CFDGOLD trade ideas

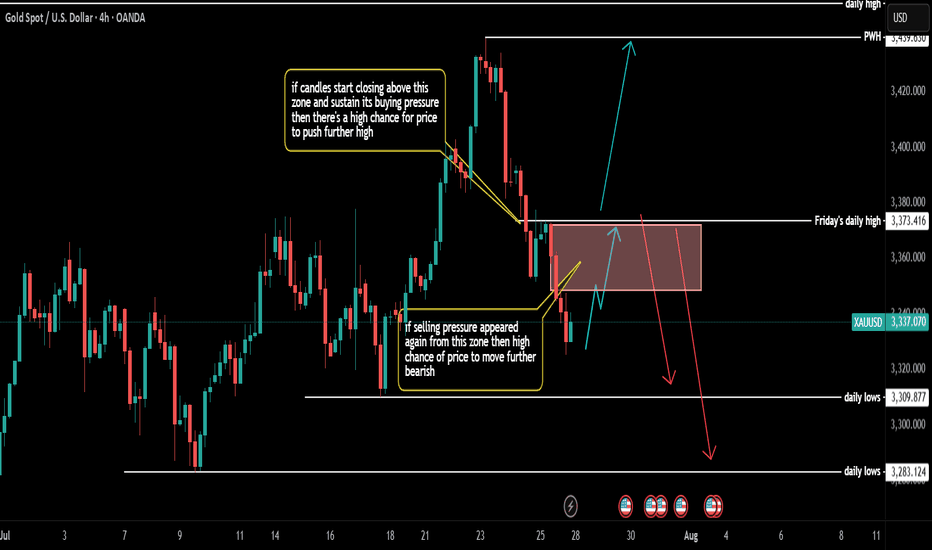

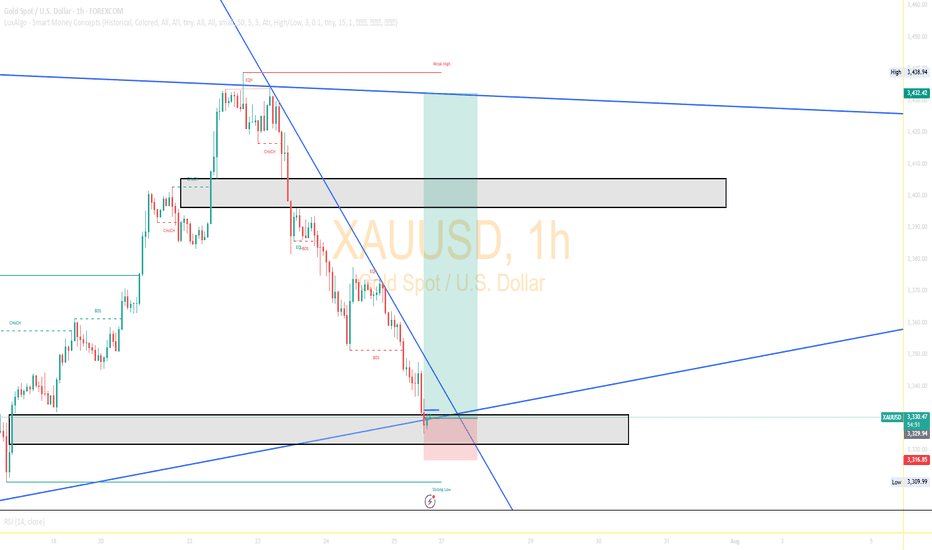

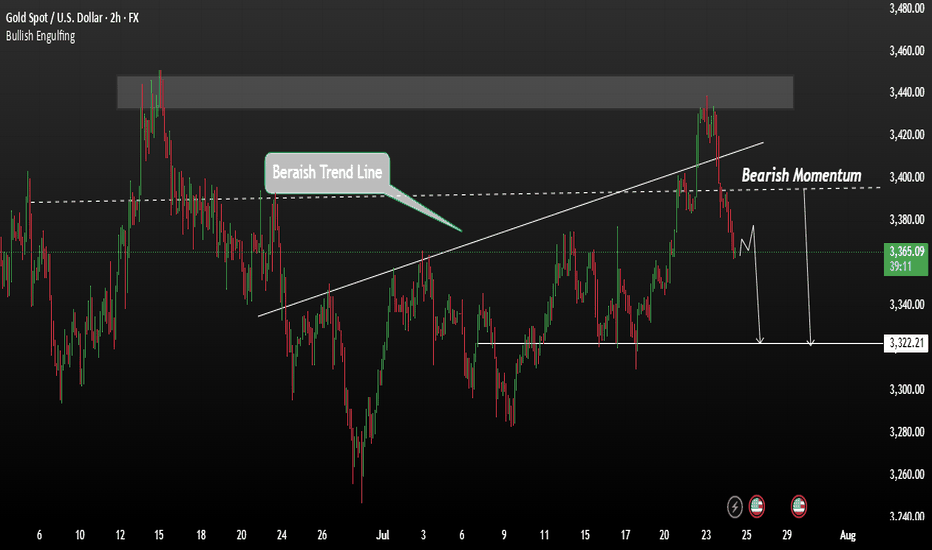

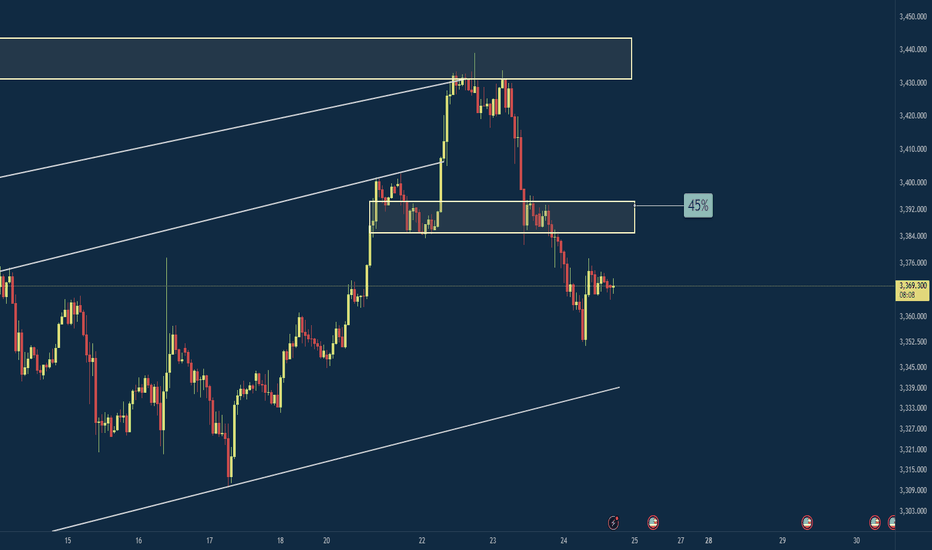

XAUUSD Update July 2025 - PLAN B - Bulls RejectionAfter Hard fall from 3439 ( 3450 rejection ), Gold will retest 3310 support.

If bounce from here, it will move upside and retest 3373 resistance.

If any hard rejection from 3373 resistance area, its a sign that price will move to make a lower low.

Becarefull in this accumulation zone.

Bearish movement still hiding before it break 3120 support.

Have a blessing day !

