CHFEUR trade ideas

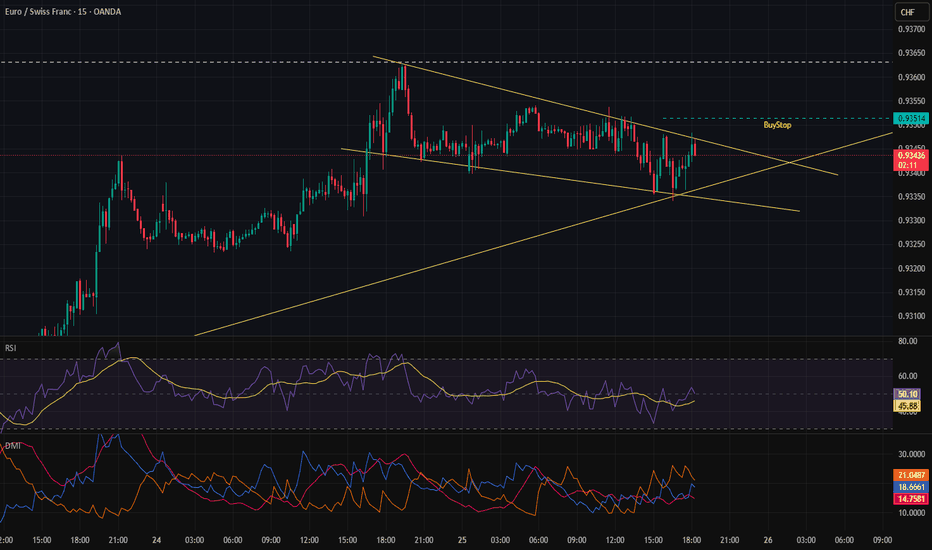

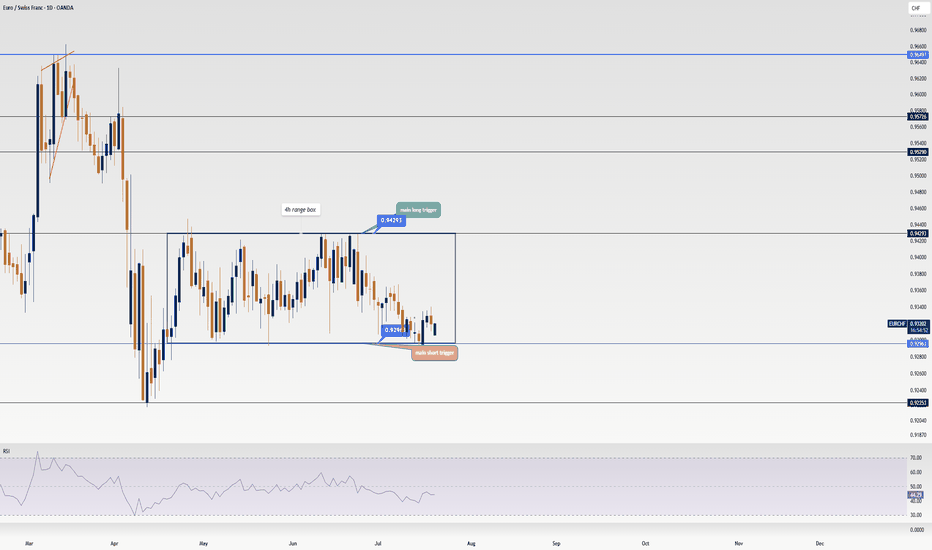

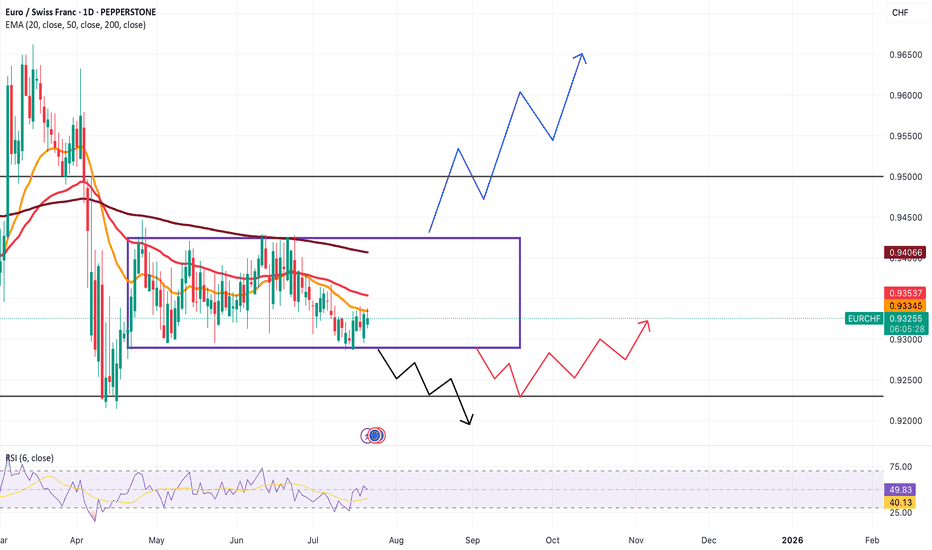

EUR/CHF Update: I just found out the next big triggerHey friends 🩵, hope you’re kicking off the week with a great vibe! It’s Skeptic from Skeptic Lab . In this video, I’m diving into EUR/CHF .

We’re stuck in a range box right now, and knowing this setup will help you miss fewer opportunities. Don’t forget money management, dodge FOMO, and have a plan for different scenarios. I also explained in the video why I personally prefer opening a short position. So, let’s get started!

