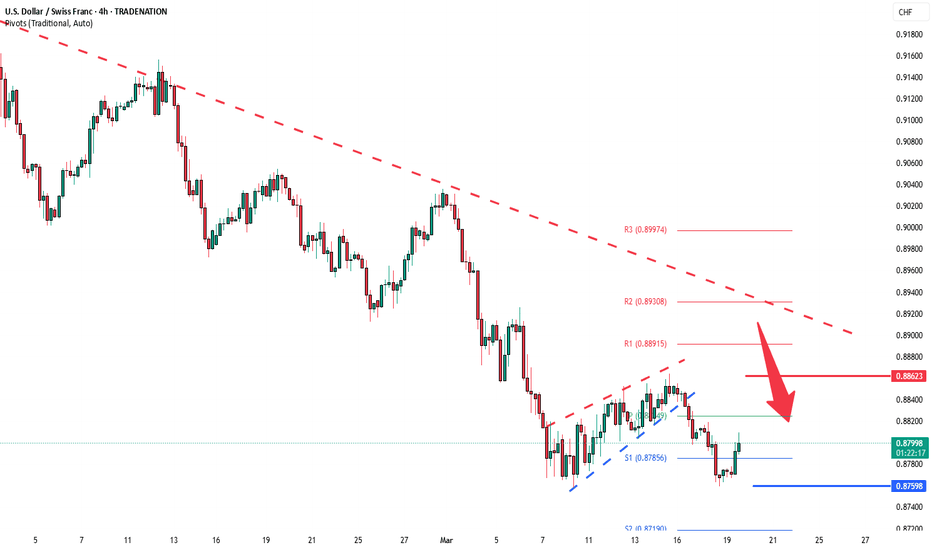

USD/CHF SELLERS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

USD/CHF is making a bullish rebound on the 3H TF and is nearing the resistance line above while we are generally bearish biased on the pair due to our previous 1W candle analysis, thus making a trend-following short a good option for us with the target being the 0.878 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

CHFUSD trade ideas

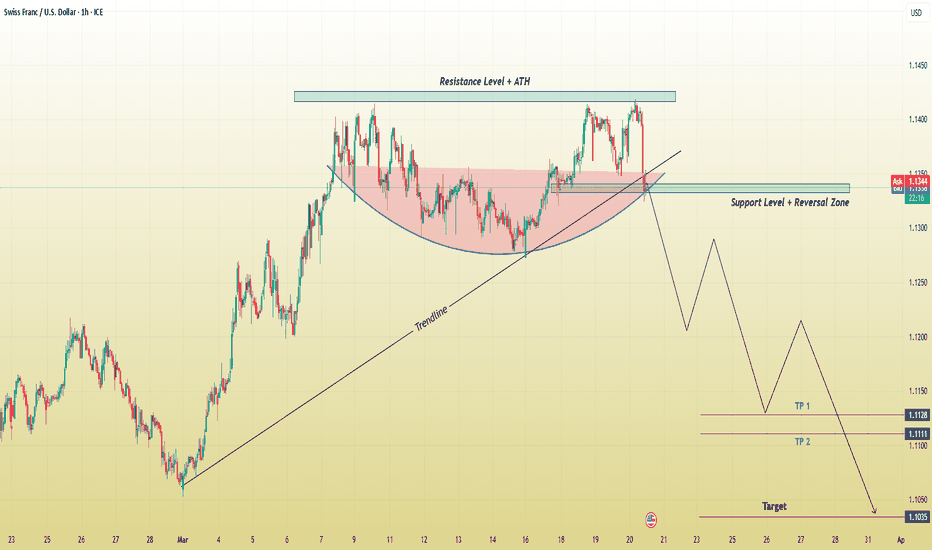

CHF/USD Bearish Reversal: Trendline Break Strong Sell-Off!his CHF/USD (Swiss Franc/U.S. Dollar) 1-hour chart showcases a bearish trading setup, signaling a potential downside move after a failed breakout at a key resistance level. Below is a comprehensive breakdown of the chart, highlighting key technical elements, potential trade setups, and risk management considerations.

