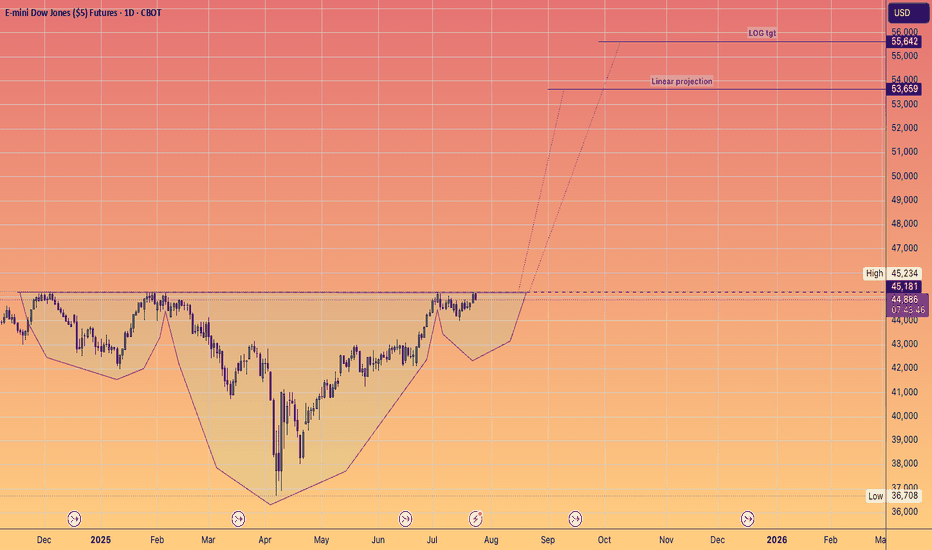

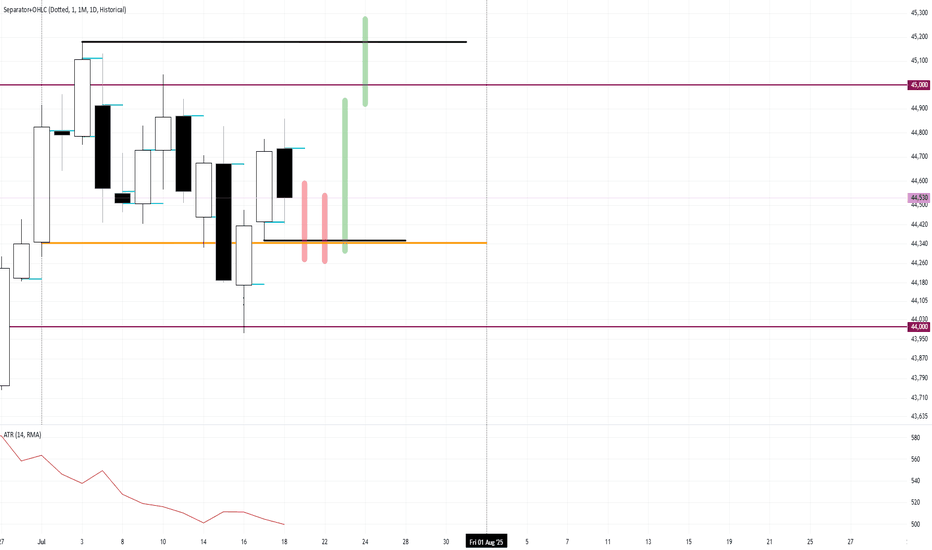

Monday and Tuesday Going To Be Down/Doji Resting Days Avoid!!Based on my intuition, Monday and Tuesday look to be avoided. Small, Doji days that will chop around on top of Monthly open and slightly under Thursday's Low. I will wait until Wednesday to look for the buy low day to take out Friday, Monday, Tuesday.

