Bullish CHF/JPY Heist! Risk vs. Reward Setup💰 SWISS-YEN BANK HEIST! 🚨 CHF/JPY Bullish Raid Plan (Risk & Reward Setup)

🌟 Attention Market Pirates & Profit Raiders! 🌟

"The vault is unlocked—time to loot!"

🔎 THIEF TRADING ANALYSIS (CHF/JPY)

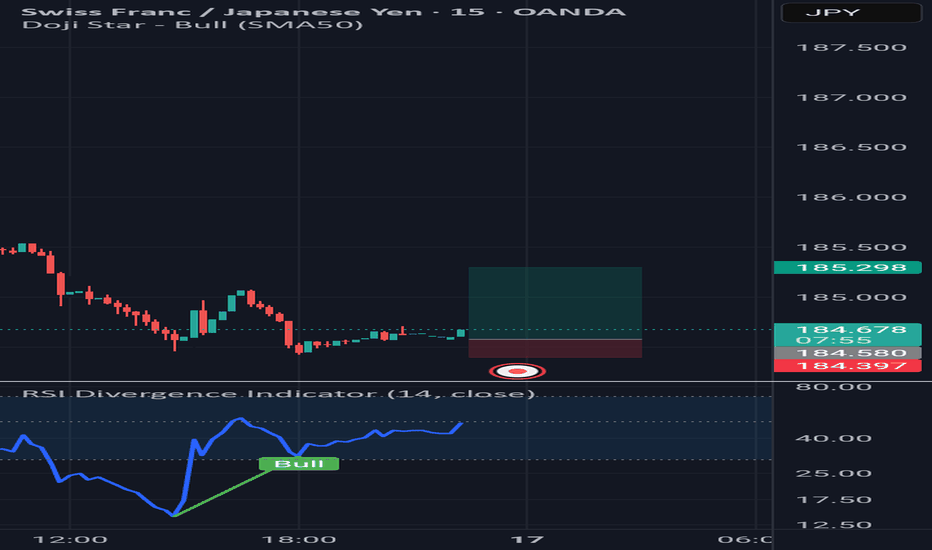

Entry (📈): "The Bullish Loot is LIVE!"

Buy limit orders within 15-30min pullbacks (recent swing lows/highs).

Aggressive? Enter anywhere—heist mode activated!

Stop Loss (🛑): Recent swing low (wick) – adjust based on your risk & lot size!

🎯 Target: 186.300 (High-risk Red Zone – Police Resistance!)

Overbought? Reversal risk? Bears lurking? Yes. But thieves play smart!

🏴☠️ SCALPERS & SWING RAIDERS:

Scalp ONLY Long (Use trailing SL to lock profits).

Low on ammo? Join swing traders for the big heist!

📡 FUNDAMENTAL BACKUP (Why This Heist?)

Bullish momentum in play (check COT, Macro, Sentiment).

News Alert (⚠️): Avoid new trades during high-impact news—trail your SL!

💥 BOOST THE HEIST!

Hit 👍 LIKE & 🔄 SHARE to strengthen our robbery squad!

More heists coming—stay tuned! 🚀

⚠️ DISCLAIMER:

Not financial advice. Risk = Reward. Adjust SL/targets based on your strategy. Market conditions change—adapt or get caught!

