CHESSUSDT trade ideas

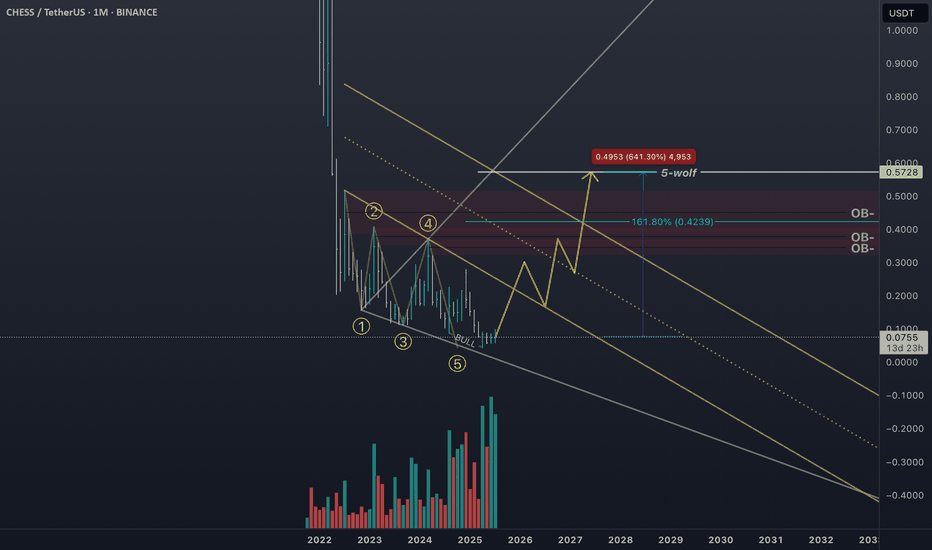

CHESSUSDT Bouncing from Broadening Wedge SupportBINANCE:CHESSUSDT has been trading inside a broadening wedge pattern for the past 1,150 days, showing long-term consolidation. The price recently bounced from the lower support of the wedge with rising volume, a potential sign of a bullish reversal.

If momentum continues, CHESS could move toward the upper wedge resistance in the $0.20–$0.25 range. A breakout above that zone may trigger a much larger trend shift.

Cheers

Hexa

CRYPTO:CHESSUSD

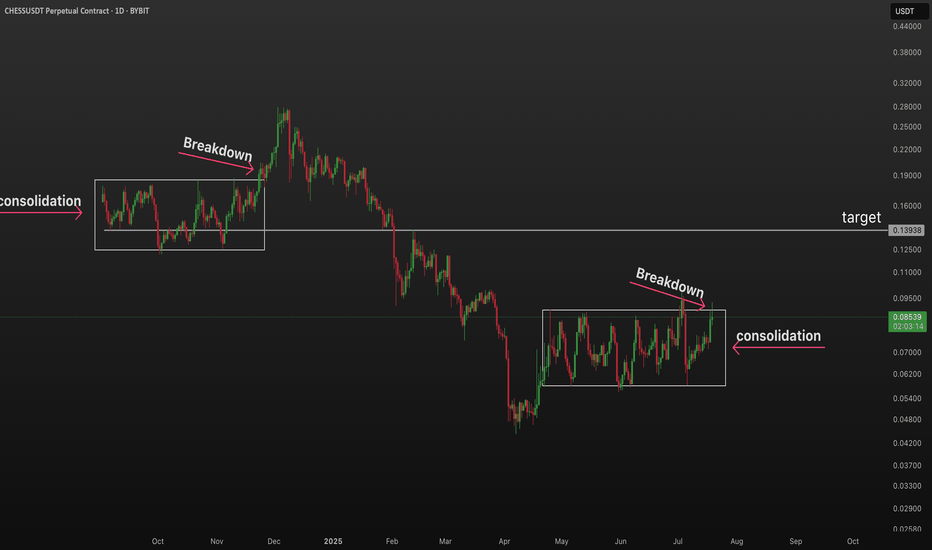

Ultimate Breakout Strategy for CHESS/USDT

The CHESS/USDT chart is currently consolidating in a symmetrical triangle pattern, signaling that a breakout could be imminent. As the price squeezes within converging trendlines, the next move is critical. Will the price push higher or drop lower? Let’s take a closer look at the potential setups.

