CHFNZD trade ideas

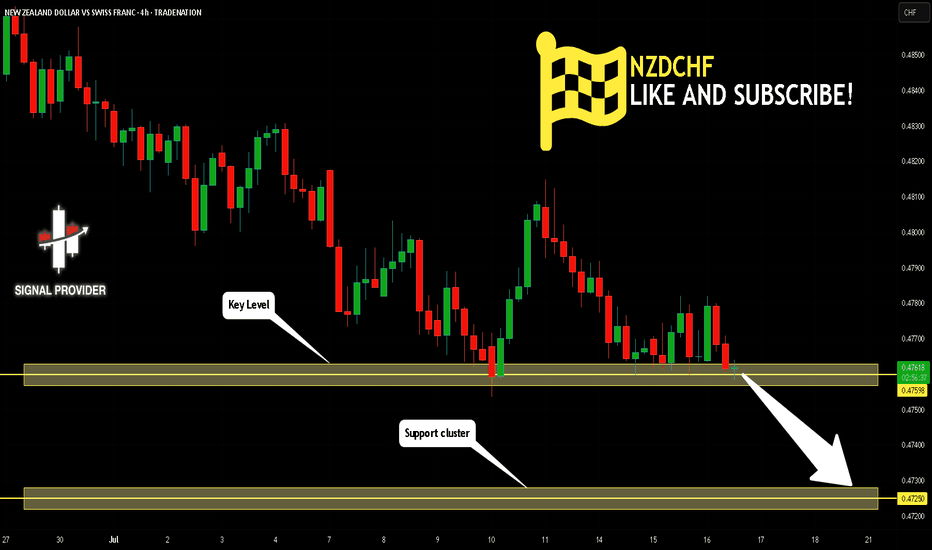

SELL NZDCHF now for a 4h time frame bearish trend continuationSELL NZDCHF now for a 4h time frame bearish trend continuation

SELL NZDCHF now for a four hour time frame bearish trend continuation..........

STOP LOSS: 0.4788

This sell trade setup is based on hidden bearish divergence trend continuation trading pattern...

Always remember, the trend is your friend, so whenever you can get a signal that the trend will continue, then good for you to be part of it

TAKE PROFIT : take profit will be when the trend comes to an end, feel from to send me a direct DM if you have any question about take profit or anything.

Remember to risk only what you are comfortable with….....trading with the trend, patient and good risk management is the key to success here

NZDCHF: Will Keep Falling! Here is Why:

The recent price action on the NZDCHF pair was keeping me on the fence, however, my bias is slowly but surely changing into the bearish one and I think we will see the price go down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

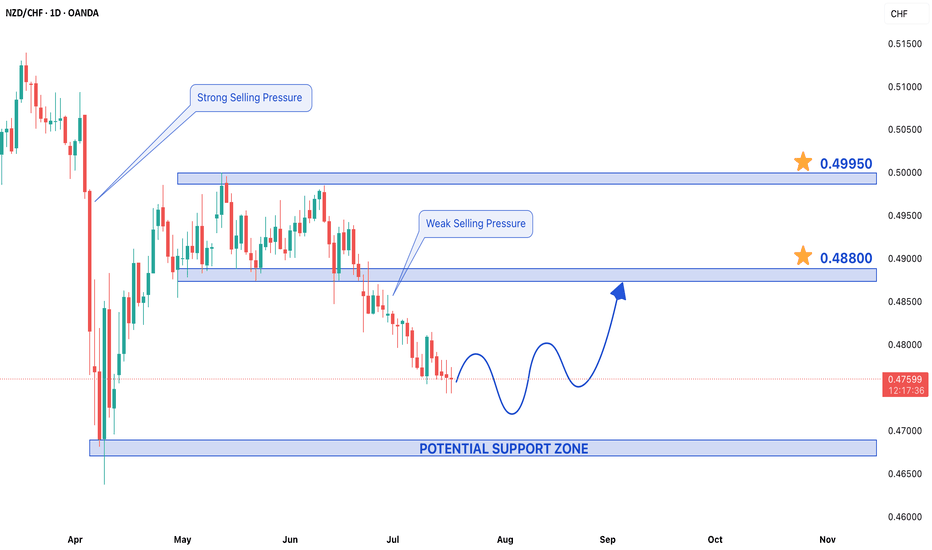

NZDCHF Shows Signs of Weakening Selling Pressure NZDCHF Shows Signs of Weakening Selling Pressure – Potential Reversal Ahead

