CHFUSD trade ideas

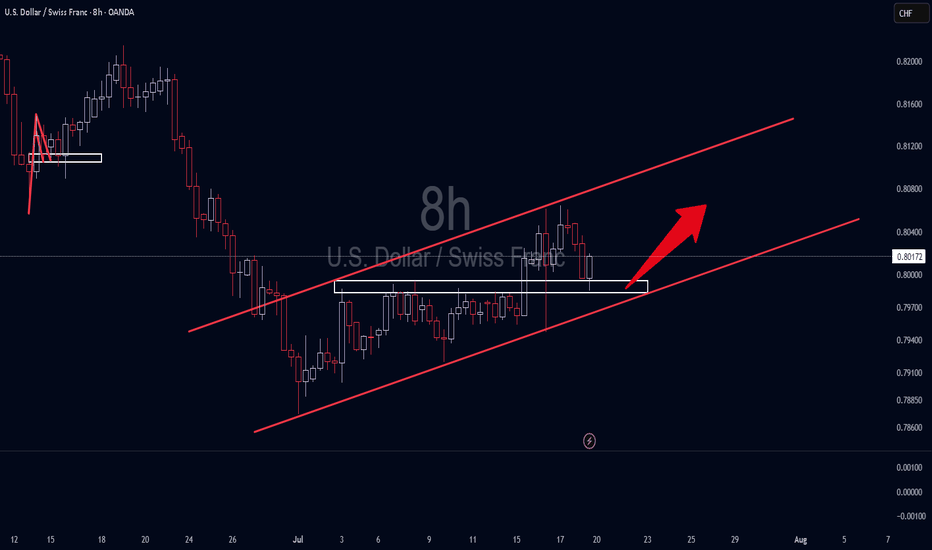

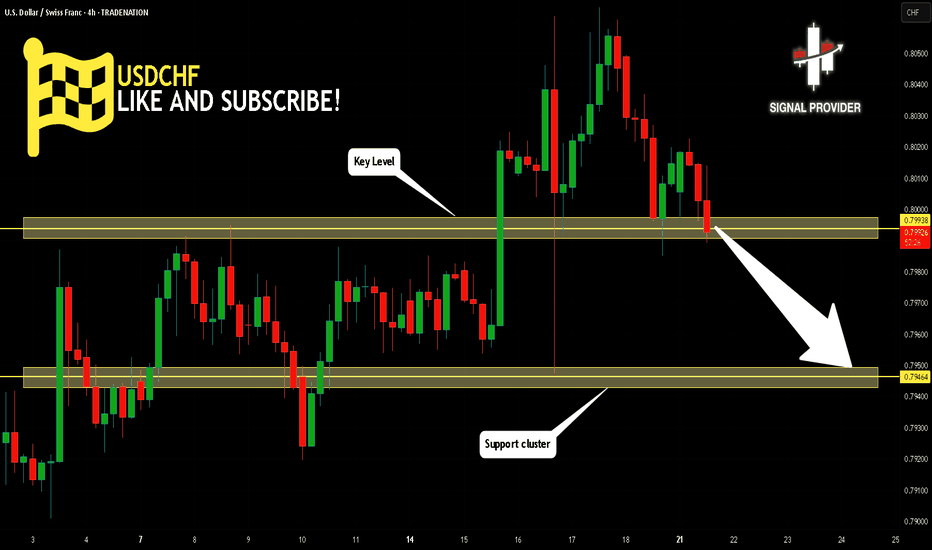

USDCHF Will Grow! Long!

Here is our detailed technical review for USDCHF.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 0.796.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 0.804 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

