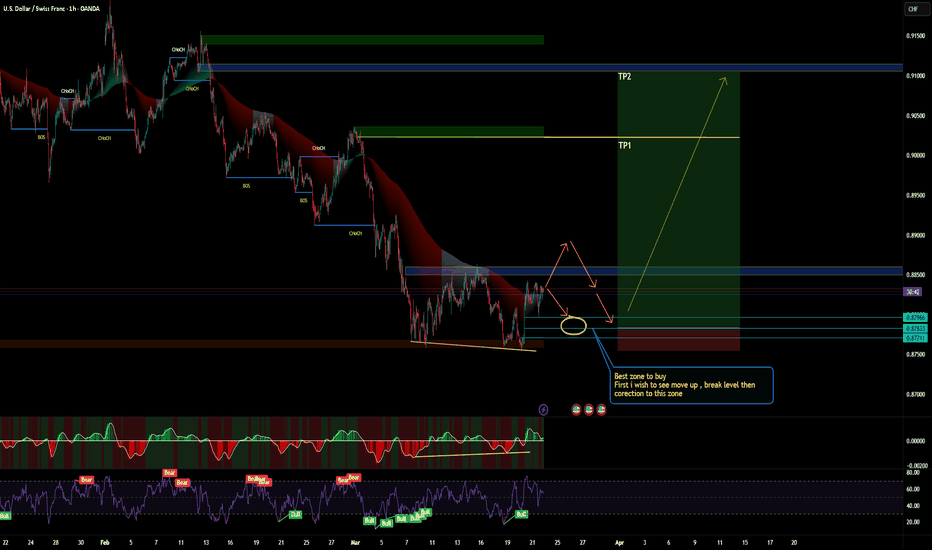

USDCHF FORECAST Q1 FY25It would be embarassing if this dont play

cause imma say it now save yourselves

price will drive higher before the final kaput

as much as we profit from insight we need to discount events that are likely from such

forecasts

i dont like forex but my forecasts area always on point and last years if you doubt ill share them cause they private

like comment follow

CHFUSD trade ideas

Support and ResistanceGood day, traders as we can see in the setup above of usdchf, price has been playing between support and resistance indicated by the red zones.. i am expecting price to sell around the current resistance down to the support. Reason being , sell at resistance buy at support, Downtrend, pair correlation and other technical reasons

UC UpdateBased on today's data from ForexFactory for the USD, the USD/CHF pair is likely to experience a short-term upward movement in the days ahead. Here's why:

Flash Manufacturing PMI: Reported at 52.5, slightly above the forecast of 52.3, indicating stronger-than-expected manufacturing activity.

Flash Services PMI: Came in at 55.3, exceeding the expected 54.8, showing robust growth in the services sector.

These positive PMI figures suggest that the U.S. economy is outperforming expectations, which typically strengthens the USD. As a result, the USD/CHF pair is expected to see a short-term rally in the coming days.

BUY opportunity on USDCHF M15

Please do not trade as my analysis might be incorrect.

I encourage constructive feedback.

If you did trade, make sure the drawing is respected, don't use exact values as they might differ from a broker to another.

Explanations:

MIN - last minimum point

MAX - last maximum point

BOS - break of structure

SMS - shift in market structure

SL - stop loss

TP - take profit

RR - risk reward

OB - order block

OB (15) - order block (based on M15) timeframe

UPDATE ON USD/CHF TRADEUSD/CHF 1H - As you can see this trade is still playing out very well, price has now broken above the previous highs after testing this area of Demand for the second time.

I am now expecting to continue trading us higher and eventually breaking the last higher timeframe high set in the market, by price doing this its confirming longer term bullishness.

This trade is currently running + 36 pips. (+ 2%) 2RR

A big well done to those who got involved in this trade last week, I went ahead and took a partial late last night for the trade leaving just under half my position left open.

If you have any questions with regards to the trade or the analysis behind the trade then please drop me a message or comment below and I will get back to you as soon as possible!

USDCHF oversold bounce back capped at 0.8862The USD/CHF price action exhibits bearish sentiment, supported by the prevailing downtrend. The current intraday swing high at 0.8860 serves as a critical trading level, as the pair shows potential for an oversold rally before facing bearish rejection.