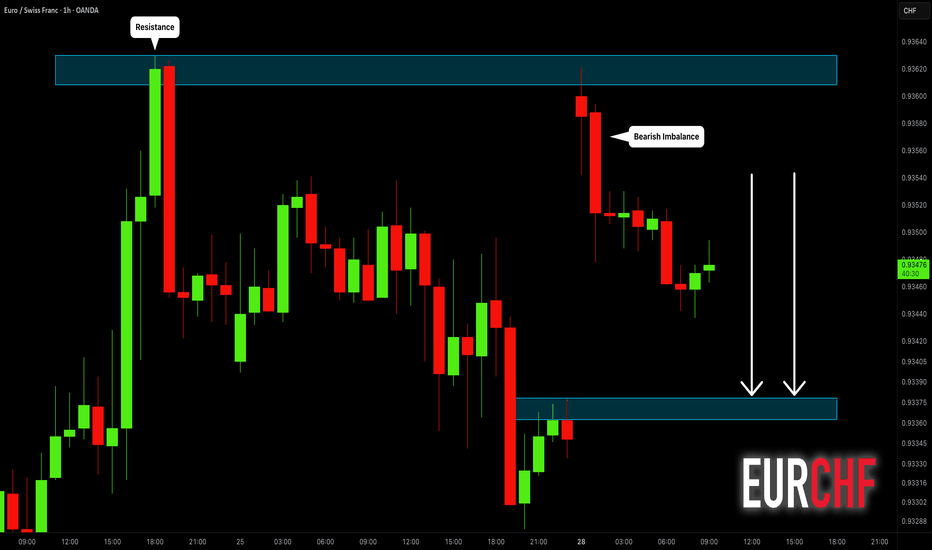

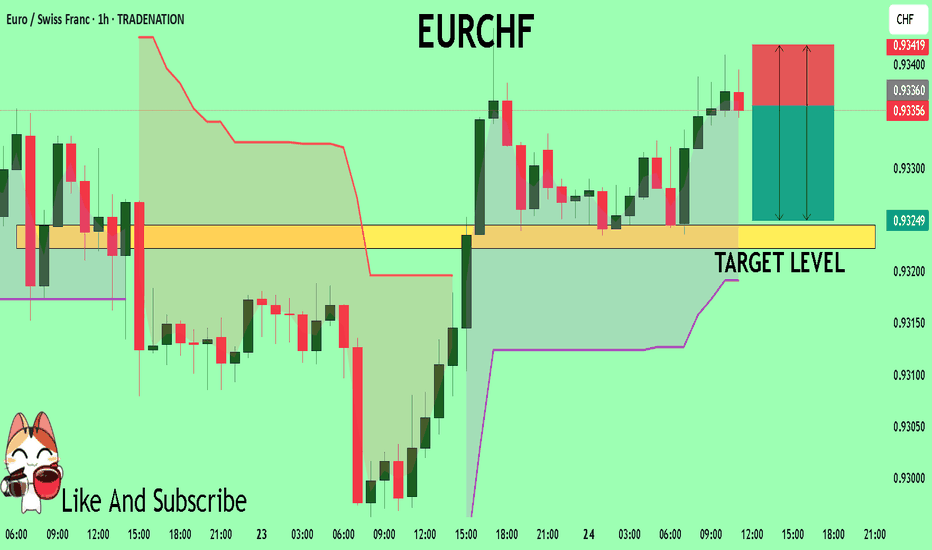

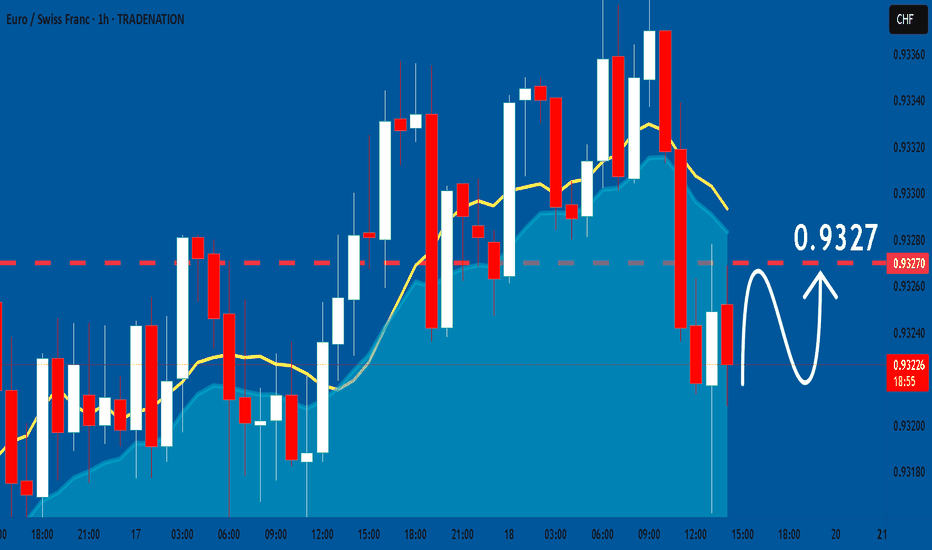

EURCHF: Classic Gap Trade 🇪🇺🇨🇭

There is a huge gap up opening on EURCHF.

The price tested a key intraday resistance with that and formed

a strong bearish imbalance candle then.

Probabilities will be high that the market will fill the gap today.

Goal - 0.9338

❤️Please, support my work with like, thank you!❤️

Trade Idea: I’m bullish on EURCHF.Europe’s Slow Burn vs. Switzerland’s Defensive Retreat 🔥🛡️

Two central banks, two very different strategies — and one potential opportunity. As the SNB scrambles to weaken its overvalued franc, the ECB is just beginning to pause. That divergence may be the crack where EURCHF bulls find their edge.

📈 Trade Idea: I’m bullish on EURCHF.

Here’s why I think the euro could outperform the franc near-term:

✅ SNB slashed rates to 0.0%, second cut this year — signaling discomfort with franc strength.

🔄 The ECB paused cuts after eight consecutive ones — signaling a shift to “wait and see.”

📉 Swiss inflation is hotter than expected, limiting further SNB easing.

⚖️ EUR strength is boosted by US-EU trade deal optimism, which reduces demand for CHF’s safe-haven status.

💬 Speculative positioning: traders are net short CHF, and net long EUR.

The SNB is stuck. They want a weaker franc to protect exports, but they can’t afford negative rates again. Meanwhile, global risk appetite is rising — and that’s bad news for safe havens like CHF. Add in upside inflation surprises in Switzerland, and the SNB is losing room to maneuver.

On the euro side, it’s not a roaring recovery — but it’s stable. Industrial production is rising, inflation is controlled, and confidence is ticking up. If the US-EU trade deal lands, the euro could gain even more ground as investors shift away from defensives like CHF.

The short-term setup? A defensive SNB, a patient ECB, and a potential EUR tailwind.

Would you take this trade? Or are you still backing the Swiss shield? 👇

EURCHF Is in The Selling Direction Hello Traders

In This Chart EURCHF HOURLY Forex Forecast By FOREX PLANET

today EURCHF analysis 👆

🟢This Chart includes_ (EURCHF market update)

🟢What is The Next Opportunity on EURCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EURCHF: Market of Buyers

Looking at the chart of EURCHF right now we are seeing some interesting price action on the lower timeframes. Thus a local move up seems to be quite likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