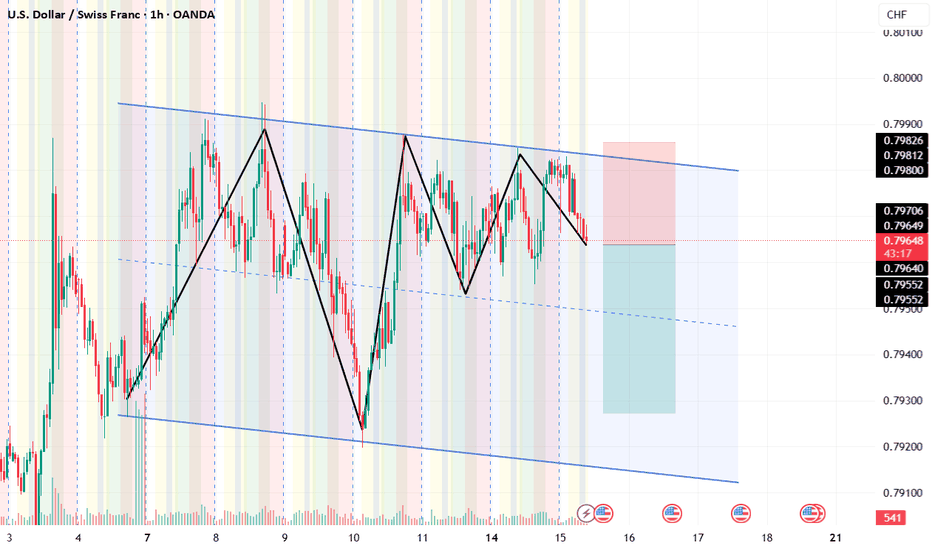

USD/CHF (1-hour timeframe)USD/CHF (1-hour timeframe), the analysis appears to include:

Ascending triangle pattern (with higher lows and a horizontal resistance).

Ichimoku Cloud for trend analysis.

Two marked target levels with projected breakout potential.

Identified Targets:

1. First Target:

🔹 Around 0.80000

This is just above the current resistance zone and seems to be the initial breakout target if price breaks the horizontal resistance.

2. Second Target (Final Target):

🔹 Around 0.80300 – 0.80350

This is the next higher resistance or profit-taking zone based on projected move from the triangle breakout.

---

Summary:

If the price breaks and closes above the horizontal resistance (approx. 0.79850), your potential targets are:

🎯 Target 1: 0.80000

🎯 Target 2: 0.80300–0.80350

Keep an eye on price action and volume confirmation before entry. Let me know if you want stop-loss suggestions or a risk/reward breakdown.