Key Levels to Watch:

Key Resistance: 0.8860 (current intraday swing high)

Immediate Support: 0.8760

Lower Support Levels: 0.8720, 0.8680

Upside Resistance Levels: 0.8913, 0.8970

Bearish Scenario:

An oversold rally toward the 0.8860 level, followed by a bearish rejection, could validate the downtrend and target the immediate support at 0.8760. Continued bearish momentum could extend the decline to 0.8720 and ultimately 0.8680 over the longer timeframe.

Bullish Scenario:

A confirmed breakout above the 0.8860 resistance level, accompanied by a daily close above this mark, would negate the bearish outlook. This scenario could trigger further rallies toward the next resistance levels at 0.8913 and 0.8970.

Conclusion:

The prevailing sentiment remains bearish amid the ongoing downtrend. Traders should closely monitor the 0.8860 level for potential bearish rejections or a bullish breakout. A sustained close above this resistance could signal a shift toward bullish momentum, while failure to break above would reinforce the bearish outlook.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

USDCHF Will Go Down From Resistance! Sell!

Please, check our technical outlook for USDCHF.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 0.882.

Considering the today's price action, probabilities will be high to see a movement to 0.866.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USD/CHF Ready for 92-Pip Bounce After Double Bottom?USD/CHF has been in a steady downtrend, but recent price action suggests a potential shift. A clear double bottom has formed near the 0.8800 level, hinting at strong buyer interest. The pair is now reacting from the 0.786 Fibonacci zone, and with bullish momentum building, it may target the 1.618 extension around 0.8919—about 92 pips higher. If this breakout sustains, further upside toward 0.8950 and above is possible, but failure to break that level could signal continuation of the broader downtrend. This zone is critical—watch closely.

Usd/chf📉 USDCHF Analysis – Sell Setup in Play! 🚀

🔻 The price was rejected from the 0.88400 - 0.88500 resistance zone and is now moving downward.

📍 The key support at 0.88000 - 0.88100 could be the next short-term target for sellers.

⚠️ If this level breaks, further decline toward 0.87700 is possible. Otherwise, a bullish reversal may occur.

🎯 Strategy: Manage the trade with Trailing Stop and monitor price reaction at the support zone.

#USDCHF #Forex #PriceAction #TechnicalAnalysis #Trading

Trading Setup for CHF/USD – Triple Bottom Breakout Strategy📌 Chart Pattern: Triple Bottom with Trendline Breakout

This CHF/USD chart showcases a triple bottom formation, a bullish reversal pattern that signals a potential uptrend after three consecutive lows at a strong support level. The price action respects this support zone and attempts a trendline breakout, suggesting a shift in momentum from bearish to bullish.

📊 Full Chart Breakdown & Professional Analysis

1️⃣ Key Levels & Structure:

✅ Support Level (1.1300 - 1.1270):

The price has tested this region three times, indicating strong buying interest.

This forms a triple bottom, a reliable reversal pattern in technical analysis.

✅ Resistance Zone (1.1400 - 1.1420):

The price previously reversed from this zone, making it a key short-term resistance level.

✅ Target Level (1.1457):

A breakout above resistance could drive the price toward this measured move target, representing a 1% potential gain.

✅ Stop Loss (1.1269):

Placed below the support zone to minimize risk in case of a breakdown.

2️⃣ Price Action & Trendline Breakout:

📌 Triple Bottom Formation:

Price hits the same support level three times, signaling strong demand.

Each bounce from support indicates a gradual weakening of bearish momentum.

📌 Trendline Breakout:

The price broke a downward-sloping trendline, suggesting a potential bullish move.

A successful retest of the trendline could confirm further upside.

📌 Expected Move:

Scenario 1: Price confirms the breakout, retests, and moves toward resistance.

Scenario 2: If resistance is broken, price targets the next major level at 1.1457.

3️⃣ Trading Strategy – How to Trade This Setup?

🎯 Buy Entry:

Enter long after a confirmed breakout and retest of the trendline.

📉 Stop Loss:

Below 1.1269 (beneath triple bottom support) to limit downside risk.

🎯 Take Profit Targets:

Target 1: 1.1400 (Resistance Area)

Target 2: 1.1457 (Measured Move Projection)

💡 Risk-Reward Ratio:

Favorable risk-reward ratio of 1:3, making it an attractive setup for traders.

4️⃣ Market Psychology Behind This Move:

Bears losing strength: Multiple failed attempts to break support indicate sellers are exhausted.

Bulls gaining momentum: Trendline breakout shows buyers are stepping in with confidence.