Bullish Breakout Opportunity

If the price breaks above the upper resistance at 0.085, this could signal a bullish breakout. A strong move above this level could lead to further upward momentum, targeting levels at 0.095, 0.105, and even 0.115. Placing a stop loss at 0.075 ensures you’re protected if the price fails to maintain the breakout and reverses. Keep an eye on volume—this will be a key indicator to confirm the breakout’s strength.

Bearish Breakdown Risk

If the price fails to break above the resistance and drops below 0.075, it could signal a bearish breakdown. In this case, consider shorting the market with targets at 0.070 and 0.060. A stop loss just above 0.082 can be used to limit risks. Be sure to monitor volume closely to confirm the move, as low volume can lead to false breakdowns.

Pro Tip:

Volume plays a crucial role in validating breakouts and breakdowns. Look for a significant increase in volume when the price breaks key levels. A well-executed risk management plan with proper stop losses will help you stay in control no matter which direction the price moves.

Stay disciplined and follow the price action closely to make the most out of the upcoming move in CHESS/USDT. Whether it’s an upside breakout or a downside breakdown, this strategy prepares you for both scenarios.

#CHESS/USDT – Breakout Confirmed ?#CHESS

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.0655.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.0623, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.0670.

First target: 0.0712.

Second target: 0.0748.

Third target: 0.0806.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

CHESS/USDT Re-accumulatingCHESS has been accumulating for the past 66 days in a tight range between $0.070 – $0.085, forming a solid base.

Price is now coiling near the top of the range, suggesting a potential breakout is imminent. A confirmed breakout above $0.085 could trigger a parabolic move as liquidity and momentum kick in.

Target Zones

• TP1: $0.095

• TP2: $0.101

• TP3: $0.125

🔻 Stop Loss: Below $0.069

CHESSUSDT Forming Bullish Ascending TriangleCHESSUSDT is shaping up to be a very promising opportunity for traders keeping an eye on altcoins with breakout potential. The chart pattern forming here resembles an ascending triangle, which often signals bullish continuation when confirmed with a strong breakout above the resistance line. The price action shows higher lows and consistent tests of the resistance, suggesting buyers are gradually overpowering the sellers. With good volume backing this setup, the conditions are ripe for a significant move to the upside.

One of the key things driving attention to CHESSUSDT is its strong community and the DeFi ecosystem it supports. As DeFi protocols gain traction again, assets like CHESS that play a role in decentralized governance and yield optimization can see renewed investor interest. This aligns well with the technical breakout potential, adding confidence to the expectation of a 70% to 80% gain in the coming weeks.

Technical traders should watch for a decisive candle close above the resistance zone for confirmation of the breakout. Monitoring volume surges during the breakout will also be essential to validate the move. With the broader crypto market stabilizing, a confirmed breakout on CHESSUSDT could attract momentum traders and investors looking for undervalued DeFi tokens.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

CHESS/USDT – Breakout Confirmed, Bullish Structure in PlayCHESS has officially broken out of a long-term descending trendline and a multi-week consolidation base. This signals the end of a prolonged downtrend and the beginning of a potential bullish expansion.

Technical Analysis:

Breakout: Price broke above the falling trendline and horizontal range ($0.07–$0.085), confirming a bullish structure.

Structure: Ascending triangle breakout + clear higher lows and higher highs forming.

Volume: Strong breakout candle with above-average volume suggests follow-through potential.

Retest Zone: Previous resistance near $0.085 now acting as support, offering a possible re-entry zone.