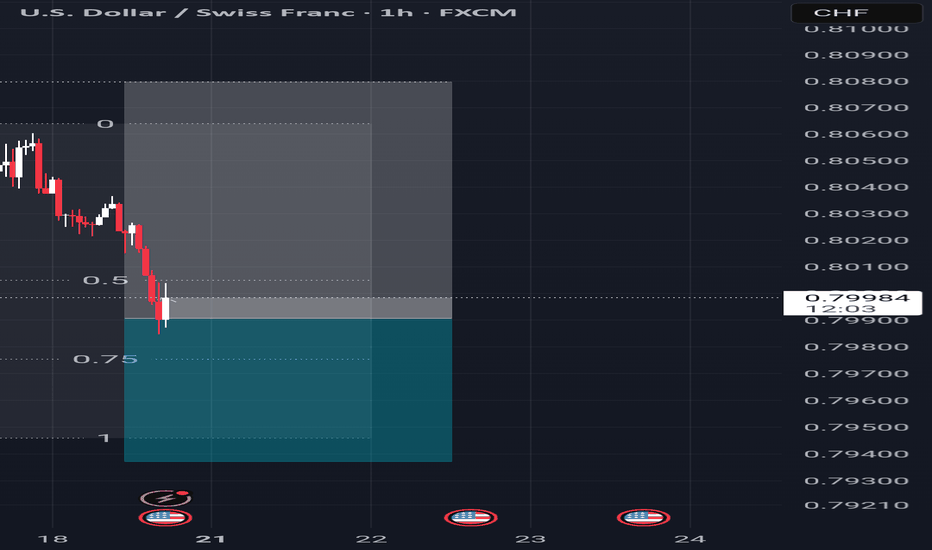

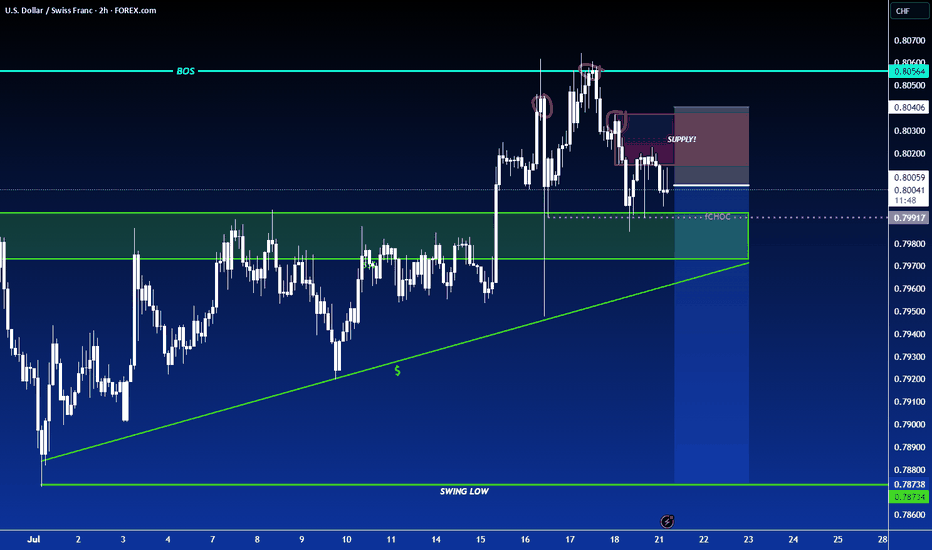

USD/CHF hoping lower. before major up turnA note to myself:

- remember no matter what happens. its a 50/50 chance you are right. even with a winning

strategy.

- whats going on inside of yourself. why? whats it trying to tell you?

- what have you learned about yoursefl?

- be patient, take a breathe and be aware of FOMO

- Its not about quantity. its about quality.(choose MAX. 3 trades a week)

- stick to your plan. load up on quality trades.

- RISK MANAGEMENT is the key to being a successful trader AND Risk Reward Ratio minimum 1:3 w

