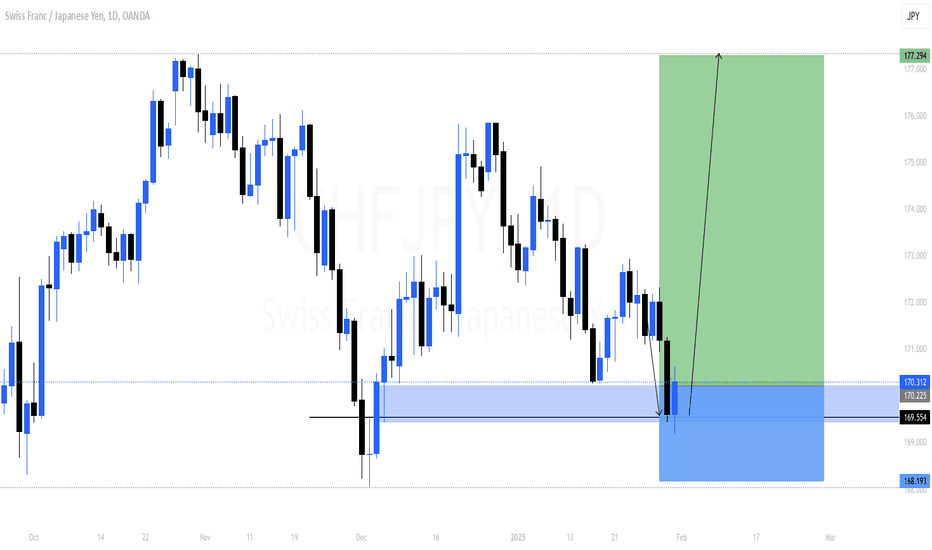

CHFJPY POSSIBLE SELL?Based on Monthly and Weekly TF, the market is in a downtrend. Daily is currently isn a downtrend as well. Let's see if this trade idea will play out.

Disclaimer:

Please be advised that the information presented on TradingView is solely intended for educational and informational purposes only.The analysis provided is based on my own view of the market. Please be reminded that you are solely responsible for the trading decisions on your account.

High-Risk Warning

Trading in foreign exchange on margin entails high risk and is not suitable for all investors. Past performance does not guarantee future results. In this case, the high degree of leverage can act both against you and in your favor.

CHFJPY trade ideas

CHFJPY - Potential short idea !!Hello traders!

‼️ This is my perspective on CHFJPY.

Technical analysis: Here we are in a bearish market structure from 4H timeframe perspective, so I look for a short. I expect price to continue the retracement to fill the imbalance and then to reject from bearish OB + institutional big figure 171.000.

Like, comment and subscribe to be in touch with my content!

CHFJPY LONGCHFJPY – Smart Money Strategies in Focus

Key Levels & Market Dynamics Revealed

Bank Sell Entry Zone:

172.00 - 172.80 - Upper supply zone where smart money may be looking to sell

Bank Buy Entry Zone:

169.00 - 169.50 - Demand zone where liquidity is accumulating

Market Breakdown:

Liquidity Sweep Below - Strong rejection at lower levels, setting up a potential bullish rally

Trendline Manipulation - Retail traders might get trapped before a significant breakout

SR Flip Around 171.00 - If price holds, we could see another push-up to challenge sell zones

Rejection at Supply Zones - Could signal a deeper retracement

What’s Next?

Bounce from Buy Entry? Bullish continuation towards institutional sell zones

Failure to Hold 171.00 Flip? Bears might step in for another liquidity grab

Big moves are on the horizon. Will Smart Money propel CHFJPY higher or lead to a liquidity sweep? Stay alert.

CHFJPY The Target Is DOWN! SELL!