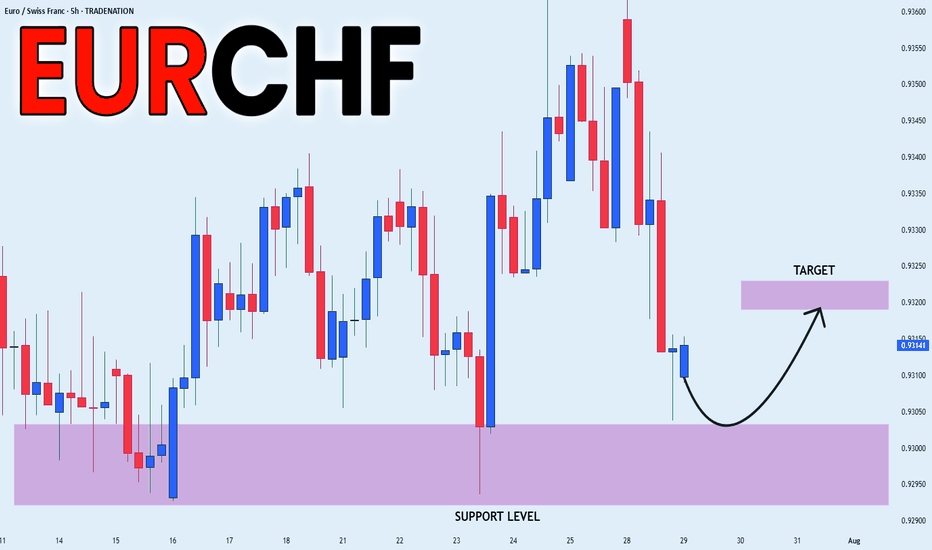

EUR_CHF RISKY LONG|

✅EUR_CHF is set to retest a

Strong support level below at 0.9300

After trading in a local downtrend for some time

Which makes a bullish rebound a likely scenario

With the target being a local resistance above at 0.9320

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURCHF Set To Fall! SELL!

My dear friends,

My technical analysis for EURCHF is below:

The market is trading on 0.9349 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 0.9340

Recommended Stop Loss - 0.9355

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURCHF Trading Opportunity! SELL!

My dear subscribers,

EURCHF looks like it will make a good move, and here are the details:

The market is trading on 0.9335 pivot level.