Key Levels:

Support Zones

$0.085 – Previous resistance, now flipped support

$0.070 – Ascending trendline zone

$0.056 – Range base and invalidation zone

Resistance / Target Levels

$0.100 – Minor psychological round number

$0.121 – Previous consolidation resistance

$0.173 – Key breakout target

$0.276 – Macro bullish target if trend continues

Trade Plan:

Entry: Any retest between $0.085–$0.090

Stoploss: Below $0.070 (conservative) or tight below $0.078 (aggressive)

Targets: $0.100 → $0.121 → $0.173 → $0.276

Risk Management: Use proper position sizing; invalidation below $0.070

This breakout appears structurally clean and may offer a strong follow-up if market conditions remain favorable. Ideal for both short-term swing and medium-term positional setups.

Not Financial Advice | DYOR Always

#CHESS/USDT#CHESS

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.0640, acting as strong support from which the price can rebound.

Entry price: 0.0642

First target: 0.0688

Second target: 0.0722

Third target: 0.0756

CHESS/USDTKey Level Zone: 0.07100 - 0.07180

LMT v2.0 detected.

The setup looks promising—price previously trended upward with rising volume and momentum, then retested this zone cleanly. This presents an excellent reward-to-risk opportunity if momentum continues to align.

Introducing LMT (Levels & Momentum Trading)

- Over the past 3 years, I’ve refined my approach to focus more sharply on the single most important element in any trade: the KEY LEVEL.

- While HMT (High Momentum Trading) served me well—combining trend, momentum, volume, and structure across multiple timeframes—I realized that consistently identifying and respecting these critical price zones is what truly separates good trades from great ones.

- That insight led to the evolution of HMT into LMT – Levels & Momentum Trading.

Why the Change? (From HMT to LMT)

Switching from High Momentum Trading (HMT) to Levels & Momentum Trading (LMT) improves precision, risk control, and confidence by:

- Clearer Entries & Stops: Defined key levels make it easier to plan entries, stop-losses, and position sizing—no more guesswork.

- Better Signal Quality: Momentum is now always checked against a support or resistance zone—if it aligns, it's a stronger setup.

- Improved Reward-to-Risk: All trades are anchored to key levels, making it easier to calculate and manage risk effectively.

- Stronger Confidence: With clear invalidation points beyond key levels, it's easier to trust the plan and stay disciplined—even in tough markets.

Whenever I share a signal, it’s because:

- A high‐probability key level has been identified on a higher timeframe.

- Lower‐timeframe momentum, market structure and volume suggest continuation or reversal is imminent.

- The reward‐to‐risk (based on that key level) meets my criteria for a disciplined entry.

***Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

Important Note: The Role of Key Levels

- Holding a key level zone: If price respects the key level zone, momentum often carries the trend in the expected direction. That’s when we look to enter, with stop-loss placed just beyond the zone with some buffer.

- Breaking a key level zone: A definitive break signals a potential stop‐out for trend traders. For reversal traders, it’s a cue to consider switching direction—price often retests broken zones as new support or resistance.

My Trading Rules (Unchanged)

Risk Management

- Maximum risk per trade: 2.5%

- Leverage: 5x

Exit Strategy / Profit Taking

- Sell at least 70% on the 3rd wave up (LTF Wave 5).

- Typically sell 50% during a high‐volume spike.

- Move stop‐loss to breakeven once the trade achieves a 1.5:1 R:R.

- Exit at breakeven if momentum fades or divergence appears.

The market is highly dynamic and constantly changing. LMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

From HMT to LMT: A Brief Version History

HM Signal :

Date: 17/08/2023

- Early concept identifying high momentum pullbacks within strong uptrends

- Triggered after a prior wave up with rising volume and momentum

- Focused on healthy retracements into support for optimal reward-to-risk setups

HMT v1.0:

Date: 18/10/2024

- Initial release of the High Momentum Trading framework

- Combined multi-timeframe trend, volume, and momentum analysis.