The NZDCHF pair is exhibiting interesting price action as selling pressure appears to be losing momentum. The latest swing low was formed with strong bearish energy, but the subsequent decline has shown noticeably weaker downside momentum. This divergence suggests that sellers may be exhausting their control, creating an opportunity for buyers to step in.

Key Market Observations:

1. Decline in Bearish Momentum: While the secondary trend remains downward, the weakening selling pressure indicates potential buyer interest at current levels.

2. Possible Trend Reversal: If buyers regain strength, NZDCHF could see a short-term recovery, targeting 0.48800 and 0.49950 in upcoming sessions.

3. Critical Support Level: On the downside, 0.46700 remains a key support zone. A strong bounce from this level could confirm bullish reversal potential.

Trading Strategy:

- Buying Opportunity: Traders may watch for bullish reversal signals (e.g., bullish engulfing patterns, RSI divergence) near 0.46700 for potential long entries.

- Target Levels: A breakout above recent resistance could push price toward 0.48800, with extended gains possible up to 0.49950.

- Risk Management: A stop-loss below 0.46700 would protect against further downside if selling resumes.

Conclusion:

NZDCHF’s recent price action suggests that bears are losing dominance, opening the door for a corrective rally. Traders should monitor price reactions near 0.46700 for confirmation of a bullish reversal. A break above immediate resistance could accelerate gains toward higher targets, while a drop below support would indicate continued bearish control.

NZDCHF Will Move Lower! Sell!

Please, check our technical outlook for NZDCHF.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 0.475.

Considering the today's price action, probabilities will be high to see a movement to 0.472.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