Bias - Bearish

My Stop Loss - 0.9341

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 0.9324

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

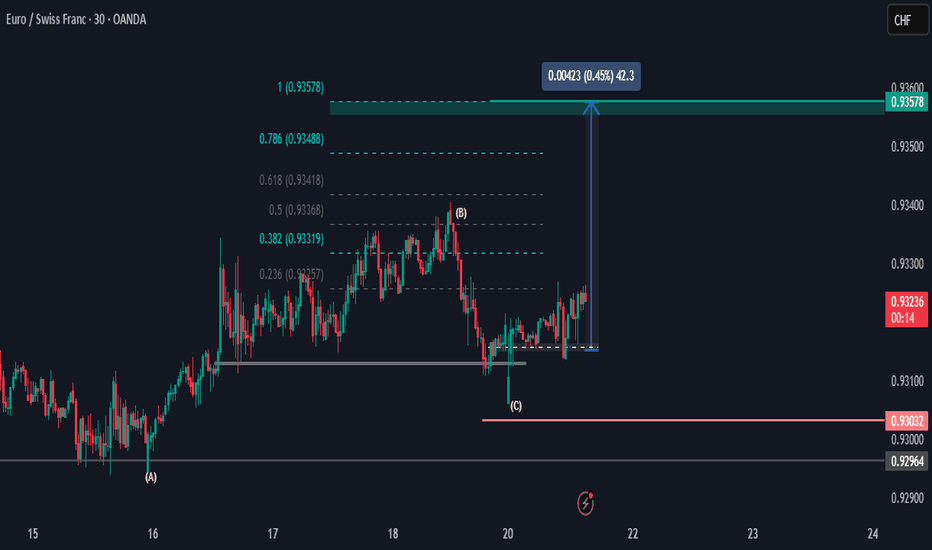

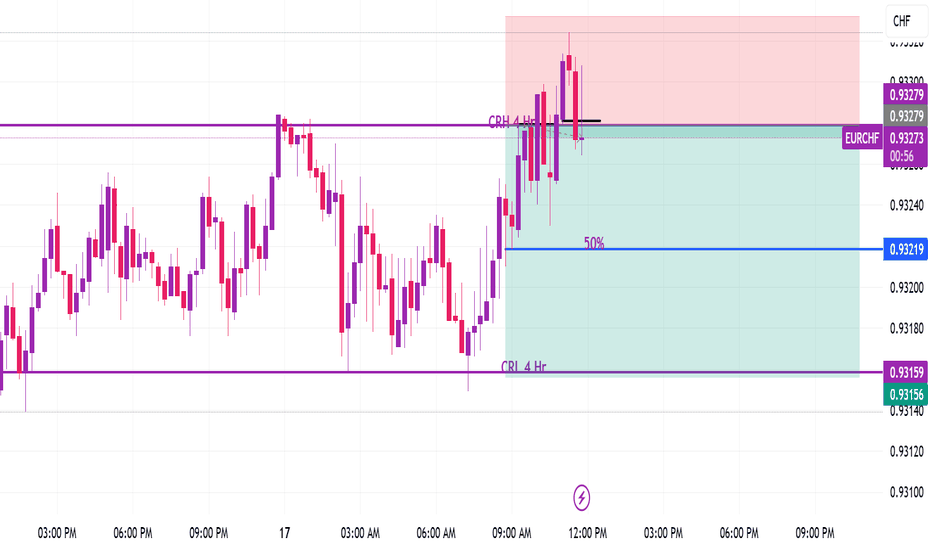

EURCHF Price Is looking UpHi there,

The EURCHF looks bearish at the M30, with the first resistance target potentially being 0.93319. I anticipate for the price to reach above area (B) into the 0.93419 price area for a potential push up to the 0.93488 area, and if momentum is strong in the higher time frames, then the bias is set for 0.93578.