CHFJPY trade ideas

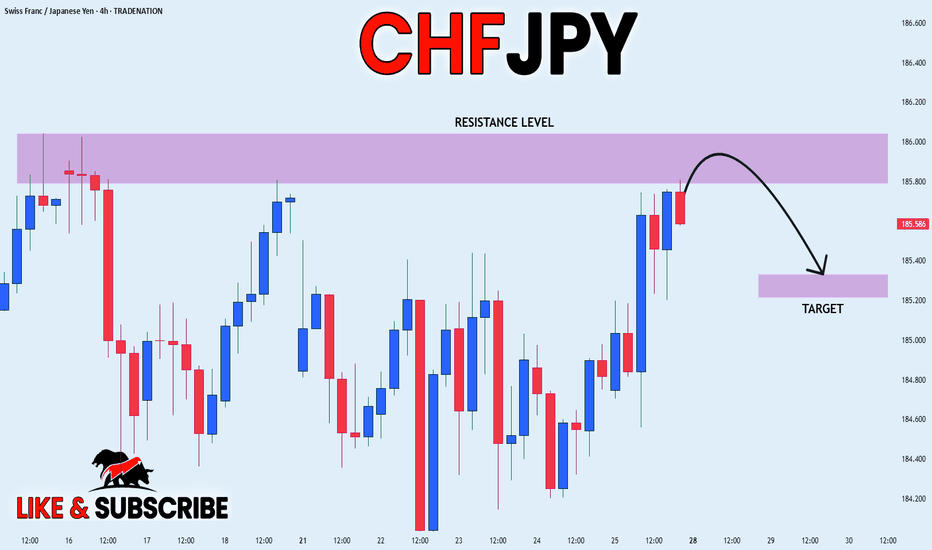

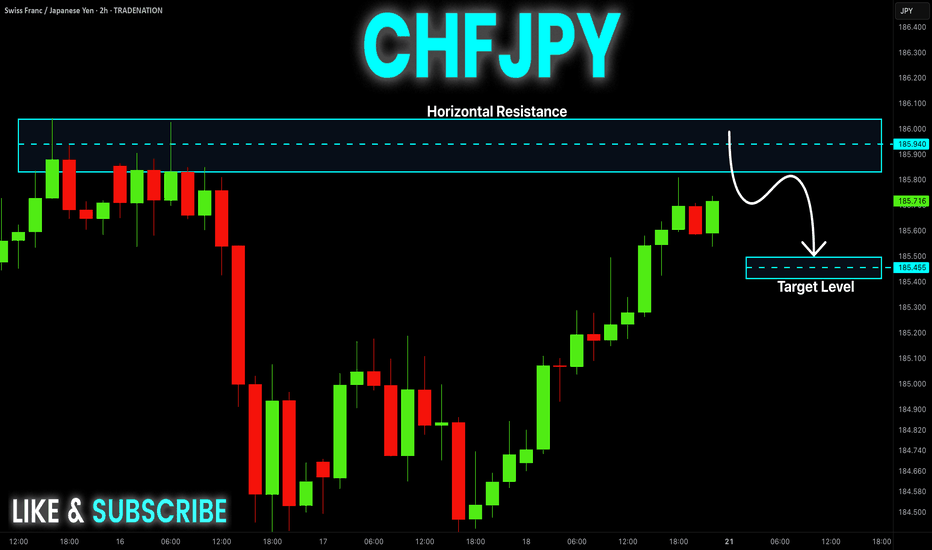

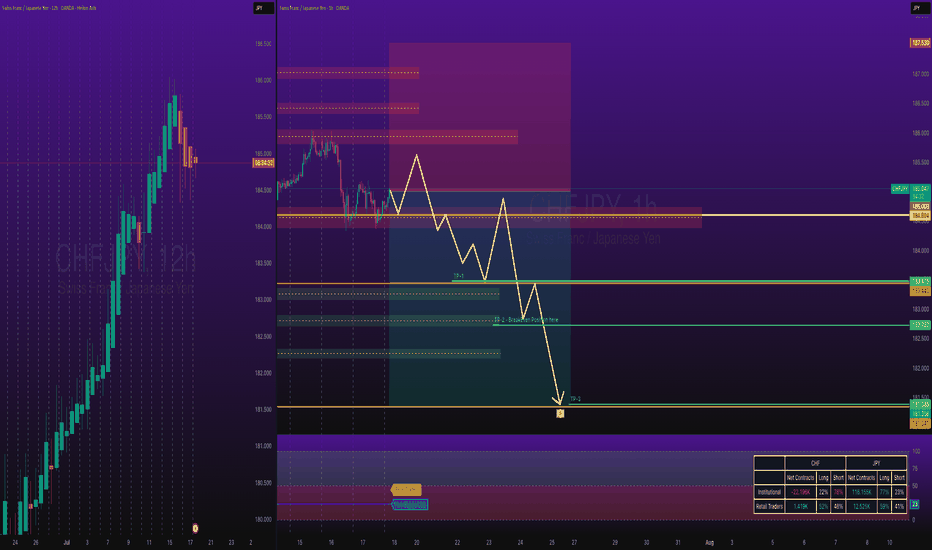

CHF_JPY RISKY SHORT|

✅CHF_JPY is going up now

But a strong resistance level is ahead at 186.036

Thus I am expecting a pullback

And a move down towards the target of 185.329

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Why CHFJPY is the #1 Forex Pair Right NowWhy CHFJPY is the #1 Forex Pair Right Now (And How to Trade It with the Rocket Booster Strategy)

