CHFNZD trade ideas

NZD/CHF Bearish MomentumAfter reaching the 4H order block, NZD/CHF initiated a bearish momentum, signaling potential downside movement. On the 1H timeframe, we can observe a liquidity grab followed by a break and retest of the support-turned-resistance level, further confirming the bearish structure. This price action suggests continued selling pressure, aligning with the prevailing downtrend.

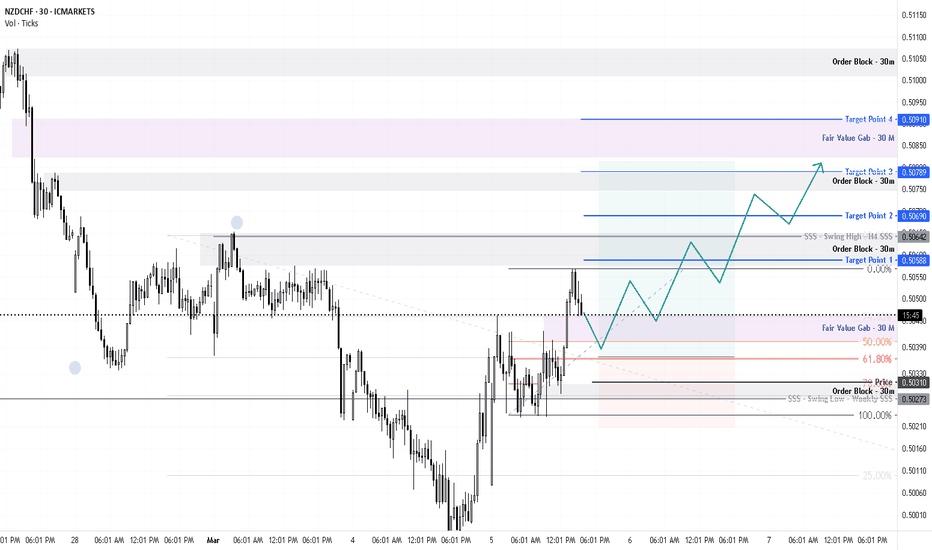

NZD/CHF BREAKOUT: LONG ENTRY AT 0.5050!ICMARKETS:NZDCHF

🟢 LONG NZD/CHF @ 0.5050

✅ Catalyst: Daily close above 0.5030 resistance.

🛑 SL: 0.4970

🎯 TP1: 0.5170 (1:1.5 R:R)

🎯 TP2: 0.5280 (1:2.8 R:R)

🎯 TP3: 0.5406 (1:4.4 R:R)

📊 Chart: Broke key resistance + bullish RSI divergence.

🌍 Context: RBNZ-SNB policy divergence fuels momentum.

💬 Where are you taking profits? 👇

#Forex #NZDCHF #Trading #RiskManagement

NZDCHF BUY?This market has been in a down trend.

RSI on daily time frame is showing oversold which could be a sign of exhaustion.

The market is currently testing the current Weekly/Daily Area and based on Daily & 4HR TF, the market seems to be forming a possible reversal pattern which could lead to a possible reversal.

We could see BUYERS coming in strong should the current level hold.

Disclaimer:

Please be advised that the information presented on TradingView is solely intended for educational and informational purposes only.The analysis provided is based on my own view of the market. Please be reminded that you are solely responsible for the trading decisions on your account.

High-Risk Warning

Trading in foreign exchange on margin entails high risk and is not suitable for all investors. Past performance does not guarantee future results. In this case, the high degree of leverage can act both against you and in your favor

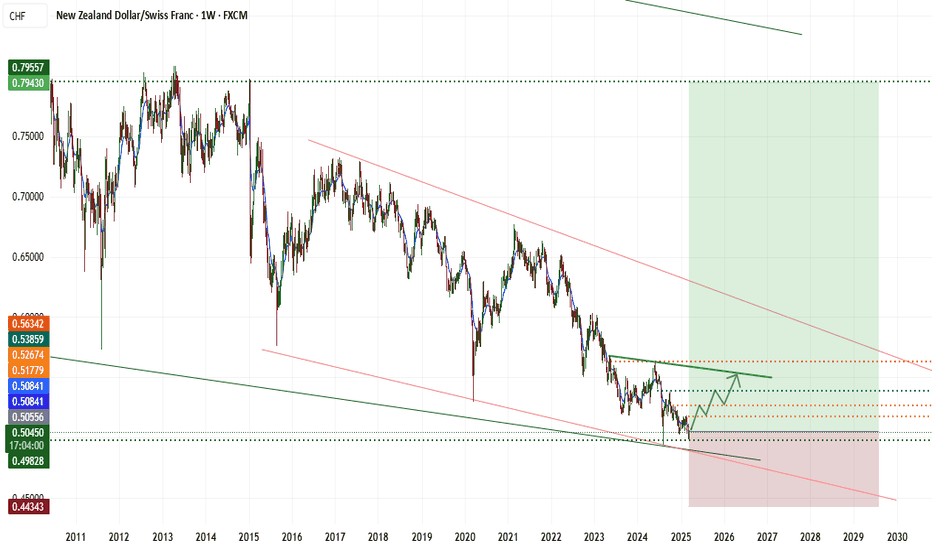

NZDCHF - Weekly Forecast - Technical Analysis & Trading IdeasMidterm forecast:

While the price is above the support 0.49439, beginning of uptrend is expected.