- Focused on identifying strong trending moves high momentum

HMT v2.0:

Date: 17/12/2024

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

Date: 23/12/2024

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

Date: 31/12/2024

- Enhanced entry confirmation for improved reward-to-risk ratios

HMT v4.0:

Date: 05/01/2025

- Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling

HMT v4.1:

Date: 06/01/2025

- Enhanced take-profit (TP) target by incorporating market structure analysis

HMT v5 :

Date: 23/01/2025

- Refined wave analysis for trending conditions

- Incorporated lower timeframe (LTF) momentum to strengthen trend reliability

- Re-aligned and re-balanced entry conditions for improved accuracy

HMT v6 :

Date : 15/02/2025

- Integrated strong accumulation activity into in-depth wave analysis

HMT v7 :

Date : 20/03/2025

- Refined wave analysis along with accumulation and market sentiment

HMT v8 :

Date : 16/04/2025

- Fully restructured strategy logic

HMT v8.1 :

Date : 18/04/2025

- Refined Take Profit (TP) logic to be more conservative for improved win consistency

LMT v1.0 :

Date : 06/06/2025

- Rebranded to emphasize key levels + momentum as the core framework

LMT v2.0

Date: 11/06/2025

- Fully restructured lower timeframe (LTF) momentum logic

Tranchess Bull Flag... Do You Agree?This one here is also a bull flag, a wide one and you know where prices are headed next.

Let me ask you a question and be honest; do you have any doubts about what I am saying? You can answer in your own mind of course but just think about it.

I say the market is bullish but consolidating.

I say the market produced a retrace, in some cases a correction, which will only lead to higher prices.

I say this based on the information that is available through the charts and I share all the charts with the evidence.

Do you agree?

I am an optimist.

To me, I have 100% level of certainty but what about you?

I was right about the rise from April but that seems already to be far away. Do you believe me? Do you trust me? Do you know what will happen next? It is written all over the charts.

If you do, then you have to take action.

Money is on the table, and this is a money game.

If you agree and you can see what I see, how will you proceed to maximize profits?

What actions can you take now to maximize your earning potential and increase your trading success?

If you know the market is going up, then, you have to take action that goes in accordance with what you know.

First you read.

Through reading we learn.

We use the gained knowledge to achieve our goals.

Thanks a lot for your continued support.

Oh, and by the way, Crypto is going up.

Namaste.

CHESS/USDT (1D) – Daily Trendline Breakout in PlayTradingView Idea: CHESS/USDT (1D) – Daily Trendline Breakout in Play

Pattern: Falling Trendline Breakout 📉➡️📈

Timeframe: 1-Day ⏱️

Pair: CHESS/USDT 💱

Published: June 11, 2025 📅

**Technical Overview:**

CHESS/USDT has been moving under a long-standing falling trendline, with price consistently making lower highs. Recently, it has broken above this trendline on the daily timeframe, signaling the start of a potential trend reversal.

A strong close above the breakout zone, combined with rising volume, could confirm bullish continuation 🔥

**Potential Trade Setup:**

**Bullish Scenario ✅**

Entry: On confirmation and daily close above 0.082–0.085

Targets:

* First target at 0.095 🎯

* Second target at 0.110 🎯

* Third target at 0.130–0.150 🎯

Stop-loss: Below 0.075 🛑

**Risk Management ⚠️**

Watch for volume confirmation to avoid false breakouts. If CHESS drops back below 0.080, the move may fail or consolidate before a second attempt.

**Conclusion:**

CHESS is showing strong breakout behavior. If confirmed, this could mark a mid-term reversal with solid upside potential 📊🔍

CHESS.USDT NEW INCREASE ROUNDEAs a trader, it's important to follow the market and the unexpected trends.

CHESS/USDT shows a possibility for a new increase in the coming time frames, after the long-term breakdown.

