CHFJPY trade ideas

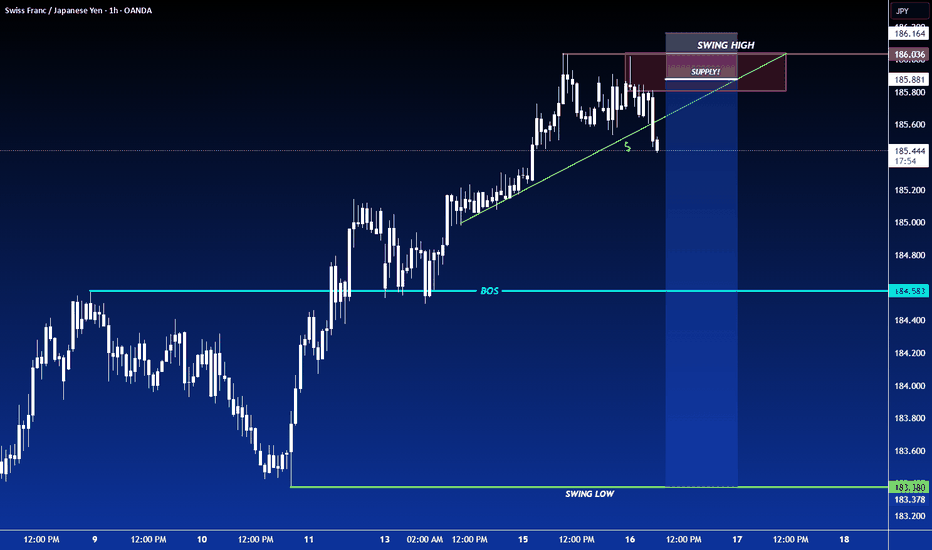

CHFJPY – Possible Trend Reversal (Sell Setup)Reasons for Potential Reversal:

1-Bearish Divergence:

Clear bearish divergence is forming between price and RSI

2-Market Sentiment:

Approximately 94% of traders are currently holding sell positions

3-Break of Last HL:

Wait for a clear break of the most recent Higher Low (HL). This will confirm a shift from bullish to bearish and provide a safer sell entry point.

Bullish CHF/JPY Heist! Risk vs. Reward Setup💰 SWISS-YEN BANK HEIST! 🚨 CHF/JPY Bullish Raid Plan (Risk & Reward Setup)

🌟 Attention Market Pirates & Profit Raiders! 🌟

"The vault is unlocked—time to loot!"

🔎 THIEF TRADING ANALYSIS (CHF/JPY)

Entry (📈): "The Bullish Loot is LIVE!"

Buy limit orders within 15-30min pullbacks (recent swing lows/highs).

Aggressive? Enter anywhere—heist mode activated!

Stop Loss (🛑): Recent swing low (wick) – adjust based on your risk & lot size!

🎯 Target: 186.300 (High-risk Red Zone – Police Resistance!)

Overbought? Reversal risk? Bears lurking? Yes. But thieves play smart!

🏴☠️ SCALPERS & SWING RAIDERS:

Scalp ONLY Long (Use trailing SL to lock profits).

Low on ammo? Join swing traders for the big heist!

📡 FUNDAMENTAL BACKUP (Why This Heist?)

Bullish momentum in play (check COT, Macro, Sentiment).

News Alert (⚠️): Avoid new trades during high-impact news—trail your SL!

💥 BOOST THE HEIST!

Hit 👍 LIKE & 🔄 SHARE to strengthen our robbery squad!

More heists coming—stay tuned! 🚀

⚠️ DISCLAIMER:

Not financial advice. Risk = Reward. Adjust SL/targets based on your strategy. Market conditions change—adapt or get caught!