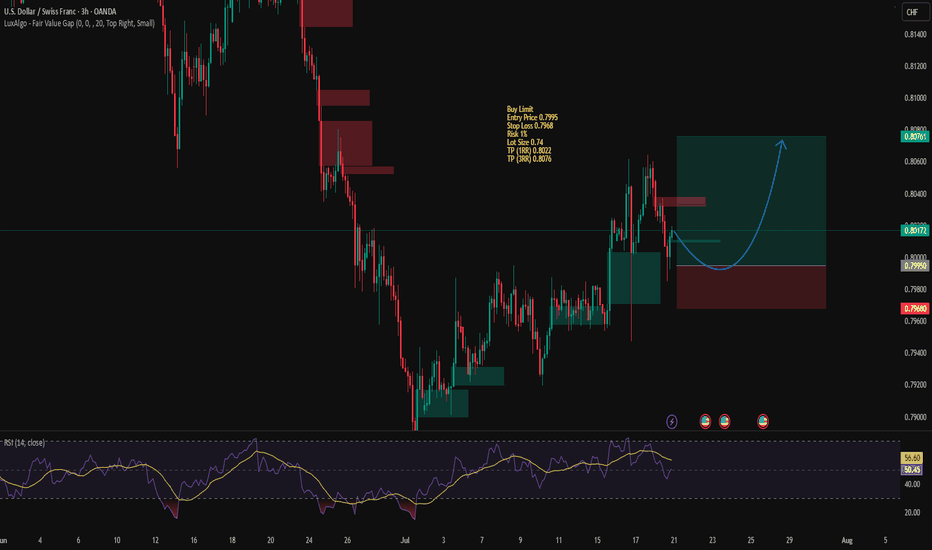

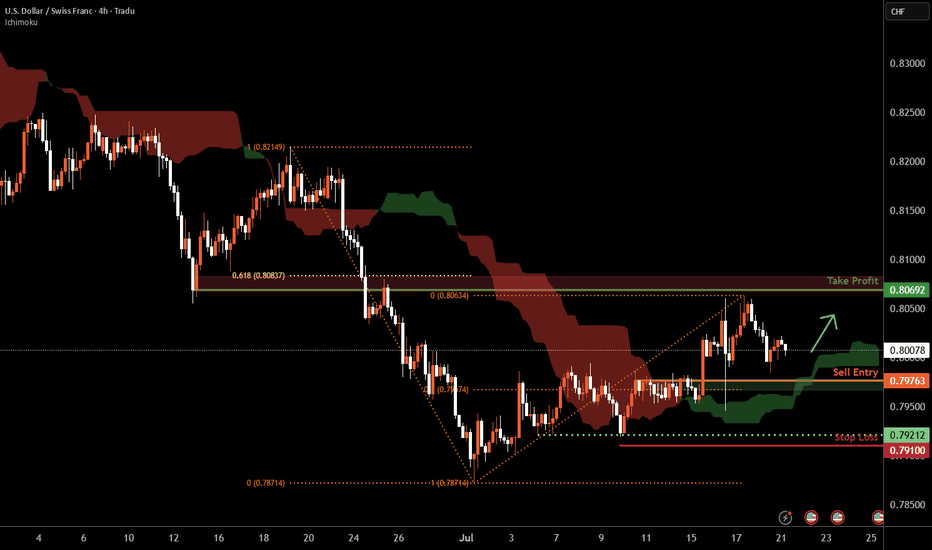

USDCHF ENTRY CHARTWe are BULLISH on this Pair, as we have a shift in trend at yesterday's daily close, the INTRA-DAY TF trend as also shifted to the upside, on our h1, we got a breaker block+ inducement with other confluences, if this matches with your idea, you can add to your watch-list. THANK YOU

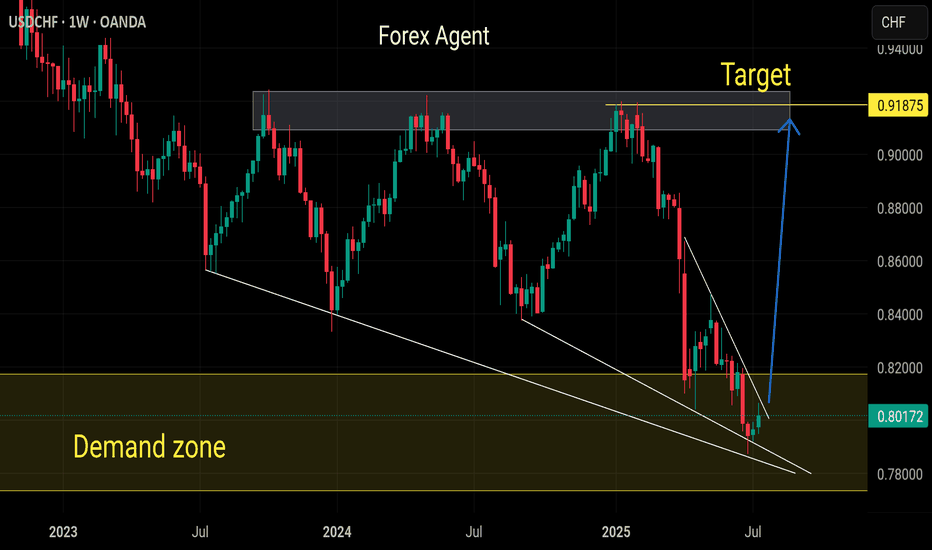

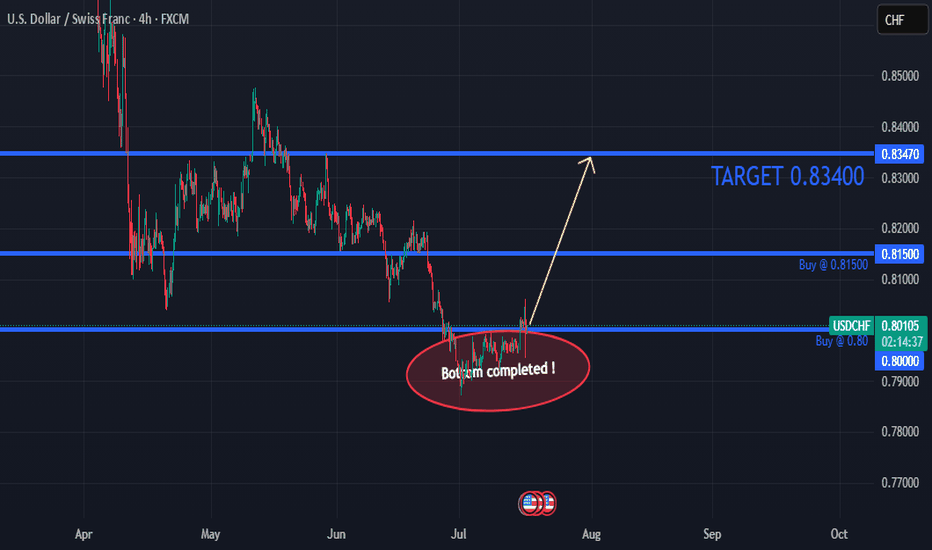

USD/CHF: The Swiss Franc Continues to WeakenOver the past four trading sessions, the USD/CHF pair has appreciated by nearly 0.5%, as a new bullish bias has begun to consolidate on the daily chart. For now, buying pressure remains steady, supported by the recovery of the U.S. dollar, which started gaining strength shortly after it was revealed that the year-over-year CPI in the U.S. came in at 2.7%, above the 2.6% expected. This outcome may lead the Federal Reserve to adopt a more hawkish tone, and if elevated interest rates persist, it’s likely that demand for the dollar will continue to strengthen in the short term.

