CHFCAD trade ideas

Buy CADCHF

All CHF pairs has been showing signs of a reversal setup for 2-3 weeks now,

Since gold price dropped on the 22/4/2025, all USD major paired currencies have all been reversing .. this effect will help boot all the CHF pairs reversal set-up. Additional catalyst to the move will be the release of the manufacturing PMI (USA)

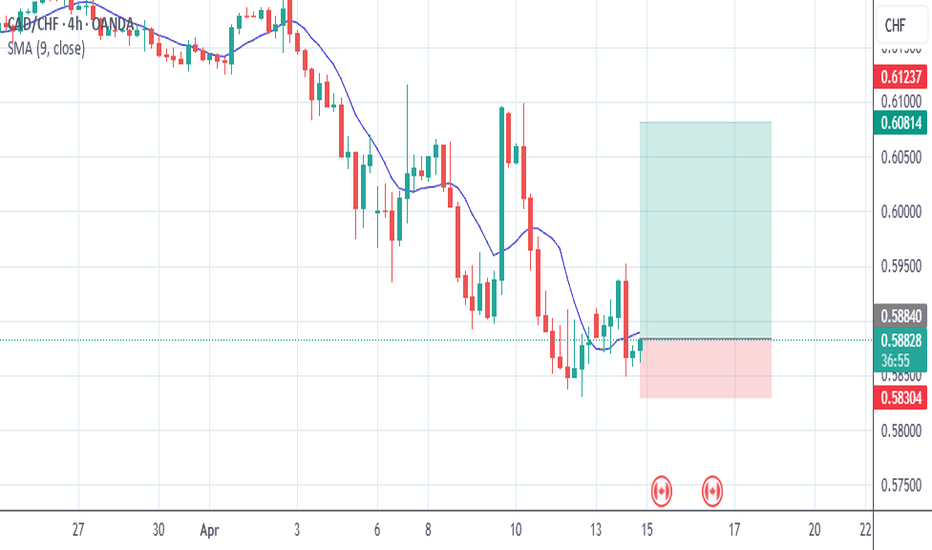

CAD_CHF LOCAL SHORT|

✅CAD_CHF made a nice

Bullish move up from the lows

But the pair is about to retest

A horizontal resistance level

Of 0.5952 from where we

Will be expecting a local

Bearish correction

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CADCHF BULLISH OR BEARISH DETAILED ANALYSIS We closely monitoring CADCHF, which is currently trading around 0.588. The pair has been in a strong downtrend, reflecting the broader weakness in the Canadian dollar against the Swiss franc. Technical indicators, including moving averages and momentum oscillators, suggest continued bearish momentum.

Fundamentally, the Canadian dollar is under pressure due to declining oil prices and a cautious stance from the Bank of Canada regarding interest rate hikes. In contrast, the Swiss franc benefits from its safe-haven status amid global economic uncertainties. The Swiss National Bank's relatively stable monetary policy further supports the franc's strength.

Key support levels to watch are at 0.57 and 0.58, while resistance levels are at 0.6050 and 0.6100. A break below the support could signal further downside potential, whereas a move above the resistance might indicate a reversal. Traders should remain cautious and consider macroeconomic developments when making trading decisions.

In conclusion, CAD/CHF presents a bearish outlook in the near term, influenced by both technical and fundamental factors. Monitoring economic indicators and central bank policies will be crucial for identifying potential trading opportunities in this pair.

CAD/CHF Weekly Analysis📊 CAD/CHF Weekly Analysis

🔍 Technical Insight by Shaker Trading

🔻 Bearish Market Structure:

Strong Descending Channel (Weekly):

The pair is currently trading within a clear and strong downward channel, confirming the ongoing bearish trend.

Weak Demand Zone:

Although there is a nearby demand area, it appears to be relatively weak and may not hold under heavy pressure.

Oversold Conditions on RSI & MACD:

Both the RSI and MACD indicators are showing signs of selling exhaustion, indicating a possible short-term bullish correction.

📌 Trading Outlook:

We do not recommend selling at this level. A high-risk buy opportunity may be considered from the current price, targeting the next supply zones for a potential short entry once price reaches those areas.

🔥 Copy Trading for Free

Let our team handle the trades while you sit back and watch the results – totally free of charge.

CAD/CHF "Loonie-Swiss" Forex Bank Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CAD/CHF "Loonie-Swiss" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Line. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (0.61000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the nearest/swing low level Using the 1H timeframe (0.59800) Day / Scalping trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.62400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💴💸CAD/CHF "Loonie-Swiss" Forex Market Heist Plan (Scalping / Day Trade) is currently experiencing a bullishness,., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets..., go ahead to check 👉👉👉🔗

Point-by-Point Recap 🔍

1. **Fundamental Analysis** 🌟: CAD’s oil ($84) and 3.5% rates edge out CHF, despite growth dip.