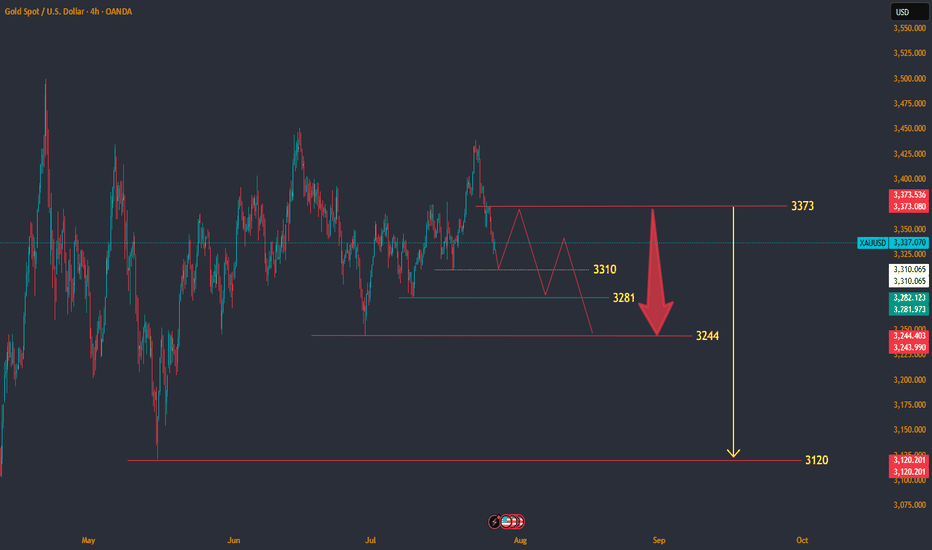

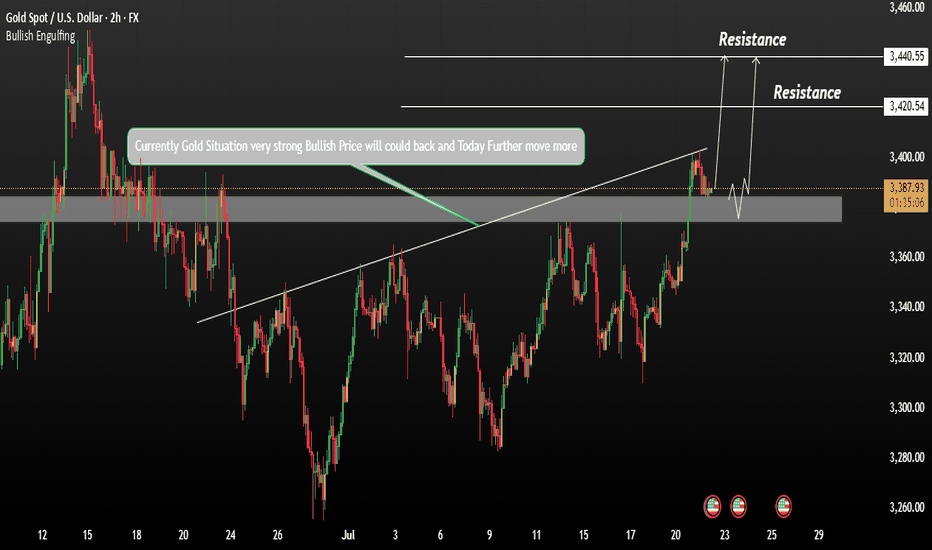

GOLD NEXT MOVE (expecting a bullish move)(18-07-2025)Go through the analysis carefully and do trade accordingly.

Anup 'BIAS for the day (18-07-2025)

Current price- 3350

"if Price stays above 3330, then next target is 3360, 3378 and 3407 and below that 3310 and 3280 ".

-POSSIBILITY-1

Wait (as geopolitical situation are worsening )

-POSSIBILITY-2

Wait (as geopolitical situation are worsening)

Best of luck

Never risk more than 1% of principal to follow any position.

Support us by liking and sharing the post.

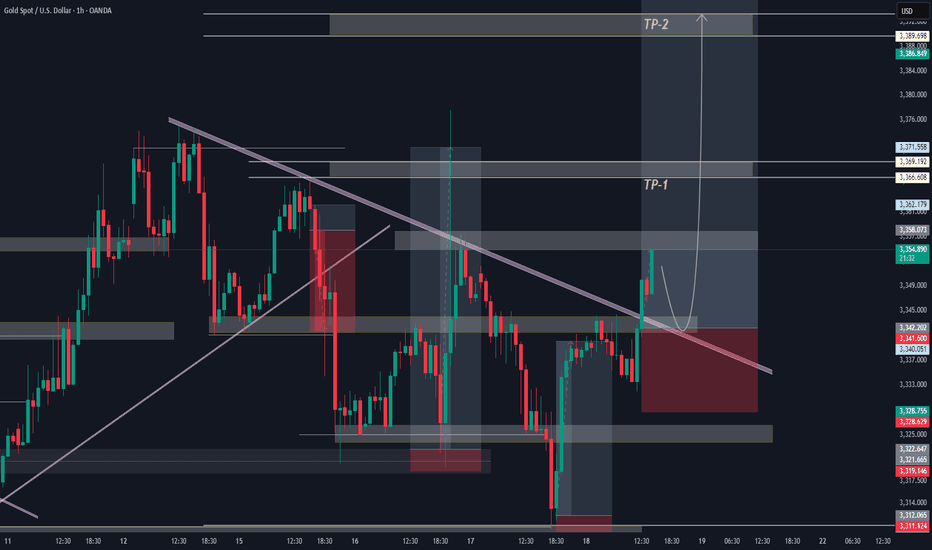

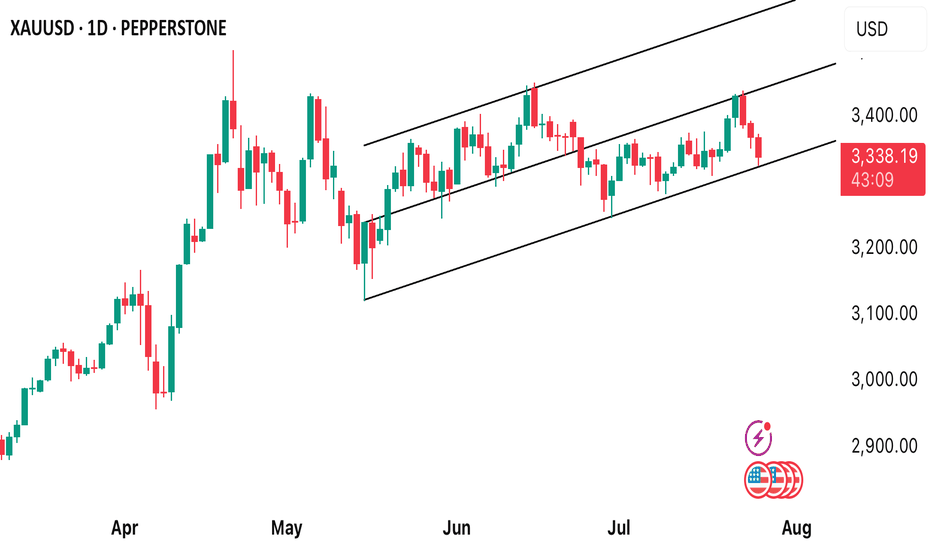

GOLD (XAUUSD): Bullish Move Ahead?!

I think that Gold is going to rise soon.

The price is now entering a strong demand area

based on a horizontal support and a rising trend line.