We make sure when the resistance at 0.52680 breaks.

If the support at 0.49439 is broken, the short-term forecast -beginning of uptrend- will be invalid.

OANDA:NZDCHF

Technical analysis:

A peak is formed in daily chart at 0.51845 on 02/20/2025, so more losses to support(s) 0.49950 and minimum to Major Support (0.49439) is expected.

Take Profits:

0.51043

0.51780

0.52680

0.53798

0.55094

0.56221

0.56728

0.57630

0.58900

0.60187

0.65051

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

NZD/CHF NEXT MOVESell after bearish candle stick pattern, buy after bullish candle stick pattern....

Best bullish pattern , engulfing candle or green hammer

Best bearish pattern , engulfing candle or red shooting star

NOTE: IF YOU CAN'T SEE ANY OF TOP PATTERN IN THE ZONE DO NOT ENTER

Stop lost before pattern

R/R %1/%3

Trade in 5 Min Timeframe, use signals for scalping

Bullish rise?NZD/CHF has bounced off the support level which is a pullback support that lines up with the 38.2% Fibonacci retracement and could rise from this level to our take profit.

Entry: 0.50307

Why we like it:

There is a pullback support level that lines up with the 38.2% Fibonacci retracement.

Stop loss: 0.50055

Why we like it:

There is a pullback support level.

Take profit: 0.5093

Why we like it:

There is a pullback resistance level that is slightly above the 78.6% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

NZDCHF SHORTMarket structure bearish at AOi 3

Entry at Daily AOi

Weekly Rejection at AOi

Daily Rejection at AOi

Previous Structure point Daily

Around Psychological Level 0.50500

H4 EMA retest

H4 Candlestick rejection

Rejection from Previous structure

Levels 5.07

Entry 100%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

Bearish reversal off 50% Fibonacci resistance?NZD/CHF is rising towards the pivot and could reverse to the 1st support.

Pivot: 0.50612

1st Support: 0.50042

1st Resistance: 0.51128

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

NZD/CHF - clear breakout for a potential bearish momentum!Hi guys we would be looking into NZD/CHF today.

Current Trend: Bearish 📉

NZD/CHF is showing signs of continued downside momentum, with price action indicating a weakening New Zealand Dollar against the Swiss Franc. The pair is trading below key moving averages, confirming a bearish bias.

Key Technical Indicators:

Resistance Levels: 0.5250, 0.5300

Support Levels: 0.5180, 0.5150

50 & 200 EMA: Price is trading below both, reinforcing a bearish trend.

RSI (Relative Strength Index): Below 50, signaling bearish momentum.

MACD: Bearish crossover, indicating downside continuation.

Trade Setup:

Entry: Sell below 0.51480

Take Profit: 0.50800 (extended target)

Stop Loss: 0.5270 (above recent resistance)

Market Sentiment & Fundamentals:

Risk-off sentiment supports CHF strength.

NZD weakness driven by softer economic outlook and lower commodity prices.

Swiss Franc benefits from safe-haven demand.

💡 Conclusion: The bearish trend remains intact, and selling on retracements near resistance zones could offer good risk-reward opportunities. Keep an eye on global risk sentiment for additional confirmation. 🚨

NZD/CHF SENDS CLEAR BULLISH SIGNALS|LONG

Hello, Friends!

NZD/CHF pair is trading in a local downtrend which we know by looking at the previous 1W candle which is red. On the 1H timeframe the pair is going down too. The pair is oversold because the price is close to the lower band of the BB indicator. So we are looking to buy the pair with the lower BB line acting as support. The next target is 0.505 area.

✅LIKE AND COMMENT MY IDEAS✅

NZDCHF: Intraday Bearish Reversal Confirmed?! 🇳🇿🇨🇭

NZDCHF formed an intraday bearish Change of Character

on an hourly time frame after a completion of a strong bullish wave.

I think that the market is going to correct and move down.

Goal - 0.5067

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bearish reversal off 61.8% Fibonacci resistance?NZD/CHF is rising towards the pivot and could reverse to the 1st support.

Pivot: 0.5109

1st Support: 0.5061

1st Resistance: 0.5136

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

can NZDCHF go further down?Currently, the price is retesting the support level, which it broke quite sharply, and it is quite natural for a price action movement. The further bearish rally will be confirmed as soon as the will again break the support level. At that time, we can place a sell stop, and our Stop Loss will be above the support level and for more clarity, I have also opened the short position on the chart.

#044 Trust The Process NZDCHF Buy 1151SGT 04032025It looks ridiculous to buy at the support of a longer term down trend(15 Minutes), however, I spotted this setup on the 1 Minute Time Frame, and my initial SL size was 7 pips or so.

My earnforex RR calculator says that 1k on 7pips is over-margin, but when I clicked T, and clicked enter, the position went through. LOL. I think the calculator might have some issues.

1154SGT 04032025

#042 Trust The Process NZDCHF Buy 2100SGT 28022025I bought the 1 Minute Time Frame's up trend. If you head to 1 Minute Time Frame, you would see it.

If I were to trade based on the 15 Minutes Time Frame, I would have sold.

Different time frame's different SL position size, thus, different direction bias.

I am doing the opposite is true on the Oanda mt4.

Do not copy my trades. I'll most probably be losing money in the long run(Oh yeah!)

2102SGT 28022025