In the ever-evolving world of Forex, where volatility and opportunity go hand in hand, traders are constantly on the

lookout for the next big mover. As of 2025, one currency pair is stealing the spotlight: CHFJPY (Swiss Franc vs. Japanese Yen). But

what makes this pair the top pick for savvy traders? And how can you capitalize on its momentum with the Rocket Booster Strategy?

Let’s break it down.

🔥 Why CHFJPY is the #1 Forex Pair Right Now

1. Safe-Haven Power Duo

Both the Swiss Franc (CHF) and the Japanese Yen (JPY) are traditionally viewed as safe-haven currencies. However, recent

geopolitical and inflationary trends have pushed CHF to dominate the Yen. Investors are choosing the Franc over the Yen for capital preservation due to:

Stronger Swiss economic fundamentals

Negative interest rate policies easing in Switzerland

Japan's continued loose monetary policy

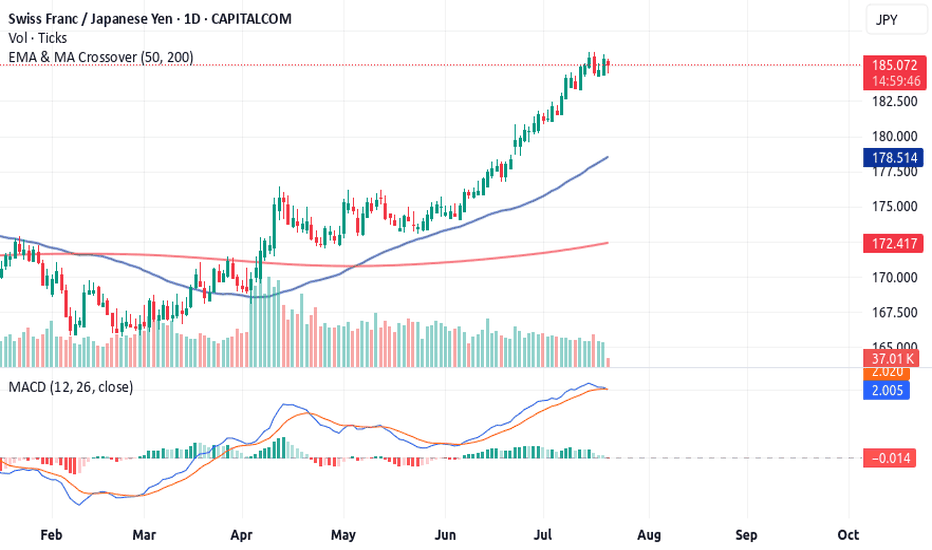

2. Clear Bullish Trend

CHFJPY has shown consistent higher highs and higher lows on daily and weekly charts — a sign of institutional buying. The pair

has been on a clean bullish trajectory, offering excellent trend-following opportunities.

3. Low Correlation With USD

CHFJPY gives traders a break from the noise of USD-related pairs. This is ideal for portfolio diversification and avoiding dollar-index-related whipsaws.

4. Volatility with Direction

Unlike other volatile pairs that move erratically, CHFJPY delivers measured moves with directional conviction — perfect for momentum traders.

🚀 The Rocket Booster Strategy: Your Weapon for CHFJPY

The Rocket Booster Strategy is designed to identify strong momentum trades before they explode. It’s a 3-step system that filters out weak setups and locks in on potential high-profit

trades.

✅ The 3 Rocket Booster Steps

1. Price Above the 50 EMA

This tells us the short-term momentum is bullish. CHFJPY often rides above the 50 EMA for days or even weeks during strong trends.

2. Price Above the 200 EMA

This confirms the long-term trend is also bullish. When price is above both 50 EMA and 200 EMA, we have alignment — just like a rocket getting clearance from both control towers.