I bet price will open slightly down with a gap

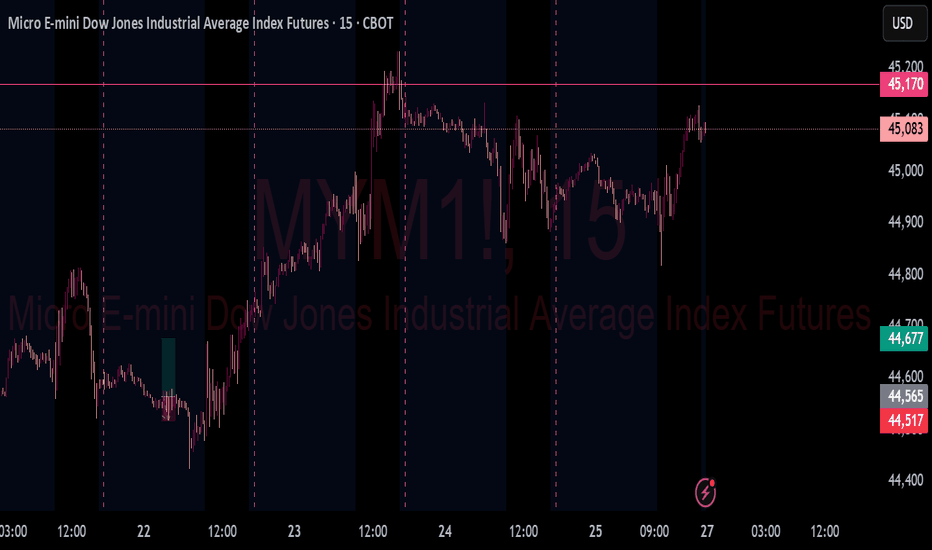

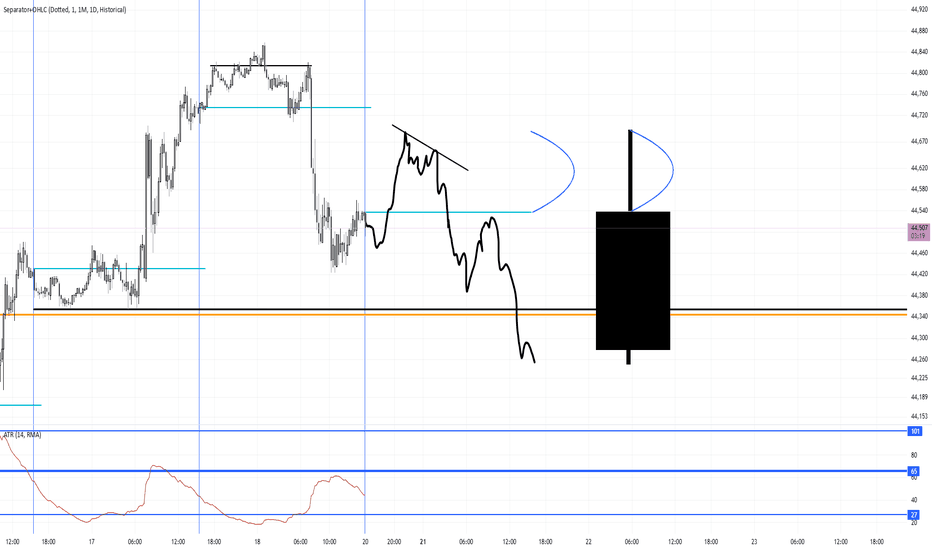

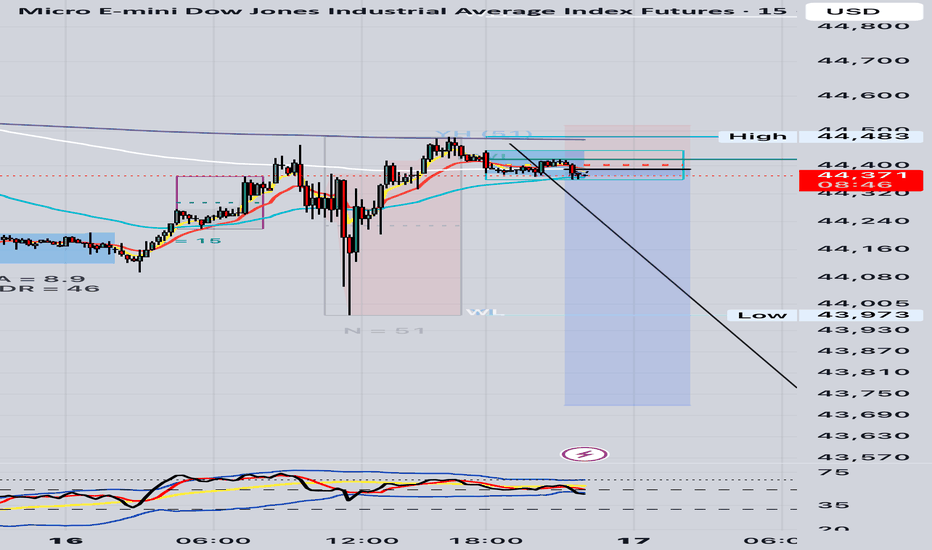

Today is the dayI found a "reaper" block today.

Were Bullish.

The Rejection block is measured from High to Low.

Tp to 1 Standard deviation.

Price knocks out buyers back into reaper FVG.

Price enters zone on top of a 1hr Orderblock at 10am.

A reaper is a Fair value gap in a discount of the impulsive price leg o

Monday Down Day (Want to Sell High on the Daily Wick)If Monday will be a down day, your best bet would be to finesse an entry ABOVE the open to form the Daily candle's upper wick. I would not sell anywhere else other than ABOVE. Look for a double top formation. It all depends on how the day sets up.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of E-mini Dow Jones Industrial Average Index Futures (Sep 2025) is 45,069 USD — it has fallen −0.02% in the past 24 hours. Watch E-mini Dow Jones Industrial Average Index Futures (Sep 2025) price in more detail on the chart.

The volume of E-mini Dow Jones Industrial Average Index Futures (Sep 2025) is 23.15 K. Track more important stats on the E-mini Dow Jones Industrial Average Index Futures (Sep 2025) chart.

The nearest expiration date for E-mini Dow Jones Industrial Average Index Futures (Sep 2025) is Sep 19, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell E-mini Dow Jones Industrial Average Index Futures (Sep 2025) before Sep 19, 2025.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For E-mini Dow Jones Industrial Average Index Futures (Sep 2025) this number is 85.73 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for E-mini Dow Jones Industrial Average Index Futures (Sep 2025) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for E-mini Dow Jones Industrial Average Index Futures (Sep 2025). Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of E-mini Dow Jones Industrial Average Index Futures (Sep 2025) technicals for a more comprehensive analysis.