My dear subscribers,

CHFJPY looks like it will make a good move, and here are the details:

The market is trading on 170.90 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 170.21

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

———————————

WISH YOU ALL LUCK

CHF_JPY RISKY SHORT|

✅CHF_JPY has retested a resistance level of 171.00

And we are seeing a bearish reaction

With the price going down but we need

To wait for a confirmation

Before entering the trade, so that we

Get a higher success probability of the trade

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

CHFJPY in bearish trendthe trend is making LHs & LLs and currently, the price is in the direction of marking the LH. The idea is to take a short position when the price touches the trendline and place SL as it is shown on the chart. One more major confluence of the bearish trend is that if the price makes its LH it will be in the region of golden Fib pocket".618". I am targeting 1:3 RR as the trend looks quite strong towards bearish.

CHF/JPY BULLISH BIAS RIGHT NOW| LONG

Hello, Friends!

The BB lower band is nearby so CHF/JPY is in the oversold territory. Thus, despite the downtrend on the 1W timeframe I think that we will see a bullish reaction from the support line below and a move up towards the target at around 169.720.

✅LIKE AND COMMENT MY IDEAS✅

CHF/JPY SHORT FROM RESISTANCE

Hello, Friends!

CHF/JPY is making a bullish rebound on the 8H TF and is nearing the resistance line above while we are generally bearish biased on the pair due to our previous 1W candle analysis, thus making a trend-following short a good option for us with the target being the 169.820 level.

✅LIKE AND COMMENT MY IDEAS✅

Bullish Setup on CHFJPY — Watching for Confirmation!OANDA:CHFJPY has reached a critical demand area where buyers have previously stepped in, leading to strong bullish momentum. This zone has historically provided a solid base for upward momentum, making it a key level to watch.

If we see bullish confirmation—such as rejection wicks, bullish engulfing candles, or a surge in buying volume—I anticipate a move toward 171.180, aligning with previous market structure. However, a decisive breakdown below this zone could weaken the bullish outlook and shift momentum downward.

This is not financial advice but rather how I approach support/resistance zones. Remember, always wait for confirmation, like a rejection candle or volume spike before jumping in.

Please boost this post, every like and comment drives me to bring you more ideas! I’d love to hear your perspective in the comments.

Best of luck , TrendDiva

#CHFJPY 1DAYCHFJPY (1D Timeframe) Analysis

Market Structure:

The price has broken down below the support line of a symmetrical triangle pattern, indicating a shift in market sentiment toward the downside. This breakdown suggests that buyers were unable to hold the support level, leading to increased selling pressure.

Forecast:

A sell opportunity is expected as the price moves below the broken support line, confirming bearish momentum. Further downside movement is likely if the price remains below this level.

Key Levels to Watch:

- Entry Zone: After a confirmed breakdown and possible retest of the previous support as resistance.

- Risk Management:

- Stop Loss: Placed above the broken support line or recent swing high.

- Take Profit: Target lower support zones for potential downside movement.

Market Sentiment:

The breakdown of the symmetrical triangle support indicates increased bearish pressure, with sellers likely to maintain control. Waiting for confirmation of sustained bearish momentum ensures alignment with market trends before entering a trade.

CHFJPY SHORTMarket Analysis:

Asset: CHF/JPY

Timeframes:

1-Hour: Bearish divergence confirmed (lower highs on RSI, higher highs on price).

4-Hour: Bearish trendline tested and respected (3 touches for confirmation).

Bias: Bearish.

Trade Setup:

Entry Point:

Enter a sell position after price rejects the 4-hour bearish trendline.

Look for confirmation such as a bearish engulfing candle or rejection wicks on the 1-hour chart.

Stop-Loss:

Place stop-loss above the recent high (or above the 4-hour trendline for safety).

Take-Profit Levels:

TP1: Near the previous 1-hour swing low.

TP2: Strong support level on the 4-hour chart.

Risk Management:

Position Size: Risk no more than 1-2% of your trading capital.

Risk-Reward Ratio: Aim for a minimum 1:2 R/R ratio.

Additional Confirmation:

Indicators:

RSI: Bearish divergence aligns with overbought conditions.

MACD: Look for bearish crossover confirmation.

Candlestick Patterns: Watch for reversal candles (e.g., bearish engulfing, shooting star).