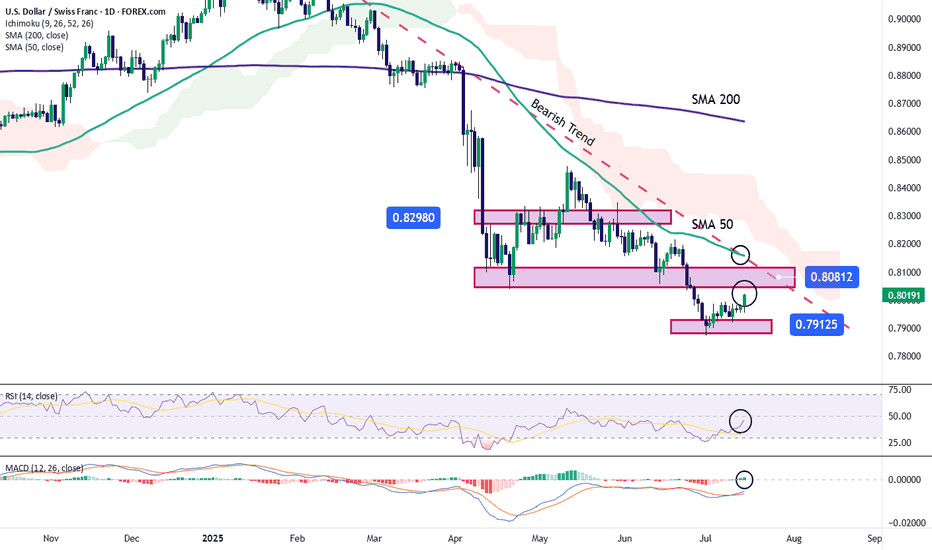

Downtrend Still in Place

The recent bearish movements have kept the pair within a steady downward trend in the short term. However, a relevant bullish correction is now emerging, and if it continues, it could put the current bearish structure at risk. As price continues to test resistance levels, buying pressure may become increasingly relevant.

Technical Indicators:

RSI: The RSI line is showing clear bullish behavior, with a sustained upward slope in the short term. It is currently approaching the neutral 50 level, and a breakout above that could signal bullish momentum dominance, reinforcing the current upward pressure.

MACD: The MACD histogram shows consistent bullish momentum, remaining above the neutral zero line. This suggests that moving average strength remains in bullish territory, and if the histogram continues to move away from the neutral axis, it could confirm stronger buying pressure in the short term.

Key Levels to Watch:

0.80812 – Immediate Resistance: This level aligns with the main descending trendline on the chart. Sustained movement above this zone could invalidate the current bearish structure and open the door to a more dominant bullish bias.

0.82980 – Distant Resistance: A zone that coincides with previous highs. If price consistently reaches this level, it could trigger the formation of a new bullish structure in the coming weeks.

0.79125 – Key Support: This level marks the recent weekly lows. A break below this zone could revive bearish momentum and potentially initiate a broader downward trend in the short term.