1. Identified Chart Pattern – Cup & Handle (Failed Breakout)

The chart initially formed a Cup and Handle pattern, a bullish continuation setup where:

The rounded bottom (cup) indicated accumulation and a gradual shift in trend from bearish to bullish.

The handle consolidation represented a minor pullback before a potential breakout.

However, the pattern failed to hold its bullish momentum. Instead of continuing higher, the price was rejected at the resistance level (ATH – All-Time High), signaling a shift in sentiment.

2. Key Technical Levels

Resistance Level + ATH (All-Time High)

The price reached a significant resistance zone (marked in blue), aligning with an all-time high (ATH) level.

Multiple rejections at this level indicate strong selling pressure, making it a potential distribution area where smart money is offloading positions.

Support Level + Reversal Zone

After rejection from the resistance, the price retraced to a critical support zone, previously acting as a demand area (buyers stepping in).

A break below this level confirms bearish momentum, increasing the likelihood of further downside movement.

Trendline Break – Bearish Confirmation

The trendline (marked in black) represents the primary uptrend support that guided price movement.

The break below this trendline signals a loss of bullish strength, increasing the probability of a trend reversal rather than a continuation.

3. Projected Price Movement – Bearish Scenario

Given the trendline break and rejection from resistance, the chart suggests a bearish wave with the following expectations:

A retest of the broken trendline and support zone before continuing downward.

Lower highs and lower lows formation – confirming a new downtrend.

A potential drop towards key downside targets (marked as TP1, TP2, and the final target).

Take Profit (TP) Targets:

✅ TP1 (1.1128): A minor support level where price may find temporary buying interest.

✅ TP2 (1.1111): A more significant support area that previously acted as demand.

✅ Final Target (1.1035): The ultimate downside objective, aligning with a major support zone and historical price action levels.

Stop-Loss Placement (SL):

📍 Above the broken trendline OR the recent swing high, ensuring protection against false breakouts or retracements.

4. Trade Execution & Risk Management

Entry Strategy (For Short Positions)

🔹 Aggressive Entry: Enter short immediately after the support zone break.

🔹 Conservative Entry: Wait for a retest of the support-turned-resistance area for confirmation before shorting.

Risk-Reward Ratio Consideration:

A properly placed stop-loss above resistance ensures a favorable risk-to-reward ratio.

Ideal ratio: 1:2 or better, meaning potential reward should be at least twice the risk.

5. Market Sentiment & Possible Alternative Scenario

While the primary outlook is bearish, traders must remain flexible and monitor price action closely:

If price reclaims the support zone and breaks above resistance, it invalidates the bearish setup, shifting momentum back to bullish.

A sustained close above the trendline could trap early sellers, leading to a short squeeze rally back toward resistance.

6. Final Thoughts

🔹 Bearish Bias: This setup favors downside movement due to trendline break, resistance rejection, and market structure shift.

🔹 Key Levels to Watch: Support zone retest, trendline confirmation, and target levels.

🔹 Risk Management is Essential: Using stop-loss protection and proper trade sizing to mitigate potential losses.

Conclusion: High-Probability Bearish Setup

🚀 The CHF/USD pair has shifted to a bearish structure after failing to break its ATH resistance. The breakdown of the trendline and key support level suggests a strong sell-off towards the 1.1035 target. Traders should look for short opportunities on pullbacks while managing risk effectively.

Would you like me to refine or simplify any part of this analysis for your TradingView post? 📉🔥

USDCHF Musical Chair Music Begins! 1613SGT 20032025Yesterday or so, I posted about selling USDCHF but it is risky, and indeed risky it was because the opportunity has been utilised already.

We would need to wait for the music to stop and start again before we walk around the chairs, and now, the music has stopped and started, again.

Price came back to the 200SMA, to stop the music, and now we have a trend again signalling that the music has begun.

Price has made the first significant setup as seen on the chart.

I will only be eyeballing because I am testing out my theory.

I think I need to see my previous entries in the moving average series, to see what I done right and what I done wrong.

Done right = I profited

Done wrong = I loss

It's not perfect but I think I know what to look out for.

Look out for when price is retracing, and I entered that i profited.