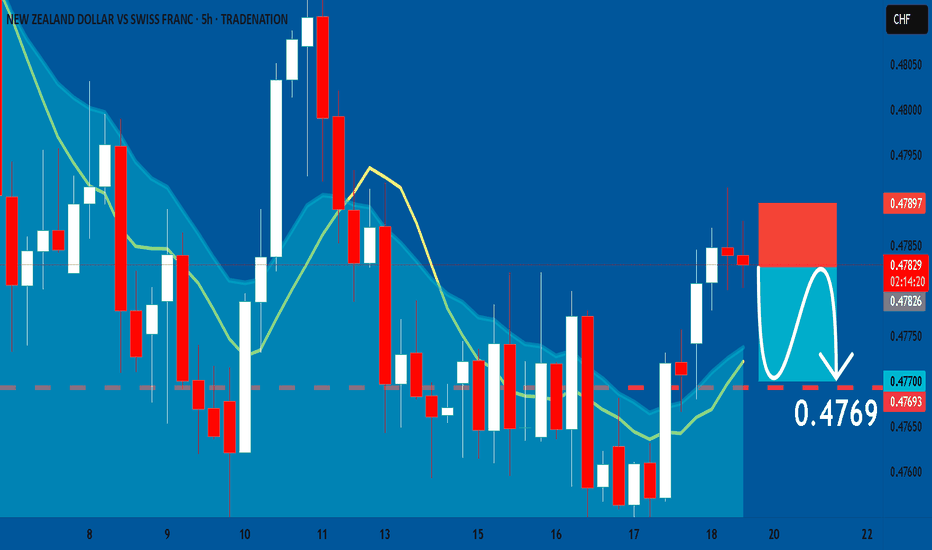

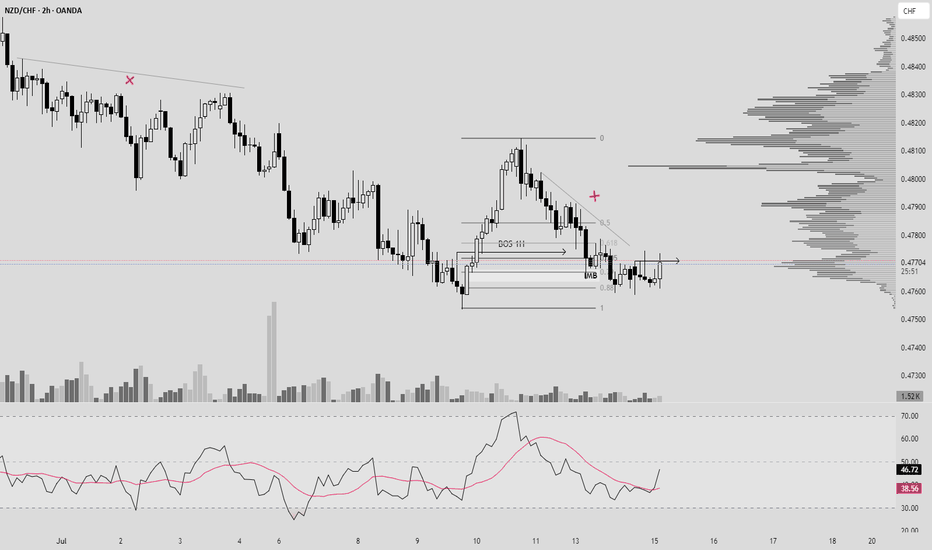

NZDCHF → Pre-breakdown consolidation on a downtrendFX:NZDCHF is forming a pre-breakout consolidation amid a downtrend. Focus on support at 0.4759. Global and local trends are down...

On July 10-11, the currency pair attempted to break out of the trend. In the chart, it looks like a resistance breakout, but technically it was a short squeeze aimed at accumulating liquidity before the fall. We can see that the price quickly returned back and the market is testing the low from which the trap formation began. The risk zone for the market is 0.4759 - 0.475. In simple terms, this is a bull trap against the backdrop of a downtrend. The NZD has passed through the risk zone. At this time, the currency pair is forming a pre-breakout consolidation relative to the support level of 0.4759 with the aim of continuing its decline.

Support levels: 0.4759, 0.4753

Resistance levels: 0.477, 0.4782

A breakout of the 0.4759 level and consolidation in the sell zone could trigger a continuation of the decline within the main and local trends.

Best regards, R. Linda!

NZD_CHF RISKY LONG|

✅NZD_CHF has retested a key support level of 0.4760

And as the pair is already making a bullish rebound

A move up to retest the supply level above at 0.4776 is likely

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

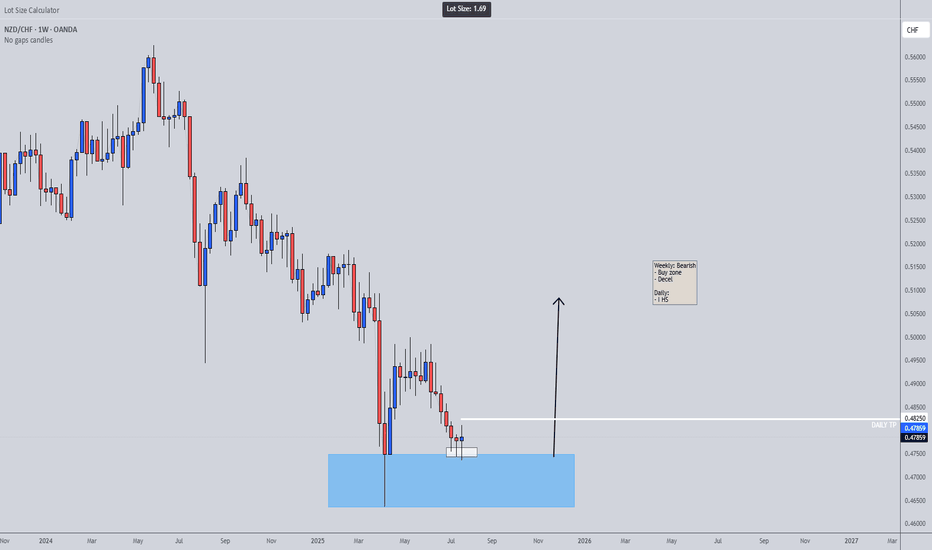

NZDCHF Long Trade based on COT ReportOANDA:NZDCHF Long trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

This is good trade, don't overload your risk like greedy, be disciplined trader, this is good trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

NZDCHF My Opinion! BUY!