Happy Trading,

K.

Not trading advice.

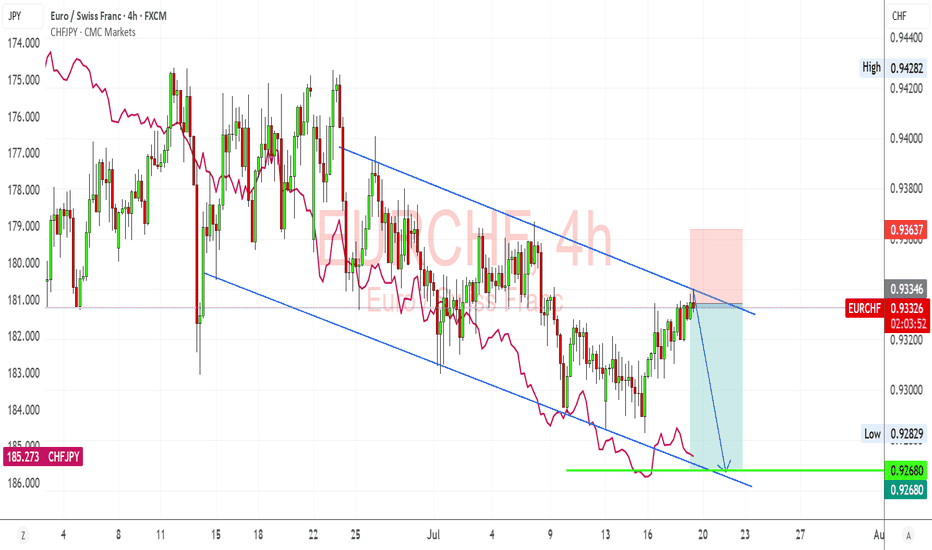

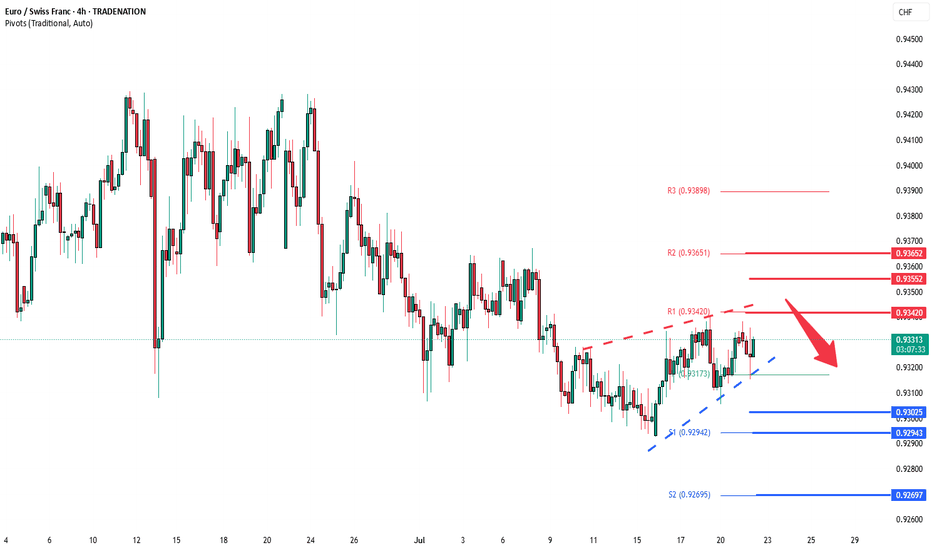

EURCHF – Bearish Channel Holds Firm, CHF Strength Set to ResumeEURCHF just tapped into the descending channel resistance again and is showing signs of rejecting. I'm expecting a bearish continuation here, especially given the strong CHF momentum recently, supported by safe-haven flows and Swiss inflation stability. If the pair fails to break above 0.9340, I’m watching for a downside push back toward 0.9270–0.9265, completing another leg within the structure.