And look out for when price was in its impulse move and I entered and loss.

1616SGT 20032025

BEARISH MOVEMENTUSDCHF is on descending channel, an ascending channel is broken to the downside, which is now giving us pure bearish move. Also on daily timeframe i can see bearish head and shoulder pattern, which additional confirmation for my analysis. So i'm for a sell risking 1%. Lets see the see the outcome

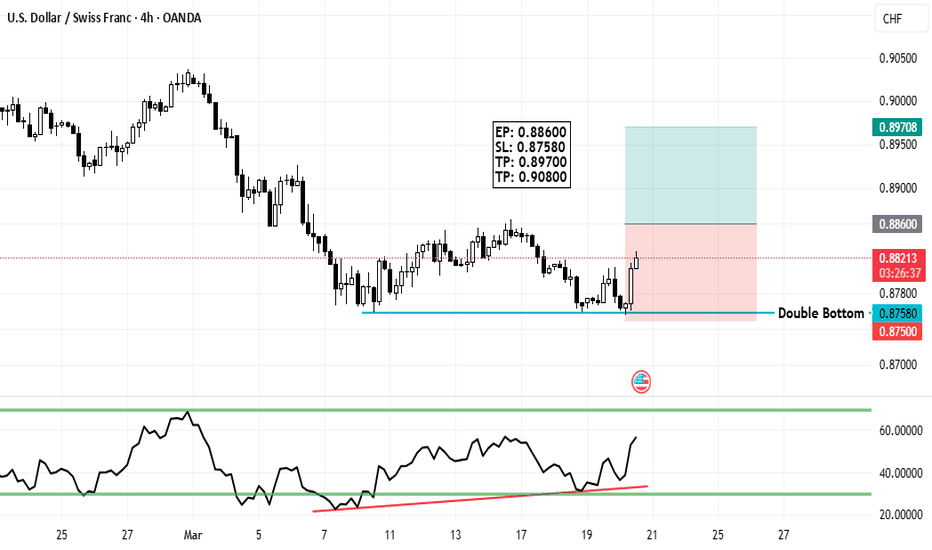

USD/CHF 15M Chart - Bullish Outlook!📈 USD/CHF 15M Chart - Bullish Outlook!

🟢 Demand Zone Identified!

Price is approaching the 0.87537 - 0.87400 demand zone, where a potential reversal could occur. If support holds, we may see an upward move toward key resistance levels.

📌 Key Levels to Watch:

🟢 Support Zone: 0.87537 - 0.87400

🚀 Breakout Target 1: 0.87887

🎯 Main Target: 0.88603

🔥 Potential Trade Setup:

🟢 Buy Near: 0.87537

🎯 TP1: 0.87887

🎯 TP2: 0.88603

🛑 SL: Below 0.87400

⚠️ Break Above 0.87887 could confirm further bullish momentum toward 0.88603. Trade wisely and manage risk!

#USDCHF #ForexTrading #SmartMoney #SupplyAndDemand #PriceAction #LiquidityGrab #FXFOREVER

USDCHF INTRADAY oversold bounce backThe USD/CHF price action exhibits bearish sentiment, supported by the prevailing downtrend. The current intraday swing high at 0.8860 serves as a critical trading level, as the pair shows potential for an oversold rally before facing bearish rejection.

Key Levels to Watch:

Key Resistance: 0.8860 (current intraday swing high)

Immediate Support: 0.8760

Lower Support Levels: 0.8720, 0.8680

Upside Resistance Levels: 0.8890, 0.8930

Bearish Scenario:

An oversold rally toward the 0.8860 level, followed by a bearish rejection, could validate the downtrend and target the immediate support at 0.8760. Continued bearish momentum could extend the decline to 0.8720 and ultimately 0.8680 over the longer timeframe.

Bullish Scenario:

A confirmed breakout above the 0.8860 resistance level, accompanied by a daily close above this mark, would negate the bearish outlook. This scenario could trigger further rallies toward the next resistance levels at 0.8890 and 0.8930.