Written by Julian Pineda, CFA – Market Analyst

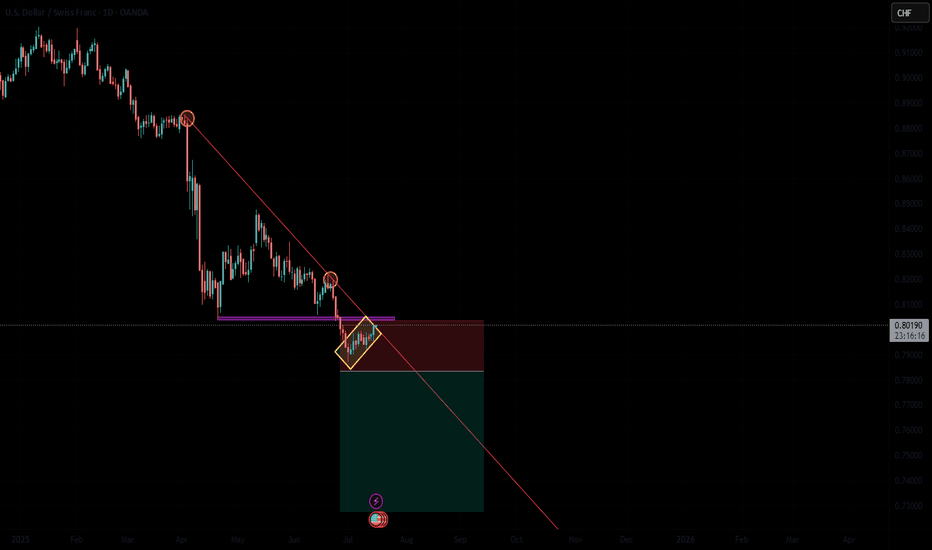

long-term bearish trendUSD/CHF is in a strong long-term bearish trend, and the recent move up is likely a temporary correction, not a reversal. Price is currently testing the 0.7980–0.8000 resistance zone, which aligns with the upper boundary of a descending channel and could attract sellers. Unless the pair breaks and holds above 0.8050–0.8100, the bearish trend remains intact. A rejection in this area or a break below 0.7870 would confirm continuation to lower targets like 0.7790 and 0.7710. In short, it's a good setup to consider a sell, but wait for clear bearish confirmation.