Breakout confirmation: If resistance breaks, a strong rally toward 1.1457 is likely.

📌 Summary: Bullish CHF/USD Trade Idea

🔹 Pattern: Triple Bottom + Trendline Breakout

🔹 Entry: Buy on retest confirmation

🔹 Stop Loss: 1.1269

🔹 Target: 1.1400 & 1.1457

🔹 Risk-Reward: Favorable 1:3 setup

🚀 This is a high-probability trade setup with strong technical confirmation, making it a great opportunity for breakout traders! 🚀

USD/CHF H4 | Potential bullish bounceUSD/CHF is falling towards an overlap support and could potentially bounce off this level to climb higher.

Buy entry is at 0.8799 which is an overlap support.

Stop loss is at 0.8745 which is a level that lies underneath a multi-swing-low support.

Take profit is at 0.8911 which is an overlap resistance that aligns with the 38.2% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

USD/CHF (1H) Analysis – 24-03-2025📊 USD/CHF (1H) Analysis – 24-03-2025

📈 Current Price: 0.88377

🔴 Supply Zone (Resistance): 0.88603 – Awaiting confirmation for potential rejection.

🟢 Demand Zone (Support): 0.87537 – Key area for possible bullish reaction.

📌 Market Outlook:

Price is approaching the 0.88603 supply zone. A rejection here could push the market downward.

Scenario 1: If price rejects 0.88603, expect a drop towards 0.87537 demand zone.

Scenario 2: If price breaks above 0.88603, bullish momentum could continue higher.

⚡ Trade Setup:

🔻 Sell Setup: If rejection at 0.88603

🎯 TP: 0.87537

🛑 SL: Above 0.88700

🔼 Buy Setup: If breakout and retest of 0.88603

🎯 TP: 0.88900+

🛑 SL: Below 0.88400

#USDCHF #ForexAnalysis #SmartMoney #Trading #PriceAction 🚀📊

#USDCHF #ForexAnalysis #SmartMoney #Trading #PriceAction

USD_CHF SHORT FROM RESISTANCE|

✅USD_CHF is going up now

But a strong resistance level is ahead at 0.8866

Thus I am expecting a pullback

And a move down towards the target of 0.8810

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Next weeks ideaUSD/CHF trades sideways around 0.8820 even though the US Dollar trades strongly.

Fed Williams believes that the current moderate restrictive policy stance is appropriate.

The SNB cut its interest rates by 25 bps to 0.25% on Thursday.

The USD/CHF pair flattens around 0.8820 during North American trading hours on Friday. The Swiss Franc pair trades sideways even though the US Dollar (USD) exhibits strength amid expectations that the Federal Reserve (Fed) will not cut its key borrowing rates in the near term.

CHF/USD Trading Setup – Triple Bottom Reversal & Breakout Setup🔍 Overview of the Chart Setup

The CHF/USD (Swiss Franc vs. U.S. Dollar) 1-hour timeframe chart reveals a classic Triple Bottom pattern, which is a well-known bullish reversal signal. This pattern indicates that sellers have attempted to break the support level three times but failed, suggesting a potential shift in momentum from bearish to bullish.

Traders closely watch this structure as it often leads to a strong upward breakout once key resistance levels are breached. The current setup provides an excellent risk-to-reward trading opportunity, especially for those looking to capitalize on the breakout.

📊 Key Levels in the CHF/USD Chart

1️⃣ Support and Resistance Zones

🟢 Support Level (~1.1300 - 1.1280 Zone)

This zone has been tested three times, confirming strong buying interest at this price level.

The formation of long wicks on candlesticks signals strong demand and buyer dominance.

A breakdown below this level would invalidate the bullish setup and may indicate a continuation of the bearish trend.

🔴 Resistance Level (~1.1415 - 1.1430 Zone)

This level acts as a price ceiling, where previous bullish attempts were rejected.

A break and retest above this zone would confirm the Triple Bottom breakout.

🎯 Target Level (~1.1457 Zone)

The projected target is based on the height of the pattern, which is measured and added to the breakout point.

This level aligns with previous price action zones and acts as a natural take-profit area for traders.

🚨 Stop-Loss Level (~1.1243 Zone)

A stop-loss is placed below the support zone to protect against false breakouts or an invalidation of the pattern.

📉 Understanding the Triple Bottom Pattern

The Triple Bottom is a strong bullish reversal formation that occurs at the end of a downtrend. It signals that sellers are exhausted, and buyers are gradually taking control.