The price may pull back to 3376 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

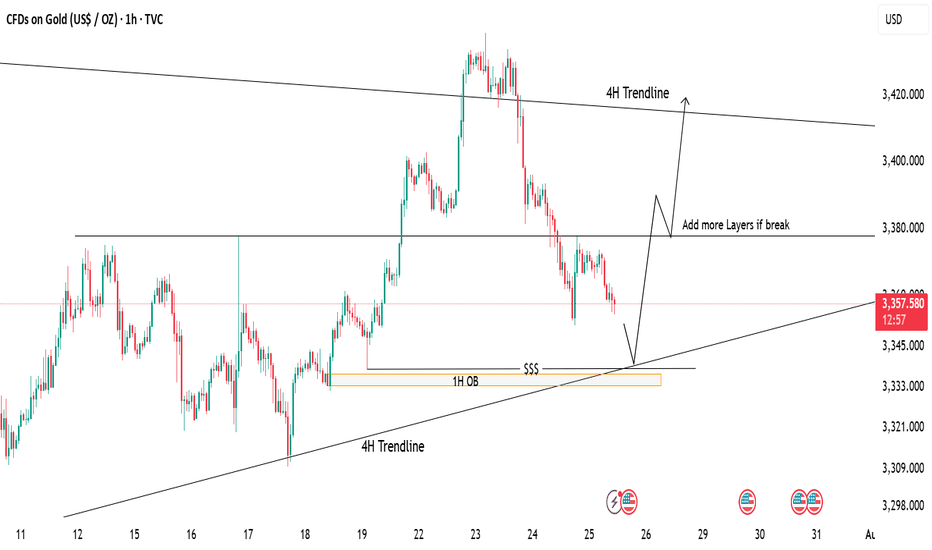

Gold Tapping Into Major Support – Eyes on Bullish ReversalPrice is currently retracing after a strong drop from recent highs. We're now approaching a key demand zone, aligning with:

📍 1H Order Block (OB)

📍 4H Trendline Support

📍 Liquidity Zone ($$$)

📉 If price taps into this area, it may offer a high-probability long setup.

📈 First target: 3380 (mid-range resistance)

🧱 If this breaks, we can look to scale in/add more positions, targeting the 4H trendline zone near 3420.

⚠️ Waiting for price reaction at support – patience is key!

Japanese Candlestick Cheat Sheet – Part OneSingle-Candle Formations That Speak

Before you dream of profits, learn the one language that never lies: price.

Indicators are just subtitles — price is the voice.

Japanese candlesticks are more than just red and green bars — they reflect emotion, pressure, and intention within the market.

This series will walk you through the real psychology behind candlestick patterns — starting here, with the most essential:

🕯️ Single-candle formations — the quiet signals that often appear before big moves happen.

If you can’t read a doji, you’re not ready to understand the market’s hesitation.

If you ignore a hammer, you’ll miss the moment sentiment shifts.

Let’s start simple. Let’s start strong.

This is Part One of a five-part series designed to build your candlestick fluency from the ground up.

1. DOJI

Bias: Neutral

What is the Doji pattern?

The Doji candlestick pattern forms when a candle’s open and close prices are nearly identical, resulting in a small or nonexistent body with wicks on both sides. This pattern reflects market equilibrium, where neither buyers nor sellers dominate. Dojis often appear at trend ends, signaling potential reversals or pauses.

As a fundamental tool in technical analysis, Dojis help traders gauge the psychological battle between buyers and sellers. Proper interpretation requires context and experience, especially for spotting trend shifts.

Meaning:

Indicates market indecision or balance. Found during trends and may signal a reversal or continuation based on context.

LONG-LEGGED DOJI

Bias: Neutral

What is the Long-Legged Doji pattern?

The Long-Legged Doji captures a moment of intense uncertainty and volatility in the market. Its long wicks represent significant movement on both sides, suggesting that neither buyers nor sellers have control. This back-and-forth reflects the psychology of market participants wrestling for control, which often foreshadows a shift in sentiment. When traders see a Long-Legged Doji, it highlights the need to monitor for potential changes in direction.

They can appear within trends, at potential reversal points, or at consolidation zones. When they form at the end of an uptrend or downtrend, they often signal that the current trend may be losing momentum.

Meaning:

The prominent wicks indicate volatility. Buyers and sellers pushed prices in opposite directions throughout the session, ultimately reaching an indecisive close.

SPINNING TOP

Bias: Neutral

What is the Spinning Top pattern?

A Spinning Top is a candlestick with a small body and long upper and lower wicks, indicating that the market has fluctuated significantly but ultimately closed near its opening price. This pattern often points to a moment of indecision, where both buyers and sellers are active but neither dominates. Spinning Tops are commonly found within both uptrends and downtrends and can suggest that a trend is losing momentum.

For traders, a Spinning Top provides a valuable insight into market psychology, as it hints that the prevailing sentiment may be weakening. While Spinning Tops alone aren’t always definitive, they can serve as a precursor to larger moves if the following candles confirm a shift in sentiment.

Meaning:

Shows indecision between buyers and sellers. Common in both up and downtrends; signals potential reversal or pause.

HAMMER

Bias: Bullish

What is the Hammer pattern?

A Hammer candlestick appears at the end of a downtrend, with a small body and a long lower wick. This shape reflects a moment when sellers pushed prices lower, but buyers managed to absorb the selling pressure and drive prices back up before the close. This pattern is particularly important for spotting potential reversals, as it indicates that buyers are beginning to reassert control.

Hammers reveal the underlying psychology of a market where buying confidence is emerging, even if sellers have dominated for a while. To successfully trade this pattern, it’s essential to confirm the reversal with subsequent candles.

Meaning:

Showing rejection of lower prices. Signals potential bullish reversal, especially if followed by strong buying candles.

INVERTED HAMMER

Bias: Bullish

What is the Inverted Hammer pattern?

The Inverted Hammer forms at the bottom of a downtrend, with a small body and long upper wick. This pattern shows that buyers attempted to push prices higher, but sellers ultimately brought them back down by the close. The Inverted Hammer is an early sign of buyer interest, hinting that a trend reversal may be underway if subsequent candles confirm the shift.

Interpreting the Inverted Hammer helps traders understand where sentiment may be shifting from bearish to bullish, often marking the beginning of a recovery. Recognizing these patterns takes practice and familiarity with market conditions.

Meaning:

Showing rejection of higher prices. Can signal bullish reversal if confirmed by subsequent buying pressure.

DRAGONFLY DOJI

Bias: Bullish

What is the Dragonfly Doji pattern?

The Dragonfly Doji has a long lower wick and no upper wick, forming in downtrends to signal potential bullish reversal. This pattern reveals that sellers were initially in control, pushing prices lower, but buyers stepped in to push prices back up to the opening level. The Dragonfly Doji’s unique shape signifies that strong buying support exists at the lower price level, hinting at an impending reversal.

Recognizing the psychology behind a Dragonfly Doji can enhance a trader’s ability to anticipate trend changes, especially in markets where support levels are being tested.

Meaning:

Found in downtrends; suggests possible bullish reversal if confirmed by a strong upward move.

BULLISH MARUBOZU

Bias: Bullish

What is the Bullish Marubozu pattern?

The Bullish Marubozu is a large, solid candle with no wicks, indicating that buyers were in complete control throughout the session. This pattern appears in uptrends, where it signals strong buying momentum and often foreshadows continued upward movement. The absence of wicks reveals that prices consistently moved higher, with little resistance from sellers.

For traders, the Bullish Marubozu offers a glimpse into market psychology, highlighting moments when buyer sentiment is particularly strong. Learning to identify these periods of intense momentum is crucial for trading success.

Meaning:

Showing complete buying control. Found in uptrends or at reversal points; indicates strong buying pressure and likely continuation of the trend.

SHOOTING STAR

Bias: Bearish

What is the Shooting Star pattern?

The Shooting Star appears at the top of an uptrend, characterized by a small body and a long upper wick, indicating a potential bearish reversal. Buyers initially drove prices higher, but sellers took over, bringing prices back down near the open. This shift suggests that buyers may be losing control, and a reversal could be imminent.

Interpreting the Shooting Star gives traders valuable insights into moments when optimism begins to fade, providing clues about a potential trend shift.

Meaning:

Indicating rejection of higher prices. Signals a potential bearish reversal if followed by selling pressure.

HANGING MAN

Bias: Bearish

W hat is the Hanging Man pattern?

The Hanging Man candle forms at the top of an uptrend, with a small body and long lower wick. This pattern suggests that sellers attempted to drive prices down, but buyers regained control. However, the presence of a long lower shadow hints that sellers may be gaining strength, potentially signaling a bearish reversal.

The Hanging Man pattern reflects market psychology where buyers might be overextended, making it a valuable tool for identifying potential tops in trends.