Conclusion:

The prevailing sentiment remains bearish amid the ongoing downtrend. Traders should closely monitor the 0.8860 level for potential bearish rejections or a bullish breakout. A sustained close above this resistance could signal a shift toward bullish momentum, while failure to break above would reinforce the bearish outlook.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

If you don't have DXY, keep an eye on USDCHF.Today we are waiting for the Federal Reserve interest rate decision, where the Bank is expected to keep the rates unchanged. However, it's the press conference, which we are more bothered about. Keep your eyes on TVC:DXY , but if you don't have MARKETSCOM:DOLLARINDEX , then MARKETSCOM:USDCHF will be just as good.

Let's dig in.

FX_IDC:USDCHF

Let us know what you think in the comments below.

Thank you.

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

USDCHF to continue in the downward move?USDCHF - 24h expiry

Broken out of the channel formation to the downside.

Our short term bias remains negative.

Offers ample risk/reward to sell at the market.

The weaker US dollar has boosted performance.

20 4hour EMA is at 0.8801.

We look to Sell at 0.8799 (stop at 0.8839)

Our profit targets will be 0.8701 and 0.8681

Resistance: 0.8777 / 0.8800 / 0.8818

Support: 0.8759 / 0.8740 / 0.8720

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

CHF/USD Trading Idea – Bearish Reversal from Key ResistanceThis CHF/USD chart presents a compelling bearish setup, suggesting that the pair may be headed for a decline after facing strong resistance. The price action has followed a technical breakout and retest pattern, with a clear rejection from a well-defined resistance level.

Traders looking for short-selling opportunities should take note of the key price zones, support levels, and overall market structure before making a move. Let’s break it down in detail.

🔍 Chart Breakdown: What’s Happening?

1️⃣ Falling Wedge Breakout & Bullish Push

The price was consolidating inside a falling wedge, a pattern that typically signals an eventual breakout to the upside.

The breakout led to a strong bullish move, pushing the price toward a well-established resistance zone around 1.1414.

After breaking out, the pair made a significant upward run before stalling at this key resistance.

2️⃣ Key Resistance Level Holding Strong

The price touched the resistance zone but failed to break above it.

This rejection indicates that sellers are stepping in, absorbing the buying pressure.

The market is showing early signs of bearish momentum, hinting at a potential downtrend.

3️⃣ Projected Bearish Move: Lower Targets in Sight

If the current rejection holds, the price is likely to fall toward the nearest support levels:

✅ TP 1 (Take Profit 1): 1.1271 → First major support level, likely to be tested soon.

✅ TP 2 (Take Profit 2): 1.1201 → A deeper retracement if selling pressure increases.

✅ TP 3 (Take Profit 3): 1.1055 → Final downside target if the bearish trend extends further.

4️⃣ Stop Loss Placement – Risk Management

To manage risk, the ideal stop loss should be placed slightly above the resistance level at 1.1414.

This protects against potential false breakouts and unexpected market shifts.

📉 Trade Strategy – How to Approach This Setup?

🔸 Entry Point: Look for a confirmed rejection of the resistance level (e.g., bearish candlestick patterns like engulfing, shooting star, or pin bars).

🔸 Stop Loss: Place above 1.1414 to avoid getting caught in a short squeeze.

🔸 Take Profit Targets:

First TP at 1.1271

Second TP at 1.1201

Final TP at 1.1055 for extended downside moves

⚠️ Important Notes for Traders:

✔ Wait for Confirmation: Don’t rush into a short trade. Look for a strong bearish candle closure or a retest before entering.

✔ Be Aware of News Events: Economic releases, interest rate decisions, and major USD-related news can impact price movement.

✔ Monitor Market Sentiment: If USD strengthens, this setup is even more likely to play out.

🧐 Final Thoughts – High Probability Short Setup?

✅ Why This Trade Looks Strong:

The technical pattern is playing out perfectly, with a clear resistance rejection.

The risk-to-reward ratio is favorable, with well-defined entry, stop loss, and take profit levels.

The overall market structure supports a potential downside move if price continues respecting resistance.

📢 Bottom Line : If price remains below the 1.1414 resistance, this trade setup could provide an excellent opportunity for short-sellers targeting lower support levels. 🚀 Stay patient and wait for confirmation before pulling the trigger!