🔹 Breakdown of the Triple Bottom Formation

✅ Bottom 1 (First Low)

The first bottom forms when the price hits the support level and bounces back.

Sellers are still active, so price declines again to test the same support zone.

✅ Bottom 2 (Second Low - Confirmation of Support)

The second test of the support zone validates the demand area.

Buyers step in again, pushing the price upward.

The market still lacks enough momentum for a breakout, leading to a third retest.

✅ Bottom 3 (Final Low and Strong Rejection)

The third bottom is crucial because it signals the last test of support before a breakout.

The failure to break lower creates a higher probability of an upside move.

📌 Breakout Confirmation & Price Action Signals

🔵 The breakout is confirmed when:

The price closes above the resistance zone (1.1415 - 1.1430) with strong momentum.

Volume spikes during the breakout, indicating institutional buying interest.

A successful retest of the resistance zone as new support further validates the trend reversal.

If the breakout lacks volume or gets rejected, traders should be cautious of a fakeout or potential retracement.

📈 Trading Strategy & Execution Plan

🔹 Conservative Entry (Safe Approach)

Enter after a confirmed breakout above 1.1415, ensuring a strong candle close above resistance.

Look for a retest of the breakout level before entering the trade.

🔹 Aggressive Entry (Early Positioning)

Enter near the third bottom (~1.1300 - 1.1320) with a tight stop-loss.

Higher risk but better reward if the price moves upward without retesting.

🔹 Stop-Loss Placement

Conservative traders: Place the stop-loss below the support zone (~1.1243).

Aggressive traders: Place a tight stop below the recent swing low for better risk management.

📌 Profit Target Projection

Take Profit Target: 1.1457, based on the height of the pattern.

📌 Risk-to-Reward Ratio

Risk: ~60 pips (from entry to stop-loss).

Reward: ~150 pips (from entry to target).

Risk-to-Reward Ratio: 1:3, making it a high-probability trade.

📡 Additional Confirmation Indicators for Stronger Trade Setup

📊 1. Volume Analysis

A spike in volume at the breakout level suggests strong buyer interest.

Low volume on the breakout may indicate a potential fakeout.

📈 2. RSI (Relative Strength Index) Confirmation

RSI should be above 50 and trending upward to confirm bullish momentum.

If RSI is overbought (>70), watch for a pullback before entering the trade.

📉 3. Moving Averages Support

If the 50-period or 200-period moving average supports the breakout level, it adds extra confirmation.

A moving average crossover may further validate the trend reversal.

🔍 4. Beware of Fake Breakouts

If the price briefly moves above resistance but fails to hold, it may be a bull trap.

Always wait for a candle close above resistance and a potential retest before confirming the entry.

🛠️ Alternative Scenarios & Market Risks

🔺 Bullish Scenario (Breakout & Rally to Target)

Price breaks above 1.1415, confirming a trend reversal.

A retest of resistance as support gives additional buying confidence.

Price reaches 1.1457 target before facing new resistance.

🔻 Bearish Scenario (Fakeout & Breakdown Below Support)

Price fails to hold above resistance and falls back below support.

A breakdown below 1.1243 invalidates the pattern, triggering a bearish continuation.

Traders should cut losses quickly if the setup is invalidated.

⚠️ Fundamental Risks to Watch

U.S. Dollar news events (FOMC, NFP, CPI reports) can increase volatility.

Swiss economic data may impact CHF strength.

Unexpected geopolitical events can influence currency movements.

🔎 Summary of the Trading Plan

📌 Trading Strategy Checklist

✅ Pattern: Triple Bottom (Bullish Reversal).

✅ Entry Strategy: Buy after breakout confirmation above 1.1415.

✅ Take Profit Target: 1.1457.

✅ Stop-Loss Level: Below 1.1243.

✅ Risk-to-Reward Ratio: 1:3 (High-Profit Potential with Proper Risk Management).

💡 Final Thought:

This setup provides a high-probability bullish trade with strong technical confluence. However, always remain cautious of market news, economic reports, and sudden volatility that could influence price action.

🚀 Patience & discipline are key—wait for confirmation before entering! 📊

Swissie long fondamentalSNB rate cut this Thursday “dovish” currency less attractive than the dollar

Which has been the subject of strong speculation about a possible recession

Because forecasts have fallen sharply and the fed is taking a more dovish view

But the US economy remains strong and is probably undervalued.