🔍 Technical Setup (4H):

Channel Structure: EURCHF remains firmly within a downward-sloping parallel channel since mid-June.

Resistance Rejection: Price recently tested upper channel resistance (~0.9335–0.9340 zone), aligning with trendline rejection.

Target Support: 0.9270–0.9265 (channel base and key horizontal level).

Confluence: CHFJPY overlay (pink line) is rising again, suggesting renewed CHF strength—this usually weighs on EURCHF.

💡 Fundamental Insight:

EUR Side:

ECB officials remain cautious, but with recent EU data showing weaker growth (especially PMIs and sentiment), euro upside is capped.

The ECB is likely to pause further tightening, while other central banks like SNB remain firm on inflation risks.

CHF Strength:

The Swiss National Bank (SNB) still leans hawkish, with stable inflation giving room to hold rates steady or tighten if needed.

CHF benefits from risk-off flows amid global tariff headlines, China slowdown, and Middle East tensions.

Rising CHFJPY = clear CHF strength across the board.

⚠️ Risks:

If eurozone data surprises to the upside (e.g., inflation rebounds), EURCHF could break out of the channel.

A sudden drop in geopolitical tension or strong risk-on rally could weaken CHF as safe-haven demand falls.

SNB jawboning or FX intervention is always a wildcard.

🧭 Summary:

I’m bearish on EURCHF while it respects this well-defined descending channel. The technicals show consistent lower highs and lower lows, while the fundamentals continue to support CHF strength due to risk aversion, stable inflation, and a resilient SNB. My short bias is valid as long as price remains below 0.9340, with downside targets at 0.9270–0.9265. CHFJPY rising confirms franc leadership across FX markets, and EURCHF is likely a lagger following broader CHF strength.

EURCHF has been a Terrible Market to Trade inEURCHF on the 1D has been consolidating for a few months now. Box has been drawn to indicate that.

It's been all noise and I dont think it would be wise to trade in a choppy market.

I'm wondering if anyone is trading EURCHF and has found a profitable way to trade it in this choppy market. Open to hearing any strategies being used in this market.

Key level of support is present at 0.92300. If price breaks the consolidation zone, I'll look to sell till 0.92300.

If the price moves up and above the consolidation zone, we could push till 0.95000

Would be setting alerts for these key levels but may not look to trade at the moment.

Open to hearing any profitable strategies being used in these market conditions.

EURCHF oversold bounce backs capped at 0.9340The EURCHF pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend.

Key resistance is located at 0.9340, a prior consolidation zone. This level will be critical in determining the next directional move.

A bearish rejection from 0.9340 could confirm the resumption of the downtrend, targeting the next support levels at 0.9300, followed by 0.9290 and 0.9270 over a longer timeframe.

Conversely, a decisive breakout and daily close above 0.9340 would invalidate the current bearish setup, shifting sentiment to bullish and potentially triggering a move towards 0.9355, then 0.9365.

Conclusion:

The short-term outlook remains bearish unless the pair breaks and holds above 0.9340. Traders should watch for price action signals around this key level to confirm direction. A rejection favours fresh downside continuation, while a breakout signals a potential trend reversal or deeper correction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EUR/CHF LOSSBoy, sometimes you think the market is targeting you.....I get it. this is not the first time we have been taken out of a trade that just "barely" touched our stop. Keep a solid money management plan in place, no revenge trading....this one didn't work out but in my opinion it was a solid trade. Onto the next one.

EURCHF: Bullish Continuation is Highly Probable! Here is Why:

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the EURCHF pair which is likely to be pushed up by the bulls so we will buy!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EUR/CHF (2H). | Elliott Wave Structure📊 Technical Structure (2H)

✅ Channel structure remains intact

✅ Wave (4) nearing completion within resistance

✅ Strong sell zone between 0.9345–0.9363

📌 Downside Targets

First: 0.93129

Final: 0.92721

🔻 Invalidation Zone

Above: 0.93634 (Break above would invalidate current wave count)

---

📈 Market Outlook

EUR Weakness: Dragged by soft PMIs and ECB's dovish stance.

CHF Strength: Risk-off flows favoring Swiss Franc demand.

Structure: Elliott Wave alignment supports further downside.

