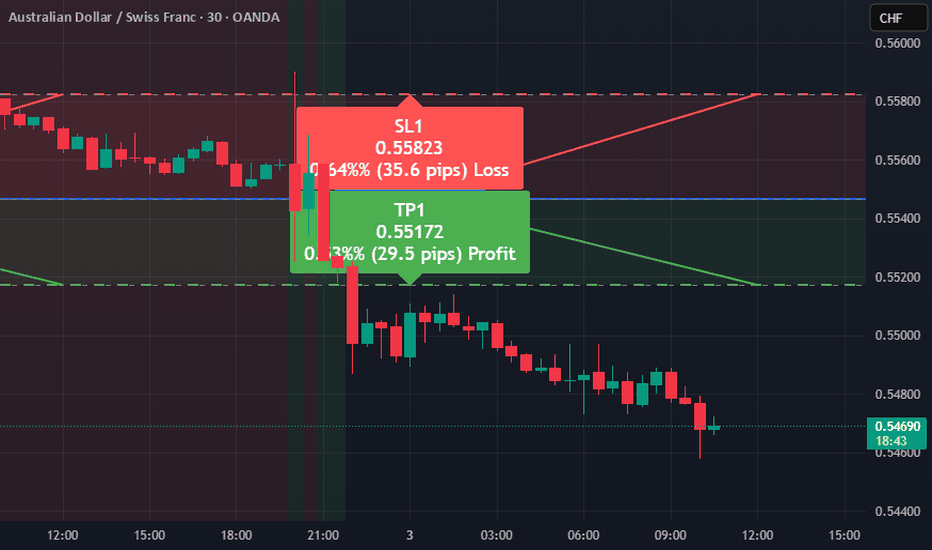

AUDCHF Analysis: Short Opportunity AheadBased on the EASY Trading AI strategy, AUDCHF signals a sell with entry at 0.55467. My analysis underlines bearish pressure supported by current technical conditions indicating weakening momentum of AUD against CHF. The immediate target (Take Profit) is projected at 0.55172, reflecting short-term bearish strength in the pair. To manage risk effectively, set your Stop Loss at 0.55823. Considering current market volatility and price patterns detected by EASY Trading AI, this trade setup provides clear and logical entry, stop loss, and take profit levels aligned with prevailing trends and momentum dynamics. Stay sharp and trade responsibly.

CHFAUD trade ideas

AUDCHF Wave Analysis – 2 April 2025

- AUDCHF reversed from the support area

- Likely to rise to resistance level 0.5600

AUDCHF currency pair recently reversed up from the support area between the pivotal support level 0.5485 (which stopped the earlier impulse wave i at the start of March) and the lower daily Bollinger Band.

The upward reversal from this support area formed the daily Japanese candlesticks reversal pattern Hammer Doji.

Given the bullish divergence on the daily Stochastic indicator, AUDCHF currency pair can be expected to rise to the next resistance level 0.5600 (top of the previous correction ii).

The Bad Date BreakawayEver been on a date so disastrously awkward that you just had to make a swift exit? That’s what this short trade feels like a moment of clarity when you decide enough is enough. It’s about recognising a no-win situation, making a bold move, and leaving with your dignity and wallet intact."

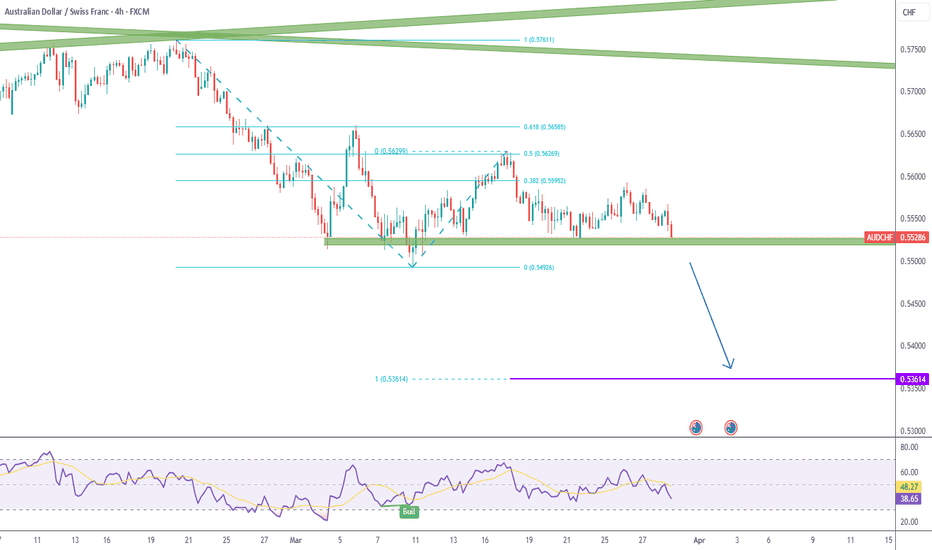

Lingrid | AUDCHF shorting OPPORTUNITY from Previous WEEK's HighThe price perfectly fulfilled my last idea . It hit the target zone. FX:AUDCHF market is currently moving towards the previous week's high after completing an ABC move. In addition, we have the upper boundary of the channel and a trendline, along with the significant round number at 0.56000 above. Since overall trend on higher timeframes remains bearish, I think that the price may rebound from this resistance level again, especially if the market shows the end of this retracement. Overall, I expect the market to form a fake breakout followed by a bearish move from the resistance. My goal is support zone around 0.55285

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

AUDCHF time to see changes?