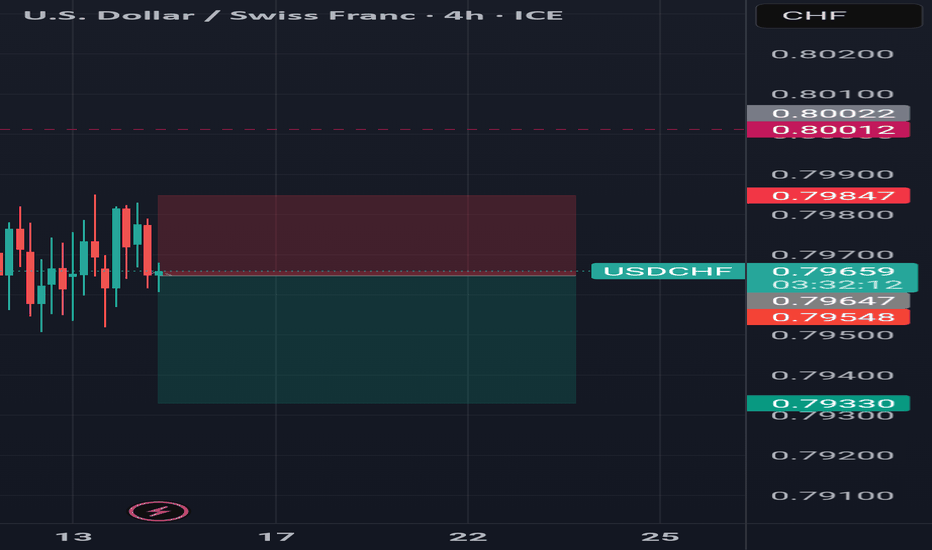

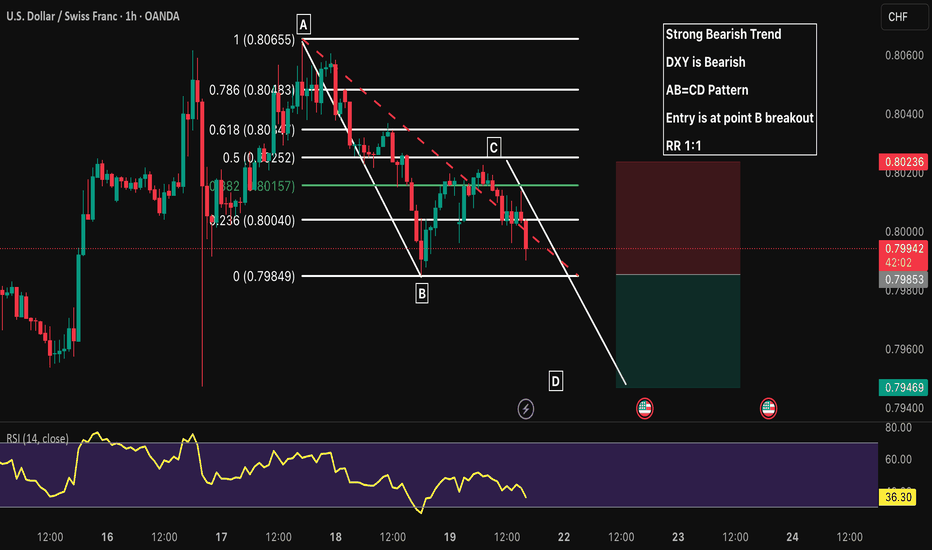

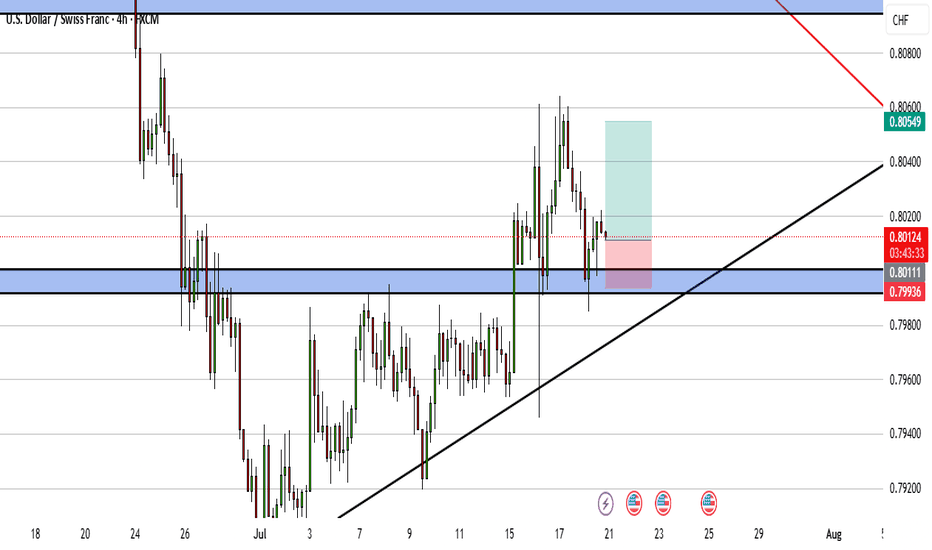

USDCHF Will Move Lower! Sell!

Here is our detailed technical review for USDCHF.

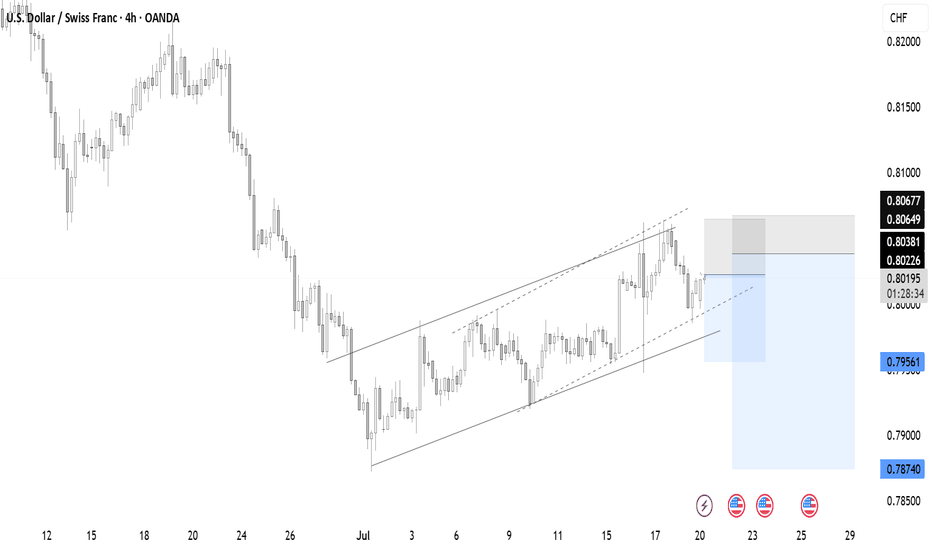

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 0.799.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 0.794 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