Let's follow the data and see if this coin is able to increase as the chart shows.

interesting to follow for the coming time frames for new confirmations.

$0,10 is an important target that this coin could hit in the coming time.

If the cycle gets confirmed, this coin could go to $0,25 as a high target and $0,35 as a best target.

In trading, never expect instant results; the market goes as it needs to go.

Risk management is the key.

Possible x's on chessTo date, the market has reached the buying period of the second half of the week, which I outlined earlier. Against the background of extremely negative statistics for the United States over the past week and a half, ether sales were successfully repaid yesterday at the next bifurcation point, and purchases with an attempt to gain a foothold above 2100 will prevail until Sunday afternoon. Against this background, there is a new opportunity for altcoin mining.

First of all, I want to draw attention to chess, which has extremely high technical goals for retest up to $ 1 and can repeat the alpaca scenario with sufficient volatility. Today, there is a trend change and by the end of the week, the probability of a 0.1 level test prevails, which is necessary to increase volatility up to the 0.25 test. If the second half of the month opens above 0.1, we can expect the trend to continue until mid-June at least and the 0.25 test. Previously, large volumes of purchases were left for a hike above 0.25. Taking this level, in turn, opens the way up to 0.50-75, but this is probably the scenario for the fall. However, we should not rule out a sharp breakdown to 0.25 this week.

In addition to chess, I am primarily considering fio for work. Pivx adx and quick can also be considered for scalping, with possible growth waves of up to 40-60% for a local break of the last wave at least. These coins have fallen in price rather due to fears of another assignment of the monitoring tag and are highly undervalued relative to the current market position. Also this week, there is a high probability of a new bull run on fantokens with interruptions of up to 2-3. The most undervalued are the city atm acms, which I consider first.

Chessusdt Trading opportunityCHESS/USDT is showing a potential ending diagonal pattern in the form of a descending broadening structure. The plan is to accumulate within the shaded zone on the chart, anticipating a reversal.

The expected price movement path is indicated, with the major external supply zone acting as a significant sell-off area to watch closely.

We’d greatly appreciate your feedback on this analysis.

#CHESS/USDT#CHESS

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.870

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.00

First target 1.05

Second target 1.12

Third target 1.20

The chess kingTranchess (CHESS)

Tranchess is a protocol designed to enhance yields while offering diverse risk-return options for asset management. The idea for Tranchess emerged in early 2020, evolving rapidly into its present form. Drawing inspiration from tranche funds which cater to different investor risk preferences, Tranchess operates by creating multiple risk/return profiles from a single principal fund. This fund can track a single cryptocurrency like BTC, ETH, or BNB, or even a combination of various crypto assets.

CHESS serves as the governance token for the Tranchess protocol, where holders can earn it by staking QUEEN, BISHOP, or ROOK tokens. CHESS can be traded on exchanges like Binance and Pancake Swap. By locking CHESS, users generate veCHESS, which allows them to engage in weekly rebates and governance decisions within the Tranchess ecosystem.

Architecture and Specs

The Tranchess Protocol is designed to enhance yield by offering a range of risk-return solutions that diversify the risk/return profiles from a single primary fund tracking a specific underlying asset, like BTC. Here's an overview of the Tranchess Protocol architecture. Each module comprises multiple smart contracts to achieve the necessary functions. Everything is developed in-house, except for two contracts under the "Asset" category, which are adaptations from other protocols.

The Tranchess Fund Protocol operates as a collection of smart contracts that form its primary market framework. Here, an underlying asset serves as the foundation for creating tokenized equities known as the Main Tranche (designated as Token QUEEN). Token QUEEN itself can be subdivided into two specialized tranches: Token BISHOP, aimed at accruing interest with a yield that adjusts weekly based on market dynamics and governance decisions, and Token ROOK, which offers investors a 2x leverage opportunity without the peril of liquidation, optimizing for capital efficiency. The protocol conducts regular assessments of the net asset value (NAV) per share. Should the ratio of NAVROOK to NAVBISHOP exceed 2 or fall below 0.5, this triggers a rebalancing mechanism, uniformly adjusting share counts in all wallets to maintain equilibrium.