3. Volume Oscillator Confirmation

This is the ignition. We look for the Volume Oscillator to tick up or reverse from a dip, indicating renewed trader interest and the potential for price acceleration.

📘 Bonus Tip from Steve Nison: Volume confirms conviction. A breakout without volume = caution.

📊 Example CHFJPY Rocket Booster Setup

Rocket Booster Checklist Status

Price above 50 EMA ✅ Confirmed

Price above 200 EMA ✅ Confirmed

Volume Oscillator rising ✅ Confirmed

MACD shows bullish momentum ✅ Strong impulse

Candlestick Pattern ✅ Bullish Engulfing on 4H

This alignment means: Launch is ready.

🚀 Final Thoughts

CHFJPY is not just a currency pair — it’s a financial jet engine right now. Its blend of safety, momentum, and clarity makes it the #1 pick for traders in 2025. But without a proven system, even the best pair can leave you behind.

That’s where the Rocket Booster Strategy comes in.

When you combine a trending pair like CHFJPY with a strategy designed to identify high-probability entries, you’re not just trading — you’re flying.

💬 Ready to launch your next CHFJPY trade? Use the Rocket Booster Strategy and experience the power of momentum, clarity, and smart entries.

⚠️ Disclaimer

This content is for educational purposes only and not financial advice. Forex trading carries risk.

Always test strategies on a demo (simulation) account before trading with real money.

CHF-JPY Resistance Ahead! Sell!

Hello,Traders!

CHF-JPY keeps growing in

An uptrend and the pair is

Locally oversold so after the

Retest of the horizontal

Resistance of 186.000

From where we will be

Expecting a local bearish

Pullback on Monday

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

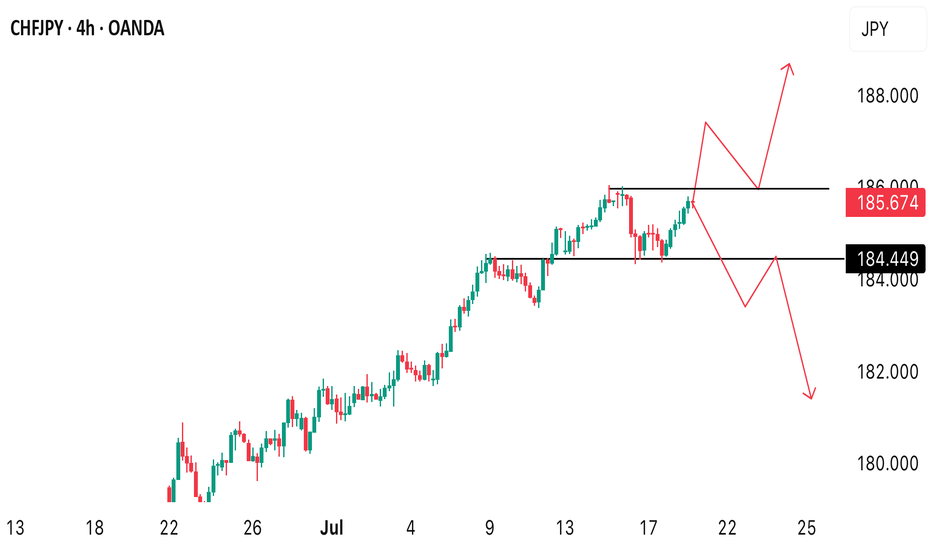

What to expect next on CHFJPYTrend remains strongly bullish from the higher timeframe. Monthly, & weekly. Daily timeframe is slightly bullish but currently loosing some momentum. Therefore, from the H4 timeframe, we’re likely to see either a break above the current resistance to form a new high or were to see a decline below the key level.