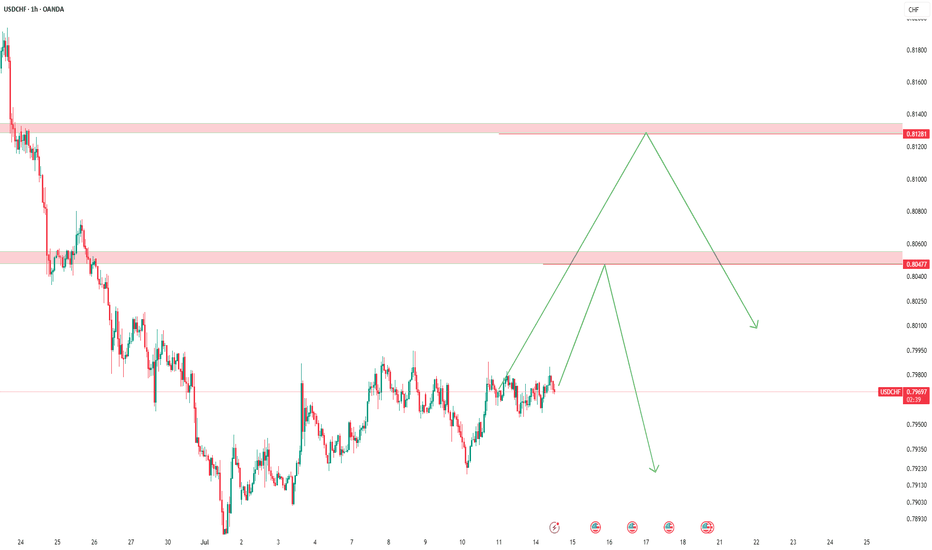

USDCHF – Two Levels, One PlanWe’re watching two key resistance zones for a potential short.

If the first level holds and gives a signal, we’ll short from there.

If that level breaks, we may switch to a short-term buy up to the next level.

Once price reaches the second resistance, we’ll be ready for another sell opportunity.

No predictions — just following the flow.

All I see, is sell The 4-hour candlestick has decisively broken below the 50 MA, confirming bearish momentum. Moves like this typically trigger strong selling pressure. Combined with the overall bearish market structure and a key Fibonacci resistance level sitting neatly within our stop-loss zone, this setup offers an excellent risk-to-reward trade opportunity.

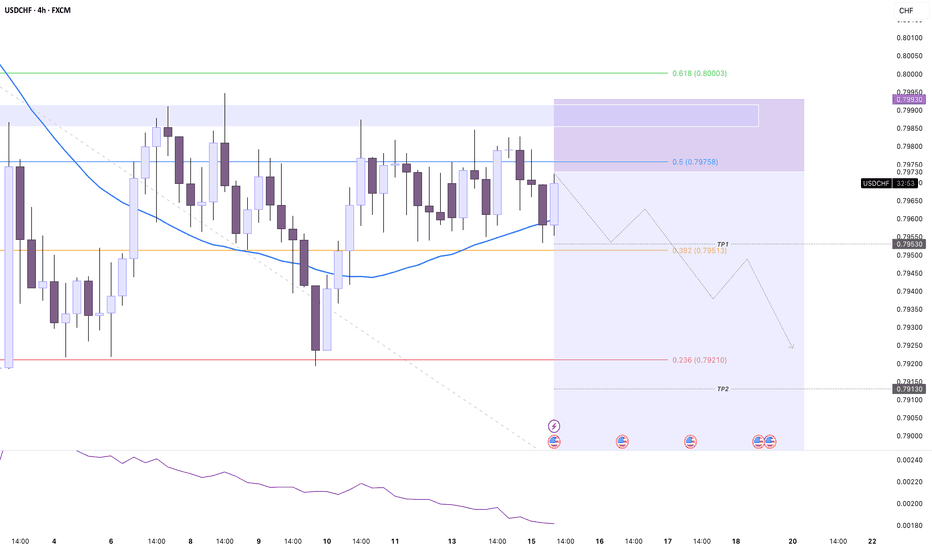

USD/CHF H4 | Pullback support at 50% Fibonacci retracementUSD/CHF is falling towards a pullback support and could potentially bounce off this level to climb higher.

Buy entry is at 0.7976 which is a pullback support that aligns with the 50% Fibonacci retracement.

Stop loss is at 0.7910 which is a level that lies underneath a multi-swing-low support.

Take profit is at 0.8069 which is an overlap resistance that aligns closely with the 61.8% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.