CHFAUD trade ideas

AUDCHFHere we come, today, 11 January 2025. I learnt that my girlfriend has other two boyfriends she has been hiding from me, Im so heart broken as we speak but I decided to go face the charts just to relax my mind a bit. So here Im strongly for bulls, however in the short run, where Bears are indicated on this RSI Divergence, sell cautiously. With the green pen, Ive spotted a Cup and Holder pattern seeming to unfold if we open the markets with strong buyers, lookout for the resistance breakout of the cup's handle and buy cautiously. With the reds, its purely Supply nd Demand, Support and Resistance.

AUDCHF Forecast: A Buy Signal to ConsiderThe AUDCHF currency pair is sending promising signals for traders inclined to take long positions. With a current entry price of 0.56511, this trade setup highlights a solid buying opportunity.

Analyzing the market conditions through the lens of the EASY Trading AI strategy, we see that the momentum may favor upward movement. The upcoming Take Profit level is set at 0.56645, granting a potential reward that justifies the risk. On the flip side, the Stop Loss level is established at 0.56356, safeguarding your investment against unexpected downturns.

A few key factors support this bullish outlook. The recent market sentiment indicates increased demand for the Australian dollar amidst a stabilizing economic environment, while the Swiss franc is facing headwinds due to ongoing policy adjustments by the Swiss National Bank. This scenario typically sets the stage for currency pairs like AUDCHF to appreciate.

Additionally, GBPCHF has shown correlations that tend to sway in the same direction as AUDCHF during similar market cycles. Trends tend to reinforce each other, enhancing the validity of trading signals generated by EASY Trading AI.

For traders aiming to capitalize on short-term fluctuations, managing your entry and exit points effectively is crucial. Leveraging tools from our trading bots can help automate this process, ensuring you don't miss profitable opportunities while also mitigating risks.

Stay informed, and happy trading!

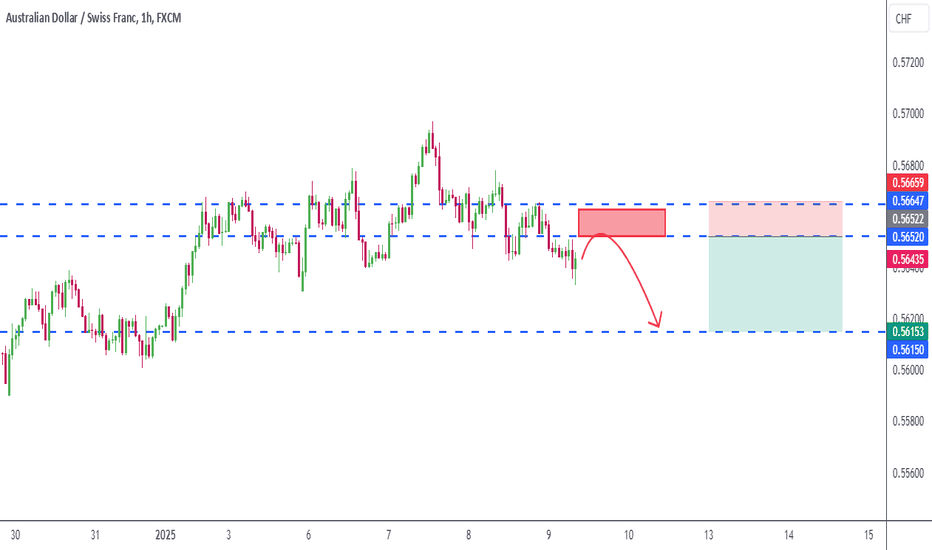

Lingrid | AUDCHF potential CHANNEL breakout. ShortThe price perfectly fulfilled my last idea. It hit the target zone. The overall trend for FX:AUDCHF remains bearish, particularly after recently bouncing off a resistance zone following the formation of a head and shoulders pattern. Additionally, the market has broken below the previous day's low after a daily long-tailed bar, which indicates rejection of higher prices. Given these factors, I believe the market is positioned to break through the lower boundary of this channel, potentially signaling a continuation of the bearish momentum. My goal is support level 0.56150

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

AUDCHF 3H LongAUD/CHF 3-hour chart shows a potential continuation of the short-term uptrend as the price trades above the Ichimoku cloud (Kumo), supported by the Tenkan-sen (red line) and Kijun-sen (blue line) trending upwards. The price has rejected the 0.618 Fibonacci retracement level and is holding above the 0.5 level, indicating strong bullish momentum. A buy entry near the current level (0.5670) is valid, with a hard stop-loss at the 1.0 Fibonacci level (0.5635) to minimize risk and a take-profit target at 0.5720, aligning with the recent swing high. Volume confirms buyer strength, and a sustained close above the 0.382 Fibonacci level would further validate the setup.

[Vienmelodic] AUDCHF - 3 Jan 2025 SetupAUDCHF Are making 2 important moves, both Ema's and bearish Structure are now broken. Spotted demand area (Green Rectangle). its the first demand area from a long bearish.

Entry Position : Long

Profit Target : 1:3 Shown on the chart image (Green Line)

Stop Loss : Slightly below demand area (Red Line)

Follow me if u guys making any gains from this idea.

Thanks

Vienmelodic

Bearish reversal off overlap resistance?AUD/CHF is rising towards the pivot and could reverse to the 1st support which acts as a pullback support.

Pivot: 0.57205

1st Support: 0.55667

1st Resistance: 0.58223

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

AUDCHF 1H LongThe AUD/CHF 1-hour chart signals a potential bullish continuation as price trades above the Kijun-sen (blue) and Tenkan-sen (red), while remaining well above the Ichimoku cloud (Kumo), confirming bullish momentum. The green Kumo ahead highlights further upside potential, with Fibonacci support at 0.56450 (61.8%) holding firmly. A break above 0.56650 (23.6%) could target 0.56950, while a stop-loss below 0.56300 ensures a favorable risk-to-reward ratio.