Meaning:

Signals potential bearish reversal if confirmed by selling candles afterward.

GRAVESTONE DOJI

Bias: Bearish

What is the Gravestone Doji pattern?

With a long upper wick and no lower wick, the Gravestone Doji reveals that buyers pushed prices up, but sellers eventually regained control. Found in uptrends, it suggests that a bearish reversal could be near, as the upper shadow indicates buyer exhaustion. The Gravestone Doji often appears at market tops, making it a valuable indicator for those looking to anticipate shifts.

Understanding the psychology behind this pattern helps traders make informed decisions, especially in markets prone to overbought conditions.

Meaning:

Showing rejection of higher prices. Found in uptrends; signals potential bearish reversal if followed by selling activity.

BEARISH MARUBOZU

Bias: Bearish

What is the Bearish Marubozu pattern?

The Bearish Marubozu is a large, solid bearish candle without wicks, showing that sellers held control throughout the session. Found in downtrends, it signals strong bearish sentiment and suggests that the trend is likely to continue. The lack of wicks reflects consistent downward momentum without significant buyer support.

This pattern speaks about market psychology, offering traders insights into moments of intense selling pressure. Recognizing the Bearish Marubozu can help you align with prevailing trends and avoid buying into weakening markets

Meaning:

Showing strong selling pressure. Found in downtrends; signals continuation of the bearish trend or an intensifying sell-off.

👉 Up next: Double-candle formations – where price meets reaction.

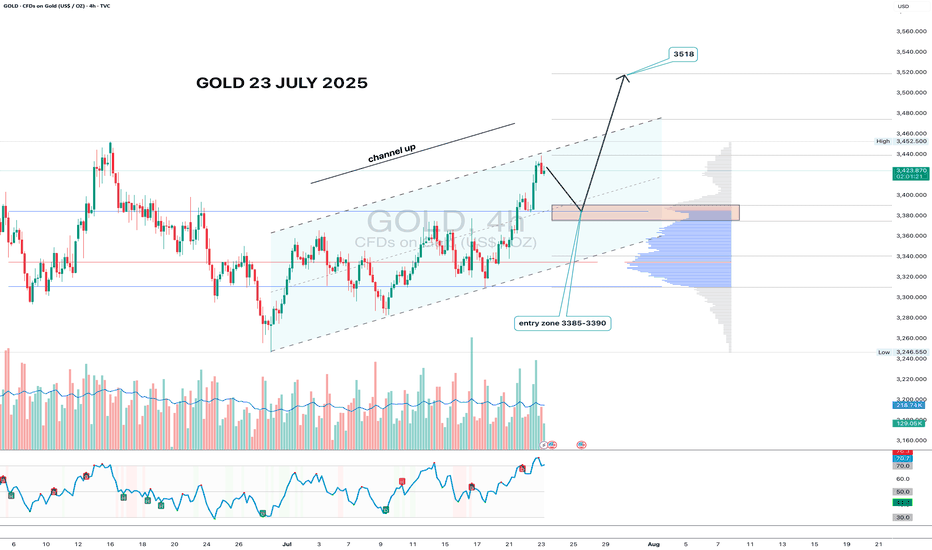

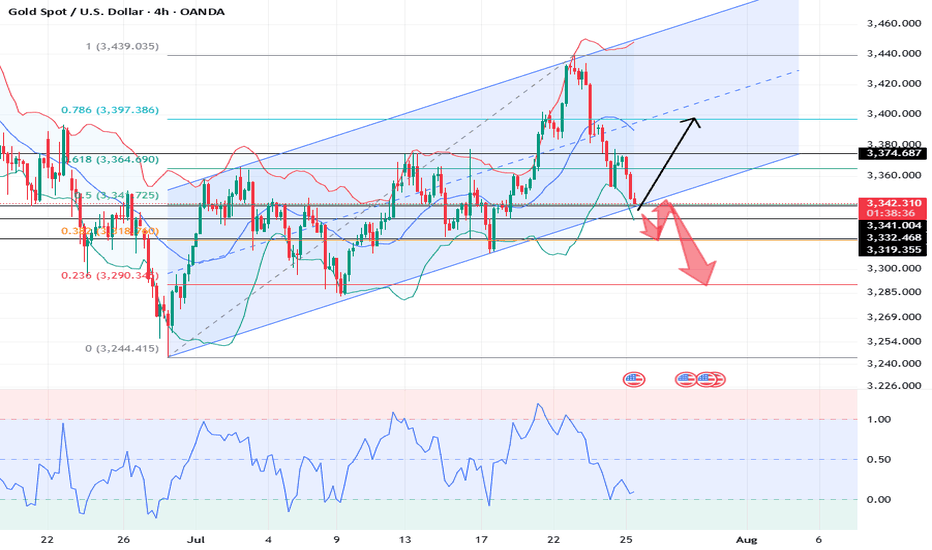

Gold 4H - channel breakout, looking for 3518 nextGold has formed a clean ascending channel on the 4H chart, broke out above resistance, and is now pulling back into the 3385–3390 zone. This area aligns with volume clusters - a perfect entry zone for bulls waiting on the sidelines.

If price holds this zone and prints a reversal candle with volume, the upside target remains at 3518 - the 1.618 Fibonacci extension and historical resistance. Volume increased during the breakout move, confirming interest. RSI still has room to go higher, supporting the bullish continuation.

Fundamentally, gold remains a safe-haven asset amid geopolitical tension, USD weakness, and potential Fed easing. Central bank accumulation further supports the bullish case.

Tactical setup:

— Entry zone: 3385–3390

— Trigger: candle confirmation + volume

— Target: 3518

— Invalidation: break below 3360 without buyer volume

If the plan plays out — gold might shine bright while bears squint in disbelief.

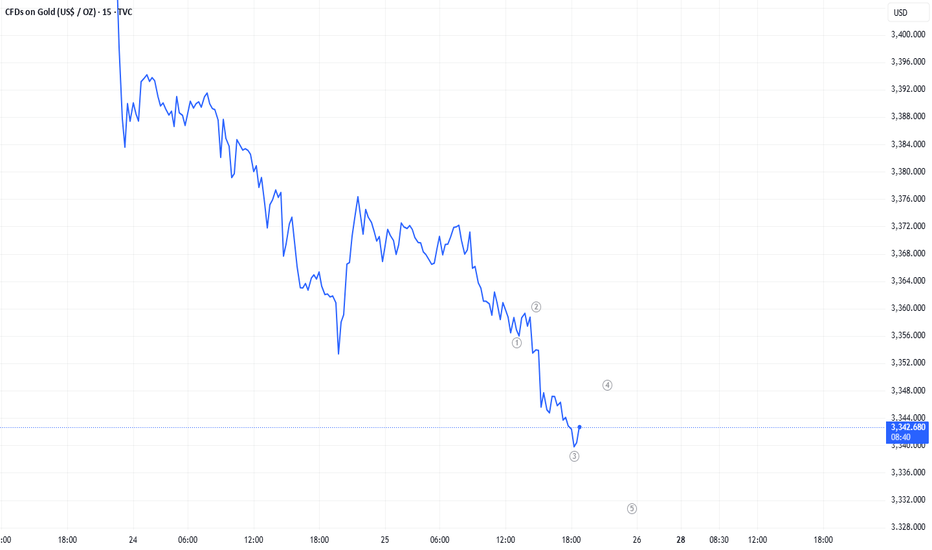

XAUUSD: Market Analysis and Strategy for July 25Gold technical analysis:

Daily chart resistance 3400, support 3300

4-hour chart resistance 3375, support 3342

1-hour chart resistance 3350, support 3333.

Gold, starting from 3438 this Wednesday, has fallen by nearly $100. It rebounded quickly after falling to 3351 yesterday. After sideways fluctuations in the Asian session, the current price is around 3343, and the key support below is around 3333. From a spatial point of view, this wave of adjustment is nearing its end. After waiting for the adjustment to be completed, the market will most likely return to an upward trend.