My dear friends,

Please, find my technical outlook for NZDCHF below:

The instrument tests an important psychological level 0.4784

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 0.4796

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NZD/CHF BEARS ARE STRONG HERE|SHORT

Hello, Friends!

NZD/CHF is trending down which is clear from the red colour of the previous weekly candle. However, the price has locally surged into the overbought territory. Which can be told from its proximity to the BB upper band. Which presents a classical trend following opportunity for a short trade from the resistance line above towards the demand level of 0.475.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

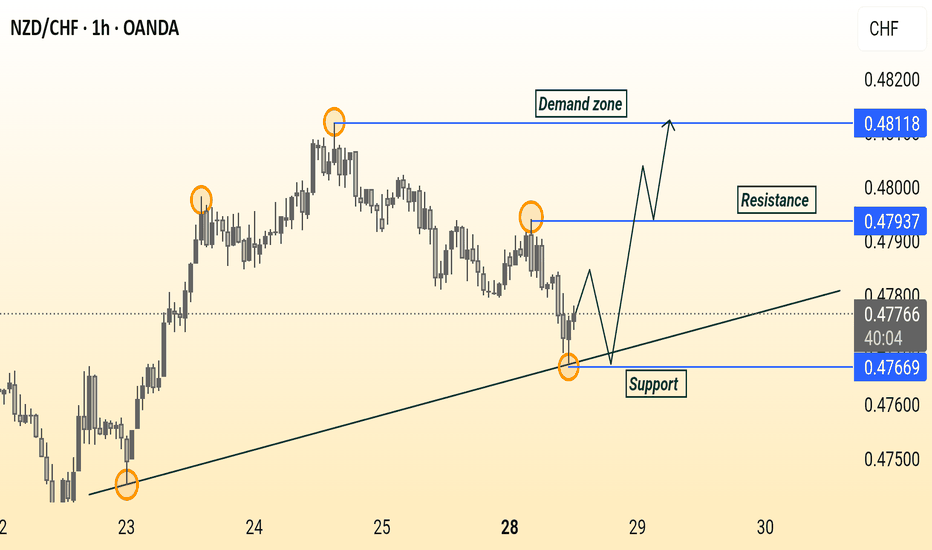

NZD-CHF Broken Wedge Pattern! Buy!

Hello,Traders!

NZD-CHF was trading in a

Narrowing bullish wedge pattern

And now we are finally seeing

A bullish breakout so we are

Bullish biased now and we

Will be expecting a further

Bullish move up after a

Local correction

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDCHF SELL.......📉 NZD/CHF Trade Idea – Bearish Setup (Daily Chart)

Price is respecting a strong downtrend, forming lower highs and lower lows. Currently approaching a key resistance zone near 0.4850–0.4875, aligned with the descending trendline and 50–61.8% Fibonacci retracement.

🔹 Trade Plan:

Bias: Bearish

Entry Zone: 0.4850–0.4875

Stop Loss: Above 0.4935

Take Profit 1: 0.4700

Take Profit 2: 0.4635

This setup offers a solid risk-to-reward ratio, with confirmation expected on bearish rejection at the pullback zone.

NZDCHF: Will Keep Falling! Here is Why:

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current NZDCHF chart which, if analyzed properly, clearly points in the downward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NZD_CHF BEARISH BREAKOUT|SHORT|

✅NZD_CHF keeps falling in

A strong downtrend and the pair

Made a bearish breakout and a

Retest of the key horizontal level

Of 0.4810 which is now a resistance

And the pair is already making a

Bearish pullback so we are

Bearish biased and we will be

Expecting a further bearish move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.