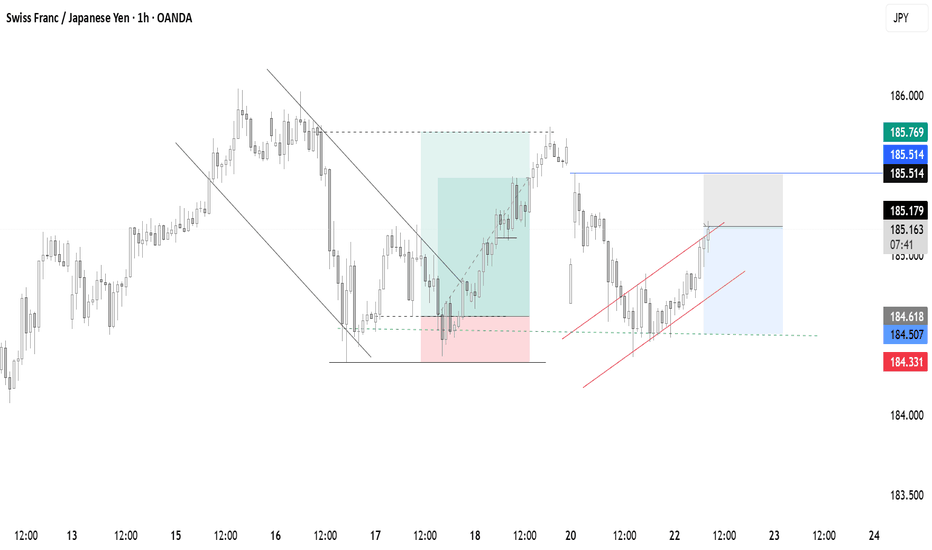

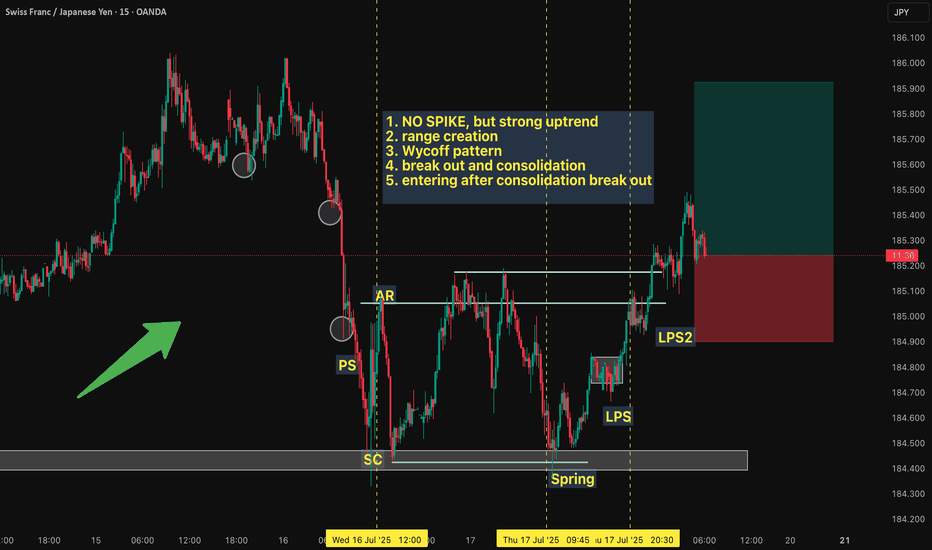

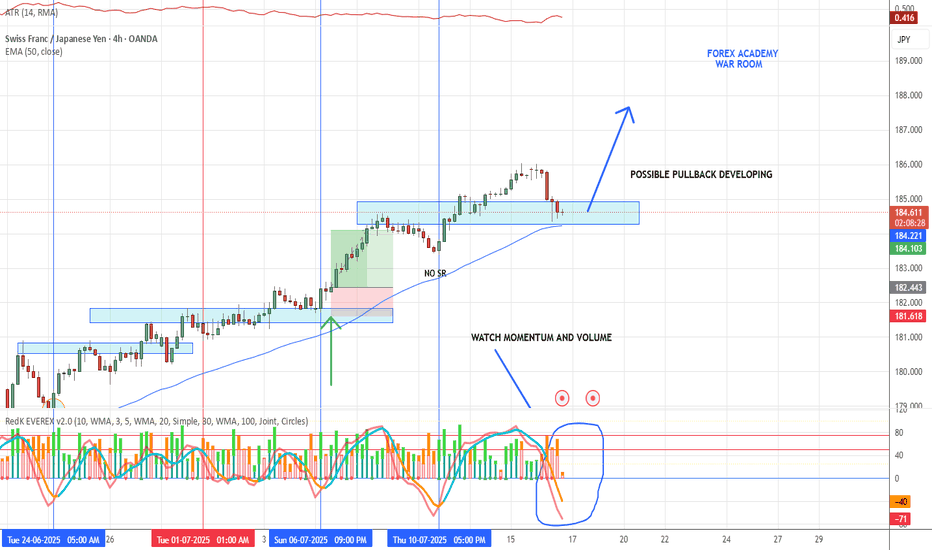

CHF/JPY MISSED MOVEWe started watching this market on Wednesday for a pullback and trigger, it happened but it was late at night....yawn....i was sleeping. No chance to get in this market even with a limit order...sometimes the market just takes off like that, this is why i use the volume and momentum indicators...if both of them line up along with a price structure pattern, it can produce a strong move