The short-term top and bottom resistance at the 1-hour level is around 3351. For intraday short-term operations, the current gold price is around 3343. Pay attention to the bearish trend near 3351. If it does not break near 3333, it will be bullish again!

SELL: 3350near

BUY: 3333near

Japanese Candlestick Cheat Sheet – Part Two- 2 candle patternsTwo-Candle Patterns That Signal Shifts in Sentiment

Single candles whisper…

But two candles talk to each other — and when they do, they often reveal the first signs of a reversal or continuation.

In this second part of the series, we go deeper.

From engulfings to haramis, tweezer tops to piercing lines — these patterns don’t just look good on charts… they capture the psychological tug-of-war between buyers and sellers.

Price doesn’t lie.

And two candles in a row can say: “Something just changed.”

Learn to spot them early. Learn to listen when the chart speaks.

This is Part Two of your practical guide to mastering candlestick formations.

BULLISH KICKER

Bias: Bullish

What is the Bullish Kicker pattern?

The Bullish Kicker forms when a strong bullish candle follows a bearish one with no overlap between the two, indicating a sudden shift in sentiment. This pattern is a powerful indicator of a reversal as buyers take control. The sharp contrast between the bearish and bullish candles reflects a dramatic shift in market psychology, where bears are caught off-guard and forced to cover their positions.

Bullish Kickers are rare but extremely telling, providing a clear signal that sentiment is favoring buyers. Recognizing such decisive patterns can be a game-changer.

Meaning:

Found after downtrends or sell-offs; suggests a sudden shift in sentiment, indicating strong buying interest and potential trend reversal.

BULLISH ENGULFING

Bias: Bullish

What is the Bullish Engulfing pattern?

The Bullish Engulfing pattern occurs when a large bullish candle fully engulfs the previous smaller bearish candle, signaling a potential trend reversal. This pattern highlights a moment when buyers overpower sellers, often marking the beginning of upward momentum. Psychologically, it suggests that buyer confidence is returning, and sellers are losing their grip.

For traders, understanding Bullish Engulfing patterns can provide crucial entry points into emerging trends. Learning to identify and trade such patterns is essential for capturing momentum and new trends.

Meaning:

Typically found in downtrends, this pattern signals a potential bullish reversal as buyers overpower sellers, often indicating a shift toward upward momentum.

BULLISH HARAMI

Bias: Bullish

What is the Bullish Harami pattern?

The Bullish Harami consists of a small bullish candle within a preceding larger bearish one, indicating a pause in downward momentum and hinting at a potential reversal. This pattern shows that sellers are beginning to weaken as buyers cautiously test the waters. The Harami reflects a shift in sentiment from bearish to neutral, often marking a transitional phase in the market.

Interpreting the Bullish Harami helps traders spot moments when sentiment is shifting, potentially signaling the start of a trend change.

Meaning:

Seen in downtrends, it suggests indecision, with possible bullish reversal if the following candles confirm buying strength, indicating a weakening bearish trend.

PIERCING LINE

Bias: Bullish

What is the Piercing Line pattern?

The Piercing Line forms when a bullish candle opens below the previous bearish candle’s low but closes over halfway into it. Found in downtrends, this pattern reflects strong buying pressure as buyers step in at lower prices, creating a potential bullish reversal. The Piercing Line pattern suggests that sentiment may be shifting as buyers gain confidence.

This pattern’s strength lies in its psychological impact, revealing moments when buyers are willing to take risks. Recognizing these signs early can provide valuable insights for traders looking to time entries.

Meaning :

Found in downtrends, this pattern suggests a possible bullish reversal if buying continues, as sellers lose control to buyers.

TWEEZER BOTTOM

Bias: Bullish

What is the Tweezer Bottom pattern?

The Tweezer Bottom pattern is characterized by two consecutive candles with nearly identical lows, one bearish and one bullish. This pattern often signals the end of a downtrend, as the matching lows suggest a strong support level where buyers are stepping in. The Tweezer Bottom highlights market psychology at work, with sellers unable to push prices lower, reflecting renewed buying interest.

Tweezer Bottoms are ideal for traders looking to identify support zones and potential reversal points. By understanding this pattern’s significance, traders can make informed decisions.

Meaning:

Found in downtrends, it signals potential reversal, showing strong support at the matching low, suggesting buyers are stepping in.

BEARISH KICKER

Bias: Bearish

What is the Bearish Kicker pattern?

The Bearish Kicker is the inverse of the Bullish Kicker, forming when a strong bearish candle follows a bullish one without overlap, indicating a sharp sentiment shift. This pattern often marks a sudden reversal, with sellers taking control after an initial bullish period. Psychologically, Bearish Kickers are powerful, signaling that buyers are caught off-guard and losing momentum.

Recognizing Bearish Kickers provides traders with insights into sudden shifts in market dynamics, helping them avoid buying into weakening trends.

Meaning:

Found after uptrends; indicates a sudden sentiment shift, signaling potential trend reversal and intensified selling pressure.

BEARISH ENGULFING

Bias: Bearish

What is the Bearish Engulfing pattern?

The Bearish Engulfing pattern forms when a large bearish candle engulfs the previous smaller bullish candle, suggesting a potential reversal in an uptrend. This pattern signals that sellers have regained control, often marking the start of downward momentum. The Bearish Engulfing reveals a psychological shift, as selling pressure overtakes buying interest.

This pattern is a powerful tool for traders who aim to catch trend reversals, allowing them to align with emerging downward momentum.

Meaning:

Typically found in uptrends, this pattern signals a potential bearish reversal as sellers overpower buyers, often indicating a downward momentum shift.

BEARISH HARAMI

Bias: Bearish

What is the Bearish Harami pattern?

The Bearish Harami consists of a small bearish candle contained within a larger preceding bullish one, reflecting indecision and a potential trend reversal. Found in uptrends, it hints that buyers are losing strength, while sellers are cautiously testing the market. This pattern highlights moments when buyer momentum begins to wane, suggesting caution.

Interpreting the Bearish Harami allows traders to spot potential shifts in sentiment, helping them manage risk and time their exits.

Meaning:

Seen in uptrends, it suggests indecision with a potential bearish reversal if following candles confirm, indicating a weakening bullish trend.

DARK CLOUD COVER

Bias: Bearish

What is the Dark Cloud Cover pattern?

The Dark Cloud Cover appears when a bearish candle opens above the previous bullish candle but closes over halfway into it, reflecting a shift in control from buyers to sellers. This pattern suggests that bullish momentum may be fading, hinting at a potential reversal. Dark Cloud Cover patterns reveal moments when sentiment shifts from optimism to caution.

For traders, understanding this pattern helps them anticipate reversals at the top of uptrends.

Meaning:

Found in uptrends; signals potential bearish reversal if selling continues, as buyers lose control to sellers.

TWEEZER TOP

Bias: Bearish

W hat is the Tweezer Top pattern?

The Tweezer Top is formed by two candles with matching or nearly matching highs, typically one bullish and one bearish. This pattern signals potential resistance, as sellers are consistently pushing back against the same level. The Tweezer Top reflects a moment of seller strength, often marking the end of an uptrend.

Recognizing Tweezer Tops helps traders spot resistance zones and potential reversal points, allowing them to avoid buying into weakening trends or even shorting the asset.

Meaning:

Found in uptrends, it signals potential reversal, showing strong resistance at the matching high, suggesting selling pressure.

🧭 Final Thought

Two-candle formations often appear at key turning points — right where most traders hesitate or get trapped.

Learn to read them not just as patterns, but as conversations between candles — one pushing, the other reacting.

And if this is your first time reading the series, don’t miss Part One – where we covered single-candle signals like dojis, hammers, and marubozus — the very foundations of candlestick reading.