CHFJPYCHFJPY price is in a very bullish trend. At the current price, there may be short-term selling. Therefore, if the price cannot break through 185.34, it is expected that the price will drop. Consider selling the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

CHF/JPY BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

We are going short on the CHF/JPY with the target of 179.028 level, because the pair is overbought and will soon hit the resistance line above. We deduced the overbought condition from the price being near to the upper BB band. However, we should use low risk here because the 1W TF is green and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

121 SYMMETRY Hello awesome traders! 👑✨

I hope you’ve had an amazing weekend and are ready to kick in the trading week like a pro. Let’s dive straight into the CHFJPY chart — and it’s shaping up to be a high-probability opportunity to start the week strong.

🧠 Setup Breakdown:

Price has formed a clean 121 bullish reversal — a classic pattern built on symmetry, structure, and timing. What makes this one stand out is how both the AB and CD legs mirror each other not just in price, but also in time, giving us a powerful edge.

We’re seeing:

✅ Symmetric correction

✅ PRZ zone rejection

✅ Impulsive breakout confirmation

Price tapped the Potential Completion Zone (PCZ) — confluence of 78.6% and 100% fibs — and immediately rejected with conviction.

🎯 Targets in Sight:

TP1: Already being approached – targeting the 61.8%–78.6% Fibonacci zone

TP2: Final objective lies near the 127.2%–161.8% extension

Structure says: "Let the trend unfold, manage the trade, and let it breathe."

Risk is clearly defined below the D point, and price has now confirmed strength above the breakout level (EL).

💡 What’s Next?

If price continues to respect structure and momentum holds, we’re tracking toward both target zones. The 121 is one of the cleanest reversal setups, and this one ticks the boxes:

🔹 Symmetry

🔹 PRZ rejection

🔹 Impulse confirmation

🔹 Defined risk

🔹 Measured targets

Let’s keep it simple: pattern → PRZ → trigger → continuation.

Wishing everyone a profitable week ahead — stay focused, manage risk like a sniper, and remember…

📊 Trade chart patterns like the pros do.

📈 Let structure lead, not emotions.

CHF/JPY in Strong Uptrend – Clear Buy Opportunity!Hi traders!, Analyzing CHF/JPY on the 30-minute timeframe, price is currently continuing a strong bullish trend, breaking above recent consolidation and showing momentum to the upside.

🔹 Entry: 183.429

🔹 Take Profit (TP): 184.429

🔹 Stop Loss (SL): 183.341

Price is respecting the 21 EMA and riding it upwards, indicating strong bullish momentum. The RSI is also in the overbought zone, but still climbing, which confirms buyer strength. This setup aligns with the trend continuation and offers a favorable risk-to-reward ratio.

A breakout above the minor resistance and the clear structure of higher highs and higher lows support the bullish idea. Watch for possible reactions near 184.429, where price may face short-term resistance.

⚠️ DISCLAIMER: This is not financial advice. Every trader is responsible for their own decisions and risk management.

CHF JPY Bearish Butterfly complete. Hi Guys,

The CHF JPY has just completed a bearish butterfly harmonic pattern with excellent fib ratios.

The entry point for the pattern is also a n important fib retracement (1.618) of the high from 2015 to the low of 2016.

Low risk entry using lower time frame could result in nice risk to reward trade if sell setups appear.

Safe trading all.

EURUSD Technical Outlook – StarseedFX Market InsightPrice has just confirmed a new higher high on the H4 timeframe, sweeping liquidity above the most recent bullish candle and then closing below its low with a strong bearish body.

After a brief retracement upward, price failed to break the previous higher high. This suggests the possible formation of a supply zone, but it is still too early to consider short positions.

If price breaches 1.17460 without breaking above the most recent higher high, this would confirm an ABCD pattern within the premium zone. If that setup completes, I will begin looking for bearish confirmation on lower timeframes, particularly M5, which I am currently focused on.

My short-term target would be the recent buy zone around 1.16375.

Keep in mind that the market moves in waves. We may see several pullbacks, minor changes of character, or even full structural shifts on lower timeframes. This technical setup remains in development and will require confirmation as price action evolves.

Stay patient. Let the structure speak.

StarseedFX