2. **Macroeconomic Analysis** 🚀: Canada’s hawkish stance beats CHF’s calm play.

3. **Global Market Analysis** 🌍: Neutral risk and US strength nudge CAD up.

4. **COT Data** 📈: Bullish CAD, bearish CHF signal upside.

5. **Intermarket Analysis** 🔗: Oil and USD/CAD back CAD/CHF gains.

6. **Quantitative Analysis** 📊: Neutral technicals (RSI 48) suggest a wait-and-see.

7. **Market Sentiment** 😊: 55% bullish vibe offers mild lift.

8. **Trend Prediction** 🔮: Bullish targets (0.6150 short, 0.6300 medium) lead.

9. **Outlook** 🎯: Neutral 5/10, a tight race.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

New Uptrend Forming — CADCHF Buyers May Be Stepping InCADCHF 12H TECHNICAL ANALYSIS 🔍

🧠 New Uptrend Forming — Buyers May Be Stepping In Below 0.59345

OVERALL TREND

📈 SHIFTING TO UPTREND — After weeks of falling prices, CADCHF is showing signs of turning around. Momentum might be changing in favor of buyers.

🔴RESISTANCE LEVELS

🔴 0.64072 — Pivot High | Seller's Stoploss

🔴 0.63787 — Sell Zone II (Lower high)

🔴 0.63211 — Sell Zone I (First trouble spot for buyers)

🎯TARGETS FOR BUYERS (TP = Take Profit)

🎯 0.62920 — BUY ORDER & TP 4

🎯 0.61817 — BUY ORDER & TP 3

🎯 0.61191 — BUY ORDER & TP 2 | Mid-Pivot

🎯 0.60212 — BUY ORDER & TP 1

🟡SUPPORT LEVELS

🟡 0.59345 — First Buy Zone (current price)

🟡 0.59210 — Support Level

🟡 0.58598 — Buy Zone II (lower entry)

🟡 0.58482 — Minor Support

🟡 0.58310 — Pivot Low | Buyer's Stoploss

🤓WHAT THE CHART IS TELLING US

Price recently bounced off 0.58310 — showing buyers are protecting this level

Multiple buy orders are lined up between 0.58482 and 0.59345

If price moves above 0.60212, buyers may push toward 0.61817 or higher

If price falls below 0.58310, the setup may no longer be valid

TRADING IDEAS FOR BEGINNERS 🧭

📈 Look to buy if price stays above 0.58598 and moves toward 0.60212

📉 Avoid buying if price starts closing below 0.58310

👀 Watch the area between 0.59345 and 0.60212 — it could be the launchpad for the next move up

📋RECOMMENDED SETUPS

SAFE APPROACH (Beginner-Friendly):

— Buy Around: 0.58598

— Take Profit: 0.60212 / 0.61191 / 0.61817

— Stop Loss: Below 0.58310

QUICK SCALP OPTION (Faster Trades):

— Buy on a bounce from 0.59210 or 0.58598

— Target: 0.60212

— Stop Loss: Just under 0.58310

“Be patient. Be consistent. Be disciplined. That’s how you grow.”

Falling towards Fibonacci confluence?CAD/CHF is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 0.57865

1st Support: 0.56812

1st Resistance: 0.59362

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Falling towards Fibonacci confluence?CAD/CHF is falling towards the pivot and could bonce to the 1st resistance which is a pullback resistance.

Pivot: 0.57865

1st Support: 0.56812

1st Resistance: 0.59362

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

CAD/CHF BULLS ARE GAINING STRENGTH|LONG

CAD/CHF SIGNAL

Trade Direction: long

Entry Level: 0.586

Target Level: 0.607

Stop Loss: 0.572

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Pre-Market Analysis – CAD/CHF1️⃣ The price has broken below the previous support zone, which had held multiple times in the past. This area is now likely to act as a new resistance.

2️⃣ The bottom boundary of the descending channel has been touched, signaling a potential reaction or short-term bounce from this level.

3️⃣ It’s quite probable that the price retraces back to the midline of the channel before continuing its downward move. This would be a classic pullback within a bearish channel structure.

📉 If price fails to reclaim the broken support and reacts bearishly near the resistance-turned zone or the channel’s midline, it could provide a solid continuation setup to the downside.

CAD_CHF RISKY LONG|

✅CAD_CHF has retested a key support level of 0.5892

And as the pair is already making a bullish rebound

A move up to retest the supply level above at 0.5949 is likely

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.