Gold remains in a bearish trendGold followed our previous analysis closely, rejecting from the strong resistance level at $3430, confirming bearish momentum. This rejection has opened the door for a potential move toward the 3400 level, and further downside is likely.

Gold remains in a bearish trend. A temporary pause or minor consolidation may occur, but the overall direction remains to the downside. This week, markets are watching the outcome of the ES–US agreement closely. If a resolution is reached, it could strengthen the USD and increase risk appetite—potentially pushing gold even lower.

We expect gold to remain under pressure unless major market sentiment shifts. A break below 3400 could accelerate the drop toward 3322.

You May find more details in the chart.

Ps Support with like and comments for better analysis Thanks.

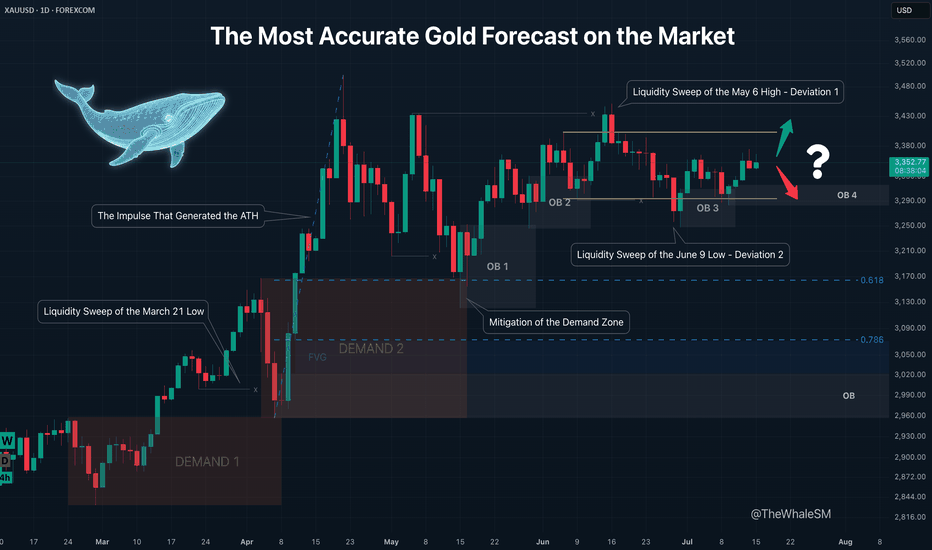

The Most Accurate Gold Forecast on the MarketThis is a continuation of sorts of my educational article that received an "Editor's Pick" from TradingView and a large number of positive reactions from this amazing trading community. However, unlike that post, this is a trade idea that outlines clear entry conditions for when the price reaches a relevant manipulation zone and shows a reversal reaction. If you don't want to get into the details and trace the entire chain of events through which large capital brought the price to its current levels, feel free to skip the intro and go straight to the 4H chart with the long setup conditions.

To better understand the logic of "smart money," let's revisit the Gold daily timeframe from my educational article:

We will approach this analysis like detectives, following the facts and footprints in the style of Sherlock Holmes and Hercule Poirot.

So, let's begin our investigation. On the daily structure, we see a clear order flow confirming the intention of large capital to lead the price in continuation of the uptrend. After the latest impulse that began on February 28th and ended on April 3rd, the price corrected and mitigated the DEMAND1 manipulation zone. The "Whale" refueled with liquidity, eliminated some competitors, closed its losing short positions used for the manipulation, and gained energy for the next impulse that set a new ATH. The correction that mitigated the DEMAND1 zone was nothing other than the next manipulation, also in the form of a DEMAND zone, within which there is a still-valid daily order block. How can we assert that DEMAND 2 is a manipulation and not just a correction?

Firstly, the sharp nature of the move swept liquidity from the March 21st low. Secondly, the sharp upward impulse accompanied by a series of FVGs showed the Whale's true intention. And thirdly, the reversal from this DEMAND 2 zone, combined with the 61.8% Fib retracement level, resulted in the formation of the next manipulation in the form of the OB 1 order block. Further, we see the continuation of the order flow on this daily structure; the price reacts to OB1, forming another order block, OB2 . The impulse from OB2 sweeps liquidity from the May 6th high. Many might have expected a continuation of the impulse and a new ATH instead of a sweep of this high, but as often happens when too many participants pile into one direction, the price sharply reverses and liquidates their positions. This intense decline after sweeping the high looked something like a local trend change from bullish to bearish, but the sharp recovery after sweeping the liquidity from the June 9th low and forming a new order block, OB 3 , finally revealed what was really happening: it turned out to be a range . It's impossible to identify a range until it is fully formed. A range is another type of manipulation where internal and external liquidity is swept from both sides. In our case, there was first a deviation above (Deviation 1 on the chart), then a deviation below (Deviation 2), after which the price swept some internal liquidity and got stuck exactly in the middle of the range.

And finally, after all our investigations and deductions, we can say with absolute certainty, practically with 100% confidence divided by two, that ABSOLUTELY NO ONE KNOWS where the price will go from the current levels. Because the center of a range is a state of complete uncertainty. Moreover, I dare to suggest that even the Whales don't know where the price will go right now. They certainly have enormous funds to sharply move prices at the right moments to capture liquidity and conduct manipulations. At other times, they can nudge the market to create a trend and direct it like a chain reaction of falling dominoes. But the entire market is much larger, and if its sentiment changes drastically due to external factors, smart money won't waste its resources fighting it. Their goal is to make more money, nothing personal. Why else is the price stuck in the middle right now? Inflation data is coming out soon, which could push the price in an unpredictable direction. The Whales will wait to use this news-driven impulse to their advantage.

So, what have we concluded from this investigation? Was it all in vain since we can't even say with 51% probability where the price will go next? Of course not. We simply need to wait for the price to reach an area where the probability of it moving in a certain direction is significantly higher than 50% — that's all you need to be profitable in the long run. This probability will never be close to 100% because we don't know what's really happening in the depths of the market. Are the Whales accumulating positions in this range now, or are they selling off at high prices after the ATH? Unless you are one of the few direct participants in large capital, you can't know this. Moreover, you don't need to know it to make a consistent profit in the market. It is enough for us to predict the next move of smart money with high probability at certain moments, join their movement, and take our profit. It's like a weather forecast: the further from the current date, the lower the probability of it being accurate. It's the same with the market; a completely unpredictable combination of factors, news, and hidden internal processes can lead the price on a unique path, but always accompanied by smart money. It doesn't matter where the gold market goes next, whether to a new ATH or down to the next correction level. When the Whale reveals itself again by leaving a trail in the form of a manipulation, we can lie in wait near it and join its next move. Why is it generally a good idea to enter from manipulation zones? You are essentially stepping onto a field where the Whale has already cleared the liquidity, and it has returned to that place for other business — to close its losing positions. That is, a mitigated manipulation zone is a safer place to enter the market; there's a much lower chance the Whale will absorb your position. Right now, we have such a manipulation in the form of the OB 4 order block, and we can switch to the 4H timeframe to look at a potential entry zone in more detail.

4H CHART - SETUP CONDITIONS

So, we already know the general context: the price is inside a range. After the second deviation, it has already reacted to the order block formed after it, and we are waiting for the mitigation of the next one, OB 4 , which will serve as a pivot point for a potential setup. A reversal from this order block will confirm the order flow for the price to move at least to the upper boundary of the range. The presence of a manipulation zone alone is not enough to open a position; additional confirming conditions are always needed. As one such condition here, we can take the combination of mitigation with one of the Fibonacci retracement levels — 61.8% or 78.6%. Upon reaching each level, the price must hold (not be broken by the bodies of 1-4H candles) and show a reversal reaction. The final confirmation for entry will be an LTF confirm in the form of a break of structure (BOS) or the beginning of order flow on a lower timeframe. An important part of the context is that important US inflation news is coming out soon, and positions should not be opened right before it or for some time after (at least an hour).