---

⚠️ Risks to Watch

Breakout above 0.9364 invalidates bearish count

Sudden shift in SNB or ECB policy stance

Broader EUR strength spilling into crosses

---

🧭 Summary: Bias and Watchpoints

EUR/CHF is likely to resume its downtrend from the current resistance zone, with a Wave (5) extension aiming toward 0.9272. While the setup offers a clean R:R, tight risk control is crucial above 0.9364. Watch for confirmation candles and bearish reaction from the red zone.

---

EURCHF bearish continuation The EURCHF pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend.

Key resistance is located at 0.9340, a prior consolidation zone. This level will be critical in determining the next directional move.

A bearish rejection from 0.9340 could confirm the resumption of the downtrend, targeting the next support levels at 0.9300, followed by 0.9290 and 0.9270 over a longer timeframe.

Conversely, a decisive breakout and daily close above 0.9340 would invalidate the current bearish setup, shifting sentiment to bullish and potentially triggering a move towards 0.9355, then 0.9365.

Conclusion:

The short-term outlook remains bearish unless the pair breaks and holds above 0.9340. Traders should watch for price action signals around this key level to confirm direction. A rejection favours fresh downside continuation, while a breakout signals a potential trend reversal or deeper correction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

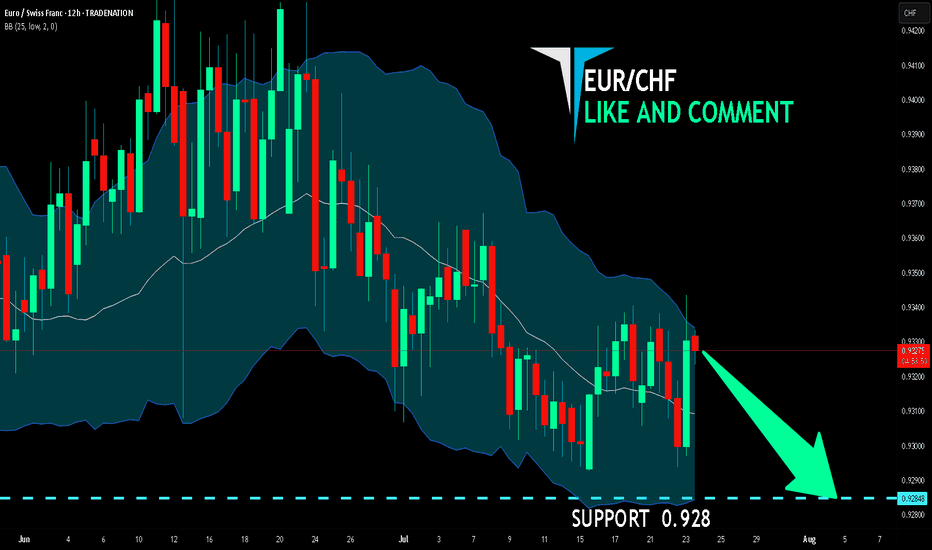

EUR/CHF BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

EUR/CHF is making a bullish rebound on the 12H TF and is nearing the resistance line above while we are generally bearish biased on the pair due to our previous 1W candle analysis, thus making a trend-following short a good option for us with the target being the 0.928 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

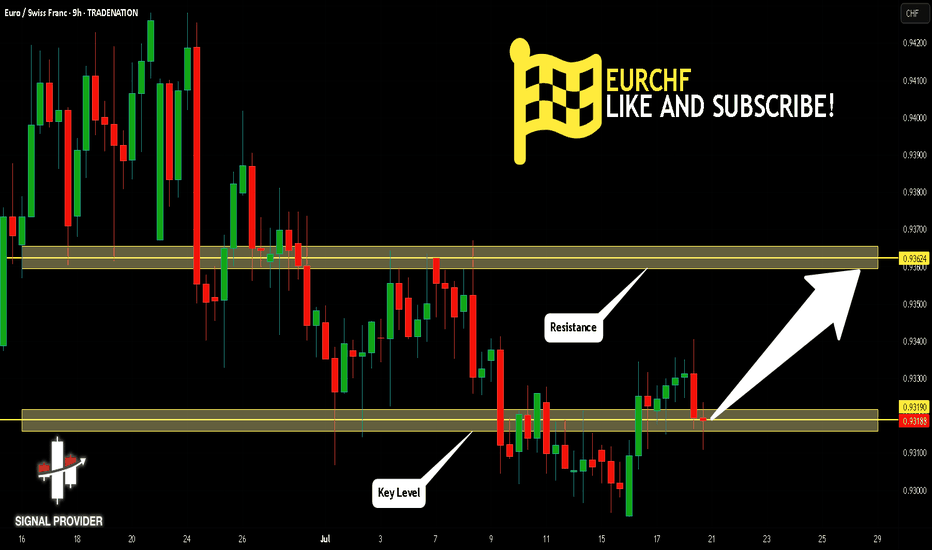

EURCHF Is Going Up! Buy!