SYMMETRY

Hello awesome traders! 👋

Hope you’ve managed to grab some solid pips from the markets this week. As we head into the weekend, I’m wrapping things up by dropping a few clean chart setups for you to review and reflect on.

Enjoy the weekend, recharge well — and I’ll see you sharp and ready next week for more structure-led opportunities.

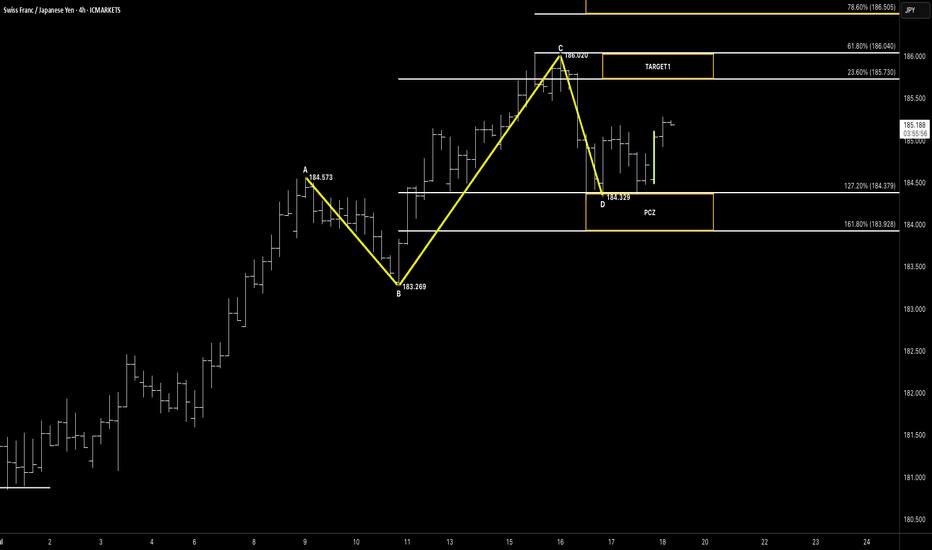

📌 Pattern Breakdown

This setup delivered exactly what we watch for:

🔹 Classic ABC structure with clean symmetry

🔹 CD leg completed directly into the Potential Completion Zone (PCZ)

• 127.2% BC = 184.379

• 161.8% BC = 183.928

🔹 Price tagged 184.329 and showed a strong, clean bullish rejection right from the zone

It’s a confirmation of intent — but the job’s not done just yet.

🎯 Next Levels in Focus

🚫 Target 1 has not yet been hit, but structure is holding well.

🎯 Target 1 Range: 185.73 – 186.04

🎯 Target 2 (extension): 186.50 – 187.10

As we head into close, this becomes a management decision:

🔸 Let partials run if you’re in

🔸 Stay flat if you missed entry — wait for next week’s confirmation or pullback opportunity

🧠 Key Concepts in Play

✅ Symmetry-based ABC pattern

✅ PCZ precision and confirmed bullish rejection

✅ Momentum building, but still below TP1

✅ Structure-based trade with defined targets and invalidation

🗝 Final Thoughts

This is a textbook end-of-week setup: clean structure, clear reaction, and patience now required.

Don’t force the next move — we’ve got rejection confirmation, now we let price follow through.

Target 1 is well-defined — and price is on its way. We'll reassess early next week for continuation toward the higher fib extensions.

“Rejection starts the move — but discipline finishes the trade.”

CHFJPY Short Swing TradeOANDA:CHFJPY Short Trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

This is good trade, don't overload your risk like greedy, be disciplined trader.