Invalidation of the long scenario would be a break below the 78.6% level and OB 4.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

If you found this analysis helpful, support it with a Boost! 🚀

Have a question or your own view on this idea? Share it in the comments! I read every single one. 💬

► Follow me on TradingView for more educational content like this and to not miss my next detailed trade idea .

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

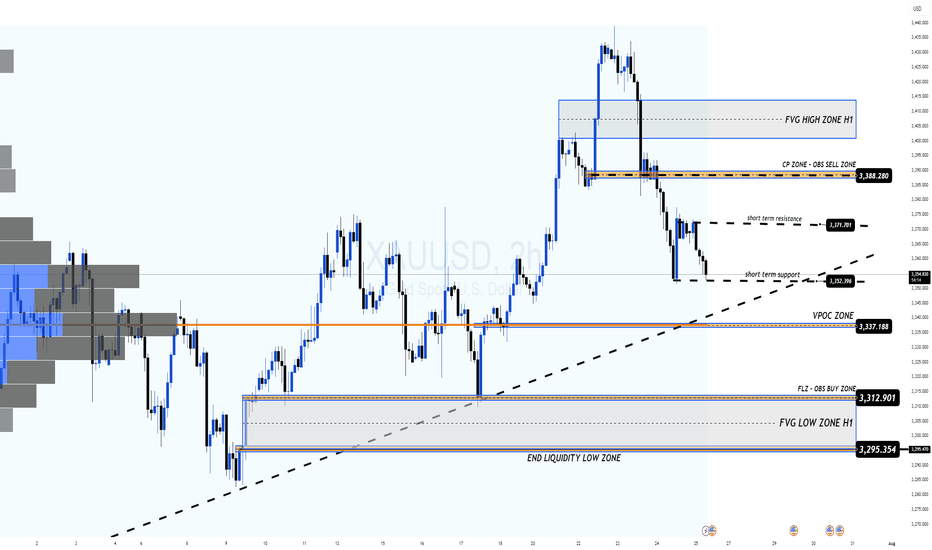

Gold at Key Support – Will Bulls Step In or Drop Continue?🌐 Market Overview

Gold has struggled to recover after yesterday's sharp drop, driven by macro-political concerns and profit-taking at recent highs.

🔻 On July 24, former President Trump made an unexpected visit to the US Federal Reserve, sparking speculation that he's pressuring the Fed to cut interest rates soon.

While the Fed has yet to make any dovish moves, short-term bond yields dipped slightly, showing growing market expectations for policy easing.

The US dollar remains strong, reflecting some skepticism around the Fed’s possible shift despite recent economic strength.

📉 Technical Outlook

On the H2 chart, gold still maintains an overall bullish structure. However, it's approaching a critical support level near 3338, which aligns with the VPOC and the ascending trendline.

📌 If this zone breaks, price may rapidly fall toward deeper liquidity zones in the 332x – 329x range.

🎯 Trade Setups

🔽 BUY SCALP (Quick Reaction Play)

Entry: 3338 – 3336

Stop Loss: 3332

Take Profit: 3342 – 3346 – 3350 – 3354 – 3360 – 3365 – 3370 – 3380

🟢 BUY ZONE (Deep Buy Area – Long-Term Potential)

Entry: 3312 – 3310

Stop Loss: 3305

Take Profit: 3316 – 3320 – 3325 – 3330 – 3340 – 3350 – 3360 – 3370 – 3380

🔻 SELL ZONE (if market retests)

Entry: 3374 – 3376

Stop Loss: 3380

Take Profit: 3370 – 3366 – 3360 – 3355 – 3350 – 3340 – 3330

🔍 Key Levels to Watch

Support: 3350 – 3338 – 3325 – 3310 – 3294

Resistance: 3374 – 3390 – 3400 – 3421

⚠️ Risk Note

As we head into the weekend, liquidity sweeps are common – especially on Fridays. Be cautious of sharp moves.

Focus mainly on scalp setups today. Avoid early long entries unless strong confirmation appears at lower liquidity zones.

Always follow your TP/SL strategy to protect your capital.

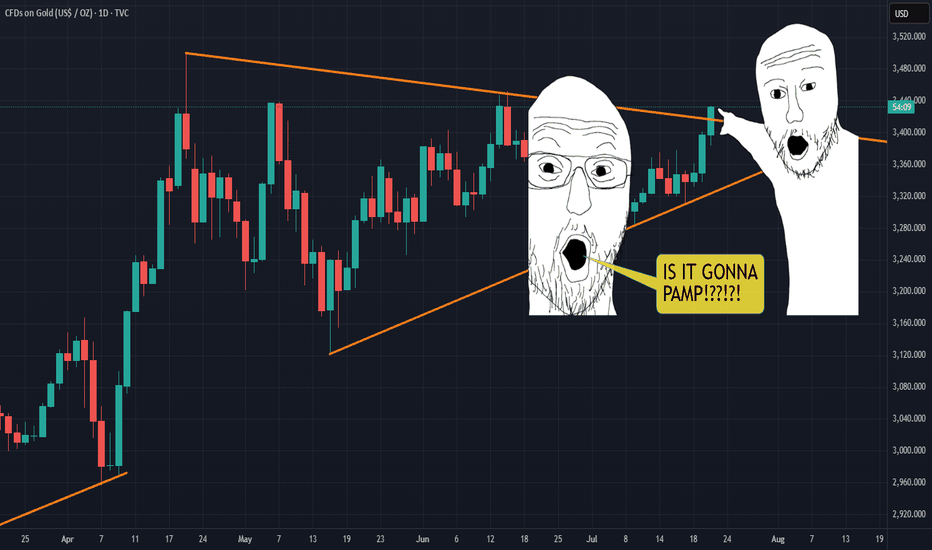

Will we be SHOWERED with GOLDen gainz?!IS IT PAMPIN TIME?!?!?! Looks like it's tryna break out, but beware of the fakeout. WIll it pop or double top!?

To those holding the golden treasure, may the lawd of pamp bless thee with gainz forever.

Gold miners went ham today too... probably nothing. LETS PAMP IT!

THANK YOU FOR YOUR ATTENTION ON THIS MATTER.

Welcome Back! Gold Trading Strategy & Key Zones to WatchIn this week’s welcome back video, I’m breaking down my updated approach to XAU/USD and how I plan to tackle the Gold markets in the coming days. After taking a short break, I’m back with fresh eyes and refined focus.

We’ll review current market structure, identify key liquidity zones, and outline the scenarios I’m watching for potential entries. Whether you’re day trading or swing trading gold, this breakdown will help you frame your week with clarity and confidence.

📌 Covered in this video:

My refreshed trading mindset after a break

Key support/resistance and liquidity zones

Market structure insights and setup conditions

What I’ll personally avoid this week

The “trap zones” that might catch retail traders off guard

🧠 Let’s focus on process over profits — welcome back, and let’s get to work.

GOLD Price Can rise catch the ResistanceGold is currently showing strong underlying momentum, although it is undergoing a short-term correction from the 3400 level. This pullback appears to be driven by profit-taking ahead of Fed Chair Jerome Powell’s upcoming speech, as well as uncertainty around U.S. trade negotiations with the EU and Japan expected to conclude before August 1.

Resistance Levels: 3420 / 3440

Immediate Support: 3375

A false breakout below resistance could result in a retest of 3375 before resuming upward momentum.

You can see more details in the chart.

Ps support with like and comments for better analysis Thanks.