Here is our detailed technical review for EURCHF.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 0.931.

Taking into consideration the structure & trend analysis, I believe that the market will reach 0.936 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

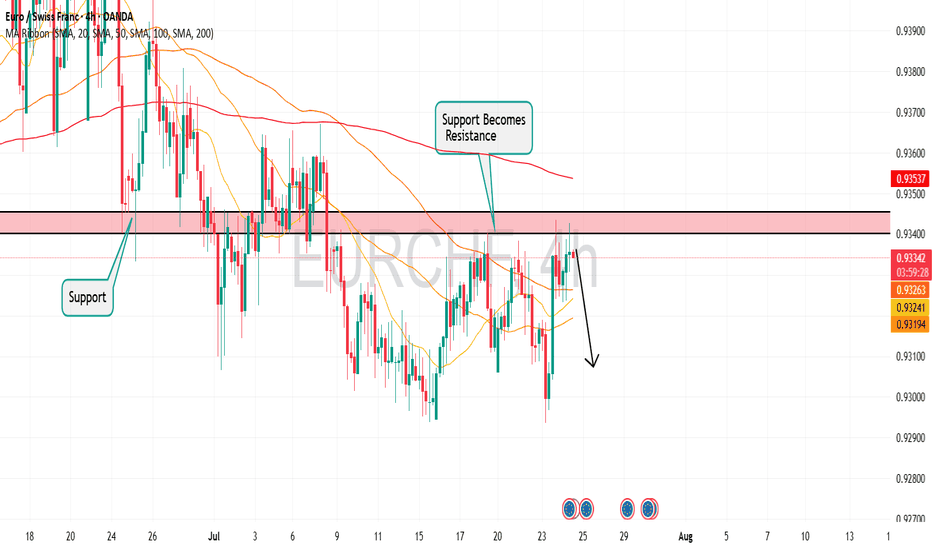

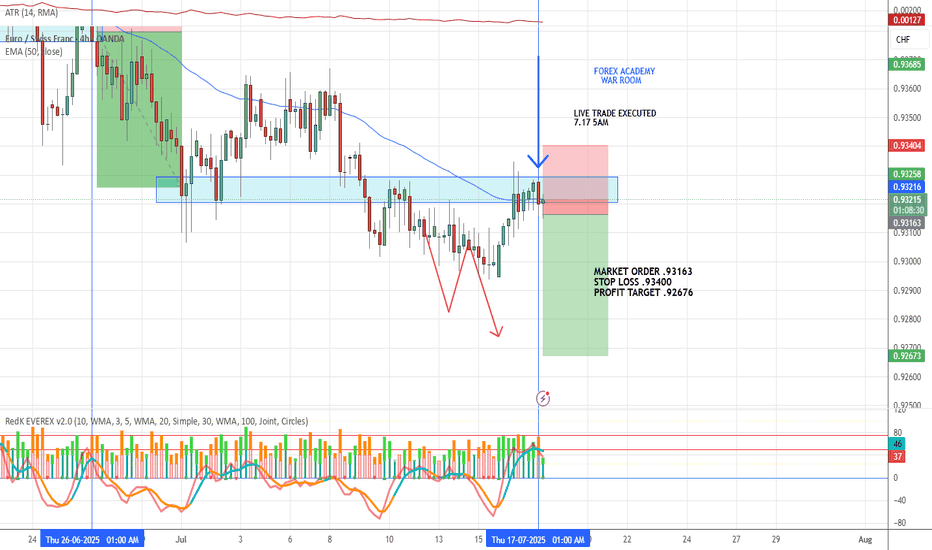

7.17 EUR/CHF LIVE TRADE 5AMUsing the VMS strategy we took a short position with this pair this morning.

1. Price Action made a new low

2. Pullback into S/R zone

3. Price action is at the 50EMA

4. Market is currently in a downtrend

5. Solid engulfing candle trigger on 4H

6. Volume is strong down

7. Momentum is good (not great) down

Price has recently been at the levels we are looking for profit at, which is important when deciding IF you think your profit target CAN be hit. The stop loss was placed based on the recent swing high and adding the ATR to it.

If you look back on the 4H charts you will see yesterday was a news day which triggered all of the fast and big moves we had yesterday. News events will do that so be careful, we were taken out of 2 of our 3 (why bankroll management is critical) but are still holding on in the EUR/USD.