I manage trade on daily basis.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

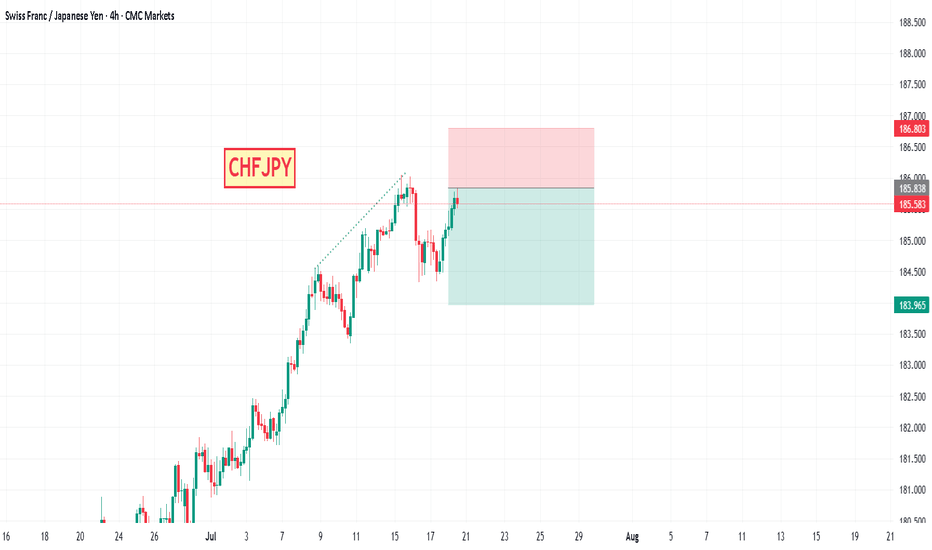

7.16 CHF/JPY SETUPPossible pullback setup developing. Price action is moving into the S/R zone after a new high. Momentum is very low and like a spring is getting wound up to go up...Momentum shows the pulse of the market. We need a great engulfing candle and a strong volume candle. This trade would not have a great S/R zone but it is good with 2 touches. We will keep watching this one.

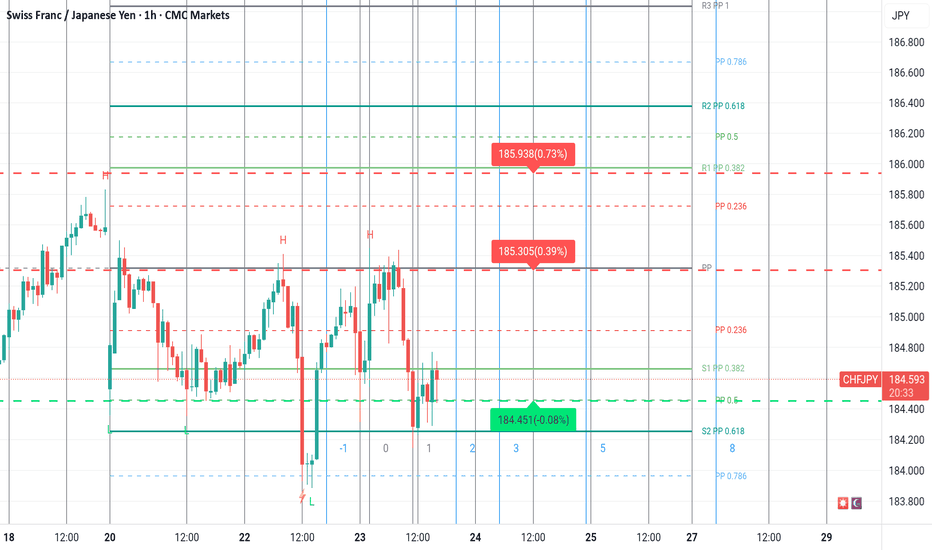

CHFJPYCHFJPY price is in a very bullish trend. At the current price, there may be short-term selling. Therefore, if the price cannot break through 185.34, it is expected that the price will drop. Consider selling the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

CHF/JPY BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

We are going short on the CHF/JPY with the target of 179.028 level, because the pair is overbought and will soon hit the resistance line above. We deduced the overbought condition from the price being near to the upper BB band. However, we should use low risk here because the 1W TF is green and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