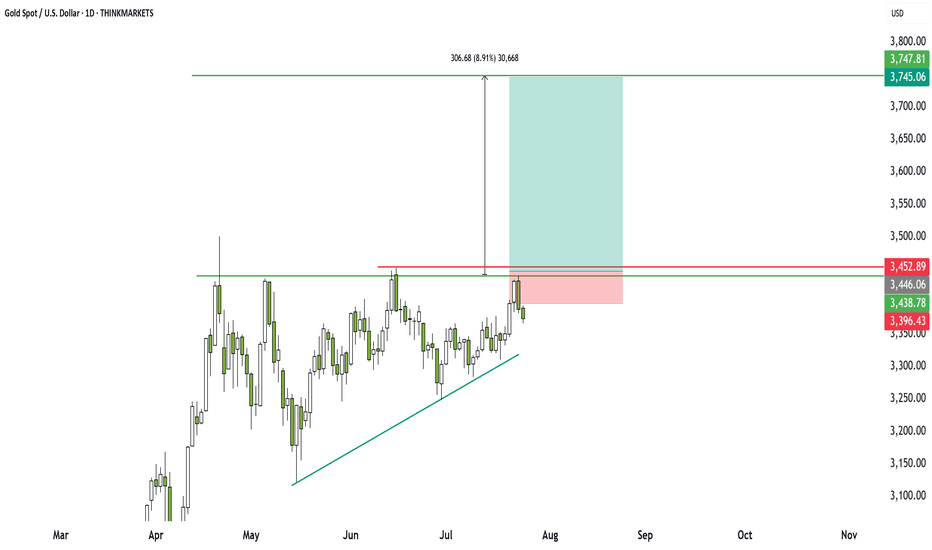

Gold: ascending triangle sets up big opportunityGold has traded sideways for 93 days, but breakout traders should take note. A clear ascending triangle is forming, offering a high reward-to-risk setup. I walk through the key levels, breakout zone, and why this could lead to a 6x return. Bulls may be frustrated, but momentum is building. Are you ready?

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

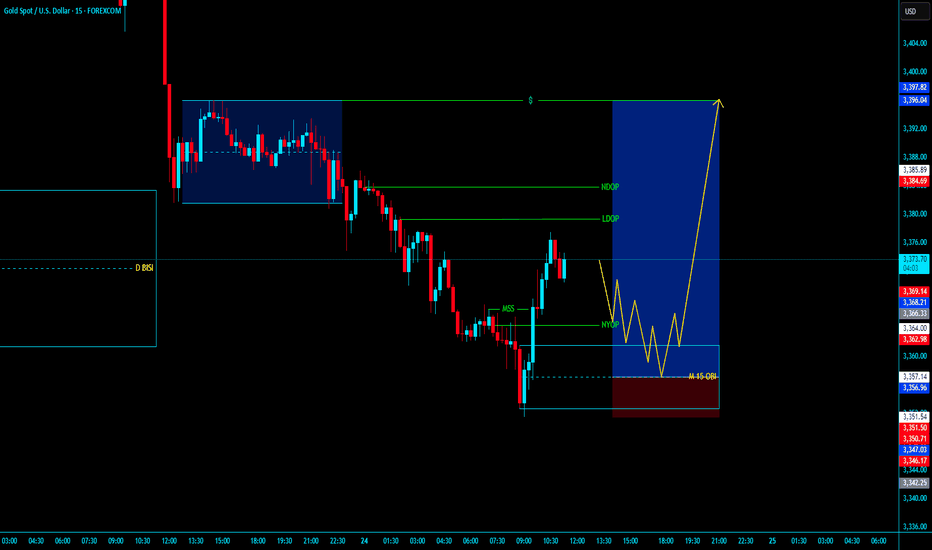

XAUUSD BUY LONG XAUUSD BUY LONG FROM BULLESH OBI

- In Daily TF Market will bullesh

- In H1 TF market is stell fully bullesh

- Market is in Daliy , H4 , H1 , M15 BISI

- In H1 & M15 MSS then our entry in OBI in LTF Valid MSS then our Entry target H1 Nearest Liquidity with Tight SL

tradE anD enjoY ......................................................

~~ KGB Priyabrat Behera ~~

~ ICT Trader & Advance Mapping SMC Trader ~

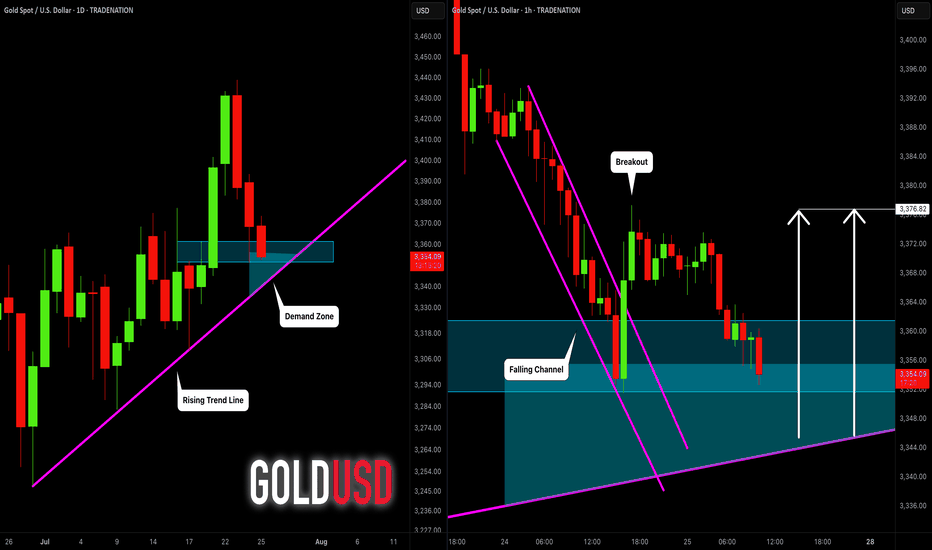

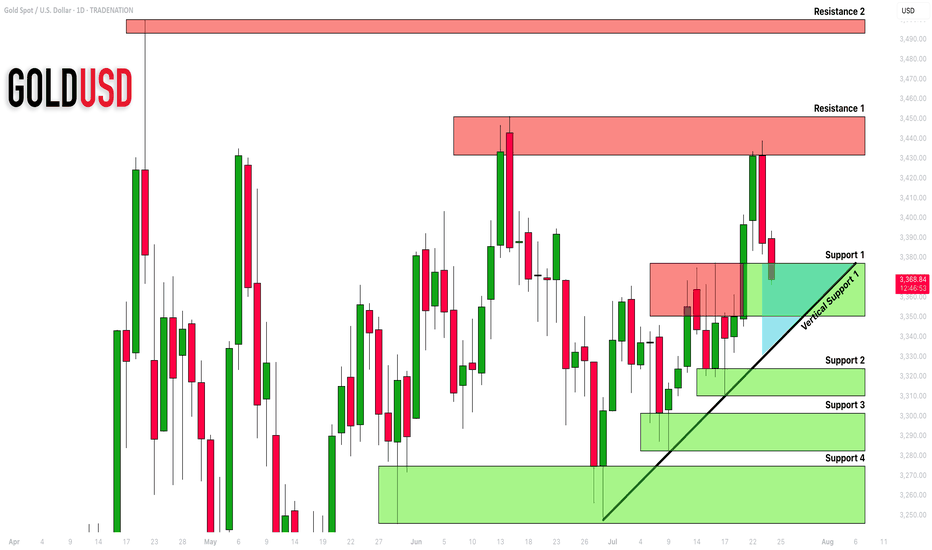

GOLD (XAUUSD): Important Demand Zone Ahead

Gold is currently retracing from a key daily horizontal resistance.

Here are important structures to watch.

Horizontal Structures

Support 1: 3350 - 3377 area

Support 2: 3310 - 3324 area

Support 3: 3282 - 3301 area

Support 4: 3245 - 3374 area

Resistance 1: 3431 - 3451 area

Resistance 2: 3493 - 3500 area

Vertical Structures

Vertical Support 1: rising trend line

Vertical and Horizontal Supports 1 compose a contracting demand zone.

Probabilities are high the price will pull back from that.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.