OANDA:AUDCHF much upsides-downsides we are not see some special moves here from start of Mart.

Today we are have RBA, AUD looks like its gather power, currently price exepcting to come in zone and break of same expecting in this week.

CHF showing self weak and with other pairs, like CAD and GBP.

SUP zone: 0.55000

RES zone: 0.56200, 0.56600

AUDCHF BUYPrice has entered into the wicked area of lows that have been a previous area of momentum change. With interest rates expecting to remain the same. I don't see how the price to drive lower. I'll be looking for Buys to surcharge the price to bounce off the wicked area. Positive Swaps via USD holdings means I'll swing this from entry and work on risk off when price moves into profit and swaps can reduce risked position.

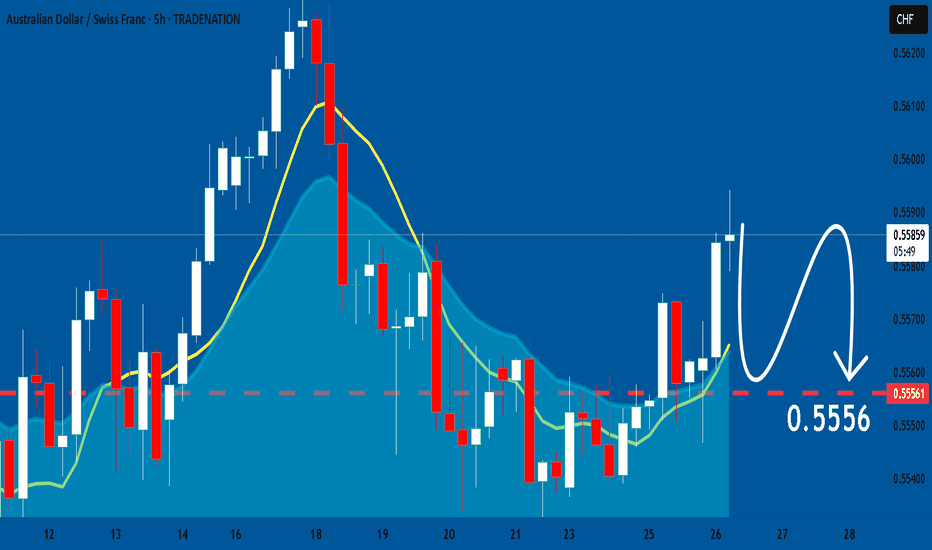

AUD/CHF SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

AUD/CHF pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 3H timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 0.553 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

A fall signal found.Dear viewers,today we search AUDCHF opportunities and find what I will mention later...OK,in my view the AUD has started a small downfall since 26 March and a great fall from 20 Feb against CHF.And absolutely a range zone from 4 March is wrought.!So what to do?!come back to the small fall where the price touched the descending channel border and started.Now we can see it closing a small support area.I am watching,watching If the price reacts to support, then I will sell at the indicated level...For now, we are looking at it this way with the AUDCHF.Follow the trend with its waves and enjoy!

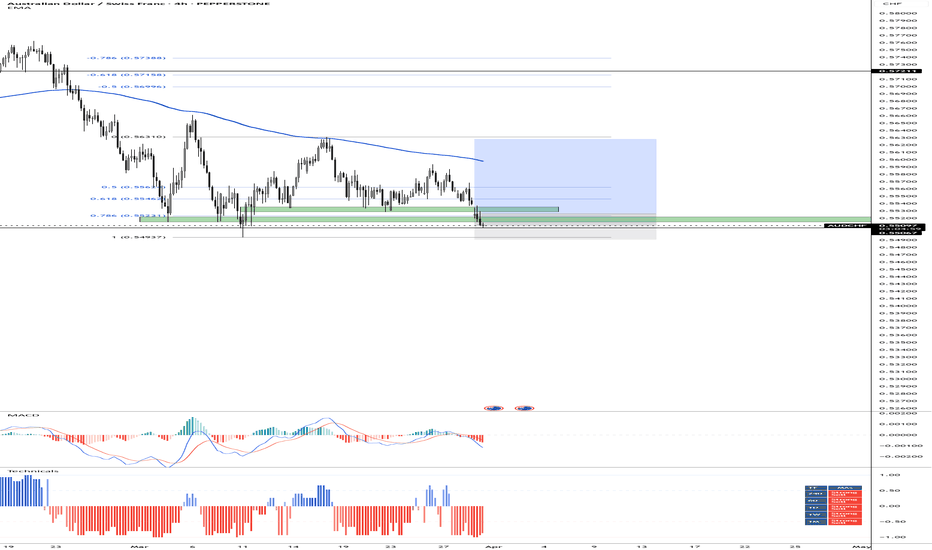

AUDCHF: Bearish Forecast & Bearish Scenario

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current AUDCHF chart which, if analyzed properly, clearly points in the downward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

AUDCHF - Potential Short-Term BottomTaking a look at the daily chart, AUDCHF has began showing indications of a potential bottom. This might be a decent low risk LONG setup as a swing trade.

Leave a comment below, let me know what you think. Share with friends. Check out my profile for more awesome trade plans and setups. DM for account management

Trade Safe - Trade Well

~Michael Harding