Tokenomics

Maximum Supply: 300 million

Community Incentives: 50%

Team: 20%

Future Investors: 15%

Ecosystem / Treasury: 10%

Seed Round: 5%

This token distribution reflects a strategy aimed at supporting the community, ensuring project development through the team, and attracting investments for future growth. The allocation of tokens between the team, investors, and the ecosystem is intended to ensure long-term interest from all parties in the project's success, while the emphasis on the community highlights the importance of users and participants in the CHESS ecosystem.

Fundraising

Tranchess has successfully completed a seed funding round, securing $1.5 million. This round was spearheaded by notable investors such as Three Arrows Capital and Spartan Group, with additional participation from Binance Labs, Longhash Ventures, IMO Ventures, and undisclosed opinion leaders.

Lead Investors: Three Arrows Capital, Spartan Group

Other Investors: Binance Labs, Longhash Ventures, IMO Ventures, anonymous opinion leaders

Vesting

As of today, all tokens have been unlocked!

GitHub

Tranchess is actively developing their smart contracts and related products. They have several repositories that include core contracts as well as tools to interact with QUEEN, BISHOP and ROOK tokens, indicating active development and support for the protocol.

Blockchain

As you can see, most of the token issuance is centered between the team, Binance and one of the leading funds. This greatly simplifies the model for pumping the asset. In addition to all this, the activity of the market maker GSR is noticed, which can skillfully pump up the price.

In addition, the wallets of other investment funds were also found. In total, the interested parties to the pumping of the asset have about 95% of the entire coin issue on their wallets.

Conclusion

We have a project in DeFi that is reborn and allows us to bypass taxation, to all this there are funds that are interested in pumping up the price. We have on board the fund (3AC) that needs price growth the most, we have a good GSR market maker, active developers and no distribution area that will be “drawn” by big capital! Be prepared for a booming growth, don't miss this chance.

Best wishes, Horban Brothers!

You will come out soonThe currency is on a downward path until the bottom at 0.11 cents

The mid-channel line is the true trend line

But after a while, the peaks and troughs were outside the path and were considered as the channel path

The next period will be outside the scope of the channel

The magic number of 1.618 is expected to be reached in Fibonacci points

At a price of approximately 0.80 cents

All of these are just predictions

#CHESS Ready for a Massive Move or it Will Fall Further? Yello, Paradisers! Could #CHESS be gearing up for a breakout or is this a classic bull trap waiting for traders? Let’s break down the analysis of #Tranchess:

💎#CHESSUSDT has recently broken out above the descending resistance of the descending channel—a major technical milestone. This breakout provided bullish momentum but faced a profit-taking wave at the $0.28 supply zone. Currently, the asset is coming down to retest its key support.

💎The $0.2814–$0.3132 level stands as the immediate barrier for #CHESSUSD's sustained rally. A daily candle close above this zone would confirm a breakout, opening the doors for a potential bullish run toward the resistance levels at $0.4000–$0.4500. This zone has historically attracted significant selling pressure, so expect a battle between bulls and bears at these levels.

💎On the downside, the $0.1643–$0.1206 region is a critical demand zone for #CHESS. If prices fail to maintain momentum and retreat, this area is likely to provide strong support, offering buyers a potential re-entry opportunity.

💎A daily close below $0.1206 would invalidate the current bullish outlook. Such a move could trigger a deeper correction, driving prices toward sub-$0.1000 levels, effectively resetting the structure and catching over-leveraged longs off guard.

Stay focused, patient, and disciplined, Paradisers🥂

MyCryptoParadise

iFeel the success🌴